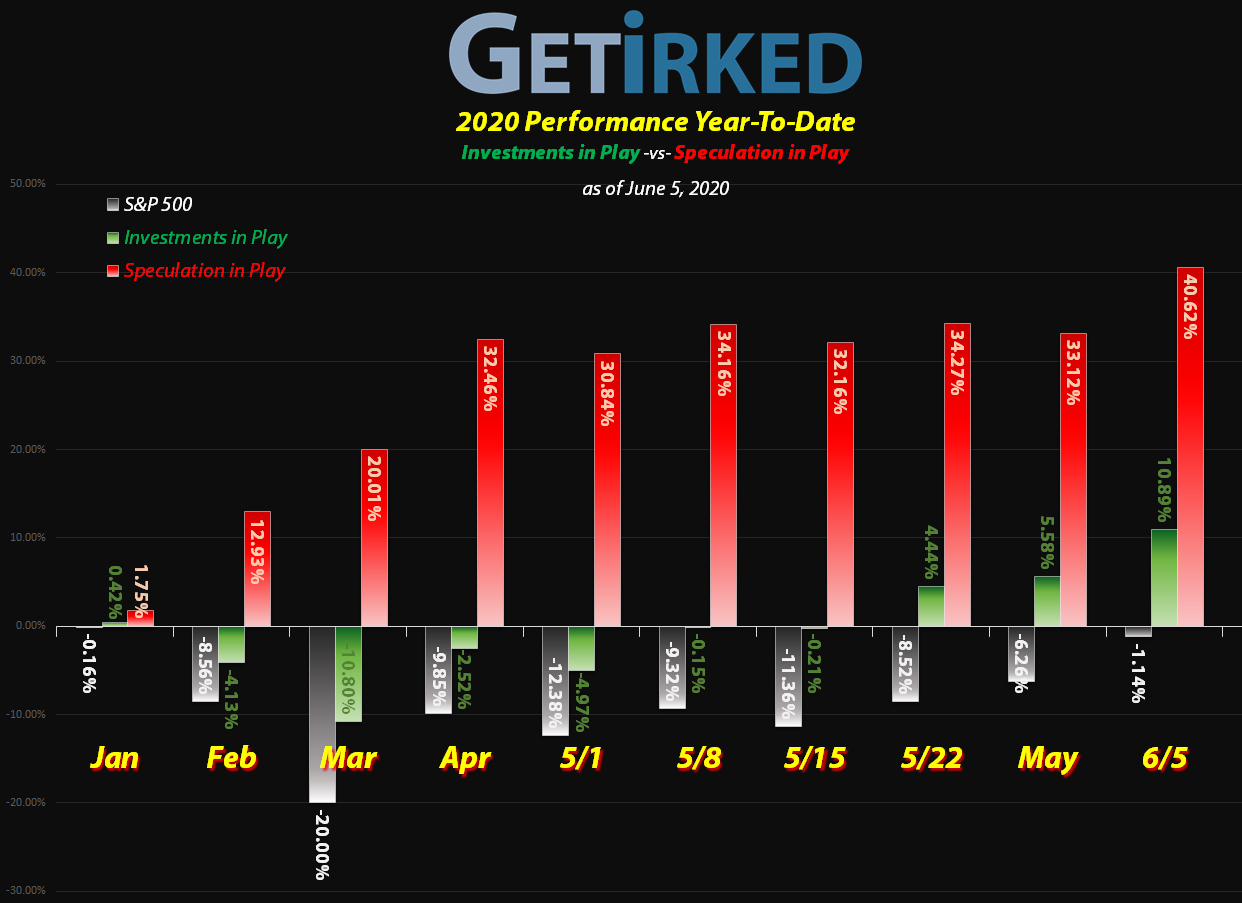

June 5, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

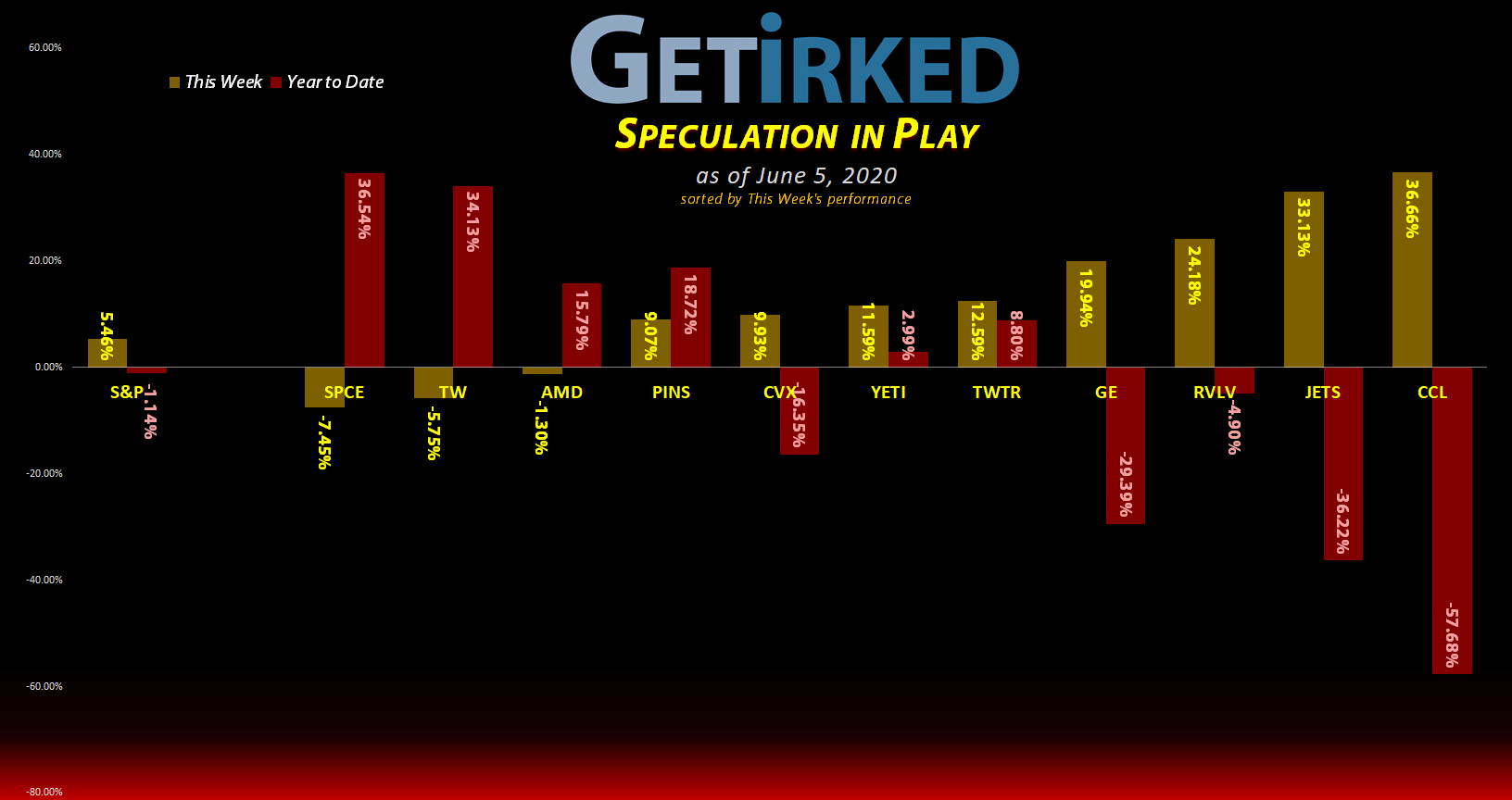

The Week’s Biggest Winner & Loser

Carnival Cruiselines (CCL)

The state economies have reopened and everyone wants to travel and go to Las Vegas. No, really. Vegas’ reopening was so big that Carnival Cruiselines (CCL) jumped +36.66% this week on the possibility people will want to travel. The Airlines ETF (JETS) also saw a huge +33.13% one-week pop. While ignoring their epic YTD loss performances, CCL definitely earned its spot as the week’s biggest winner.

Virgin Galactic (SPCE)

With all the excitement going on down here on Earth, it seems no one cares about traveling to space, anymore.

Virgin Galactic (SPCE) saw no love this week, dropping -7.45% while the rest of the market skyrocketed into the stratosphere. SPCE gets this week’s Biggest Loser spot.

