June 19, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

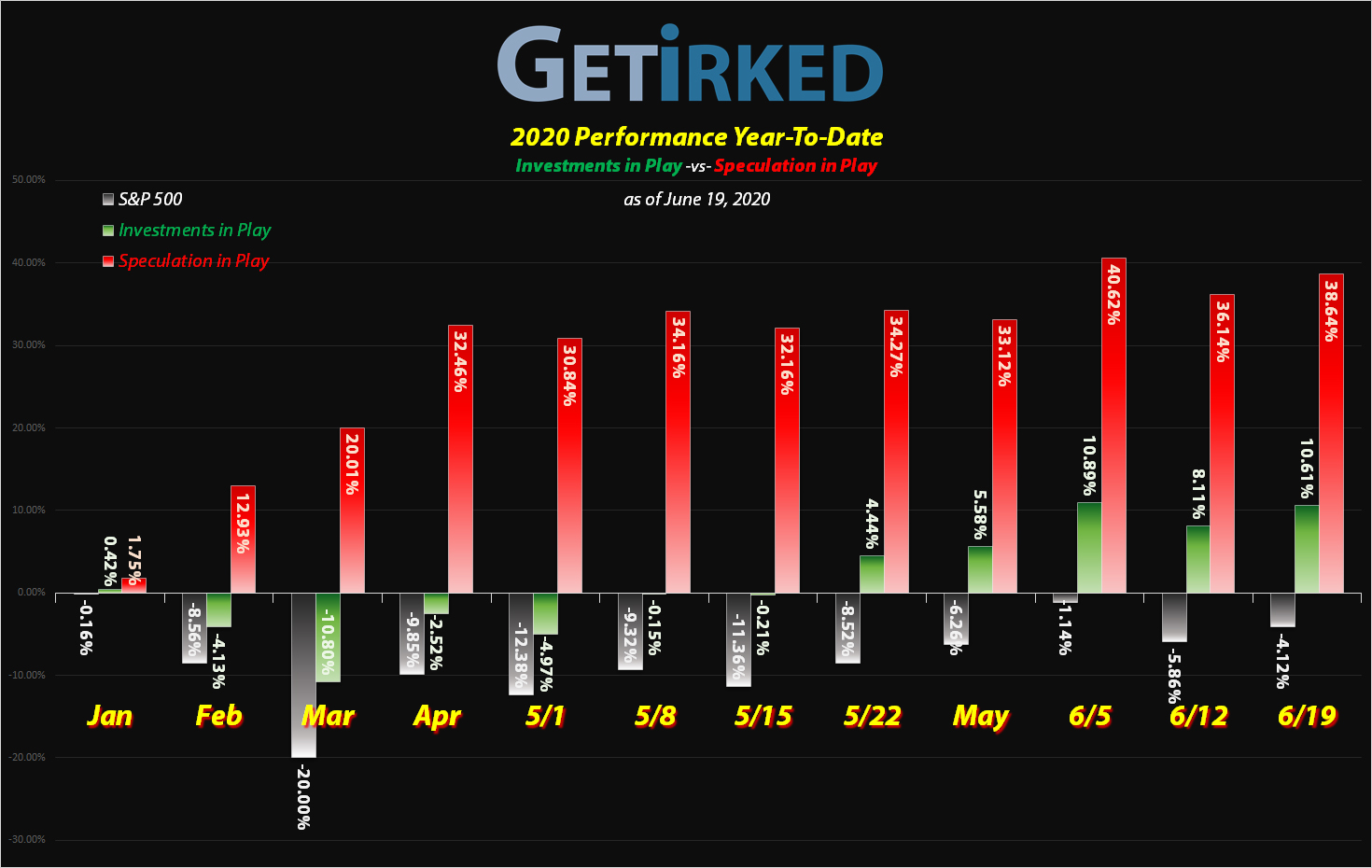

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Pinterest (PINS)

The only social media network stock that has seemed to escape controversy (for the moment), Pinterest (PINS) jumped +11.11% this week and earned itself the spot of the Week’s Biggest Winner.

