April 5, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click either chart for an enlarged version

Current Position Performance

Canopy Growth (CGC)

+185.41%

Insys Thera (INSY)

+133.46%

Tencent Music (TME)

+116.39%

AMD (AMD)

+67.05%

Aurora Cannabis (ACB)

+62.30%

Groupon (GRPN)

+51.58%

Cronos Group (CRON)

+29.21%

Yeti (YETI)

+10.80%

Iridium Comm (IRDM)

+6.54%

EventBrite (EB)

+3.18%

BiliBili (BILI)

+1.92%

Gossamer Bio (GOSS)

-0.60%

Nio (NIO)

-6.74%

TransEnterix (TRXC)

-7.72%

New Age Bev (NBEV)

-16.97%

Highlights from the Week

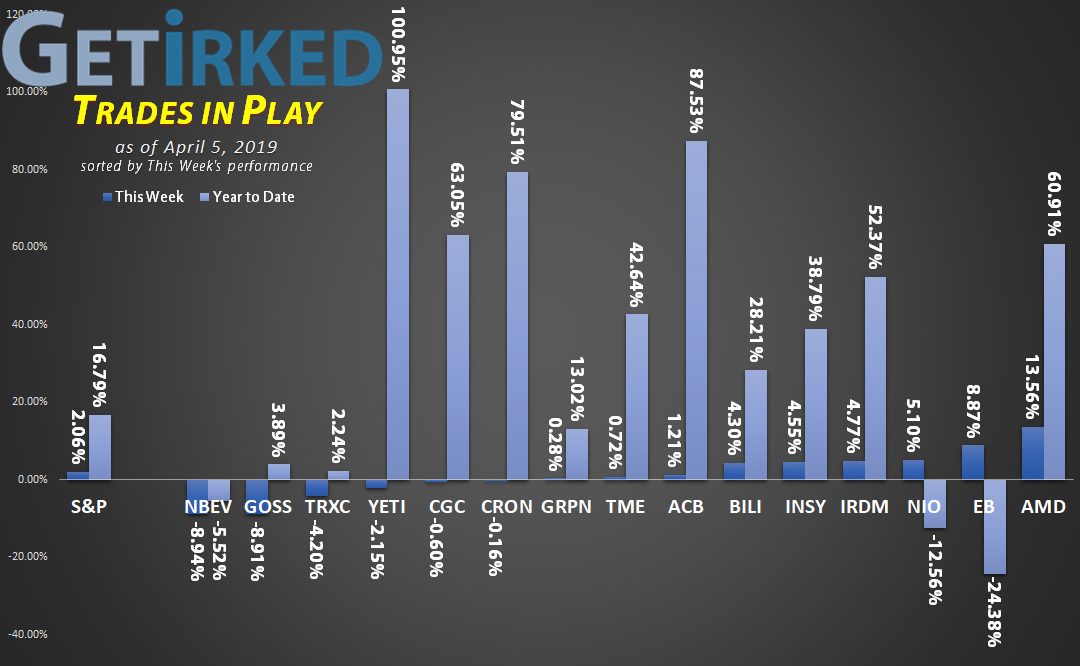

Biggest Winner: AMD (AMD)

The semiconductor sector saw huge gains this week with China data pushing all of them higher, especially AMD who closed the week up +13.56% and capped its year at +60.91%.

Biggest Loser: New Age Beverages (NBEV)

The cannabis sector continues to get smacked, and New Age Beverages (NBEV) is getting hit harder than most, likely due to its somewhat disconnected exposure to the space as a beverage play rather than a consumer play. NBEV lost another -5.52% this week and is down nearly 9% year-to-date.

Other Highlights

EventBrite (EB) Brightens Up

After getting slammed more than 40% following bad earnings, EventBrite (EB) may have found its bottom last week at $19.04 as it rebounded to finish this week at $20.87, up +8.87% over last week’s close.

While still down -24.38% on the year, EB is now up +3.18% from our $20.23 per-share cost basis.

Gossamer Bio (GOSS) Loses its Shine

GOSS, the IPO that seemed it could do no wrong in recent weeks, reversed course to lose nearly 9% this week (-8.91%) on no real news.

This loss is likely due to the influx of hot new IPOs coming to market – a scenario where hedge funds pull funds from stale names to put take advantage of the new hotness.

Along those lines, market darling Yeti (YETI) also pulled back -2.15% over the course of the week.

Iridium Communications (IRDM) sets new All-Time High

One of our newer plays almost more appropriate for the Investments in Play portfolio, Iridium Communications (IRDM) pegged a new all-time high of $28.00 this week before pulling back slightly to close the week +4.77% at $27.70.

We’ve been pleased with the short-term performance of this position, having gained +6.54% since we opened our play at $26.28.

Nio (NIO) Recharges its Batteries

We’re often too early to many of our plays (a trend we’re working on rectifying), and Nio (NIO), the Chinese Tesla (TSLA) electric car manufacturer, demonstrates that while our thesis of Nio bottoming was correct, our entry timing was not.

Nio saw a gain of slightly more than 5% this week closing at $5.36 after putting in a bottom at $4.90. Unfortunately, we started adding to this position too early so we’re still down -6.74% with a $5.75 per-share price.

This Week’s Trades

Gossamer Bio (GOSS)

Following its report of its 2018 Annual Finance Results, Gossamer (GOSS) pulled back pretty dramatically on Thursday, dropping nearly 7% and triggering a buy order we had in place at $19.18 to add to the position and lower our per-share cost to $19.86.

Still a fairly recent IPO (first trading day: Feb. 8), we’re buying at the fresh levels established by GOSS on its way up, and will continue to add if it retraces to its all-time low of $16.00.

GOSS closed the week up slightly from our $19.18 purchase to close at $19.74 with our position down -0.60%.

New Age Beverages (NBEV)

The selloff in New Age Beverages (NBEV) refuses to let up, with the stock breaking the key $5.00 mark to make its way down to lower-lows, hitting $4.71 on Friday and triggering our buy order at $4.72 which chipped away at our per-share cost, dropping it to $5.69.

NBEV closed the week at $4.79 with our position down -15.74%.

We’re Getting Aggressive

Astute readers of Get Irked may notice that the performance of our Trades in Play portfolio is lagging the S&P 500 as of this week and is more than 5% behind our “more conservative” Investments in Play.

This performance disparity is a great demonstration that higher-quality, more well-known names typically considered “boring” by those new to the market often outperform over the long-term as more speculative names rely on huge upside surprises to get their gains.

That being said, we’re adjusting our approach to our Trades in Play portfolio by getting more aggressive with our buy levels in an effort to increase the gains in the portfolio by taking on more risk. (What could possibly go wrong??)

As always, remember that this portfolio is highly speculative and we are not professional advisers (and not very good traders, either, at this point in the year, apparently).

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.