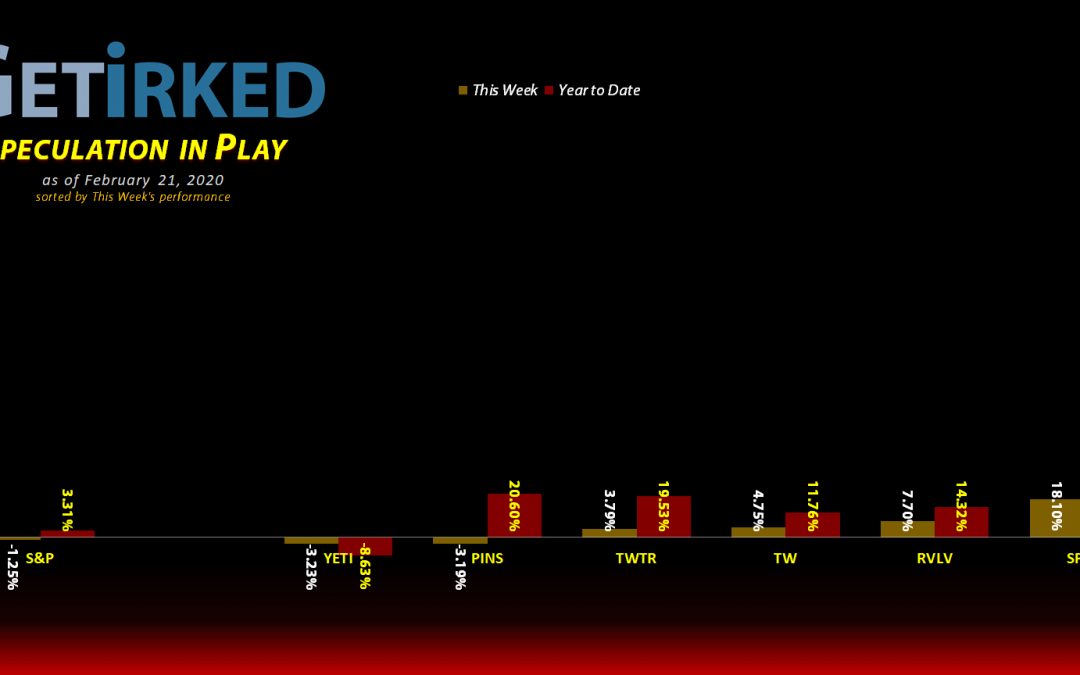

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) takes home the biggest winner once again, but this time with a… *yawn*… +18.10% weekly increase.

Man, this one’s slowing down, isn’t it? /sarcasm

Yeti (YETI)

Despite a good quarterly report, the short-sellers continue to slam down Yeti (YETI), causing the company to lose -3.23% this week and earning it the title of Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Virgin Galactic (SPCE)*

+493.71%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$0.15)

Yeti (YETI)

+434.40%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: -($7.07)*

Tradeweb Mkts (TW)

+65.67%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $31.27

Twitter (TWTR)

+44.87%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $26.45

Pinterest (PINS)

+21.34%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $18.35

Revolve Group (RVLV)

-16.84%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $25.25

SPY 2/28 Puts

-89.31%

Cost: 2/12/2020 @ $3.415

Current Value: $0.365

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Pinterest (PINS): Profit-Taking

After Facebook (FB) announced its copycat app for Pinterest (PINS) last week, I’ve been carefully managing the profits I have in this position.

PINS tried to snap its tight leash on Monday, breaking through a few key levels with me selling a substantial portion of my shares at an average price of $22.96. The sales reduced my per-share cost by -14.84% from $21.76 to $18.53.

If Pinterest falls below $20.77, its most recent weekly monthly low (and a low since before its excellent earnings report), I’ll be closing my position with a lifetime gain target in the range of 8-9%. A market-wide sell-off is one thing, but even with Facebook’s (FB) history of not actually beating off competitors with copycats, there’s simply too much downside risk in this stock to turn a profit into a loss.

PINS closed the week at $22.48, down -2.09% from my average selling price.

Yeti (YETI): Added to Position

Despite thinking I had waited too long to take profits in Yeti (YETI) last week, it turns out I hadn’t as shorts continued to push down the stock despite the company reporting some damn decent earnings with their last quarterly report.

I replaced some of the shares I sold last week when Yeti dropped below $32 on Monday, buying at $31.83. The order captured a discount of -8% from some of the shares I sold just last week at $34.60.

I’m still playing with the house’s money in this name, even after Monday’s buy, but I will definitely add more if it drops through $30.

YETI closed the week at $31.78, down -0.16% from where I added on Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.