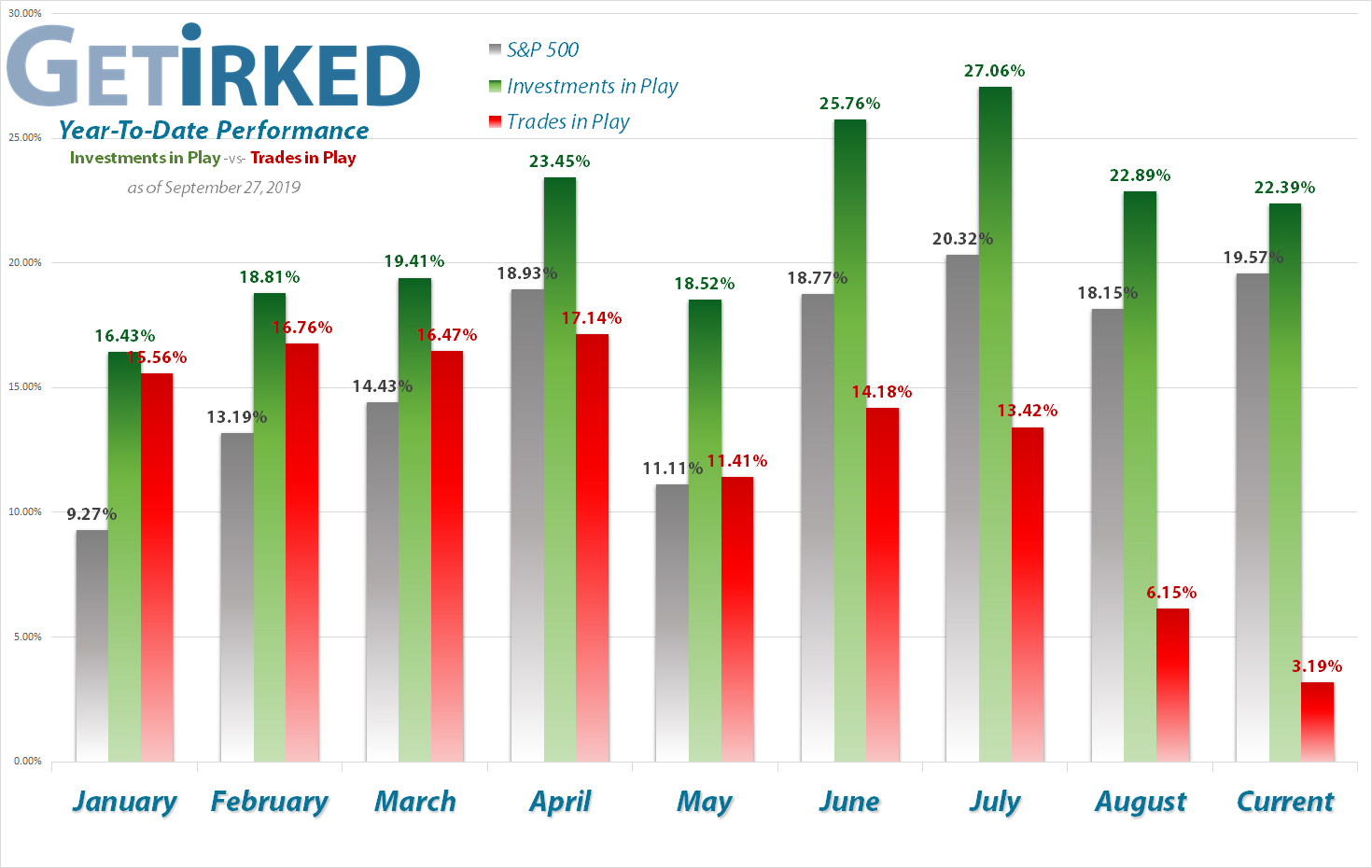

September 27, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

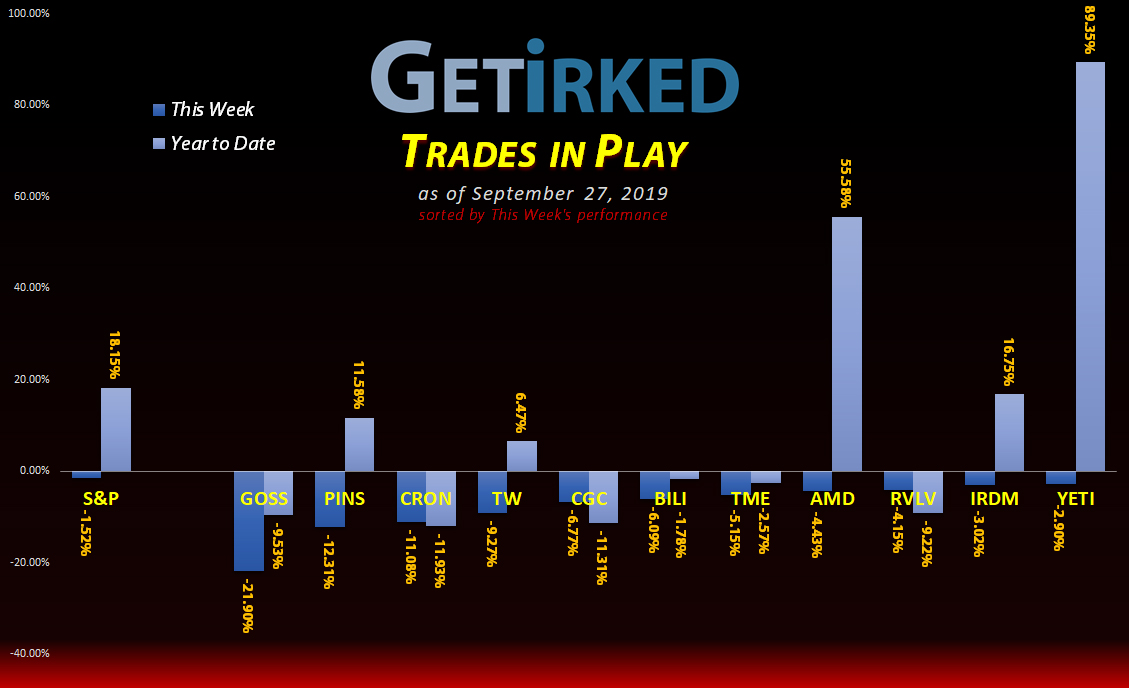

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+66.17%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $16.91

AMD (AMD)

+59.20%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $18.04

Tencent Music (TME)

+19.70%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.76

Canopy Growth (CGC)

+15.97%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.55

Pinterest (PINS)

+6.00%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $25.00

Gossamer Bio (GOSS)

+0.70%

1st Buy: 9/26/2019 @ $17.07

Current Per-Share: $17.07

Tradeweb Mkts (TW)

