March 13, 2020

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

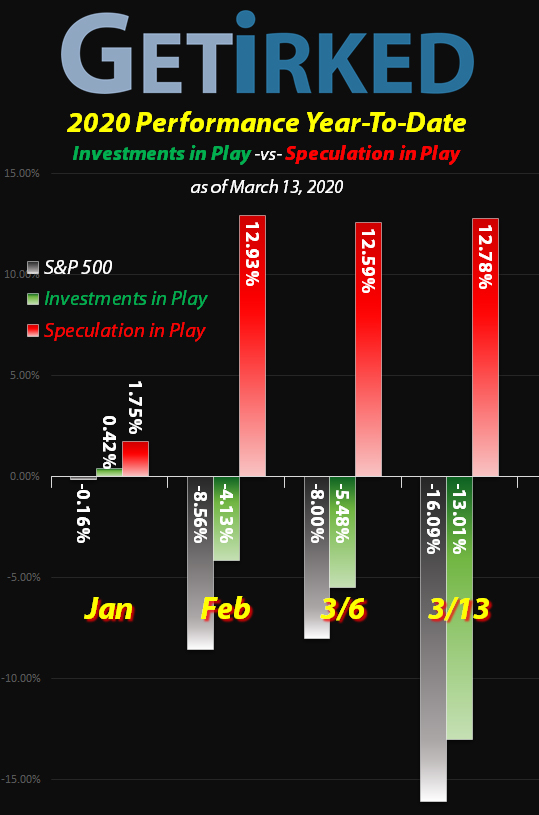

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

AMD (AMD)

In the face of overwhelming odds, AMD (AMD) held up… O.K. … this week, “only” losing -9.65% to earn itself two weeks in a row as our Weekly Winner.

*yay*

Sigh….

Carnival (CCL)

Whew. It’s a tough time to be a cruise line with COVID-19 turning your once-beautiful ships into floating petri dishes.

Carnival Cruiselines (CCL) got positively destroyed this week, and it’s not like they’d been having a good year at -65.41%.

They lost -35.25% in value this week alone and that makes them our biggest loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)*

+448.65%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($1.29)*

Virgin Galactic (SPCE)*

+271.72%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)*

SPY 3/20 Put Spreads 1

+203.75%

Cost: $1.96

Closing Price: $4.00

Yeti (YETI)

+44.47%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $15.84

Tradeweb Mkts (TW)

+21.11%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $35.83

Chevron (CVX)

+8.42%

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: $76.94

Carnival Cruise (CCL)

+6.57%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $16.50

Twitter (TWTR)

+3.85%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $28.21

Pinterest (PINS)

-5.68%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $15.18

General Electric (GE)

-10.98%

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: $8.82

SPY 3/20 Put Spreads 2

-34.03%

Cost: $1.50

Current Value: $0.985

Revolve Group (RVLV)

-56.02%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $21.58

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

AMD (AMD): Added to Position

AMD (AMD) and its amazing CEO Lucy Su held up incredibly well over the past few weeks of selling… until Thursday. AMD finally fell through one of my price targets, triggering a buy order at $41.11.

I’m still playing with the house’s money and no capital in AMD, however, I continue to give a wide berth during this selloff with my next buy target at $33.75.

AMD closed the week at $43.90, up +6.79% from my buy price on Thursday.

Carnival Cruiselines (CCL): *New Position*

I know what you’re thinking – “What the heck is Irk possibly thinking opening a position in the blast zone of the coronavirus?”

Well, here’s my logic – this is my Speculation in Play portfolio and when Carnival Cruise Lines finally dropped below $20 – a price it hasn’t been down to since the 2008 Financial Crisis – I decided to open a position at $17.25 during Thursday’s freefall and added more at $15.00 for an average of $16.50.

Given the potential for absolute volatility in this position along with maybe even bankruptcy, I’m using wide spreads with my next price target at $12.30, another past support period.

