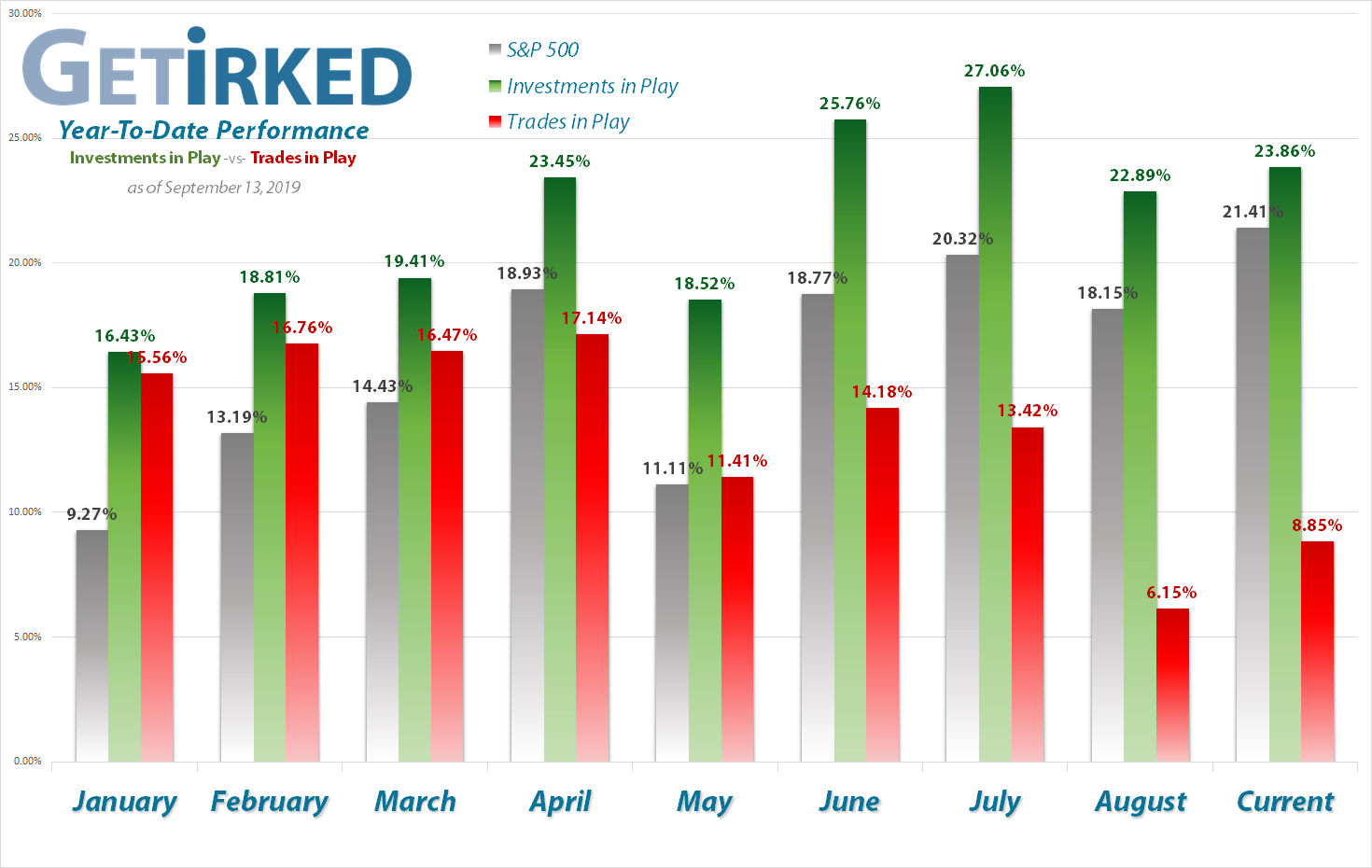

September 13, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

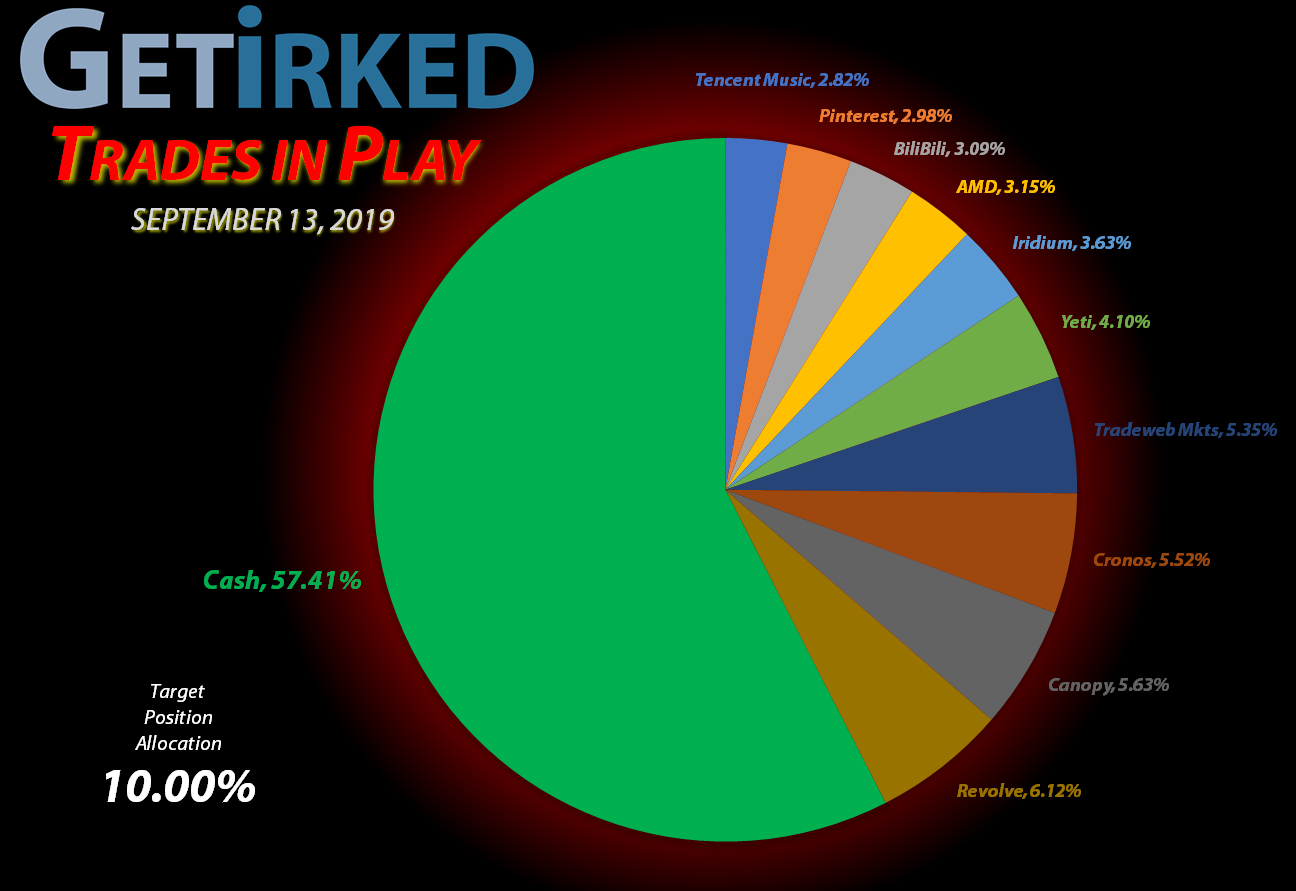