-2.79%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.57

BiliBili (BILI)

-6.57%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.34

Iridium Comm (IRDM)

-8.57%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $23.56

Cronos Group (CRON)

-22.95%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $11.88

Revolve Group (RVLV)

-27.69%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $31.59

Profit % for * positions = Current Gross Profit / Original Capital Investment

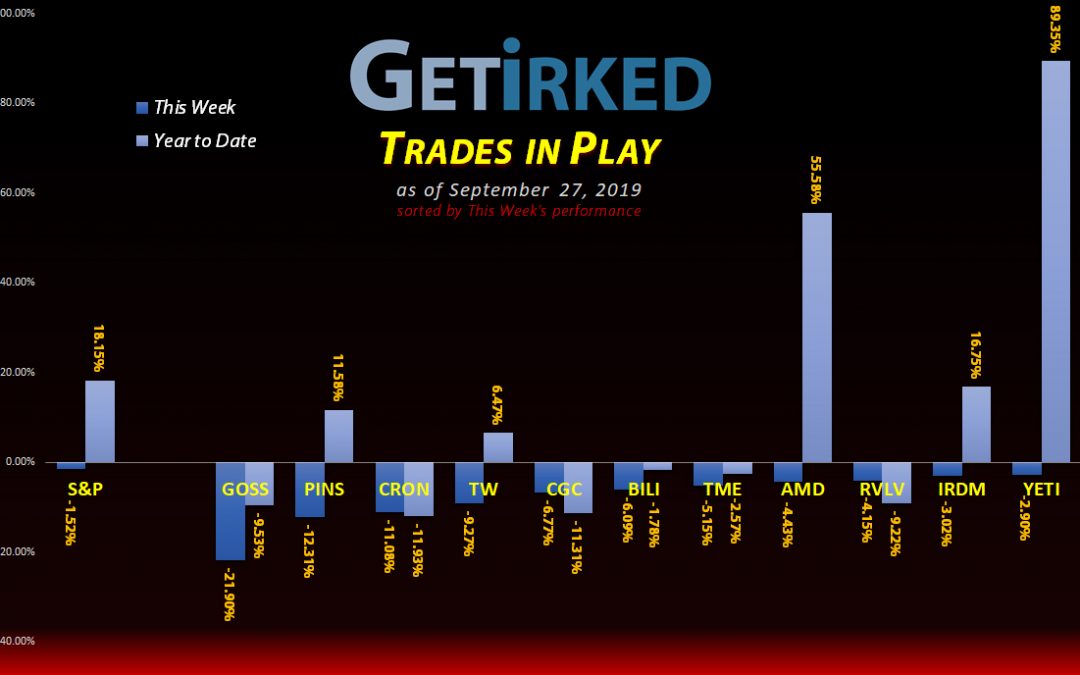

Highlights from the Week

Biggest Winner (?): Yeti (YETI)

It’s another one of those terrible weeks where the “Biggest Winner” is just the “smallest loser” as Yeti (YETI) snags the top spot for losing “only” -2.90% this week. Yuck.