CCL closed the week at $17.58, up +6.57% from my average buying price.

Chevron (CVX): *New Position*

Heh… if you thought Carnival Cruiselines (CCL) was a bad idea, here’s an even worse one – Chevron (CVX) the epic petroleum and gas company.

What’s the deal now? Am I drunk-trading?

Nope.

Chevron is positively the best house in a god-awful neighborhood with an amazing balance sheet and a CEO who’s actually looking toward opportunities in the future that, believe it or not, don’t have anything to do with oil.

Chevron and the rest of the oil cohort were destroyed this week thanks to the OPEC fiasco an subsequent price war. Nobody wants to own these stocks. Already beaten down under $100 a share last week, Chevron got hit again on Monday, down -20% into the $80s, and then again on Thursday where it triggered my first buy order at $76.94.

Just like Carnival Cruiselines, I’m giving this one very wide margins with the next buy order at $70.00. And, again, just like CCL, these are prices Chevron hasn’t seen since the 2008 Financial Crisis (but that doesn’t mean it can’t go lower…)

CVX closed the week at $83.42, up +8.42% from where I opened Thursday.

General Electric (GE): Added to Position

General Electric (GE) fell hard on Monday which reassured my conservative approach to rebuilding this position. A buy order I had in place filled at $8.23 during the death drop and lowered my per-share cost -6.17% from $9.40 to $8.82.

My next buy target for the stock is $7.75.

GE closed the week at $7.85, down -4.62% from where I added on Monday.

Pinterest (PINS): Added to Position

I know I said previously that I wanted to exit Pinterest (PINS) after Facebook (FB) targeted the company with a copycat app, however, after performing additional research, Facebook’s track record is almost nothing when it comes to winning with that approach.

Given Pinterest’s excellent growth, great leadership, and solid fundamentals combined with my taking significant profits on my position at much higher levels, I decided to add to my position when it dropped on Monday with an order filling at $17.19 (PINS continued to head much lower, of course).

On Tuesday, I picked up some more when PINS tested its lows with an order filling at $15.88. On Thursday, the buying really picked up during the selloff with an average buying price of $13.23 giving me a weekly average price of $14.33.

The orders lowered my per-share cost -17.28% from $18.35 to $15.18, and my next buy target is $11.40, a price calculated using Fibonacci Predictive methodology since we’re in uncharted waters with PINS’ price action.

PINS closed the week at $14.31, virtually unchanged from my average buy price.

Revolve Group (RVLV): Added to Position

When Revolve Group (RVLV) reported a mediocre-to-terrible quarter a few weeks ago, I was waiting for the prerequisite Three-Day Rule to finish before I closed the position at a loss.

Then, the sell-off happened.

Revolve kept getting smacked down further and further. I was waiting patiently for a green day to take the loss, and there was no reprieve.

On Thursday, Revolve was slammed under $10 a share, so, given that this is my speculative portfolio, I flipped my strategy, adding at $9.85 and lowering my per-share cost -14.53% from $25.25 to $21.58.

This might be stupid, but that’s what speculation is for!

RVLV closed the week at $9.49, down -3.65% from where I added on Thursday.

SPY Insurance Put Spreads: *O/C +204.11% Gain*

Following the historic selloff on Monday, the markets bounced on Tuesday, however, there was no news calming the concerns of coronavirus or the OPEC oil price battle. This was simply price action resulting in an oversold bounce.

Seeing a test of Monday’s low as distinctly possible, I picked up some insurance in the form of vertical put spreads, specifically the 384-379 expiring in a little over a week and a half on Friday, March 20.

On Thursday, the epic selloff was so dramatic that my spreads immediately doubled in value. I added a new rule to my trading discipline – when your trade doubles in value in 24 hours, close it, so that’s what I did, doubling my money in one day.

