September 6, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+111.10%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $14.50

Yeti (YETI)

+79.48%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $16.91

Canopy Growth (CGC)

+34.61%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.55

Pinterest (PINS)

+26.50%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $24.00

Tencent Music (TME)

+24.06%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $10.45

Tradeweb Mkts (TW)

+15.67%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $36.30

Iridium Comm (IRDM)

+0.73%

1st Buy: 3/25/2019 @ $26.28

Current Per-Share: $24.75

BiliBili (BILI)

-5.73%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $15.34

Cronos Group (CRON)

-6.13%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $12.71

Build-A-Bear (BBW)

-12.41%

1st Buy: 8/12/2019 @ $3.38

Current Per-Share: $2.80

Revolve Group (RVLV)

-32.14%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $32.76

Profit % for * positions = Current Gross Profit / Original Capital Investment

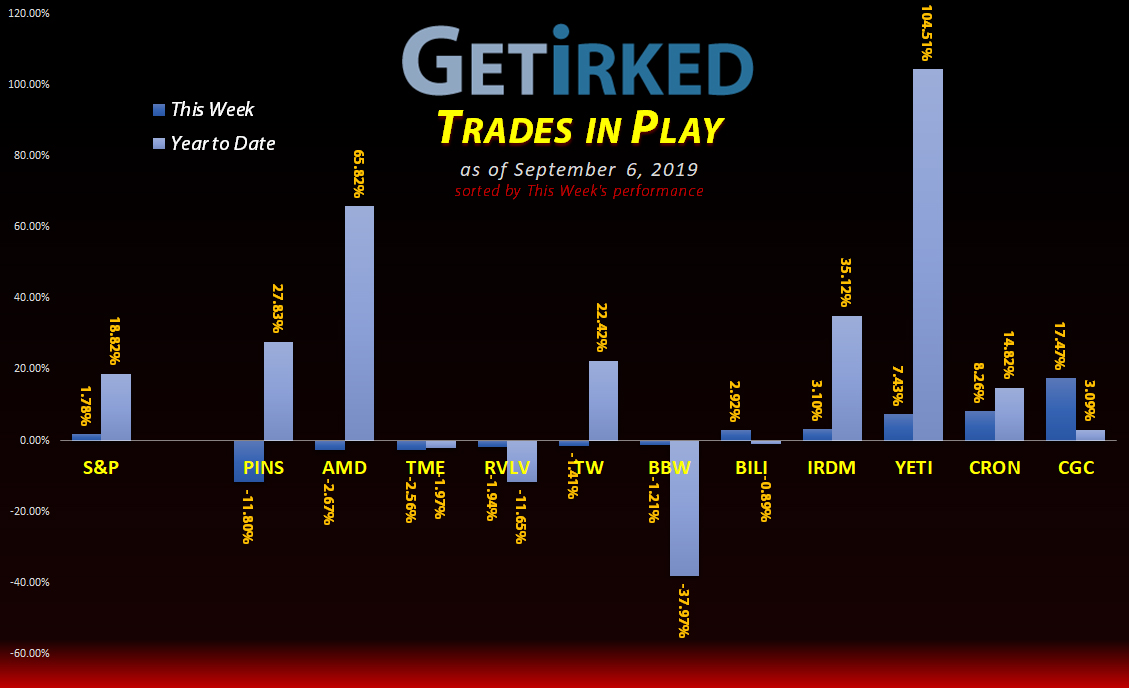

Highlights from the Week

Biggest Winner: Canopy Growth Corp (CGC)

Since Canopy Growth Corp (CGC) is my only crossover play in both Investments and Play and Trades in Play, whenever CGC is the biggest winner or loser, it typically is the same in both portfolios.

However, this week, Canopy (CGC) truly earned the Biggest Winner title with a +17.47% bounce off of its recent selloff. Granted, the bounce is not an indication that CGC has bottomed, but it at least gives us a low to play off of.

Biggest Loser: Pinterest (PINS)

After holding up remarkably well in terms of relative strength over the past few weeks of volatility, Pinterest (PINS) finally slipped up this week, losing -11.80% of value to earn itself the Biggest Loser spot.

To make matters even more frustrating, there was no real news leading to PINS’ collapse; the price action was almost as if all the buyers evaporated, on an up day, no less.

PINS fell through its 50-Day Exponetial Moving Average on Friday which could potentially indicate lower-lows in its future.

This Week’s Trades

Build A Bear (BBW): Added to Position?!

As I was tracking the stock during the Three Day Rule window after reporting a terrible quarter last week, Build-A-Bear (BBW) continued to sell off dropping another nearly -20% since its -11% drop on Thursday. It reached a new all-time low of $2.34 on Tuesday.

At its current levels, BBW has reached historically oversold conditions – conditions never seen in the history of the company’s stock.

Since Trades in Play is a speculative portfolio and my position represented 0.62% of my entire invested assets, I decided to experiment and break my rules.

Rather than cut the loss, I doubled-down at $2.36 on Wednesday in order to play for a potential bounce, increasing my position allocation to 2.93% of the Trades in Play portfolio and a total of 0.144% of all invested assets. The buy order reduced my per-share cost more than -17% from $3.38 to $2.80.

The Strategy?

Historically, when BBW becomes this oversold on the Daily, Weekly, and Monthly time frames, it bounces as high as 50% of its most recent selloff. The current selloff started with a high of $6.29 back in June, making a potential bounce play to $4.31 – 50% of the drop and 84% higher from its $2.34 low – a distinct possibility.

That being said, I’m not playing for that big of a bounce with the entire position. I’ve placed a limit sell order to pull out the new shares I added on Wednesday should BBW bounce to my new per-share cost basis of $2.80. That will reduce my invested capital lower than the original play plus offer me the opportunity to pull the remainder out near the $4.31 target (if BBW gets there).

My desired price target is $4.15, a 40% gain for my initial capital or ~20% over the current allocation (including the sale of the new shares at $2.80).

Note: This play goes against my long-term investing discipline and I would never make a similar move in my Investments in Play account. Since this position represents a tiny portion of my portfolios and the entire point of a speculative account is to allow an investor to make mistakes using a very small basis, I decided to take the risk and am prepared to take greater losses.

BBW closed the week at $2.45, up +3.81% from where I added on Wednesday.

Pinterest (PINS): Added to Position

In the middle of a market headed higher, Pinterest (PINS) lost support at the $32 mark on Thursday, dropping to a buy order I had in place at $31.52. The order replaces shares I sold 9.1% higher at $34.67 and raises my per-share cost from $20.24 to $24.00.

While I don’t expect to see PINS drop below $30 given the current market conditions, my next buy order is at $28.00, down more than -10% from where I bought on Thursday.

PINS closed the week at $30.36, down -3.68% from where I added on Thursday.

Tradeweb Markets (TW): Added to Position

Tradeweb Markets (TW) lost support during Monday morning’s selloff, finally breaking through the $42.00 mark and triggering a buy order I had in place at $41.42, raising my per-share cost +7.59% from $33.74 to $36.30, but replacing shares I sold much higher at $47.12, locking in 12.1% profits on the shares I sold.

My next buy target is much lower at $37.70. Given the relative strength TW has demonstrated during the recent selloffs and extreme volatility, I don’t expect it to drop that low, however, I do want to pick up some more shares should it test that level.

TW closed the week at $41.99, up +1.38% from where I added on Monday.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.