April 9, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

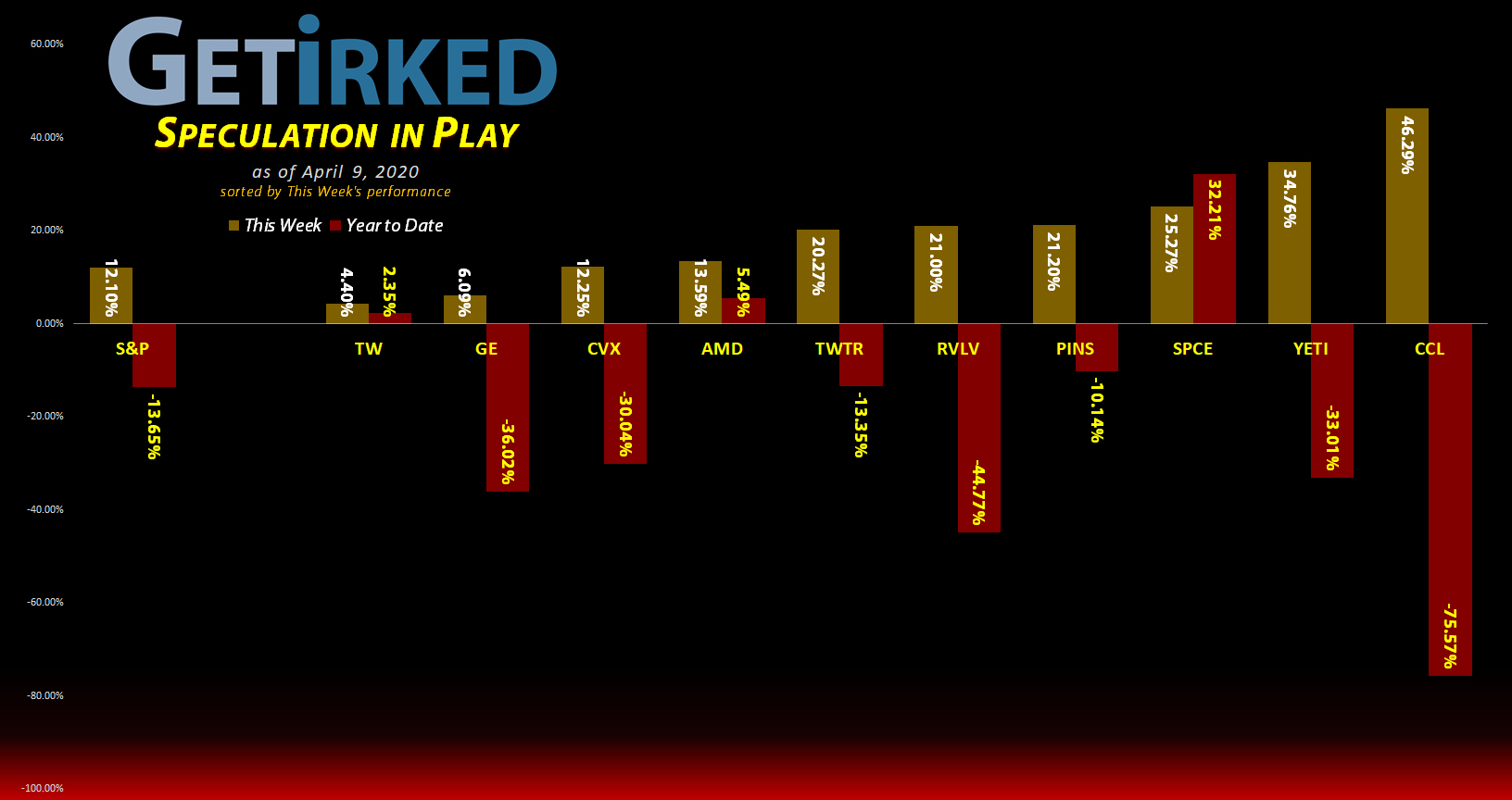

Carnival Cruiselines (CCL)

When you sell off in as epic a fashion as Carnival Cruiselines (CCL) did (down a whopping -75.57% YTD), you’re bound to have a bounce, and this week CCL bounced +46.29% to earn itself the spot of the week’s Biggest Winner.

Tradeweb Markets (TW)

Tradeweb Markets (TW) has been an incredibly strong performer since its IPO last year, and even this week it gained +4.40%; that just wasn’t enough to beat the next stock up making it our Biggest Loser. I would like to point out that TW is one of only 3 positions in the portfolio that’s up YTD, just sayin’.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)*

+483.22%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($1.29)*

Virgin Galactic (SPCE)*

+278.43%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

Yeti (YETI)

+43.83%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $16.15

Tradeweb Mkts (TW)

+40.16%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $33.85

Pinterest (PINS)

+29.03%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $12.99

Chevron (CVX)

+26.63%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $66.58

Twitter (TWTR)

+6.81%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $26.00

Carnival Cruise (CCL)

+4.13%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $11.93

General Electric (GE)

-7.26%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $7.70

Revolve Group (RVLV)

-53.00%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Pinterest (PINS): Profit-Taking

Pinterest (PINS) saw a huge pop in the last half of the week, triggering a few sell orders I had in place which filled at an average $17.06 selling price. The small sell orders lowered my per-share cost by -2.25% from $13.32 to $12.99.

My next sell order is near the $20.00 mark with my next buy target is near PINS’ March lows at $10.10-$10.15.

PINS closed the week at $16.75, down -1.82% from my average selling price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.