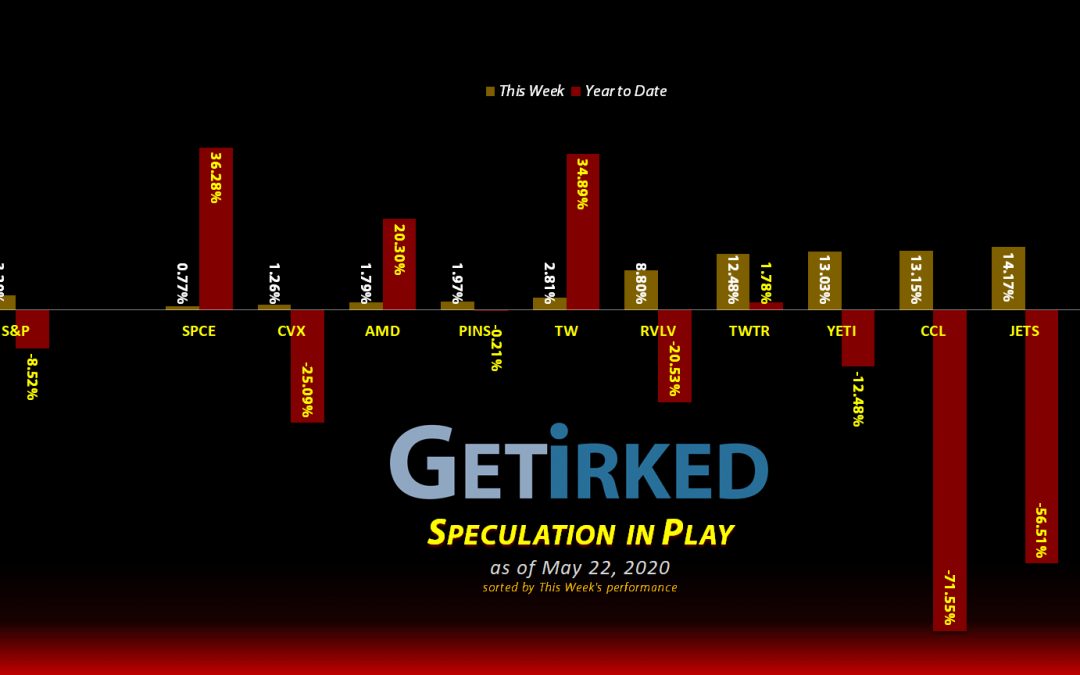

May 22, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

General Electric (GE)

Rumors to the death of the industrial sector may have been exaggerated as General Electric (GE) dominated the week with a +16.76% gain throughout the week’s massive rally.

Virgin Galactic (SPCE)

The week’s Biggest Loser for two weeks in a row, Virgin Galactic (SPCE) only saw a piddly +0.77% gain in a week that saw substantial gains in a variety of riskier stocks similar to Virgin. Ouch.