Carnival Cruise (CCL)

The noob day-traders finally got smacked down when Carnival Cruise Lines (CCL) reported earnings, and – shocker – they didn’t have any! It’s hard to make money as a cruiseline when you can’t actually, y’know, cruise. CCL dropped -10.76% this week, earning itself the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+797.63%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$14.69)*

AMD (AMD)

+558.10%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$5.14)*

Virgin Galactic (SPCE)

+275.31%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Tradeweb Mkts (TW)

+225.91%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: (-$10.09)*

Pinterest (PINS)

+174.42%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $8.46

Airlines ETF (JETS)

+166.57%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$1.26)*

Carnival Cruise (CCL)

+132.78%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-1.01)*

Chevron (CVX)

+64.24%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.19

Twitter (TWTR)

+55.82%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $21.46

General Electric (GE)

+8.39%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.60

Revolve Group (RVLV)

-24.41%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Reallocation: The Super-Speculative Basket

After reviewing my positions this past weekend, I realized that I have a handful of incredibly high-risk, incredibly speculative positions which is really saying something since this is the Speculation in Play portfolio.

The three positions I was eyeing are so high-spec that I don’t want to give each of them a full allocation, instead, rolling them into a single allocation (exactly like the Speculative Basket in my Investments in Play portfolio).

The three Super-Spec stocks are: the Airlines ETF (JETS), Carnival Cruise Lines (CCL), and Virgin Galactic (SPCE). From now on, they will be listed as a single allocation in my portfolio breakdown charts.

Airlines ETF

JETS

Carnival Cruise

CCL

Virgin Galactic

SPCE

This Week’s Moves

Airlines ETF (JETS): *Capital Removed*

When the markets bounced Monday and Tuesday causing high-risk recovery stocks like Carnival Cruise Lines (CCL) and the Airlines ETF (JETS) to pop, I stuck to last week’s plan and pulled out my investing capital.

On Tuesday, I pulled the remainder of my capital out of the JETS at $18.93, lowering my per-share cost to -$1.26 (each share I hold is free plus adds $1.26 in profits to the portfolio).

My next sell target for JETS is $31.00. Unlike CCL (as you’ll read below), I do have a buy target for JETS at $13.60. As an ETF, the chances of JETS going to zero are slim-to-none as it’s made up of a myriad of airlines stocks including consumer, parts manufacturers, plane manufacturers, and more. The entire industry would have to declare bankruptcy to zero out JETS.

As I mentioned above, JETS is now part of my Super-Speculative Basket (“Super-Spec”, for short) which also includes Carnival Cruise Lines (CCL) and Virgin Galactic (SPCE) with all three sharing a single allocation in the portfolio.

JETS closed the week at $17.55, down -7.29% from where I sold Tuesday.

Carnival Cruise (CCL): *Capital Removed*

When the markets bounced Monday and Tuesday causing high-risk recovery stocks like Carnival Cruise Lines (CCL) and the Airlines ETF (JETS) to pop, I adhered to my trading discipline and plan which I mentioned last week. I took the opportunity to pull my remaining investment capital out of CCL at $21.09, leaving me with a -1.01 per share price (each share I hold is free plus adds $1.01 in profits to the portfolio).

At this time, my next sell target for CCL is around $33.50, and I am no longer going to put any money back into the position. If CCL drops below $10 again, it’s likely because it may declare bankruptcy, and I’m only willing to risk the house’s money on that move.

As I mentioned above, CCL is now part of my Super-Speculative Basket (“Super-Spec”, for short) which also includes the Airlines ETF (JETS) and Virgin Galactic (SPCE) with all three sharing a single allocation in the portfolio.

CCL closed the week at $17.83, down -15.46% from where I sold Tuesday.

Pinterest (PINS): Profit-Taking

When the markets flew to the upside on Monday and Tuesday, it was time to take the opportunity to reduce my Pinterest (PINS) position, taking profits with an order which filled at $21.91 on Tuesday morning.

Tuesday’s sale took +64.00% in profits on some of the shares I bought back on March 12 for $13.36 a share. It also lowered my per-share cost -21.96% from $10.84 to $8.46. My next sell target for PINS is $26.85 and my next buy target is $13.50.

PINS closed the week at $23.21, up +5.93% from where I sold Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.