November 20, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Grow Generation (GRWG)

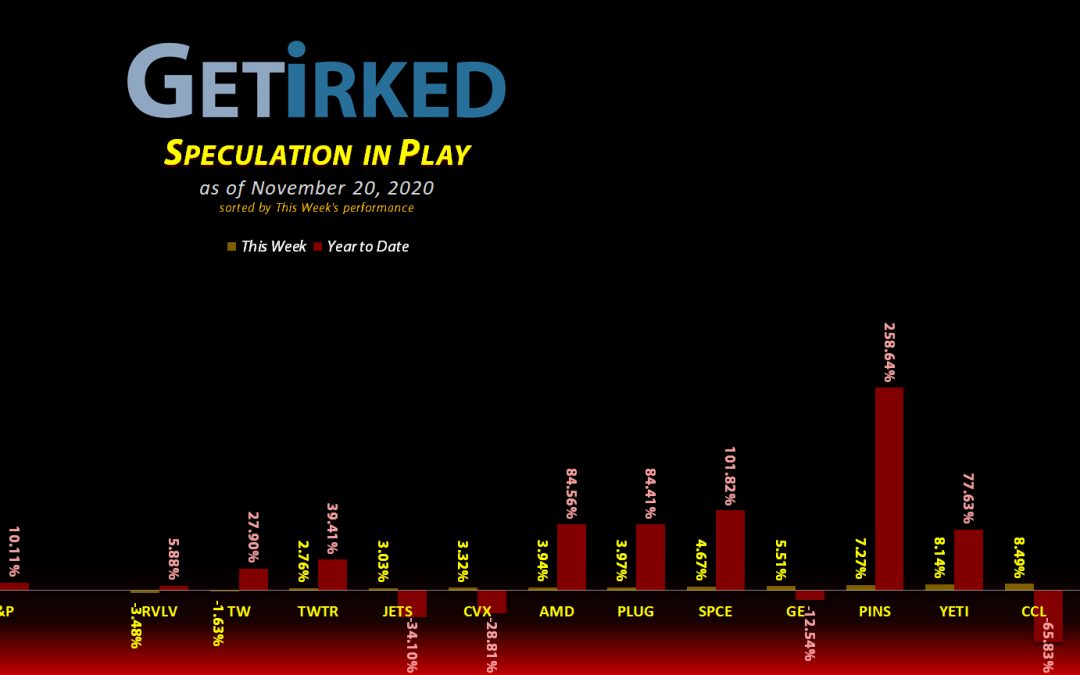

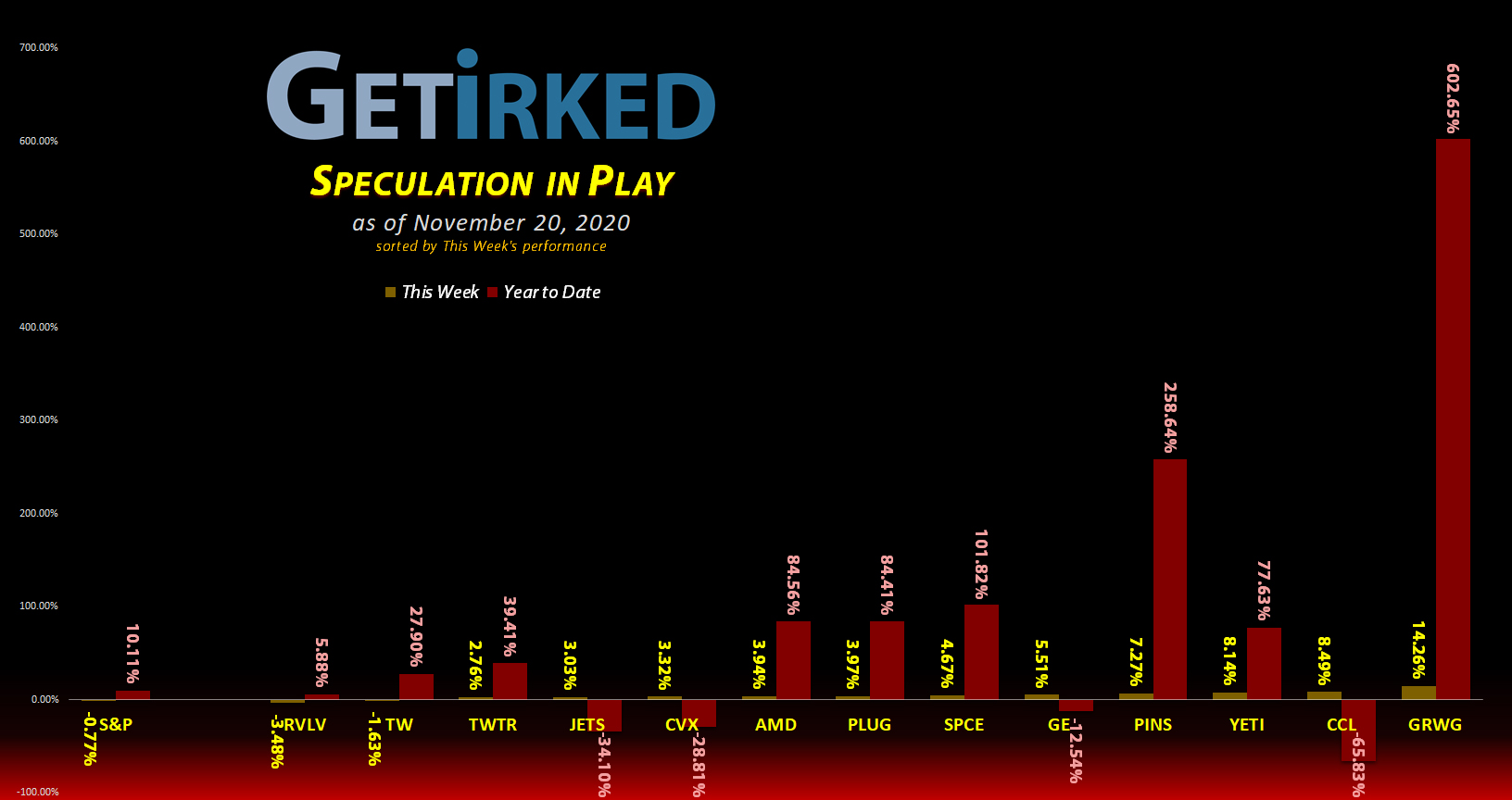

Grow Generation (GRWG) grabbed another high this week, gaining +14.26% and locking in its spot as the Biggest Winner.

Revolve Group (RVLV)

Revolve Group (RVLV) remains out-of-fashion and just can’t get the attention of, well, anyone, really. RVLV lost -3.48% this week and earned itself the spot of the Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+768.70%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($58.79)*

AMD (AMD)

+558.88%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$5.14)*

Yeti (YETI)

+531.98%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+226.70%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Twitter (TWTR)

+199.81%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: (-$45.02)*

Airlines ETF (JETS)

+186.59%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$3.72)*

Carnival Cruise (CCL)

+179.91%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-1.01)*

Tradeweb Mkts (TW)

+176.13%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $21.47

Grow Gen. (GRWG)

+81.85%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.04

Plug Power (PLUG)

+72.28%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $14.28

General Electric (GE)

+54.65%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.32

Chevron (CVX)

+44.49%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $59.38

Revolve Group (RVLV)

+0.76%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $19.29

12/31 SPY Put Spreads

-57.19%

Cost: $2.4993

Current Value: $1.07

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Super-Speculative Basket

Airlines ETF

JETS

Carnival Cruise

CCL

Virgin Galactic

SPCE

What is the Super-Speculative Basket?

The Super Speculative Basket (“Super-Spec”) is made up of a handful of stocks so incredibly volatile that I’m uncomfortable giving any of them full allocations even in my Speculation in Play portfolio, instead dividing a single allocation among all of them.

Currently, my Super-Spec stocks are as follows: the Airlines ETF (JETS), Carnival Cruise Lines (CCL), and Virgin Galactic (SPCE). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Pinterest (PINS): Profit-Taking

It was time to take more profits in Pinterest (PINS) when it made a stab at its all-time high on Friday with a sell order that filled at $67.13.

The sale locked in +290.52% in profits on some shares I bought back on March 9 for $17.19, nearly a quadruple. I have no additional sell targets at this time as I’d like to wait to see where Pinterest heads from here, although my next buy target is $53.78, just above the point where it last pulled back.

PINS closed the week at $66.85, down -0.42% from where I sold Friday.

