May 15, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

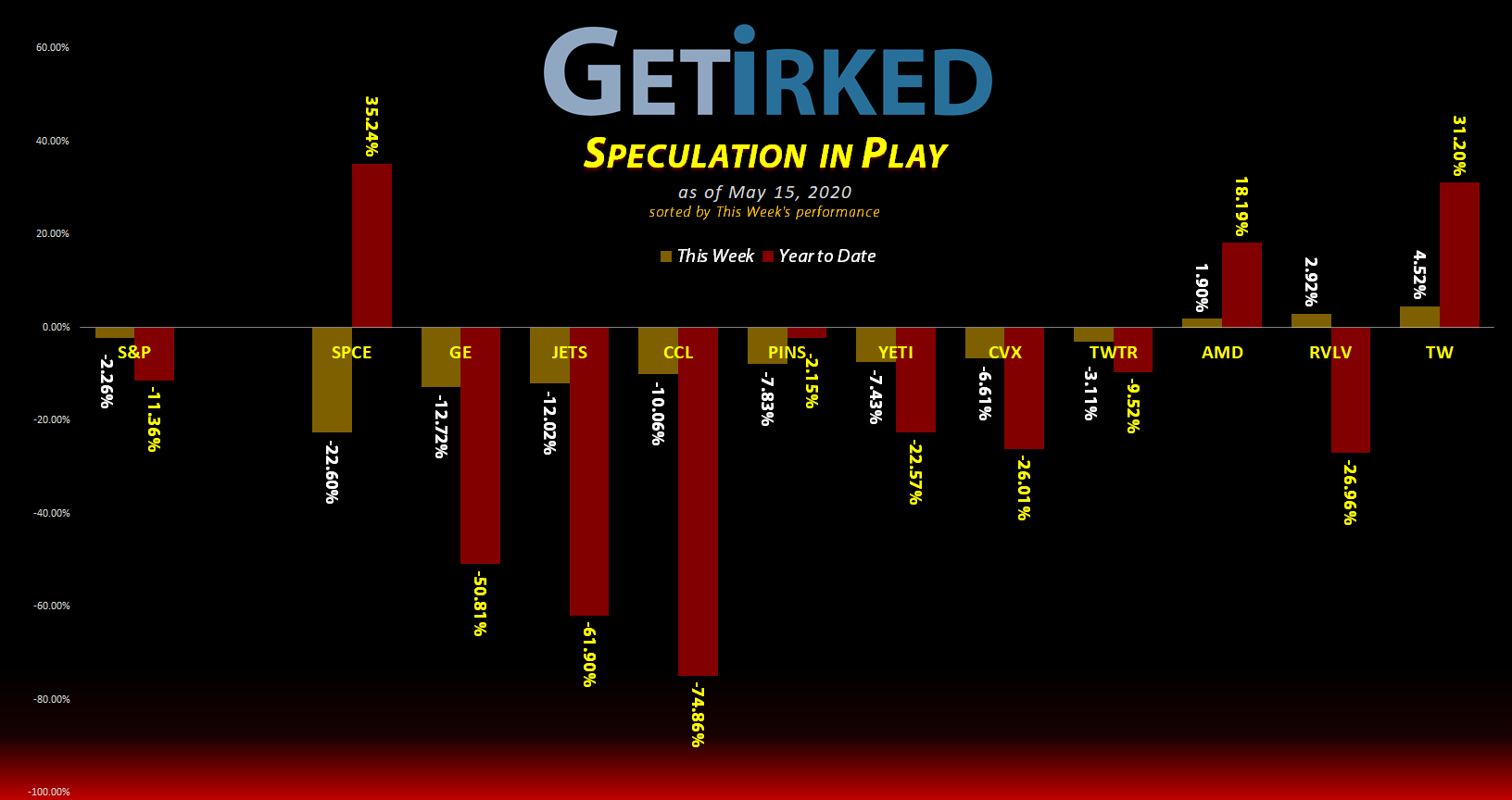

The Week’s Biggest Winner & Loser

Tradeweb Markets (TW)

Tradeweb Markets (TW) once again demonstrates the importance of going online, as its business popped +4.52% this week, earning itself the spot of the week’s Biggest Winner.

Virgin Galactic (SPCE)

In a recession, no one can hear your empty wallet? Virgin Galactic (SPCE) dropped -22.60% this week, earning itself the spot of the Biggest Loser. Apparently, no one thinks about space travel during economic collapse.