Portfolio Allocation

Positions

%

Target Position Size

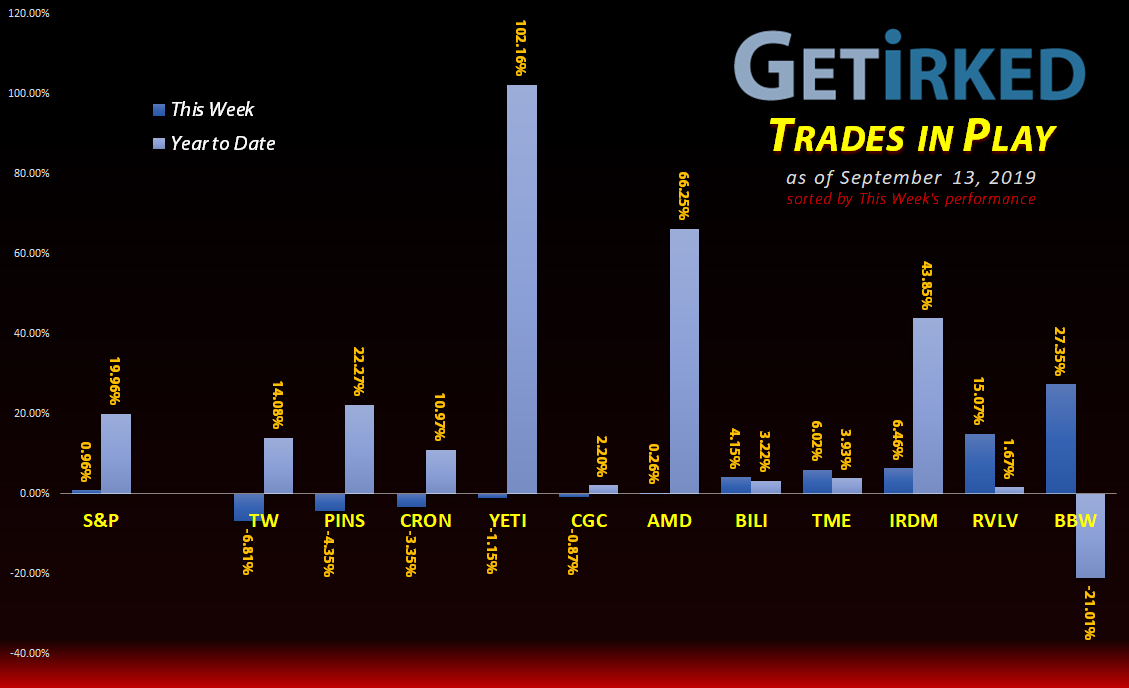

Current Position Performance

AMD (AMD)

