May 17, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

%

Desired Cash On-Hand

Current Position Performance

Aurora Cannabis (ACB)

+316.45%

Canopy Growth (CGC)*

+186.98%

AMD (AMD)

+62.88%

Groupon (GRPN)

+46.04%

Tradeweb Mkts (TW)

+40.28%

Tencent Music (TME)

+38.99%

Yeti (YETI)

+24.31%

Gossamer Bio (GOSS)

+20.16%

Cronos Group (CRON)

+10.03%

Pinterest (PINS)

+3.81%

New Age Bev (NBEV)

-5.01%

Iridium Comm (IRDM)

-8.21%

BiliBili (BILI)

-11.66%

Nio (NIO)

-19.98%

* Indicates a position where the capital investment has been previously sold.

This figure represents the profit returns made on the original capital investment.

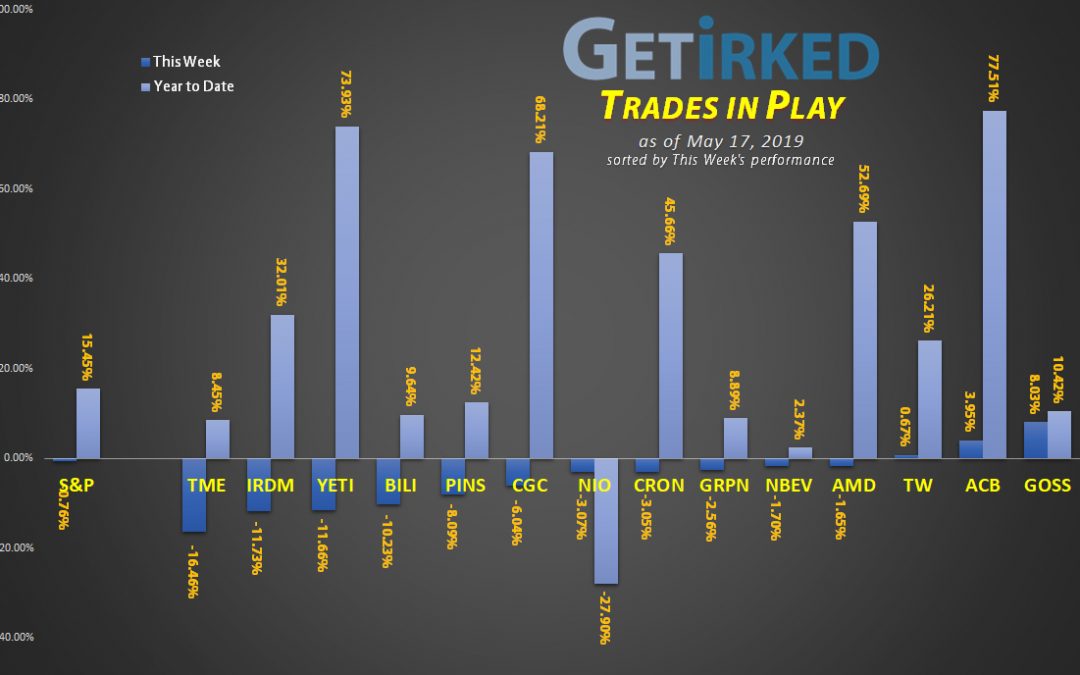

Highlights from the Week

Biggest Winner: Gossamer Bio (GOSS)

For THREE weeks in a row, Gossamer Bio (GOSS) has been our weekly winner, gaining another +8.03% this week for a total of +10.42% for the year. Once again, this week’s gains were made on no news.

What’s going on with this stock?

Biopharma is notoriously volatile. Combine that fact with Gossamer being a relatively new IPO, and you’ve got the recipe for a day-trader’s dream. Both the bulls and bears are targeting this stock with daily trades, causing it to shoot from oversold to overbought levels and back again.

Although we do like this company’s long-term prospects, we’re having to implement trading strategies over investing strategies in order to take advantage of the whip-saw action in the stock.

Biggest Loser: Tencent Music (TME)

Tencent Music (TME) reported declining subscriber interest and adjusted its long-term earnings potential, and the stock reacted accordingly dropping a whopping -16.46% which definitely earned it the spot as our Biggest Loser.

Although there will likely be an oversold bounce play to be had, TME is one to be careful with. Longer-term traders will want to exercise extreme caution and watch price action closely to determine if TME can retake its growth-play crown.

