August 2, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

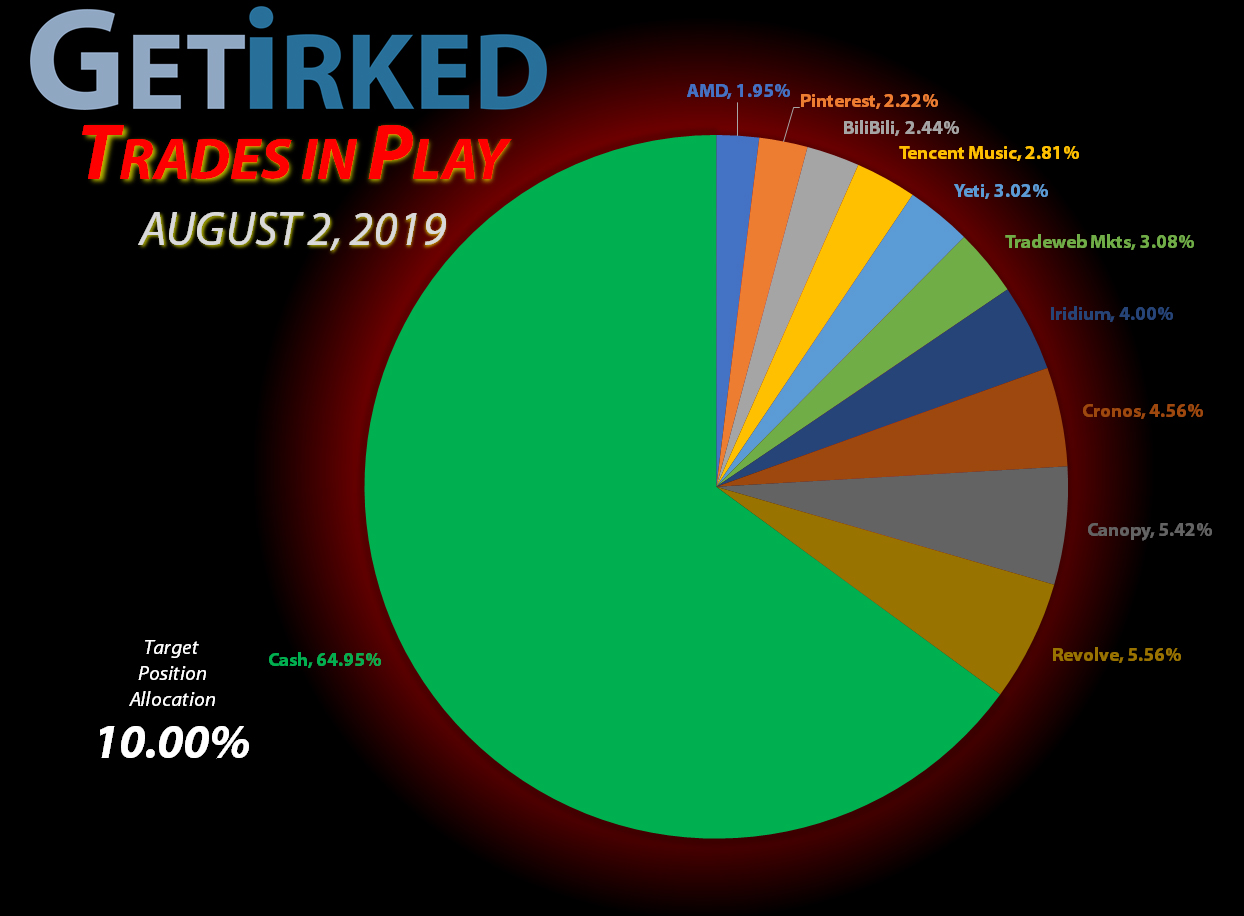

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+270.31%

Yeti (YETI)

+124.11%

Groupon (GRPN)*

+116.59%

Canopy Growth (CGC)

+69.83%

Pinterest (PINS)

+65.86%

Gossamer Bio (GOSS)

+44.49%

Tradeweb Mkts (TW)

+37.82%

Tencent Music (TME)

+35.16%

Cronos Group (CRON)

+3.41%

Iridium Comm (IRDM)

-2.46%

Revolve Group (RVLV)

-4.20%

BiliBili (BILI)

-6.13%

Nio (NIO)

-24.81%

New Age Bev (NBEV)

-34.48%

* Indicates a position where the capital investment was sold.

Profit % for * positions: Held Shares Gain + 100% of Capital Returned.

Highlights from the Week

Biggest Winner: Pinterest (PINS)

Pinterest (PINS) was one of the only bright spots in a sea of red, earning the Biggest Winner spot with an outstanding earnings report on Thursday, causing the stock to pop more than +20% on Friday.

Biggest Loser: Yeti (YETI)

Yeti (YETI) continues to be one of the most volatile positions in the portfolio and once again is the Biggest Loser this week, selling off more than -15% this week as traders took their profits after Yeti’s new all-time high.

This Week’s Trades

Canopy Growth (CGC): Added to Position

The Great Cannabis Selloff continued this week, causing Canopy Growth Corp (CGC) to break through support this week, triggering buy orders I had placed at areas of support at $33.95 (crossed Monday) and $31.90 (crossed Thursday), an average price of $32.93.

The order raises my per-share cost to $19.26 but increases my allocation by replacing shares I sold at $46.72, a decrease in cost of -29.52% to replace the shares I sold.

My next buy order at $28.85 is slightly above another point of support and will raise my per-share cost to $22.00 where I will reevaluate the stock’s price action before making additional buys and raising my per-share cost any further..