SPY Put Spread Insurance: Option Roll Out

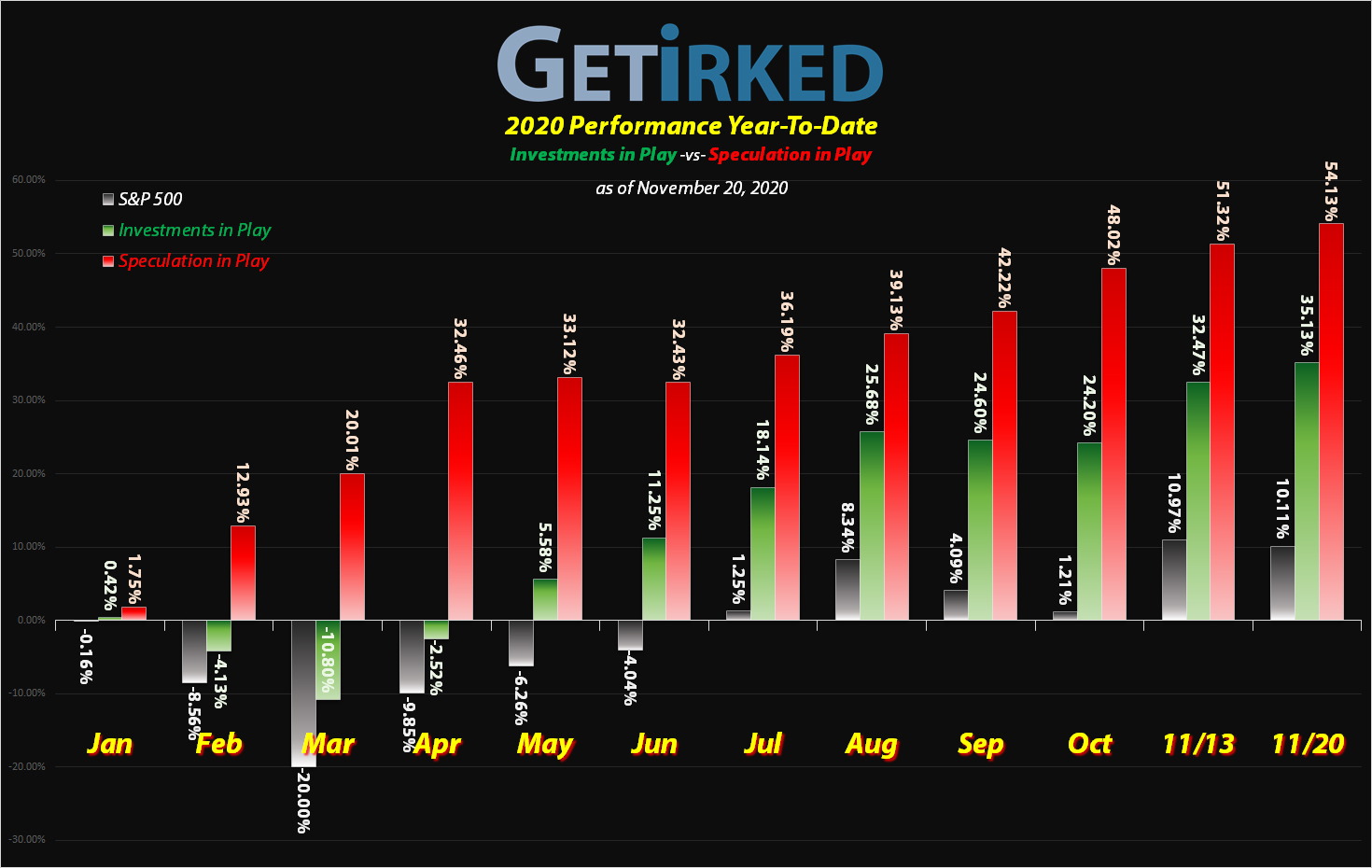

When the market continued to rally on vaccine news on Monday, the all-new highs seen in the S&P 500 (and the SPY, the ETF that tracks the S&P 500) just seemed to euphoric to be believed.

Rather than just sticking with the put spreads I had in place, the 329-324 spreads expiring on December 4, I decided to make some changes. The 329-324 spreads would require the market to sell off more than 8.5% before they would be back in the green, and that sell off would have to happen in a matter of less than 3 weeks.

Given that short time frame and the fact that the VIX was relatively low on Monday around 24, I decided to roll out my put spreads, increasing the spread range and also picking the options that expired on 12/31 so I could have put spread insurance between now and year-end. I chose the 343-338 spread range as any selloff of 5% or more from these levels between now and year-end could make the spreads break-even and a bigger selloff would mean profits.

Between closing out my existing 329-324 spreads and opening the 343-338 spreads, I increased the cost of puts from $1.83 each to $2.4993 each. The maximum profit per spread is $500 (the difference between 343 and 338 multiplied by 100 per contract).

This means, I have the potential to make 2:1 on my capital ($500 maximum return over $250 cost). As of Monday’s portfolio value, I did decide to take on higher risk play, now risking 5.81% of my portfolio’s current value to protect against downside and provide a potential 11.61% in gains.

Given the portfolio is up +54.13% and the spreads only make up only 2.49% of the entire portfolio at current values, I’d still finish the year up +51.64% if the rest of the portfolio remained flat and the spreads expired worthless, a highly unlikely scenario (as either my positions will go up with the market increasing the overall portfolio gains or the spreads will increase in value when the market sells off). Either way, being up +51.64% at year-end is still a remarkable gain and a definite win during a pandemic.

Cost per Spread: $2.4993

Current Value: $1.07

Profit/Loss: -57.19%

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.