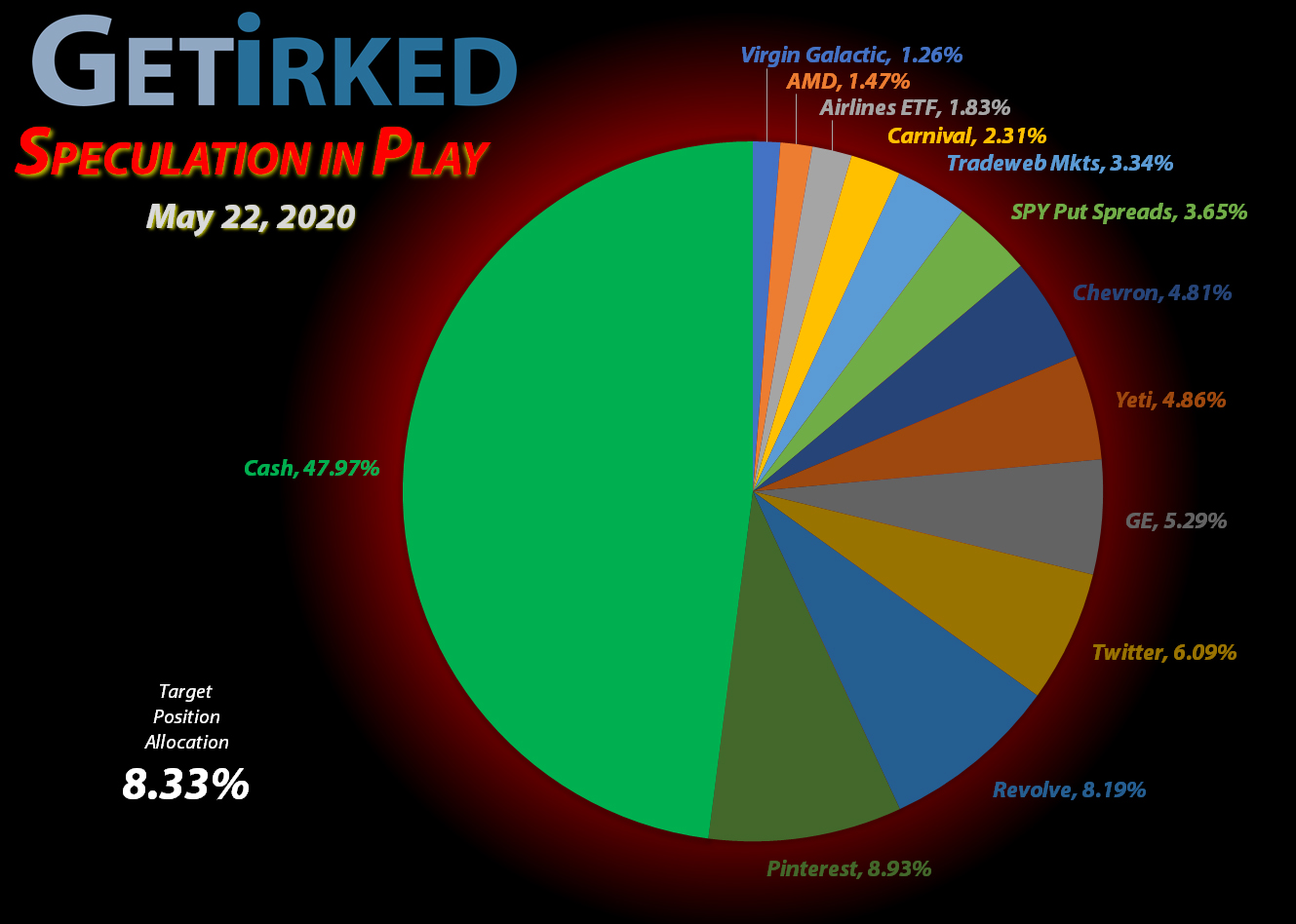

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)*

+545.10%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($60.21)*

Virgin Galactic (SPCE)*

+283.41%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Tradeweb Mkts (TW)*

+222.63%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($10.10)*

Yeti (YETI)

+182.40%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $10.77

Pinterest (PINS)

+62.57%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $11.45

Chevron (CVX)

+61.35%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.95

Carnival Cruise (CCL)

+35.72%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $10.65

Twitter (TWTR)

+29.20%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $25.25

Airlines ETF (JETS)

+21.48%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $11.30

General Electric (GE)

-2.98%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.60

Revolve Group (RVLV)

-32.20%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

SPY Put Spreads

-44.82%

Cost: $2.48

Current Value $1.37

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

SPY Put Spreads 5/29 & 6/12: Added to Position

When the markets came back from Tuesday’s slight sell-off to retest the S&P 500’s 200-Day Simple Moving Average (SMP) on Wednesday and the Volatility Index dropping more than -5% below 29, I decided to take out additional insurance by purchasing SPY 6/12 295-292 put spreads (buying the 295 puts and selling the 292 puts to offset the cost of the spread).

My existing 5/29 278-275 spreads had dropped to nearly worthless, so rather than take the entire loss, I bought back the 275 puts I sold at $0.49 each. My hope is that we see a selloff going into the month-end which may cause the naked 278 puts I now hold to pop and reduce the loss I would have taken from the spreads.

The new SPY 6/12 295-292 Put Spreads cost me just $0.99 each (options are sold in lots of 100 contracts so the actual cost is $99.00 each) with the potential to triple my investment with a maximum return of $3.00 or $300 per spread (the difference between the strike price I bought and the strike price I sold).

As for record-keeping, rather keep each spread as separate positions, I’m going to roll all of my portfolio’s options together with one profit/loss for the entire option position. Wednesday’s moves resulted in the total cost for my 5/29 puts and my 6/12 put spreads to ring in at $2.48 after all is said and done.

My options position closed the week at $1.37, down -44.82% overall.

Tradeweb Markets (TW): Profit-Taking

After the market’s positively insane performance following Moderna’s (MRNA) possible vaccine announcement on Monday, I decided I was pushing my luck with Tradeweb Markets (TW) and took profits on Tuesday at $62.00, pulling the remainder of my capital investment out of the position along with profits of $10.10 per share (which explains the -$10.10 per-share price in the position chart).

My next buy target for the stock is $48.58, a past point of support, with no additional selling targets at this time since TW’s making new all-time highs.

TW closed the week at $62.56, up +0.90% from where I sold on Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.