+111.66%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $14.50

Yeti (YETI)

+77.41%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $16.91

Canopy Growth (CGC)

+33.64%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.55

Tencent Music (TME)

+31.53%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.45

Pinterest (PINS)

+21.00%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $24.00

Iridium Comm (IRDM)

+9.06%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $24.34

Build-A-Bear (BBW)*

+5.33%

1st Buy: 8/12/2019 @ $3.38

Current Per-Share: $0.00

Tradeweb Mkts (TW)

+5.05%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.25

BiliBili (BILI)

-1.81%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.34

Cronos Group (CRON)

-9.28%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $12.71

Revolve Group (RVLV)

-21.91%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $32.76

Highlights from the Week

Biggest Winner: Build-A-Bear (BBW)

Remember how I said last week that Build-A-Bear (BBW) had never been so oversold in the life of the stock? Well, BBW bounced +27.35% earning itself the Biggest Winner title for the week! I guess it’s only fitting considering exactly how slammed BBW took it over the past two weeks. Keep reading to see what I did with my upside-down trade.

Biggest Loser: Tradeweb Markets (TW)

Tradeweb Markets (TW) finally lost its footing after holding up so strong in these recent sell-offs, losing -6.81% and becoming our Biggest Loser for the week. Given that its areas of support have completely given out, this one might have a lot further to fall before it finds a floor…

This Week’s Trades

Build-A-Bear (BBW): *Closed with +5.33% Profit*

Last week’s Technical Analysis (TA) paid off as Build-A-Bear (BBW) continued last week’s bounce significantly, beginning in earnest on Tuesday before tapering off on Wednesday when I closed the position for a gain rather than a loss!

Recapping the Trade

Last week, after waiting three days from BBW’s devastating earnings report the week prior, the price action beat the stock to incredibly oversold conditions on the longest time-frames: Daily, Weekly. and even Monthly. By reviewing months of price history, BBW regularly bounces pretty substantially from similarly oversold conditions. I took the risk and doubled-down on my position to lower my per-share cost and see if I could take advantage of the bounce.

On Tuesday, I sold the extra shares I bought to reduce my exposed investment capital when Build-A-Bear crossed $2.80. Less than a week after doubling-down, I was holding as many shares as when I put on the trade in BBW in August except my position per-share cost had been reduced -17.16% from $3.38 to $2.80.

BBW continued its incredible bounce on Tuesday, hitting a daily high of $3.14 (a gain of more than 36% from last week’s low). I used a stop-loss limit order to sell 1/3 of the position at $3.09, a gain of +10.36% over my new per-share cost, which further lowered my per-share cost another -5.36% to $2.65.

On Wednesday, I noticed BBW potentially rolling over, so I used a trailing stop order (a new order option Robinhood added recently – read my Contingent Orders feature to learn more) to close the position if BBW lost support, which it did and my order filled at $2.92, locking in a total gain of +5.33%.

Although on Thursday BBW ended up bouncing to higher levels from where I sold, I’m very satisfied snatching a small victory from the jaws of a pretty epic defeat given the fact this position was down more than -25% at its low point and is now closed at +5.33%.

BBW closed the week at $3.12, up +6.85% from where I closed on Wednesday.

Iridium Communications (IRDM): Profit-Taking

Iridium Communications (IRDM) has been trading in a range between $20.50-$27.00 for the past few months, so when IRDM encountered resistance at $26.92 on Thursday, I used a trailing-stop order to take some profits, selling shares at $26.41 and lowering my per-share cost slightly -1.66% from $24.75 to $24.34.

While the sale didn’t significantly reduce my per-share cost, it freed up investment capital allowing me to allocate additional buys starting at my next price target of $21.38.

IRDM closed the week at $26.54, up +0.49% from where I sold on Thursday.

Tradeweb Markets (TW): Added to Position

Despite its relative strength comparative to its peers, even Tradeweb Markets (TW) got hit by the market rotation out of high-flying growth stocks into more reliable cyclical companies this week, dropping during Wednesday trading to trigger a buy order I had in place at $40.10.

The new shares raised my per-share cost +2.62% from $36.30 to $37.25, but also increase the position allocation to 5.58%. My next buy target is $37.80.

TW closed the week at $39.13, down -2.42% from where I added on Wednesday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.