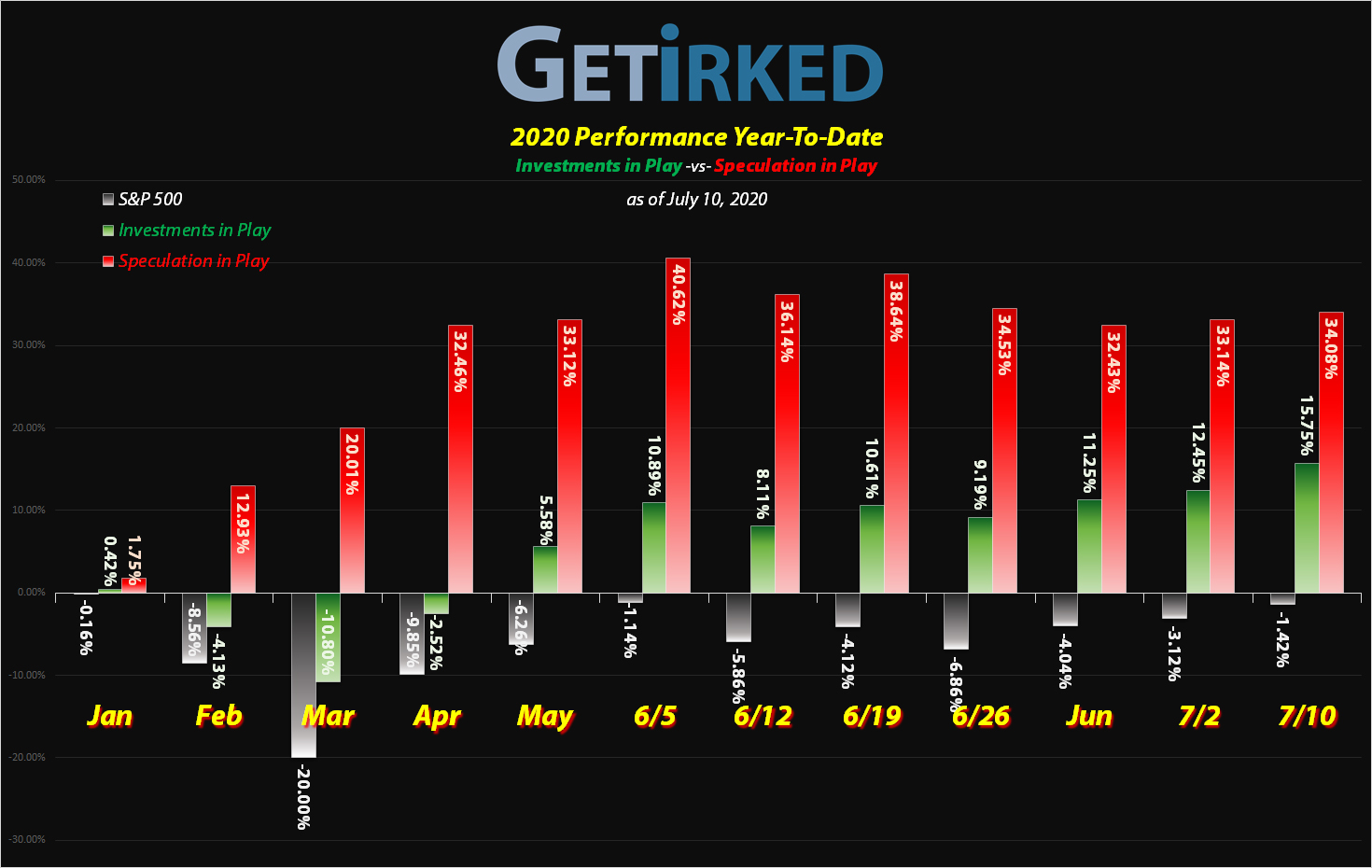

July 10, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

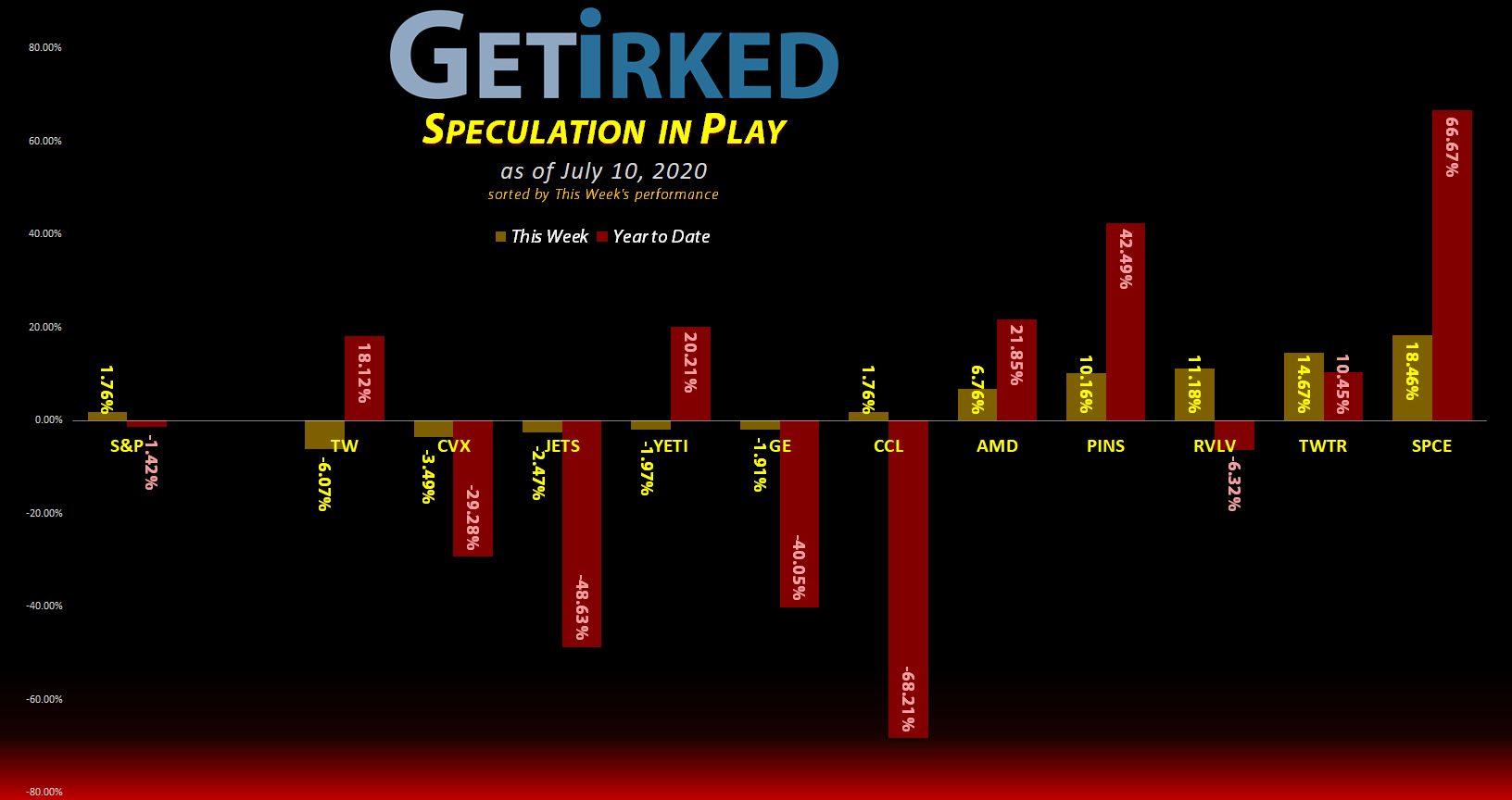

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) hit its second-stage rocket boosters this week and catapulted +18.46% on no news to earn itself the week’s Biggest Winner spot.

Tradeweb Markets (TW)

Tradeweb Markets (TW) is a funny stock – it often goes UP in DOWN markets and DOWN in UP markets, just like this week when it dropped -6.07% to land the Biggest Loser spot.