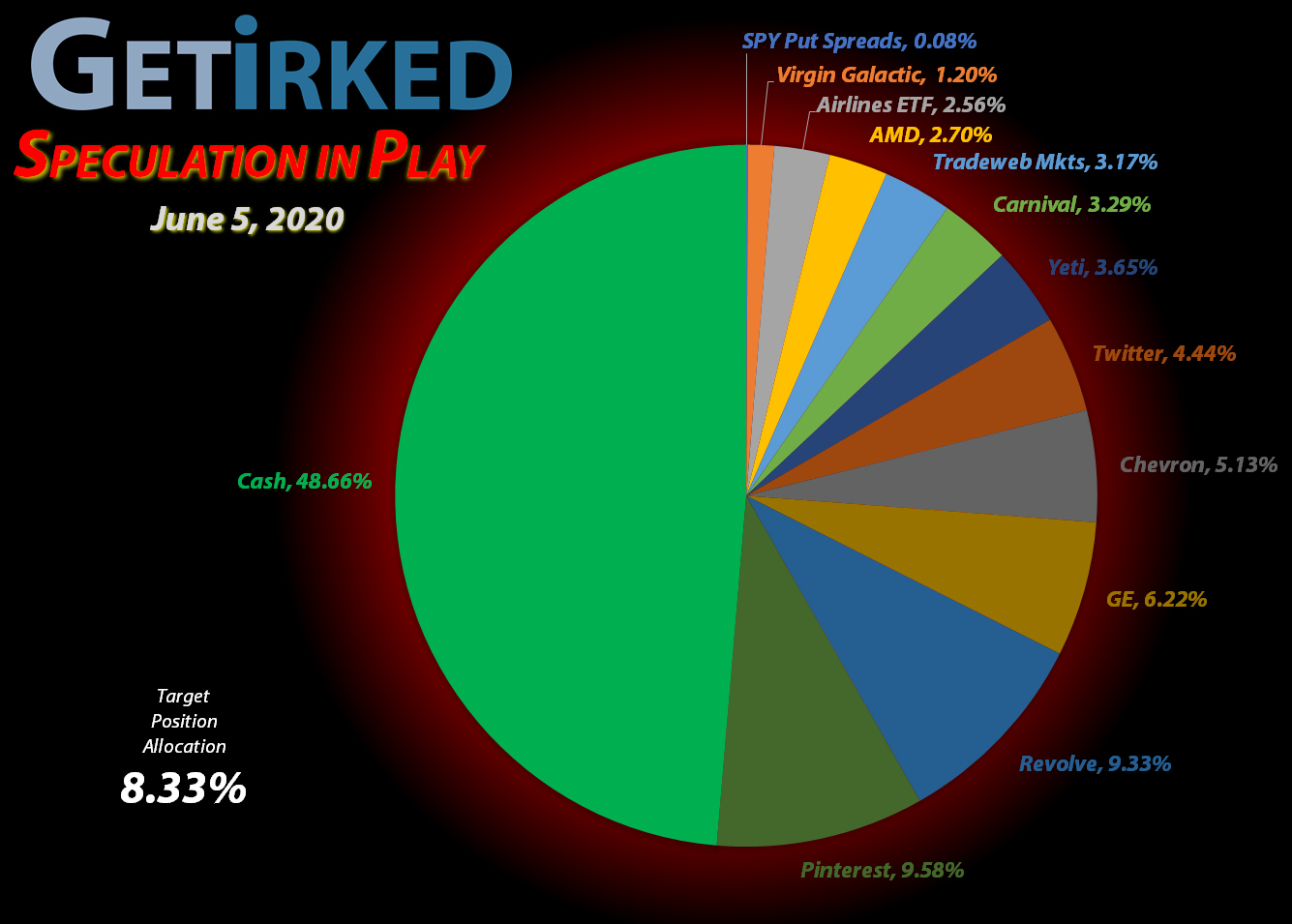

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)*

+742.27%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$1.48)*

AMD (AMD)*

+549.38%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($5.14)*

Virgin Galactic (SPCE)*

+284.22%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Tradeweb Mkts (TW)*

+221.97%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($10.10)*

Pinterest (PINS)

+104.30%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $10.84

Carnival Cruise (CCL)

+102.04%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $10.65

Chevron (CVX)

+80.19%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.95

Airlines ETF (JETS)

+77.76%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $11.30

Twitter (TWTR)

+62.62%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $21.46

General Electric (GE)

+19.45%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.60

Revolve Group (RVLV)

-19.08%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

6/12 SPY Put Spreads

-98.79%

Cost: $2.48

Current Value $0.03

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Pinterest (PINS): Profit-Taking

Pinterest (PINS) rose throughout the week, triggering a sell order I had in place on Thursday which filled at $21.79. The sale took +84.04% in profits on some of the shares I purchased on March 16 for $11.84. It also lowered my per-share cost -5.33% from $11.45 to $10.84.

My next sell target for PINS is around $23.50 with my next buy target at $10.25.

PINS closed the week at $22.13, up +1.56% from where I sold Thursday.

Twitter (TWTR): Profit-Taking

When the market rallied Friday, Twitter (TWTR) shot through a sell target of mine where I took profits at $35.92. The sale locked in +48.31% in gains on shares I bought back on March 16 for $24.22.

The sale also served to lower my per-share cost -10.10% from $23.86 to $21.45. My next sell target is around $39.00 and my buy target is around $21.00-$23.00.

TWTR closed the week at $34.87, down -2.92% from where I sold Friday.

Yeti (YETI): Profit-Taking

During Friday’s insane rally following the Better-Than-Feared (BTF) unemployment report, Yeti (YETI) skyrocketed through my next sell price target with an order filling at $36.60.

The sale locked in +43.81% in profits on shares I purchased for $25.45 back on March 9 at the beginning of the selloff and, more importantly, fully removed all capital I had left in the stock, leaving me to play with the house’s money.

My next sell target is near Yeti’s all-time high at $38.50 with my next buy target down around $19.50.

YETI closed the week at $35.82, down -2.13% from where I sold Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.