October 25, 2019

Name Change!

I decided that it was time to change the name of Trades in Play to Speculation in Play. Most of the techniques and activities in this portfolio are speculative investing both in terms in how I’m approaching the positions and length of time.

Trades are typically much shorter-term holdings – weeks, days, or even hours – where some of the positions in the Speculation in Play portfolio have been held for months (with a few even more than a full year).

So, welcome to Speculation in Play! The name has changed but not much else has! 😉

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

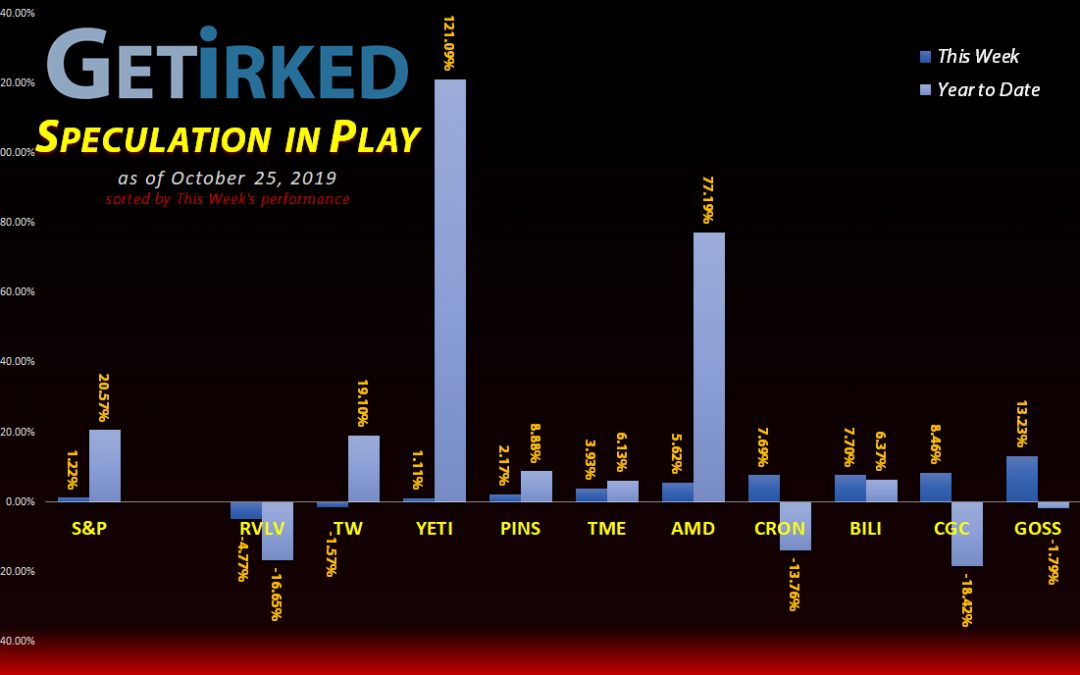

The Week’s Biggest Winner & Loser

Gossamer Bio (GOSS)

Do you remember how I may have mentioned how incredibly volatile Gossamer Bio (GOSS) continues to be as a stock? Well, its volatility earned it +13.23% and its spot as the week’s Biggest Winner.

Its nutty movements aren’t just contained to weekly moves, either. Read on for the flip-flop insanity that occurred this week.

Revolve Group (RVLV)

Revolve Group (RVLV) is the IPO everyone loves except investors, losing another -4.77% during an up week to earn itself its spot as the week’s Biggest Loser.

Despite being one of the only profitable IPOs of 2019, RVLV just can’t catch a break even with every analyst at its back.

