May 10, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

# of Positions

%

Target Position Size

%

Desired Cash On-Hand

Current Position Performance

Aurora Cannabis (ACB)

+661.40%

Canopy Growth (CGC)*

+189.55%

Tencent Music (TME)

+66.37%

AMD (AMD)

+65.61%

Groupon (GRPN)

+49.87%

Yeti (YETI)

+40.71%

Tradeweb Mkts (TW)

+14.94%

Cronos Group (CRON)

+12.10%

Gossamer Bio (GOSS)

+5.49%

Iridium Comm (IRDM)

+3.46%

BiliBili (BILI)

-1.59%

New Age Bev (NBEV)

-3.36%

Nio (NIO)

-17.45%

* Indicates a position where the capital investment has been previously sold.

This figure represents the profit returns made on the original capital investment.

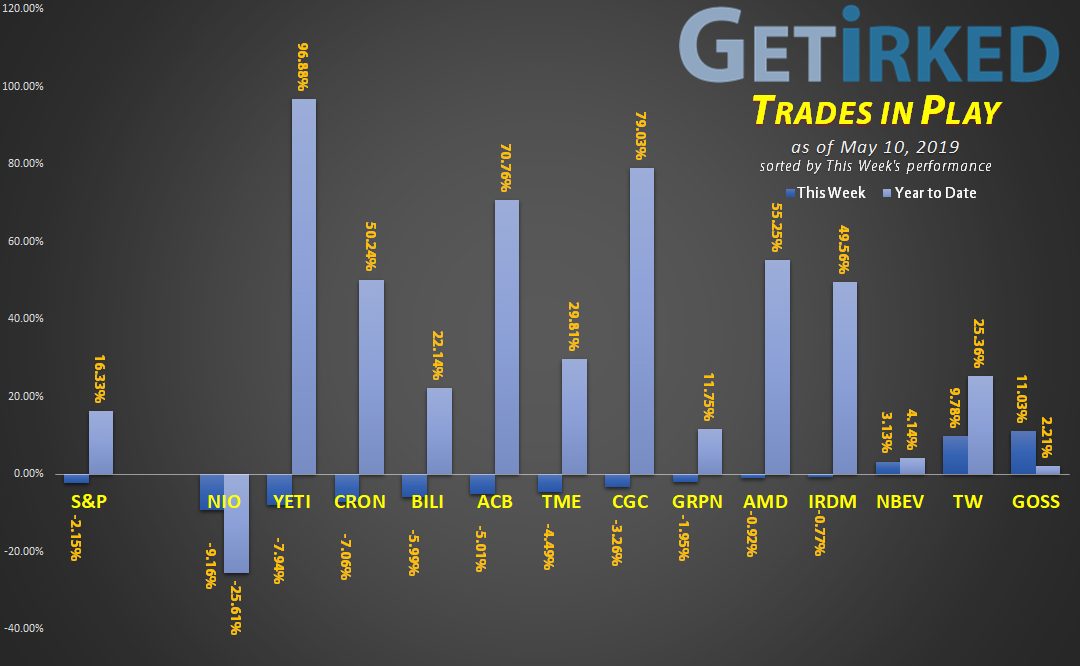

Highlights from the Week

Biggest Winner: Gossamer Bio (GOSS)

Gossamer Bio (GOSS) comes from nowhere on no real news and scores a 11.03% gain in the middle of a market-wide selloff. No, we have no idea what’s going on here.

Biggest Loser: Nio (NIO)

Looks like Tesla’s (TSLA) not the only one that gets hit hard during a market-wide sell-off as Nio (NIO) gets beaten down to the tune of -9.16% partially thanks to U.S.-China Trade Wars, and partially, well, because they’re a nonprofitable Chinese electric car maker making pricey cars for a low-income population. Hmmm… why are we in this one again?

Trade Revisited – TransEnterix (TRXC)

Get Out While the Getting’s Good

We keep an eye on our trades even after we’ve gotten out of them, and we were particularly curious about TransEnterix (TRXC), a trade we took a -13.35% loss on last week due to concerns we had about its price action and potential for a negative earnings release.

TradeEnterix is a maker of robotic surgical equipment and supplies, and when its far-superior competitor, Intuitive Surgical (ISRG), reported a less-than-stellar quarter, we didn’t see any possibility for TransEnterix to do better.

Well, TRXC released earnings after the bell Thursday and this is one of those situations where we wish we could say we were wrong for the traders still in it.

We weren’t.

TransEnterix didn’t just report a bad quarter. They reported a horrendous quarter, dropping more than 35% into the high $1.20s on Friday after missing significantly in their Q1 earnings report.

With TRXC closing the week at $1.29, our decision to take a -13.35% loss by selling last week at $1.92 helped us avoid an additional -32.81% drop from where we sold.

