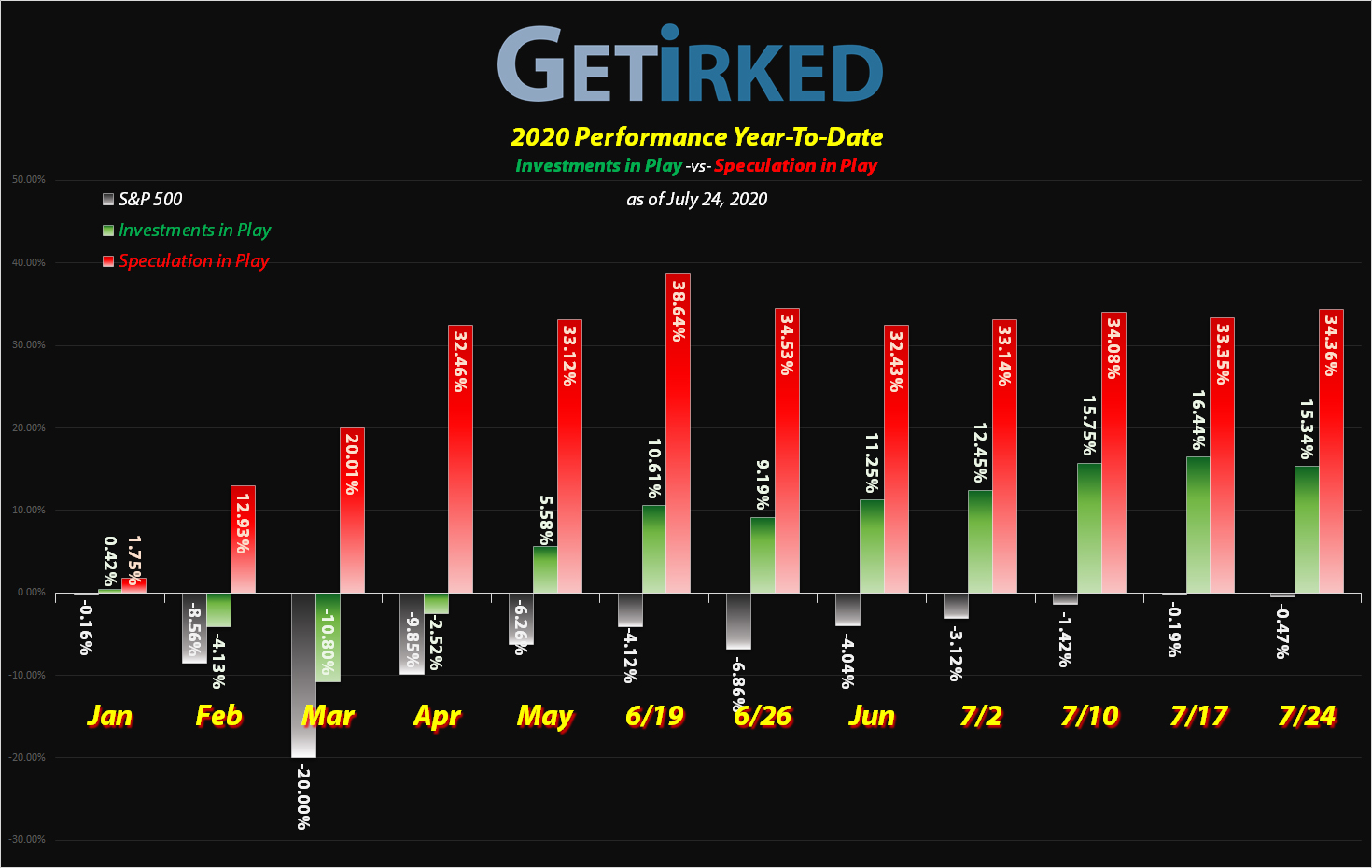

July 24, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

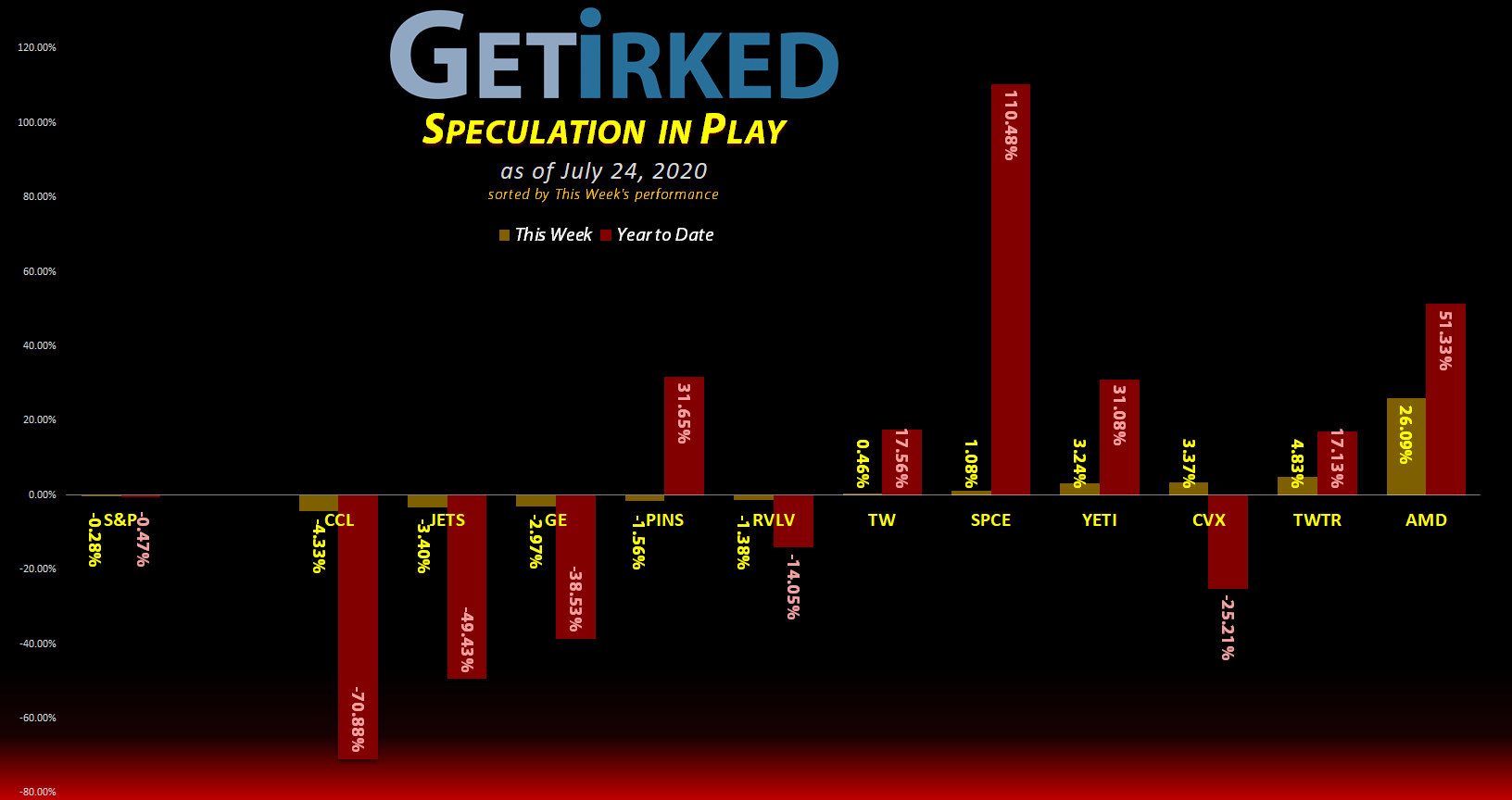

The Week’s Biggest Winner & Loser

AMD (AMD)

AMD (AMD) started the week strong only to finish stronger, popping +16.50% on Friday alone after Intel (INTC) reported a dismal quarter, announced it couldn’t manufacture with a 7nm process, and admitted it was losing ground to AMD. AMD locked in +26.09% in gains this week, easily snagging the week’s Biggest Winner spot.

Carnival Cruise (CCL)

Funny thing about a pandemic is that when the number of sick people increases, no one wants to be trapped on a floating coffin with the potential of being eaten by zombies (I threw in that last bit to see if you’re paying attention). Carnival Cruise Lines (CCL) sold off more than the rest of the market, finishing the week down -4.33% and earning the Biggest Loser spot.