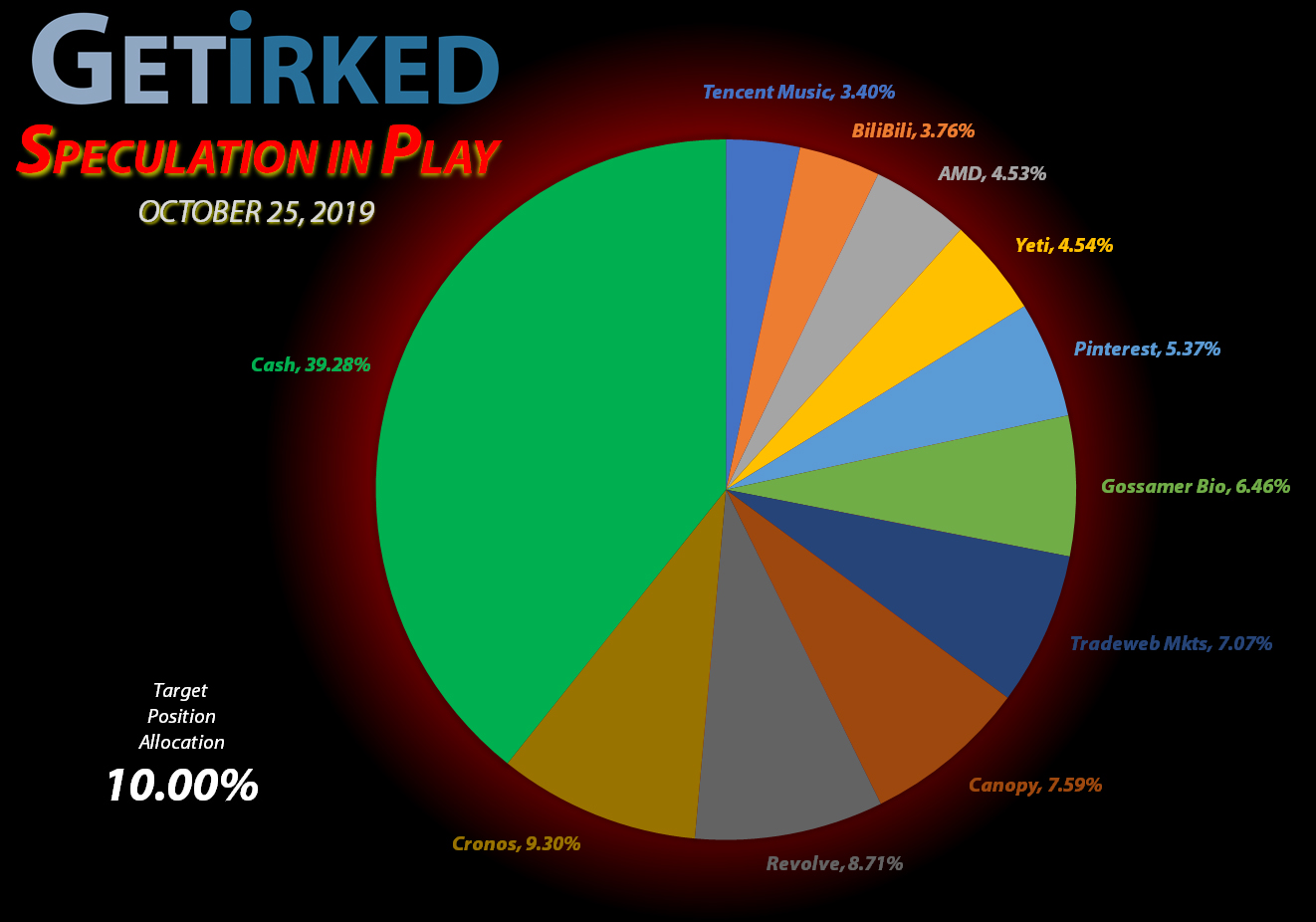

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+109.95%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $15.63

AMD (AMD)

+81.32%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $18.04

Tencent Music (TME)

+30.39%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.76

Gossamer Bio (GOSS)

+25.06%

1st Buy: 9/26/2019 @ $17.07

Current Per-Share: $14.93

Tradeweb Mkts (TW)

+10.00%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.14

Canopy Growth (CGC)

+7.56%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.38

BiliBili (BILI)

+3.16%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.05

Pinterest (PINS)

+2.97%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $25.12

Cronos Group (CRON)

-15.43%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $10.60

Revolve Group (RVLV)

-25.62%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $28.20

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Gossamer Bio (GOSS): +13.79% Gain in 30 Minutes?!

Market orders are dangerous. I have taken to using trailing stop orders to attempt to get better buy and sell prices, however, sometimes market action will whipsaw so erratically that you can have an order filled nowhere near where you wanted to.

Case in point, I had a trailing stop on Gossamer Bio (GOSS) set to trigger if the stock dropped to $14.68 and then try to fill at $0.05 higher. In practice, if GOSS dropped to $14.68, my market order would place at $14.73 and fill shortly afterward (in theory).

On Tuesday, GOSS opened at $14.49 nearly -15% under its Monday close with no news and then rocketed nearly +21% to $17.52 in less than five minutes! My trailing stop order triggered at $14.68 but wasn’t able to fill until $15.898 because the price action was that fast.

Given that $15.898 was more than 8% higher than where I wanted to fill, I immediately placed a stop order to sell the new shares if GOSS lost its footing, which it did, with my sell order filling at $18.09, capturing +13.79% of gains in less than a half hour of trading.

The flip-flopping price action lowered my per-share cost -6.8% from $16.02 to $14.93. Currently, I have no additional buy targets as my per-share cost is very near GOSS’s new $14.49 all-time low and I am targeting $22.00 to sell my entire position and effectively capture nearly a 50% total-position gain in just a few weeks.

GOSS closed the week at $18.66, up +3.15% from where I sold on Tuesday.

Revolve Group (RVLV): Added to Position

Revolve Group (RVLV) made a death-defying -10% dive on Tuesday, triggering a trailing stop order I had placed at $20.75 which filled at $20.848. The order lowered my per-share cost -4.95% from $29.67 to $28.20, still more than 35% higher from Tuesday’s levels.

At this point, my position is about 18-19% overweight to my allocation target (on a cost basis) so I’m holding off any additional buying until we see where RVLV goes from here. Mind-blowingly, hedge funds and other analysts continue to be wildly bullish on RVLV and its forward-looking prospects, however, I’m holding pat with my current allocation.

My first sell target is actually right around my per-share cost as it’s right at a key 50% retracement from July’s highs to Revolve’s current levels.

RVLV closed the week at $20.97, up +0.59% from where I added on Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.