TRADE MAKEUP:

Buy SPY 3/20 284 Puts: -$11.2365

Sell SPY 3/20 279 Puts: +$9.2733

Total Cost: -$11.2365 + $9.2733 = $1.9632 per Spread

BREAK-EVEN:

Higher Strike Price: $284

Cost: $1.9632

Break-Even: $284 – $1.9632 = $282.04

MAXIMUM PROFIT:

Lower Strike Price: $279

Break-Even: $282.04

Maximum Profit: $282.04 – $279 = $3.04 per spread

Maximum Gain: $3.04 / $1.9632 = 154.85% (2.5 times the investment)

CURRENT STATUS:

Cost of Each Spread: $1.9632

Selling Price of Each Spread: $4.00

P/L %: 4 / 1.9632 = +203.75%

SPY Insurance Put Spreads: *Opened SPY 255-251*

When the market saw a relief rally during trading on Friday after Thursday’s disastrous sell-off, I put in an order to buy the 3/20 255-251 on the cheap if it dropped in price significantly.

When I first looked at it, the spread was selling for $2.00 per contract so I threw on an order for $1.50. Well, I got my bid, so I have some relatively cheap insurance for the portfolio if the S&P tests this week’s lows in the next week (which I believe it likely will).

The spreads will risk about 3.23% of the portfolio (not too rough seeing as how it’s up more than 10% for the year), but could potentially earn as much as another +8.6% in YTD gains, a worthy risk.

TRADE MAKEUP:

Buy SPY 3/20 255 Puts: -$11.53

Sell SPY 3/20 251 Puts: +$10.03

Total Cost: -$11.53 + $10.03 = $1.50 per Spread

BREAK-EVEN:

Higher Strike Price: $255

Cost: $1.50

Break-Even: $255 – $1.50 = $253.50

MAXIMUM PROFIT:

Lower Strike Price: $251

Break-Even: $253.50

Maximum Profit: $253.50 – $251 = $2.50 per spread

Maximum Gain: $2.50 / $1.50 = 166.67% (2-2/3 times the investment)

CURRENT STATUS:

Cost of Each Spread: $1.50

Current Value per Spread: $0.985

P/L %: -34.03%

Tradeweb Markets (TW): Added to Position

Although Tradeweb Markets (TW) held up initially during this epic coronavirus selloff, the market took no prisoners this week, sending TW through my price target with a buy order filling at $45.76 (before TW headed even lower) on Thursday.

On Friday, Tradeweb suddenly lost support (odd since many stocks were experiencing a relief rally) and a second order order filled at $39.85 giving me an average buying price of $42.81. My next price target is at near its IPO at $33.72.

The two orders replace shares I sold in February at $47.66, locking in a -10.18% discount from that level, but, more significantly, a -19.76% discount from Tradeweb’s $53.35 all-time-high made in February.

TW closed the week at $43.40, up +1.38% from my average buy price.

Twitter (TWTR): Added to Position

Twitter (TWTR) showed remarkable relative strength throughout the week with a number of good news stories helping the stock maintain support… until Wednesday when it finally dropped through my buy order which filled at $30.71.

On Thursday, I added more during the selloff with an average buying price of $28.71 giving me a weekly average buy of $29.38.

The orders replace shares I sold less than a month ago on February 14 after Twitter popped to $36.98 following a good earnings report. That’s a discount of -20.56% from the price I sold them for. My next price target is $26.30.

TWTR closed the week at $29.29, down -0.31% from my average buy price.

Yeti (YETI): Added to Position

Yeti (YETI) is a notorious outperformer both on the upside and the downside, and Monday was no exception when it crashed through my price target with orders filling at an average price of $24.90.

On Thursday, YETI collapsed further, triggering a buy order at $21.00 and giving me an average weekly price of $23.92.

The orders raised my per-share cost to $15.84, however, I was also able to substantially increase my allocation in the stock which has excellent long-term prospects (maybe really long-term?). My next buy price target is $19.88.

YETI closed the week at $22.88, down -4.35% from my average buy price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.