July 19, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+309.31%

Canopy Growth (CGC)

+249.46%

Aurora Cannabis (ACB)

+110.46%

Yeti (YETI)

+73.13%

Gossamer Bio (GOSS)

+55.23%

Tradeweb Mkts (TW)

+46.71%

Tencent Music (TME)

+37.46%

Groupon (GRPN)

+18.56%

Cronos Group (CRON)

+12.51%

Pinterest (PINS)

+2.04%

BiliBili (BILI)

-0.87%

Revolve Group (RVLV)

-3.85%

Iridium Comm (IRDM)

-4.20%

New Age Bev (NBEV)

-25.61%

Nio (NIO)

-25.63%

* Indicates a position where the capital investment was sold.

Profit % for * positions: Held Shares Gain + 100% of Capital Returned.

Highlights from the Week

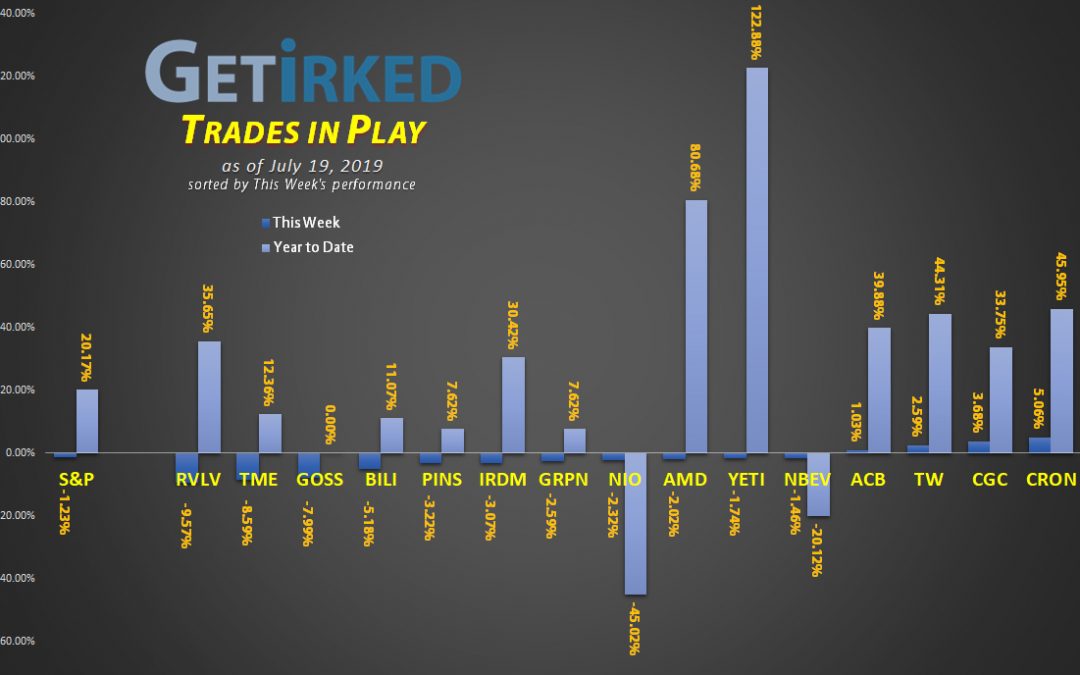

Biggest Winner: Cronos Group (CRON)

The weekly winner this week is from the cannabis sector, but don’t get too excited – Cronos Group’s (CRON) +5.06% pop comes after the entire sector has gotten slammed over the past few weeks, with Cronos down more than -15% from June 11’s high (pun intended). Cronos is still up +45.95% for the year, so I’m not feeling too bad about it.

Biggest Loser: Revolve Group (RVLV)

Traders love an Initial Public Offering (IPO) and Revolve Group (RVLV) showed why with an epically-volatile near 10% drop this week, earning it the Weekly Loser award.

Revolve continues to show good forward prospects and IPOs are notoriously volatile, so its price action just goes to show why I choose to keep this one in my speculative portfolio with small allocations rather than putting it toward any kind of long-term investing.

This Week’s Trades

No Moves This Week, but Check Out Slack (WORK)!

Wait. What? There were no moves in the Trades in Play this week?!

That’s right!

When the market trades sideways, sometimes there’s just not enough movement to hit any position’s price target either higher or lower, so that means it’s time to just sit on my hands and watch the market.

It occurred to me that I don’t often revisit my old positions in the blog after I’ve closed them out, so I decided to take a look at Slack (WORK) after I cut my losses last week:

Slack (WORK) did end up seeing a nice bounce after I sold on July 12, but once word came out that the CEO’s been selling his shares, all hell broke loose.

Following Microsoft’s (MSFT) announcement that their free Teams product was kicking the snot out of Slack’s freemium offerings, bad went to worse when news came out that Slack’s CEO has been selling millions of dollars worth of his own shares every single day since the company’s direct listing.

Analysts and pundits claim this strategy is normal since he had so much of his personal wealth tied up in the company, but there’s an old trading adage: “Insiders only buy for one reason – they think their company’s stock is going higher. While they may claim they’re selling for many reasons – it’s typically the opposite: the stock’s headed down.”

Although Slack (WORK) did pop after I bailed on my position, it closed the week at $31.30, down –6.9% from where I called it quits last week at $33.62.

Questions?

As always, If you have questions about how I’m playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.