You may have noticed that Canopy Growth (CGC) is the only crossover position which I hold in both my Trades in Play and my Investments in Play portfolios, kind of like Kermit the Frog. He was the only Muppet to appear both on The Muppet Show and Sesame Street. It’s true! He’s the only character to cross over from the entire ensemble!

While in my Trades in Play portfolio I’m using a much more aggressive strategy with CGC, my Investments in Play portfolio uses CGC as a long-term investment with my next buy target not until CGC hits much more oversold conditions at $26.66 and lower.

CGC closed the week at $32.71, down -0.07% from my average buy price.

Cronos Group (CRON): Added to Position

Just like the rest of the cannabis sector, Cronos Group (CRON) entered extreme oversold territory on its Daily Relative Strength Indicator (RSI) on Thursday, prompting me to add to my position when Cronos edged down to my cost basis of $13.30 before bouncing.

My next buy target is much lower at $11.31 if Cronos and the rest of the cannabis sector continues its descent into dramatically oversold territory rather than bottoming here.

CRON closed the week at $13.75, up +3.38% from Thursday’s buy.

Gossamer Bio (GOSS): Position Closed for +44.49% Profit

Gossamer Bio (GOSS) lost its uptrend on Monday, triggering a stop-limit sell order I had in place and taking profits at $20.68.

This sale captures 9.59% in gains in a single week, selling the shares I picked up last Monday and lowering my per-share cost to $11.34, a price point more than -27% lower than GOSS’s all-time low of $15.59. As discussed last week, I will no longer be adding back to this position and will use Technical Analysis (TA) to unwind my position to capture as much profit as possible.

Given GOSS’s loss of the uptrend, I switched from using limit orders at higher levels to sell shares to using stop-limit sell orders to prevent losses. On Tuesday, GOSS dropped below its 12-Day Exponential Moving Average, triggering another stop order which filled at $19.68 to capture more profits.

From that point, GOSS reversed course and bounced through Wednesday and into Thursday’s trading with me raising my stop loss repeatedly intraday to chase the bounce.

I noted that GOSS historically doesn’t break an uptrend until it retreats through the 12-interval Exponential Moving Average (EMA) on the 5-minute time interval. Since I wanted to minimize losses and maximize gains, I used this very aggressive strategy, raising my stops at key points until GOSS pulled back and closed out my position entirely on Thursday at $20.50.

Overall, I earned 44.49% in profit over the five months I held my position. I’m going to continue watching GOSS for oversold conditions, but future trades will be much shorter now that I better understand how this crazy stock moves.

GOSS closed the week at $18.57, down -9.41% from where I last sold on Tuesday.

Groupon (GRPN): Cost Basis Removed +5.33% Profit

Groupon (GRPN) pulled back on Monday, triggering the stop-limit sell order I had in place, pulling out my capital investment along with +5.33% in profits at $3.47.

I intend to keep the remaining shares as a “lottery ticket” in case GRPN’s management pulls off a miracle, either turning the company around or tendering a buyout offer. In the meantime, this will be last time Groupon (GRPN) will be reported on in Trades in Play until something magical happens.

Oh, and here’s an example of Better Lucky Than Good:

GRPN reported its Q2-2019 earnings after the bell on Tuesday and it was a stinker. In fact, GRPN missed on revenue and profit decreased in all areas. The stock dropped more than -5% in after-hours trading. Looks like I dodged a bullet and although I wish it could say it was skill, it was all luck. Talk about timing!

GRPN closed the week at $3.12, down -10.09% from where I sold on Monday.

New Age Beverages (NBEV): Closed -34.48% Loss

As if the selloff in the cannabis sector wasn’t enough, Trump’s announcement that he plans to increase tariffs against China on Thursday created a market-wide selloff leading to New Age Beverages (NBEV) losing the little uptrend it had and reversing course, triggering my stop order to completely close the position at $3.58, a total loss of -34.48%.

NBEV ended up seeing a surprise bounce into the end of the week. However, they report earnings next week, and although they might pull off a good report, it’s doubtful.

The lesson (as you will read in Nio (NIO) below) is that I should have cut my losses sooner. The one bright side is at least this bugger’s out of my portfolio now.

NBEV closed the week at $3.75, up +4.75% from where I sold on Thursday.

Nio (NIO): Closed -24.81% Loss

The Trump Selloff on Thursday hit all stocks hard, particularly those that had been in shaky uptrends like New Age Beverages (NBEV) and Nio (NIO) which promptly reversed course and triggered a stop loss order I had in place to cut my losses at $3.25.

The total loss for the position is -24.81%, however, given the new tariffs announced by Trump to be placed on China as well as the weakness in the Electric Vehicle (EV) segment both in the U.S. and abroad, I’m not too sad to see this one go.

NIO closed the week at $3.27, up +0.06% from where I sold on Thursday.

Pinterest (PINS): Profit-Taking

Pinterest (PINS) reported earnings after the bell Thursday, and they were good… very, very good. Revenue blew away the numbers as analysts were expecting $236 million for the quarter and the company reported revenues totaling $261 million – a 10.59% beat!

PINS skyrocketed more than 20% on Friday.

I followed the stock’s upward trajectory using stop loss orders to capture profits in some of my shares at $34.67 when PINS pulled back from its $35.21 daily high. The sale represents a gain of +38.40% from my $25.05 per-share cost and effectively lowered the cost of my remaining shares to $20.24, a -19.2% decrease.

PINS closed the day at $33.57, down -3.17% from where I took profits.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.