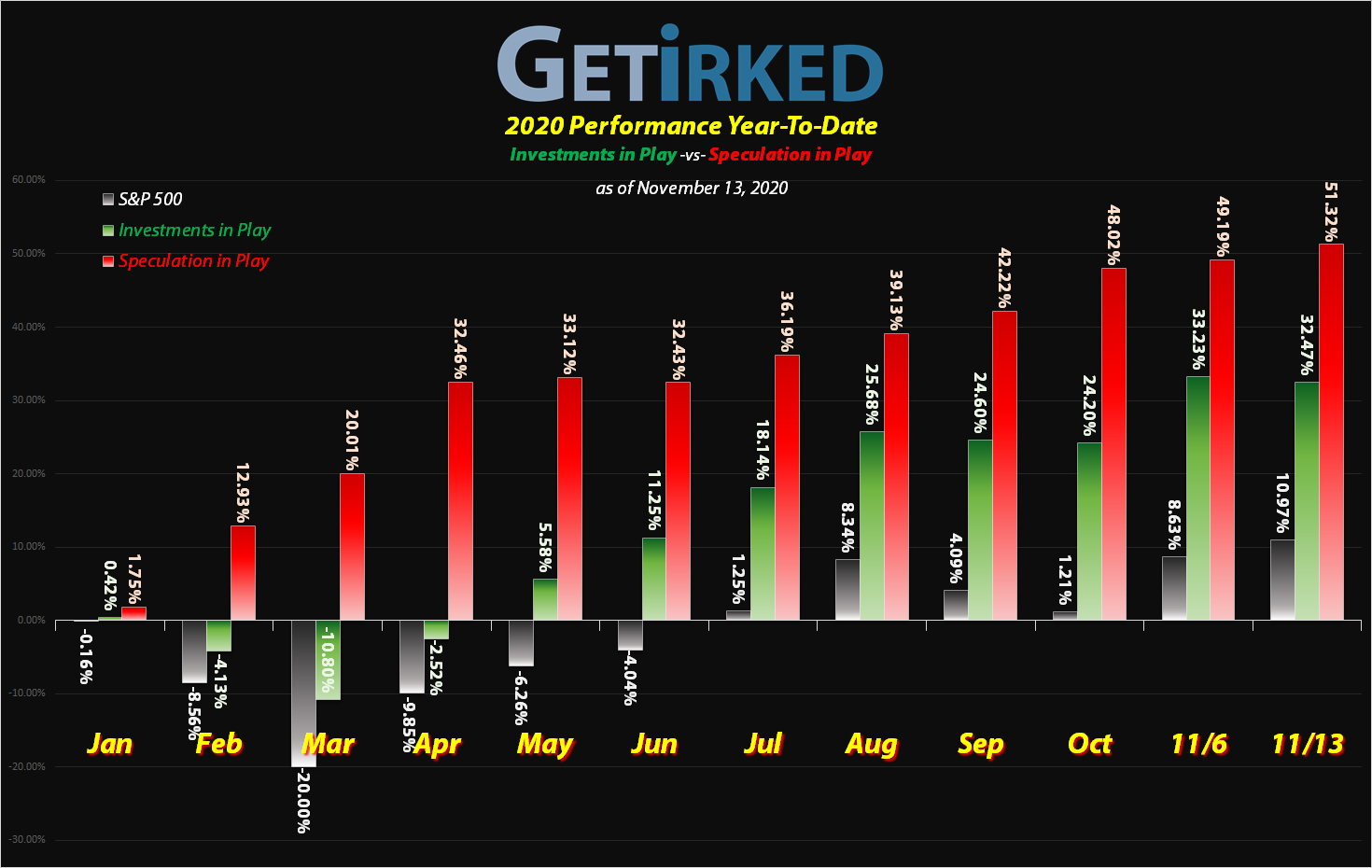

November 13, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

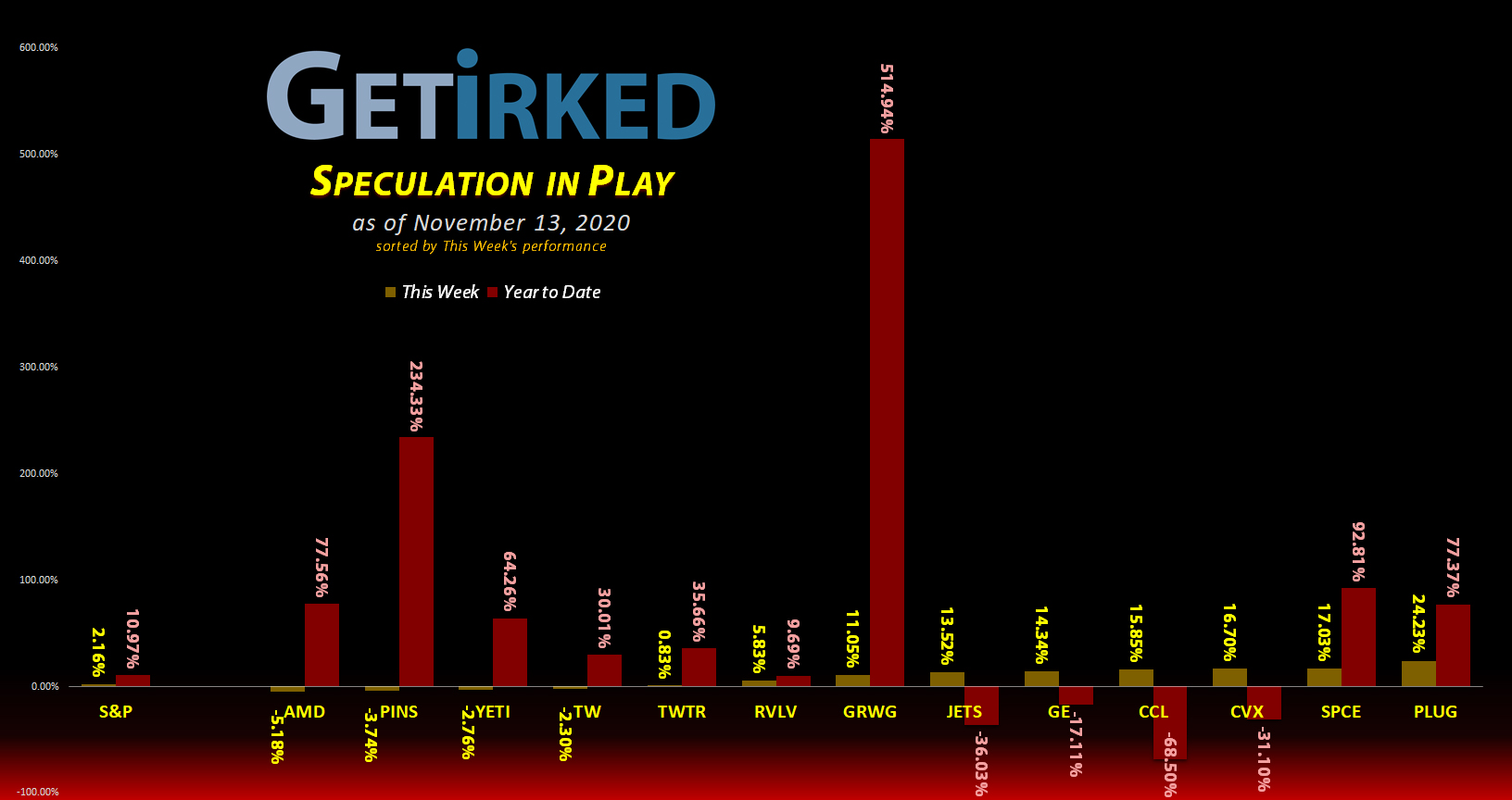

The Week’s Biggest Winner & Loser

Plug Power (PLUG)

Plug Power (PLUG) reported a better-than-expected earnings report and solidified itself as a potential future for Electric Vehicles (EV) this week. Plus, it locked in the Biggest Winner spot with a +24.23% gain!

AMD (AMD)

Investors threw away everything tech and stay-at-home this week, and even shining star AMD (AMD) got slammed, earning itself the week’s Biggest Loser spot with a -5.18% weekly loss.