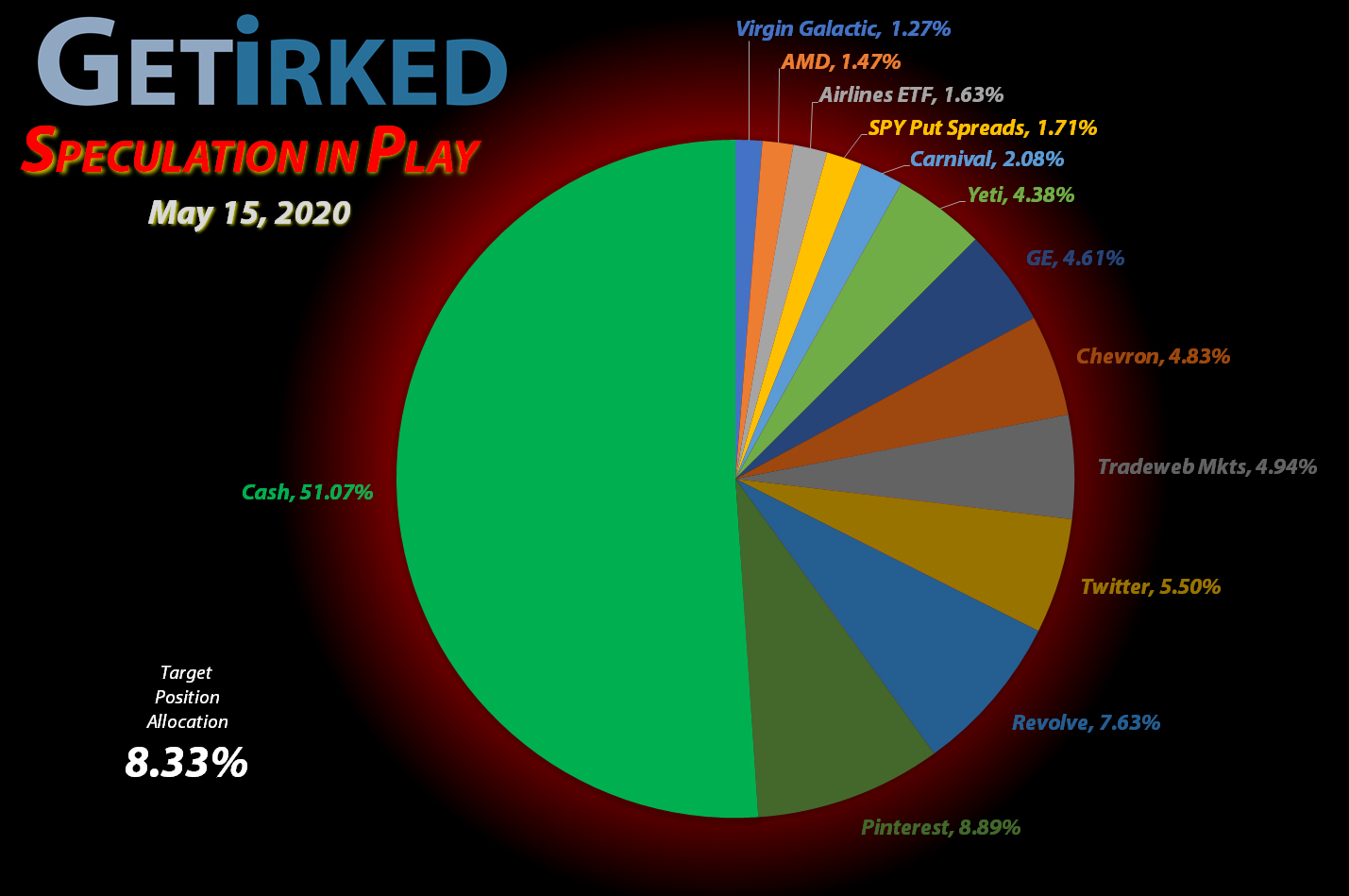

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)*

+541.40%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($60.21)*

Tradeweb Mkts (TW)

+336.44%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $13.93

Virgin Galactic (SPCE)*

+282.48%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Yeti (YETI)

+150.09%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $10.77

Pinterest (PINS)

+59.43%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $11.45

Chevron (CVX)

+59.37%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.95

Carnival Cruise (CCL)

+20.04%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $10.65

Twitter (TWTR)

+14.86%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $25.25

Airlines ETF (JETS)

+6.18%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $11.30

General Electric (GE)

-16.78%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $6.60

SPY Put Spreads 5/29

-36.57%

Cost: $0.9932

Current Value $0.63

Revolve Group (RVLV)

-37.85%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Airlines ETF (JETS): *New Position*

I know, I know. The airlines, really? Well, this is a speculative portfolio and there’s nothing more speculative (or risky) than the airline industry right now.

The airlines got positively slammed this week with all of them reaching unbelievable lows which pushed the Airlines Exchange Traded Fund (ETF) with its cute “JETS” ticker symbol back to its all-time lows. I decided this might be a fun way to test the ol “Buy When There’s Blood in the Streets” adage or, as the kinder, gentler Warren Buffett puts it, “Be greedy when others are fearful, be fearful when others are greedy.”

So, why did I go with the Airlines ETF rather than putting my weight behind a single name that might see a bigger bounce off its lows?

Well, thanks to the pandemic, airlines have almost no business, and, earlier this week, David Calhoun, Boeing’s (BA) CEO, said in an interview that he fully expects at least one of the airlines to declare bankruptcy which caused this tailspin selloff.

While those comments created a buying opportunity, it’s hard to know which airline may declare bankruptcy. It’s important to remember that bankruptcy doesn’t mean “going out of business” – it means the company gets restructured. However, part of that restructuring typically means the company’s stock equity gets zeroed out i.e. all investors lose all their money.

Rather than risk a play – even a speculative one – going to zero, I decided to play the sector using the ETF where I can make a play on a bounce in the sector as a whole but where any chance of my equity being zeroed out is very, very slim.

I opened my position on Thursday at $11.30 when the ETF tested its $11.25 all-time low made in March (it touched $11.27 on Thursday). From here, my next buy target is $10.00-$10.25 (a target made using Fibonacci Retracement techniques) and my first sell target will be around $16.00 followed by $18.00 – two points of resistance from prior bounces after the March selloff.

JETS closed the week at $12.00, up +6.18% from where I opened my position.

General Electric (GE): Added to Position

General Electric (GE) got slammed during the selloff which started on Wednesday following comments with Dr. Anthony Facui and The Federal Reserve, dropping through key levels where I added at an average price of $5.62.

The orders lowered my per-share cost -10.81% from $7.40 to $6.60. My next buying target is around $4.50-$4.60. With my first sell price around $10.

GE closed the week at $5.49, down -2.31% from where I added on Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.