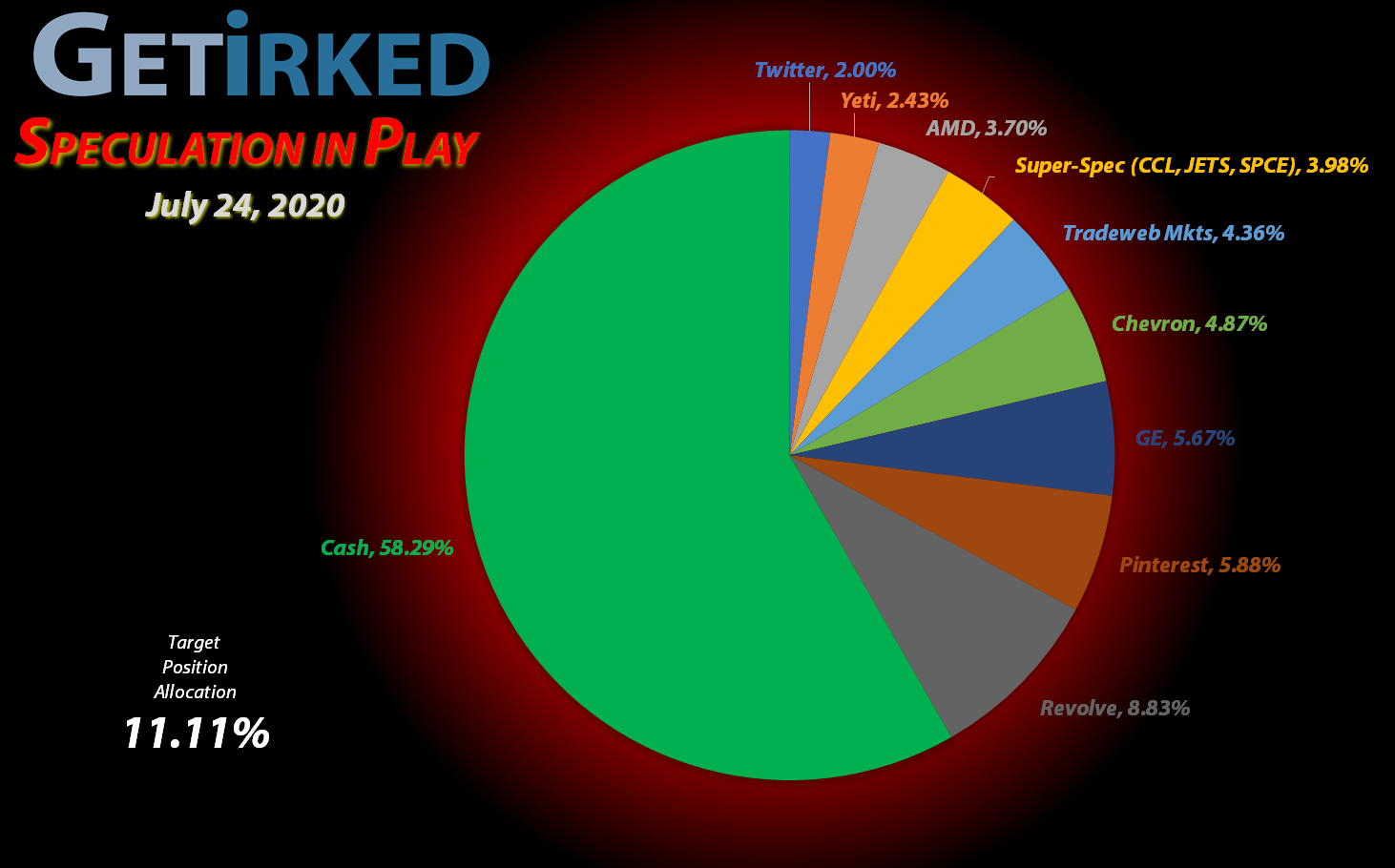

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+875.63%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$44.50)*

AMD (AMD)

+675.15%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$5.14)*

Pinterest (PINS)

+396.67%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($0.24)*

Virgin Galactic (SPCE)

+383.06%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Tradeweb Mkts (TW)

+375.60%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $11.46

Twitter (TWTR)

+226.05%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: (-$0.01)*

Airlines ETF (JETS)

+160.84%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$1.26)*

Carnival Cruise (CCL)

+127.51%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-1.01)*

Chevron (CVX)

+63.34%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.18

General Electric (GE)

+3.99%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.60

Revolve Group (RVLV)

-26.87%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Super-Speculative Basket

Airlines ETF

JETS

Carnival Cruise

CCL

Virgin Galactic

SPCE

What is the Super-Speculative Basket?

The Super Speculative Basket (“Super-Spec”) is made up of a handful of stocks so incredibly volatile that I’m uncomfortable giving any of them full allocations in my portfolio, instead dividing a single allocation among all of them.

Currently, my Super-Spec stocks are as follows: the Airlines ETF (JETS), Carnival Cruise Lines (CCL), and Virgin Galactic (SPCE). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Twitter (TWTR): Profit-Taking

Twitter (TWTR) rocketed higher in a down tape on Thursday after reporting mediocre quarterly results but outstanding growth in user engagement. The stock shot through my $38.39 sell order which pulled the remaining capital out of the position leaving me to play with the house’s money.

Thursday’s sale locked in +25.01% in gains on shares I bought on March 11 for $30.71. My next sell target is near Twitter’s all-time high around $45.00 and my next buy target for the stock is $28.80.

TWTR closed the week at $37.54, down -2.21% from where I sold Thursday.

Yeti (YETI): Profit-Taking

It was time to take profits in Yeti (YETI) once more when it made a run at its $45.18 all-time high once more on Monday. While I like Yeti’s long-term prospects as a Covid-19 play given its products target outdoor activities, the run YETI has seen since its $15.28 March 23 low is incredible – nearly a triple in just four months!

My sell order filled at $44.93 and took +53.40% in profits on shares I bought on February 27 for $29.29. I currently have no additional sell targets on the stock from here with my next buy target much lower at a previous point of support around $31.50.

YETI closed the week at $45.59, up +1.47% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.