June 21, 2019

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Canopy Growth (CGC)

+295.67%

Aurora Cannabis (ACB)

+124.62%

Gossamer Bio (GOSS)

+87.01%

AMD (AMD)

+48.45%

Tencent Music (TME)

+43.59%

Yeti (YETI)

+33.04%

Groupon (GRPN)

+21.01%

Cronos Group (CRON)

+19.88%

Tradeweb Mkts (TW)

+13.12%

Pinterest (PINS)

+11.70%

Revolve Group (RVLV)

-0.51%

BiliBili (BILI)

-1.58%

Slack (WORK)

-4.69%

Iridium Comm (IRDM)

-5.86%

New Age Bev (NBEV)

-15.51%

Nio (NIO)

-39.58%

* Indicates a position where the capital investment was sold.

Divide position’s current price by gains to calculate initial buy price

Highlights from the Week

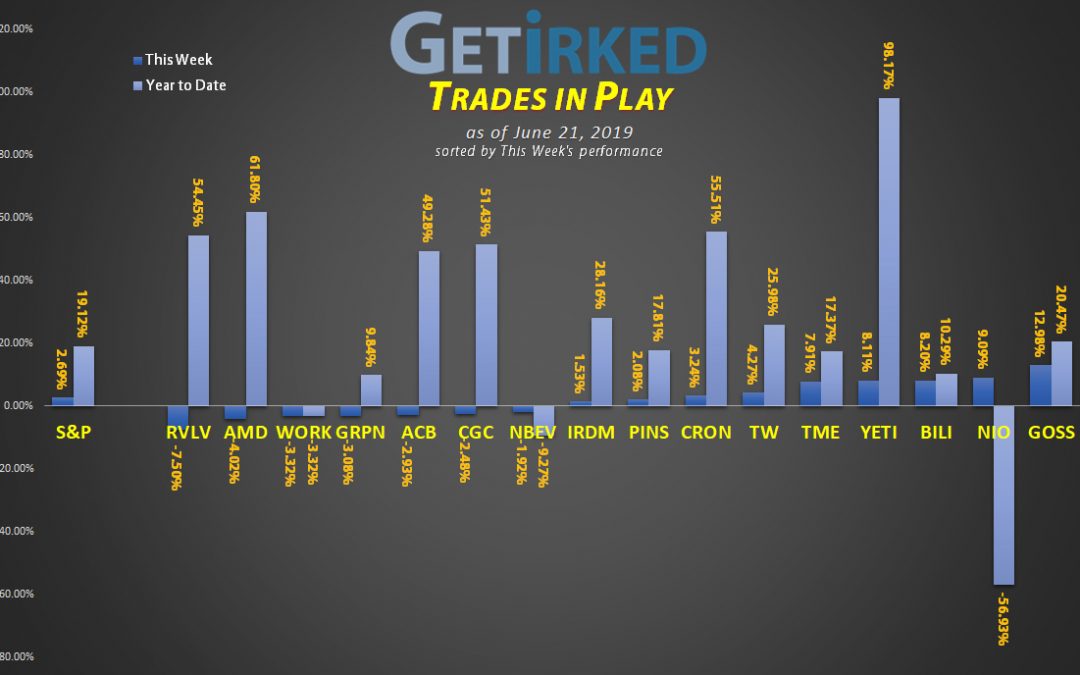

Biggest Winner: Gossamer Bio (GOSS)

Gossamer Bio (GOSS) returns to our Weekly Winner spot with a +12.98% gain this week, capping out a Year-To-Date (YTD) gain of +20.47%. This stock continues to trade contradictory to the market, seeing its biggest gains during marketwide down days and pulling back when the rest of the market goes up.

Biggest Loser: Revolve Group (RVLV)

Revolve Group (RVLV), the millenial clothing IPO with a social media play that was our Weekly Winner last week, reversed course to earn the Weekly Loser position this week, dropping -7.50% but still up +54.45% from where it started publicly trading just a short while ago.

This Week’s Trades

Aurora Cannabis (ACB): Added to Position

Aurora Cannabis (ACB) lost support on Friday following Canopy Growth’s (CGC) guidance for greater losses in Q4 of 2019, triggering a buy order we had in place at $7.33. This order raises our per-share cost to $3.25 but also increases our allocation.

We have lower buy targets for ACB at $6.00 and $5.05.

ACB closed the week at $7.30, down -0.41% from where we added on Friday.

BiliBili (BILI): Position Reduction

Patience is everything in this business. BiliBili (BILI) rose with the rest of the markets on Thursday, giving us the opportunity to correct last week’s “fat-finger error” where we accidentally added to our position at $15.10 per share when we were actually intending to enter a limit sell order at higher levels.

Thursday allowed us to reduce our position size at our per-share cost of $15.69, effectively capturing an increased position size overall for less money. Our initial buy in BiliBili was $17.68 on March 7, 2019 for less than half of our current allocation, a reduction of more than 11.25% to our current per-share cost.

BILI closed the week at $15.44, down -1.59% from where we sold Thursday.

Gossamer Bio (GOSS): Taking Profits

Gossamer Bio (GOSS) continued its climb this week, crossing through the $22.00 mark on Wednesday, triggering a sell order where we took profits, lowering our position cost to $12.24 (down -37.8% from our initial buy in the stock at $19.68 on Feb 20, 2019).

GOSS seems to be stuck in a trading range from $15.59, its all-time low, to the $23-25 mark with its all-time high at $25.06. We have no problem with that, as it offers us the opportunity to add to our position in the lows and then use profits to reduce costs as it returns to the highs.

Our next buy target is in the low $16s, if GOSS returns to those levels, with no intention at the moment to sell any of our current position before we see where the current upward move takes us as it might make a higher all-time high.

GOSS closed the week at $22.89, up +4.05% from where we sold on Wednesday.

Slack (WORK): *New Position*

Slack (WORK), the revolutionary enterprise communication platform mixing Instant Messaging with data storage, came public during a direct-listing (different from an IPO in that the company doesn’t issue new shares and goes straight to market with only its existing shares) on Thursday.

While some analysts suggest that competitors such as Google (GOOG) or Microsoft (MSFT) could create an alternative to Slack’s platform, the userbase Slack has developed swears by the product which offers a “freemium” subscription model where teams up to a certain size can use the service for free followed by a per-user monthly cost.

Slack’s team continues to develop new features for the service, and their studies demonstrate a “stickiness” to their product where users become so entrenched that the idea of switching to a competitor simply isn’t on the table.

The direct-listing reference price for WORK was $25.00 per share, but it ended up coming public at $38.50 after huge demand. We waited for a pullback and built a position with an average price of $39.05.

Our lower price targets for the stock are $36.05, $32.25, 28.61, 26.26 and $25.18.

Slack closed the week lower at $37.22, down -4.69% from our position per-share cost.

Questions?

As always, If you have questions about how we’re playing different positions or anything at all, really, feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.