Biggest Loser: Pinterest (PINS)

Pinterest (PINS) earns the spot of Biggest Loser this week (GOSS is a “new” position) after scoring the Biggest Winner slot last week. To make matters worse, this week’s 12.31% decline decimates the measly 4-5% gain that got PINS first place last week.

Analysts believe WeWork’s failed IPO (they actually canceled the IPO and even fired the CEO) has destroyed the market’s appetite for high-flying growth stocks that spend money and make no profits. Go figure, right?

This Week’s Trades

Advanced Micro Devices (AMD): Added to Position

AMD (AMD) lost support on Friday following Micron’s (MU) negative outlook for forward earnings, dropping with the rest of the chipset sector and following through the $29.00 mark where I added to my position at $28.66.

The buy order raised my per-share cost nearly 25% from $14.50 to $18.04 but also substantially increased my allocation. It replaced shares I sold at $33.92, effectively capturing profits in excess of 15% for those shares.

My next buy target for AMD is much lower slightly above a level of support at $24.34.

AMD closed the week at $28.72, up +0.21% from where I added on Friday.

Cronos Group (CRON): Added to Position

Cronos Group (CRON) broke the key $10.00 psychological support mark on Tuesday, dropping through a buy order I had in place at $9.74 which lowered my per-share cost by nearly -5% to $11.88 from $12.41.

My next buy order at $7.65 is slightly above a much lower support level. While I don’t expect CRON to drop that low, I will definitely add more shares to my position if this cannabis catastrophe continues to descend gets that low.

CRON closed the week at $9.15, down -6.01% from where I added on Tuesday.

Gossamer Bio (GOSS): Re-Opened Position

I know what you’re thinking – “Irk, didn’t you close Gossamer Bio (GOSS) back at the beginning of August because it was ‘too volatile for your tastes?'”

Well, over the past two months, I’ve been watching Gossamer Bio (GOSS) as a “Tidal Wave” play, a stock that regularly trades between a low level and a high level which allows a nimble trader to get in near the lows and sell at the highs.

Since Trades in Play is my speculative portfolio using funds I can afford to lose, I use it to practice techniques I wouldn’t consider in my long-term retirement accounts. So, I kept an eye on GOSS and waited.

I noticed that GOSS regularly drops to $17 and jumps to $22 so I waited for it to pull back on Thursday to re-open my position by buying at $17.07. I’ve also noticed that GOSS can sometimes pull back to below $16 so I have another order to double up on my position if GOSS pulls back to $15.61. I also have a sell target of just over $22.00 a share as GOSS regularly breaks through $22.50 on its return trip higher, hopefully capturing a near-30% gain over my new purchase price.

GOSS closed the week at $17.19, up +0.70% from where I added on Thursday.

Iridium Communications (IRDM): Added to Position

Less than two weeks after making an attempt at a new all-time high, Iridium Communications (IRDM) has fallen back to Earth, breaking through the $22.00 mark where I added more at $22.01 on Tuesday, lowering my per-share cost by more than -3% from $24.34 to $23.56. This buy order also serves to replace shares I sold 20% higher from here at $26.41 less than two weeks ago.

My next buy order targets if IRDM overshoots the key $20.00 psychological support mark, adding more shares at $19.92.

IRDM closed the week at $21.54, down -2.14% from where I added on Tuesday.

Pinterest (PINS): Added to Position

Pinterest (PINS) dropped on Tuesday, triggering a buy order I had in place at $28.00 which raised my per-share cost to an even $25.00 but offered a more interestingly-sized allocation. My next buy order at $23.65 is below my per-share cost but slightly above PINS all-time low of $23.05.

PINS closed the week at $26.50, down -5.36% from where I added on Tuesday.

Revolve Group (RVLV): Added to Position

Revolve Group (RVLV) once again lost its support on Monday, breaking down below the $24.00 mark where I used a trailing stop order to pick up a small amount at $23.40.

My next buy target will only be hit if RVLV breaks its current $21 floor of support and heads lower with additional buys at $19.60 and $17.67.

RVLV closed the week at $22.84, down -2.39% from where I added on Monday.

Tencent Music (TME): Added to Position

Tencent Music (TME), China’s Spotify (SPOT) competitor, lost support on Friday, dipping below $13.00 a share and triggering a buy order I had in place at $12.64. My next buy target for TME is near its historic all-time low at $11.80 where I plan to add more to this once high-flying growth play.

TME closed the week at $12.88, up +1.90% from where I added on Friday.

Tradeweb Markets (TW): Added to Position

Tradeweb Markets (TW) lost all support on Thursday, crashing more than -6% through its $38.38 low from more than a week ago. On its way down, it careened through a buy order I had in place at $37.74 before making a low at $36.08.

I’m still not entirely sure what happened as there was no news for the crash, making the move almost completely technical based on the charts. I’m going to continue investigating, but, in the meantime, my next buy order isn’t until TW breaks its all-time low of $33.68.

TW closed the week at $36.52, down -3.23% from where I added on Thursday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.