This Week’s Trades

Aurora Cannabis (ACB): Adding to Position

Aurora Cannabis (ACB) finally lost its footing heading into the week and dropped during the market-wide selloff, offering us the opportunity to add a bit to our position at $8.01 a share, raising our per-share cost basis to $2.09 per share.

ACB reported a somewhat disappointing quarterly report on Tuesday, causing its price to drop through the $8.00 level, however it rebounded significantly by the end of the week as it continues to be a popular pick among day-traders and speculative investors.

ACB is part of our long-term cannabis thesis, so we have buy targets at the following levels: $7.38, $6.48, $6.02, $3.68 and $2.87.

ACB closed the week at $8.68, up +8.36% from where we added.

Cronos Group (CRON): Flip-Flopping

Cronos Group (CRON) sold off with the rest of the market, allowing us to take advantage of the flip-flop we performed last week where we bought at $13.94 and sold at $15.34, replacing some of what we sold once again at $14.13 leaving us with a per-share cost basis of $13.79.

Just like last week, our flip-flop executed again on Tuesday when Cronos popped 7.5%+ during trading, hitting our sell target of $15.31 and lowering our per-share cost to $13.57.

CRON closed the week at $14.93, down -2.48% from where we took profits.

Gossamer Bio (GOSS): Profit-Taking

The stock market never ceases to surprise us with unexpected movements. In a day of utter terror and market-wide selloffs, Gossamer Bio (GOSS) continued to skyrocket from its oversold lows – on no news – bouncing 5%+ in trading on Monday which let us take more profits at $20.30 a share, lowering our per-share cost to $18.10.

After pulling back slightly to rest on Wednesday, GOSS continued even higher on Thursday, hitting yet another sell price for us and taking more profit at $21.26, leaving our per-share cost at $17.46.

The lesson here? Always expect the unexpected in the markets.

GOSS closed the week at $20.98, down -1.32% from where we took profits.

Iridium Communications (IRDM): Adding to Position

Iridium Communications (IRDM) lost its grip early in the week and dropped, allowing us to add to our position at $25.88, however, losing its relative strength caused an even more powerful drop than we anticipated as IRDM dropped through $25.00.

IRDM has definitely lost a key level of support, dropping through the $24.00 mark during Friday trading, and we expect it to drop to much lower levels where we have buy targets at $21.58, $19.58 and $17.78.

IRDM closed the week at $24.00, down -7.26% from where we added.

Pinterest (PINS): *New Position*

We’ve been wanting to get into Pinterest (PINS) – the social network – since it’s red-hot IPO several weeks ago, but the popularity of the stock caused its price to rise to levels we weren’t comfortable with.

Pinterest offers a unique proposition – a fresh IPO with an actual path to profitability (UBER and LYFT could learn a thing or two), a different approach to social networking allowing users to post or “pin” images of their favorite products or ideas, and cultivating a primarily-female international audience who claim the company’s network is a beacon of “positivity.” Basically, the opposite of Facebook (FB) and Twitter (TWTR).

We decided to wait until PINS reported its first quarterly earnings report, knowing that anything but a significantly better-than-expected report would most likely cause the stock to sell off.

As we expected, PINS did not blow the doors off the place. In fact, PINS’ quarterly report was a disappointment, causing the stock to sell off more than -15% in after-hours trading to under $26.00.

Typically, companies don’t hold an IPO without locking down a good quarterly report for their first public earnings release, so the disappointment from PINS is quite unusual. That being said, we believe the company has long-term potential both as a standalone company as well as a takeover target.

We decided to take the risk and snagged less than 13% of our overall desired allocation during after-hours trading at an average price of $25.72 before the price bounced back above $26 where we’re holding off before grabbing more.

Using Pinterest’s IPO price of $19.00 (they opened in the public markets at $23.75) and a key level of Fibonacci Retracement Technical Analysis, we’re setting a buy order to fill the rest of the first half of our PINS allocation much lower at $19.82.

We’d be surprised if PINS drops that low, but until we can see a few levels of price action, we want to back off and watch what happens from here.

PINS closed the week at $26.70, up +3.81% from our initial buy.

Tradeweb Markets (TW): Profit-Taking

Tradeweb Markets (TW) popped nearly 4% during Tuesday’s rally, triggering a sell order we had in place at $43.96 which lowered our per-share cost to $30.86.

We’re looking to replace our sold shares should a market-wide selloff send Tradeweb under $40 a share.

TW closed the week at $43.29, down -1.52% from where we sold.

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.