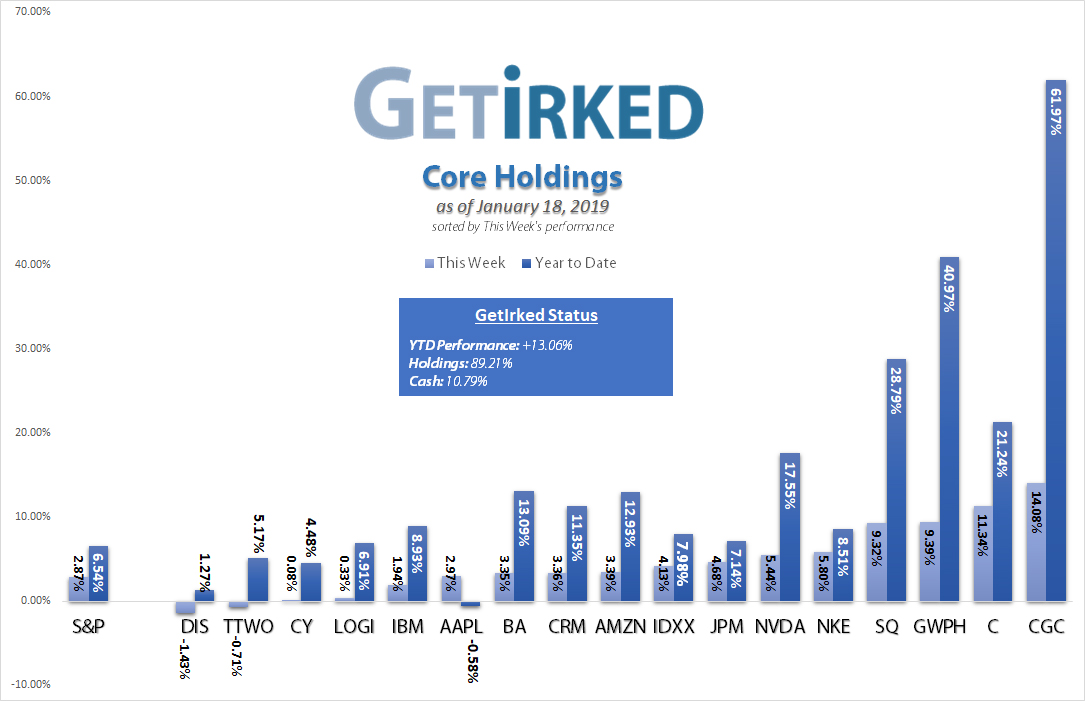

Core Holdings as of January 18, 2019

Highlights from the Week

- The cannabis stocks continue to make newer highs headed into potential New York legalization. They’re the big performers this year, however they are as volatile as cryptocurrency, so selling before the news event is recommended as they historically collapse afterward. Canopy Growth (CGC) saw another 14.08% increase this week with GW Pharma (GWPH) gaining an additional 9.32%.

- The banks are coming back thanks to the “not-as-bad-as-expected” earnings. In fact, Jim Cramer thinks the sector is going to be the leader into the next bull run. Citigroup (C) popped 11.34% this week with JP Morgan (JPM) gaining 4.68%.

- Disney’s (DIS) been a surprising underperformer since the start of the year with the lowest increase of any of our positions at just 1.27% for the year. DIS even dipped -1.43% last week. Maybe earnings will make a difference?

Gameplan for Next Week

- Trump is expected to announce a deal to trade border funding in exchange for extending DACA and TPS protections later today (Saturday). If the government shutdown ends next week, expect the market to roar higher. If his deal doesn’t pass muster and the government stays closed, expect this to weigh on the markets and pull them lower.

- With overweight positions in GW Pharma (GWPH), JP Morgan (JPM) and Take Two (TTWO), I will be keeping a close eye on those stock prices. If they cross over my per-share cost, I will be setting stop-limit orders to sell the overbuy to regain the investment capital while maintaining the lower per-share cost overbuying gave me.

- We had no activity in our Core Holdings this week, choosing instead to watch the market action rather than make a move.

- Year-To-Date Performance: +13.06%

- Cash: 10.79%

- Invested: 89.21%

This Week’s Trades

Core Holdings Status

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.