May 8, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

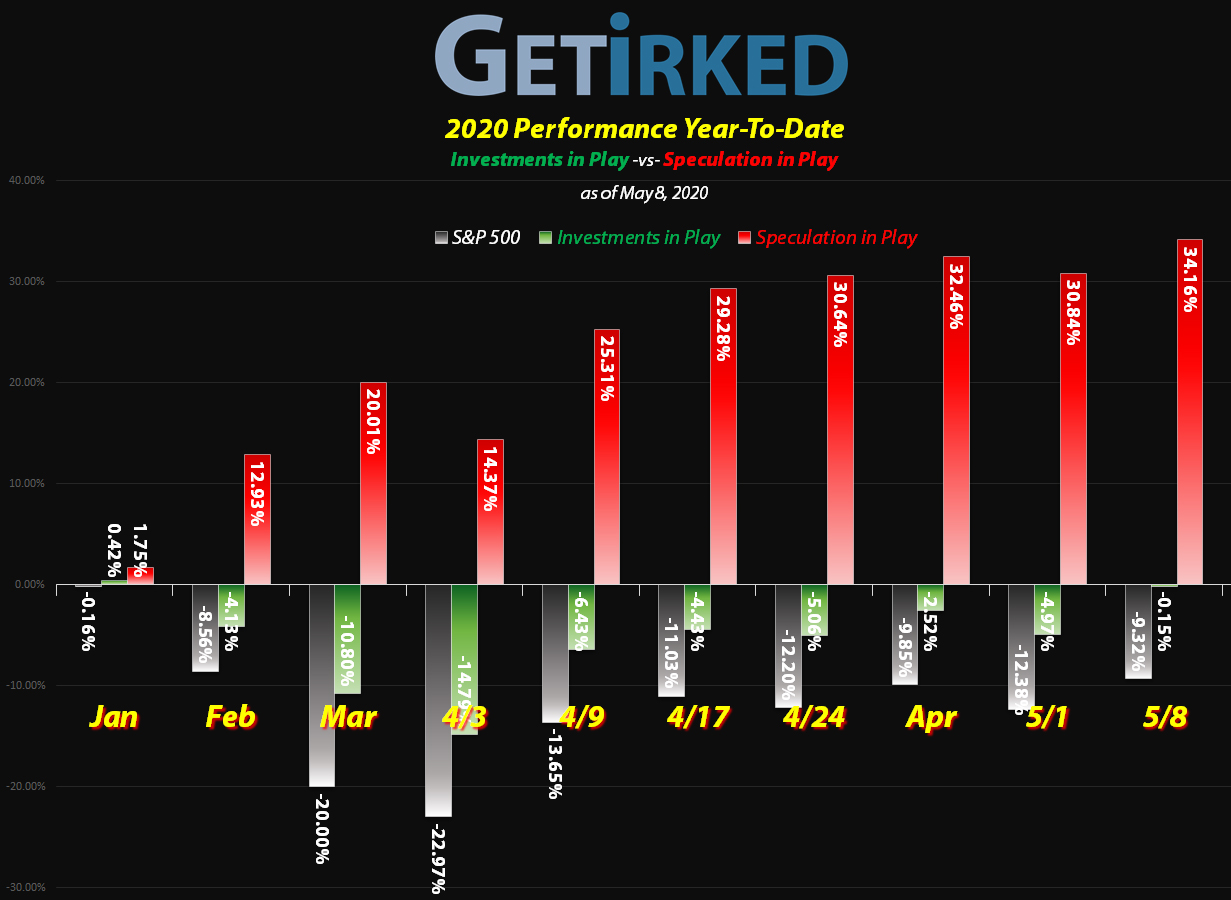

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Revolve Group (RVLV)

Revolve Group (RVLV) won the week with +27.12% on… no news? This is the definition of a short squeeze. So many traders were betting against the stock that when the markets flew higher, it was time for them to bail, causing RVLV to become the week’s Biggest Winner (although it’s still down -29.03% for the year… yowtch).

General Electric (GE)

A recession is a terrible time to be an industrial company, and General Electric (GE) demonstrated that fact to a “T,” dropping -3.23% in a week that saw even Carnival Cruiselines (CCL) head higher. If you’re gonna be the Biggest Loser for the week, that’s the way to do it.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)*

+537.50%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($60.21)*

Virgin Galactic (SPCE)*

+335.26%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Tradeweb Mkts (TW)

+317.56%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $13.93

Yeti (YETI)

+170.14%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $10.77

Pinterest (PINS)

+72.97%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $11.45

Chevron (CVX)

+70.65%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $55.95

Carnival Cruise (CCL)

+33.47%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $10.65

Twitter (TWTR)

+18.55%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $25.25

General Electric (GE)

-14.99%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $7.40

Revolve Group (RVLV)

-39.61%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

SPY Put Spreads 5/29

-58.22%

Cost: $0.9932

Current Value $0.415

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

General Electric (GE): Added-to-Position

General Electric (GE) saw some serious selling pressure on Wednesday, cracking through the $6.00 mark and triggering an order which added shares at $5.9965. The buy reduced my per-share cost -3.90% from $7.70 to $7.40.

Wednesday’s buy was actually for only half of my intended target with the other half targeting $5.92 for fill, but I decided to split it up when I saw the resistance holding during trading.

GE closed the week at $6.29, up +4.89% from where I added on Wednesday.

Pinterest (PINS): Profit-Taking

Pinterest (PINS) continued its inexorable climb on Monday, retaining its status as the biggest holding in the portfolio which meant, yes, more profits needed to be taken. This time, the sell order filled at $21.42, locking in 80.92% in profits on some of the shares I bought back on March 16 for $11.84.

The sell order reduced my per-share cost by -4.34% from $11.97 to $11.45. My next sell target is $24.35 and my next buy target is back at March’s lows around $10.10-10.15.

PINS closed the week at $19.79, down -7.61% from where I sold on Monday.

Tradeweb Markets (TW): Profit-Taking

Tradeweb Markets (TW) rocketed higher during Friday’s trading, triggering a sell order I had in place at new all-time highs which filled at $57.38, selling shares I bought back on March 12 for $45.76 and locking in +25.39% in profits.

The sale also lowered my per-share cost by -43.83% from $24.80 to $13.94. My next sale, targeting much higher at $65.85 will take out the remainder of my investment capital as well as some decent profits. My next buy is back down around $40.25-$40.50 per share.

TW closed the week at $58.18, up +1.39% from where I sold on Friday.

Yeti (YETI): Profit-Taking

Yeti (YETI) popped dramatically following a good earnings report after-the-bell on Wednesday. During Thursday morning trading, Yeti triggered a sell order I had in place at $30.15, locking in +43.57% in gains on shares I bought for $21.00 back on March 12.

Thursday’s sale lowered my per-share cost -20.46% from $13.54 to $10.77. My next sell target for the stock is around $33.00 and my next buy target is back near March’s lows at $15.70.

YETI closed the week at $29.09, down -3.52% from where I sold on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.