There’s always a stock market adage for every situation, and, in this case, there are two:

“Your First Loss is Your Best Loss.”

This rule applies to both trading and investing, however it’s more apt for trading. When your thesis doesn’t go your way, such as a catalyst not happening or a company’s inability to turn itself around, close the trade even if that means taking a loss.

Never hang on to a trade that’s proven your thesis wrong just to avoid taking a loss. Take the loss early and it’ll be less painful. Don’t get us wrong, it’ll still be painful, it’ll just be less painful.

Sure, we took a -13.35% loss in TRXC, but if we held on in hopes of a good quarterly report, we would have been down more than -40%!

“It’s Better to Make Money than Be Right.”

In our experience with the many trading websites we visited before founding our own (Get Irked feels this kind of information should be available to all those who want it free-of-charge), trading site owners seem to need to be prolific seers of the future, trying to predict future stock moves and executing perfect trades.

Instead of focusing on profits, they often focus on whether the stock moved exactly the way they predicted. We’re going to ruin Technical Analysis (TA) for you: not only does no one ever really know what’s going to happen next in any individual stock or in the markets as a whole, a lot of the time – price action is entirely random.

At Get Irked, we know that every investor is often wrong. We’re wrong most of the time. Success in investing or trading doesn’t come from not whether you’re right or wrong, but whether you’re able to pivot, make the right decisions, and walk away with a profit.

Or, at the very least, walk away without taking a loss.

What’s next for TransEnterix (TRXC)?

At this point, it looks as though TransEnterix (TRXC) may be headed for The Land of the Penny Stocks (i.e. sub-$1.00) but even if it recovers from here, we’ve moved on.

It’s important to know what you’re good at and what you’re not. We may always be figuring out what we’re actually “good” at, but we know for certain that we’re not good at short-term trading these sub-$3 stocks.

We’re leaving TransEnterix (TRXC) and its penny-stock cohort to better (or less risk-adverse, at least) traders than us.

This Week’s Trades

BiliBili (BILI): Added to Position

BiliBili, China’s YouTube, held up incredibly strong throughout the week, but finally got punched in the face on Thursday, dropping below $17.00 and triggering a buy order we had in place at $16.79.

Although we’re in a precarious situation with BILI reporting earnings on Monday (we don’t typically make buys or sells going before a quarterly report), this China-focused play doesn’t need U.S. support in order to thrive and won’t be affected by tariffs from China or the U.S.

BILI closed the week at $17.10, up +1.84% from where we added to our position.

Cronos Group (CRON): Buying -AND- Selling

This week’s market sell-off hit the cannabis stocks particularly hard, causing Cronos Group (CRON) to drop to our per-share cost basis of $13.94, a whopping -11.55% drop from its market-open price of $15.76 high on Thursday. We took the opportunity to increase our position size by picking some up.

On Friday, Cronos made an about-face and popped after Treasury Secretary Mnuchin announced the China Trade Talks were improving, giving us the opportunity to sell a portion of some of the shares we picked up just one day earlier, selling at $15.34, pocketing a 10%+ gain in less than 24 hours, and reducing our per-share cost to $13.74.

CRON closed the week at $15.40, up +10.47% from where we added to our position.

Gossamer Bio (GOSS): Taking Profits

Gossamer Bio (GOSS) popped 4%+ going into Thursday’s close on no news. On a day that saw a dramatic market-wide sell-off before leveling off, to see a stock pop – especially to this extent with no real reason – was a real head-scratcher.

With China and Uber both on the plate for Friday, we took the opportunity to reduce our position size and take small profits, selling at $18.63, 18.92 and $19.18 on GOSS’s way up during after-hours trading on Thursday and during market trading on Friday.

The sales reduced our per-share cost to $18.41 from $18.61, but, more importantly, freed up capital by reducing GOSS to 4.34% of our portfolio from its previous 7.28% overweight allocation. We may add back into GOSS should a market-wide sell-off push it back down.

GOSS closed the week at $19.42 with our position up +5.49%.

Tencent Music (TME): Added to Position

Trump’s tweets about increasing China tariffs to 25% caused the entire market to sell off early in the week, however, as one might expect, Chinese stocks took the news the hardest, with TME plummeting nearly -8% to $16.00 first thing Monday, letting us add a little to our position at $16.18.

While TME bounced with the rest of the market on Monday, the trade news released throughout the week caused the stock to re-test its lows.

TME closed the week at $16.59, up +2.53% from where we added to our position.

Yeti (YETI): Added to Position

Tuesday’s selloff beat up the entire market, especially Yeti (YETI), which dropped to a key target we had in place at $27.68 where we added to the position. Yeti fell nearly -10% during Tuesday’s selloff. Talk about stomach-flipping.

Yeti closed the week at $29.00, up +4.77% from where we added to our position.

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.