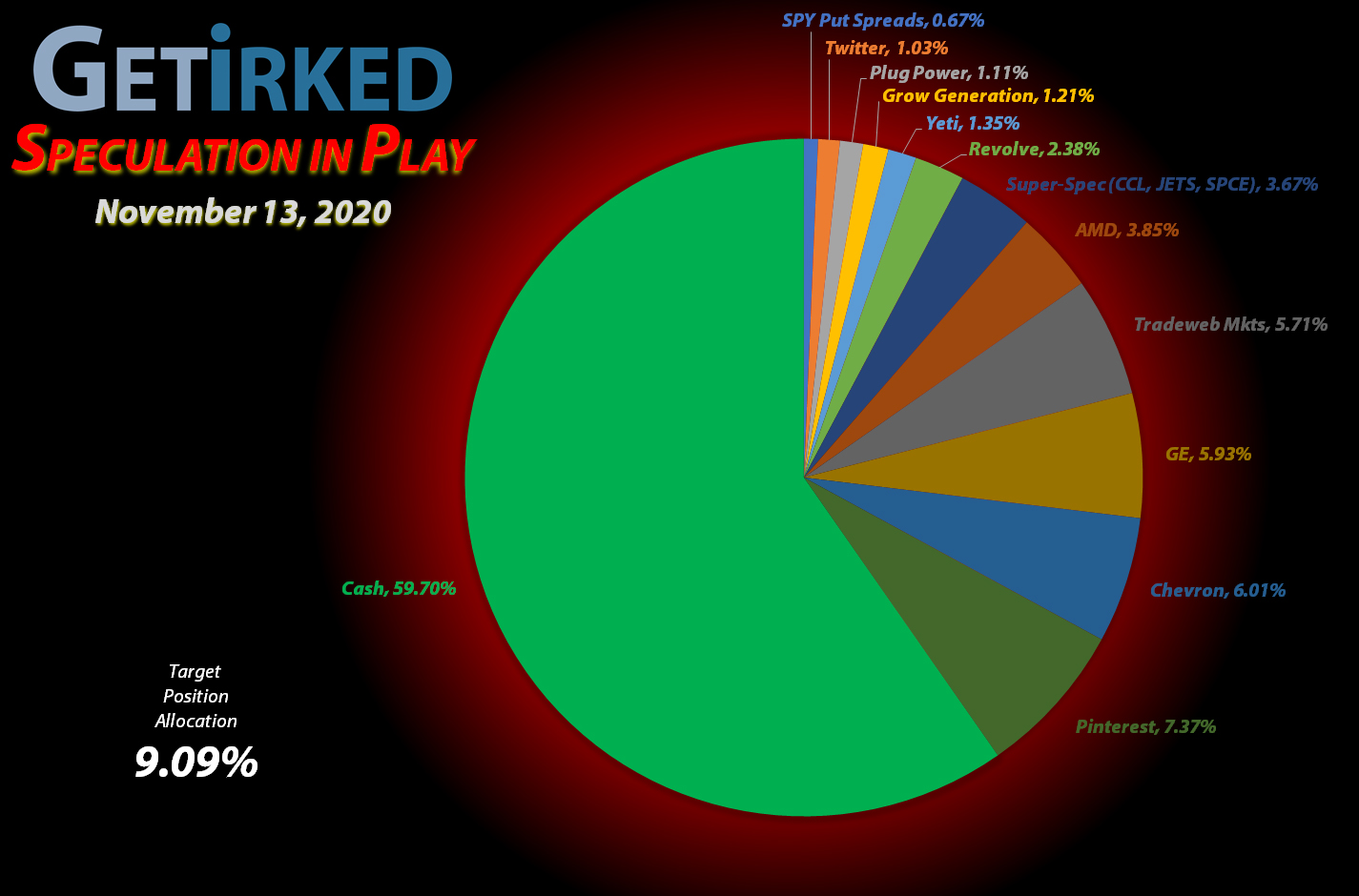

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Pinterest (PINS)

+738.19%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.60)*

AMD (AMD)

+542.47%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$5.14)*

Yeti (YETI)

+522.14%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+221.08%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Twitter (TWTR)

+198.48%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: (-$45.02)*

Airlines ETF (JETS)

+184.45%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$3.72)*

Tradeweb Mkts (TW)

+180.70%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $21.47

Carnival Cruise (CCL)

+173.99%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-1.01)*

Plug Power (PLUG)

+65.70%

1st Buy: 10/30/2020 @ $14.28

Current Per-Share: $14.28

Grow Gen. (GRWG)

+59.15%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.04

General Electric (GE)

+46.57%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.32

Chevron (CVX)

+39.84%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $59.38

Revolve Group (RVLV)

+4.38%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $19.29

Put Spreads (SPY)

-84.37%

Cost: $1.83

Current Value: $0.285

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Super-Speculative Basket

Airlines ETF

JETS

Carnival Cruise

CCLVirgin Galactic

SPCEWhat is the Super-Speculative Basket?

The Super Speculative Basket (“Super-Spec”) is made up of a handful of stocks so incredibly volatile that I’m uncomfortable giving any of them full allocations even in my Speculation in Play portfolio, instead dividing a single allocation among all of them.

Currently, my Super-Spec stocks are as follows: the Airlines ETF (JETS), Carnival Cruise Lines (CCL), and Virgin Galactic (SPCE). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Airlines ETF (JETS): Profit-Taking

Following the COVID-19 vaccine news on Monday, the Airlines ETF (JETS) skyrocketed, flying through a sell order I had in place which filled at $21.35.

The order sells some of the shares I just bought on October 28 for $16.44 to lock in +29.87% in gains in less than two weeks and pulls my capital back out of the position. This takes the per-share cost down to -$3.72 (each remaining share cost nothing from the investment capital and adds $3.72 in profit in addition to its share price value).

From here, I have no additional sell targets and my next buy target is $16.90

JETS closed the week at $20.15, down -5.62% from where I sold Monday.

General Electric (GE): Profit-Taking

General Electric (GE) exploded higher with the rest of the market on Monday thanks to COVID vaccine news and the election of President-Elect Joe Biden. A sell order I had in place filled at $8.84, locking in +59.57% in profits on some shares I bought back on May 13 for $5.54.

The sale reduced my per-share cost -2.62% from $6.49 to $6.32. My next sell target for the stock is just over $10.00 and my next buy target is around $5.95.

GE closed the week at $9.25, up +4.64% from where I sold Monday.

Revolve Group (RVLV): Profit-Taking

After reporting a decent but not super-impressive quarter Thursday morning, I decided it was time to take some small profits and further reduce my position in Revolve Group (RVLV) by selling some shares at $20.87.

The sale reduced my per-share cost -3.55% from $20.00 to $19.29. My next sell target is $24.50 and my next buy target is $16.40.

RVLV closed the week at $20.14, down -3.50% from where I sold Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.