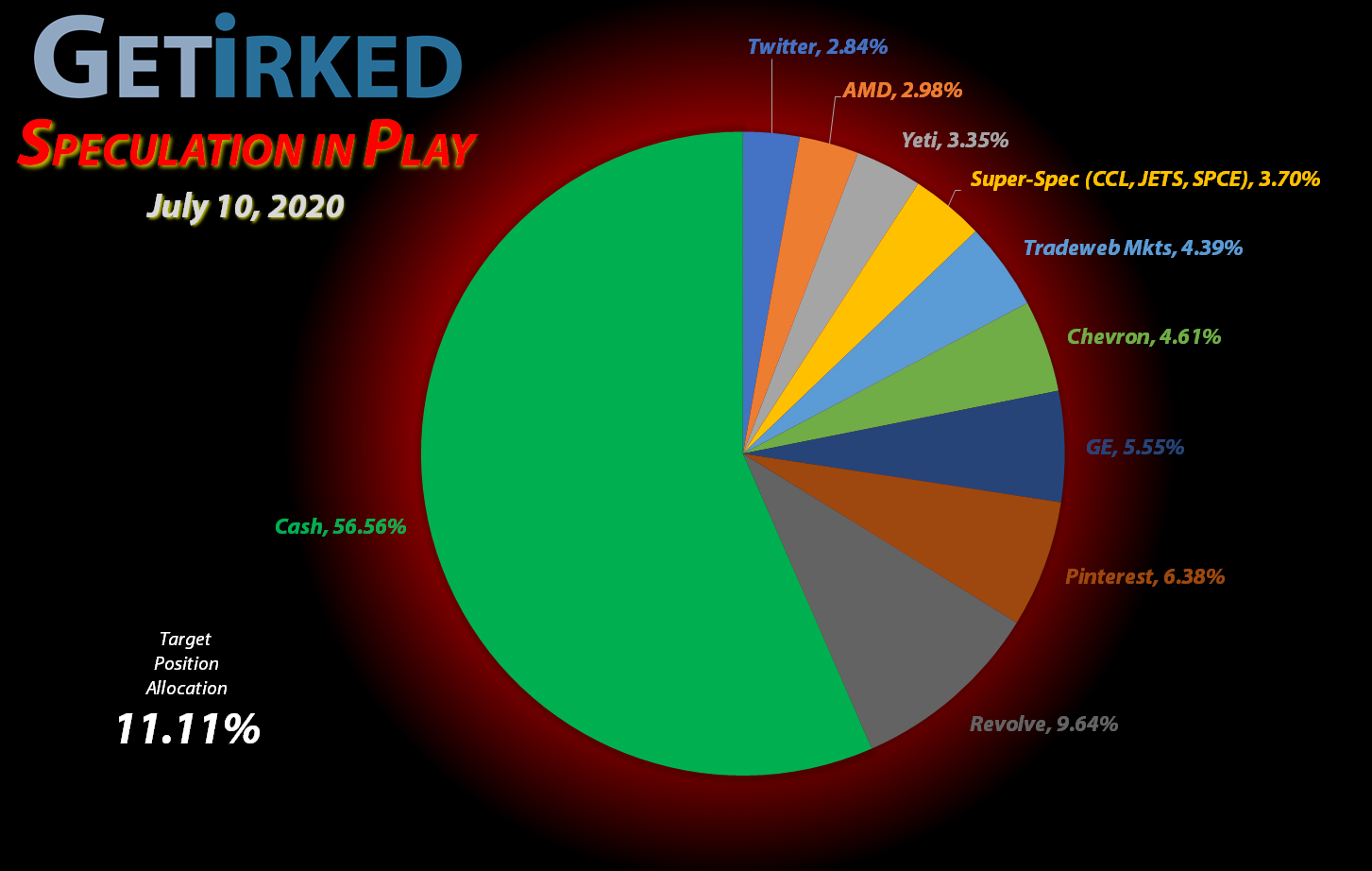

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+829.66%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$14.69)*

AMD (AMD)

+570.83%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$5.14)*

Pinterest (PINS)

+420.86%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($0.24)*

Tradeweb Mkts (TW)

+377.87%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $11.46

Virgin Galactic (SPCE)

+324.50%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Twitter (TWTR)

+176.78%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $12.79

Airlines ETF (JETS)

+161.72%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$1.26)*

Carnival Cruise (CCL)

+129.88%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-1.01)*

Chevron (CVX)

+54.46%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.18

General Electric (GE)

+1.41%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.60

Revolve Group (RVLV)

-20.28%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Super-Speculative Basket

Airlines ETF

JETS

Carnival Cruise

CCLVirgin Galactic

SPCEWhat is the Super-Speculative Basket?

The Super Speculative Basket (“Super-Spec”) is made up of a handful of stocks so incredibly volatile that I’m uncomfortable giving any of them full allocations in my portfolio, instead dividing a single allocation among all of them.

Currently, my Super-Spec stocks are as follows: the Airlines ETF (JETS), Carnival Cruise Lines (CCL), and Virgin Galactic (SPCE). They are listed as a single allocation in the portfolio breakdown chart each week.

This Week’s Moves

Tradeweb Markets (TW): Added to Position

Tradeweb Markets (TW) has been a fantastic stock since IPO’ing in April 2019 and rocketing to an all-time high of $69.06 just a month ago on June 2, 2020, so when it retested its pullback level of around $54.50 on Friday, it was time for me to add some capital back into my position with a buy order that filled at $54.60.

The order replaced shares I sold on May 19 for $62.00 and locked in +13.55% in gains. I now have a per-share cost of $11.46. My next buy target for the stock is around $49.00, slightly above its 200-day simple Moving Average (MA). My next sell target is around $80.00.

TW closed on Friday at $54.75 up +0.46% from where I added Friday.

Twitter (TWTR): Profit-Taking

Given the significant amount of negative attention all of the social media networks have been receiving as of late thanks to Facebook’s (FB) bungling of, well, pretty much anything and everything to do with free speech, I felt it was time to take more profits in Twitter (TWTR) when it started popping this week.

I sold some shares on Wednesday’s pop, filling at a $34.42 average selling price which lowered my per-share cost -40.04% from $21.46 to $12.79. My next sell target is near $35.50 with my next buy target around $23.25.

TWTR closed the week at $35.40, up +2.85% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.