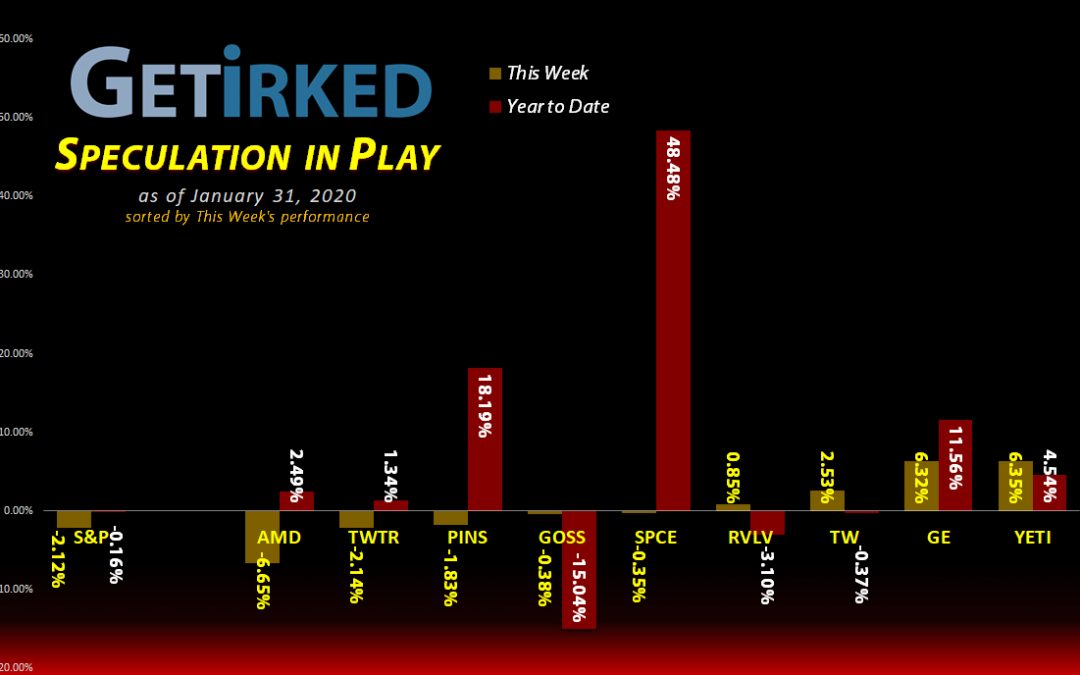

The Week’s Biggest Winner & Loser

Yeti (YETI)

In a sea of red, Yeti (YETI) somehow became the bright spot, earning a +6.35% pop throughout the week, seemingly out of nowhere and edging out General Electric (GE) as this week’s Biggest Winner.

General Electric (GE) was nipping at its heels after reporting an excellent quarterly report suggesting the turnaround the behemoth is well under way.

AMD (AMD)

AMD (AMD) reported earnings this week and gave soft guidance. While the earnings report wasn’t terrible by any stretch, this monster is up insanely huge over the past 12-18 months so the selloff was vicious, knocking it down -6.65% with AMD earning the Biggest Loser spot this week.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+369.16%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $7.75

AMD (AMD)

+210.13%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$37.04)*

Virgin Galactic (SPCE)

+178.52%

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: $6.16

Tradeweb Mkts (TW)

+30.58%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $35.37

General Electric (GE)

+12.40%

1st Buy: 12/19/2019 @ $11.08

Current Per-Share: $11.08

Twitter (TWTR)

+8.42%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $29.96

Pinterest (PINS)

+1.28%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $21.75

Gossamer Bio (GOSS)

-6.74%

1st Buy: 12/17/2019 @ $14.51

Current Per-Share: $14.24

Revolve Group (RVLV)

-29.52%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $25.25

SPY 2/28 Put Spread

-36.48%

Cost: 1/27/2020 @ $3.03

Current Value: $1.93

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Spy 2/28 Vertical Put Spread: Rolling Around

When the market sold off on Monday, I used the pop in my the value of my 2/3 vertical put spreads to roll the trade to the end of February. While it looked like the market might see a decent-sized selloff, I wasn’t completely confident it could happen before February 3, the date of expiration for my spreads.

I swapped my 2/3 325-317 put spreads for 2/28 323-317 put spreads. The reduction in my strike price from 325 to 323 returned some capital to reduce the cost of the trade while simultaneously extending the expiration date and reducing the maximum profit for the trade.

How does this math affect the entire cost of the trade?

Sell SPY 2/3 325-317 Spreads: +$2.26

Buy SPY 2/28 323-317 Spreads: -$1.75

Profit Returned / Reduction of the Trade Cost: $0.51

Cost of Spreads Before Conversion: $3.54

New Cost of each Spread: $3.03 ($3.54 – $0.51)

What are the trade’s new break-even and profit targets?

BREAK-EVEN: With the new vertical put spreads, I need the SPY to selloff to my strike price plus the cost of the trade or $319.97 (a selloff of -1.24% from the price of SPY at the time of conversion at about $324.00).

Strike Price: $323

Cost of each Put Spread: $3.03

Break-Even Price: $319.97 ($323.00 – $3.03)

PROFIT MAXIMUM: The puts I sold have a 317 strike price which means I make a profit anywhere below my break-even price of $319.97 down to $317. The maximum profit of my trade is $2.97 per spread or a gain of +98.02%.

Break-Even: $319.97

Puts Sold: $317.00

Maximum Profit: $2.97 ($319.97 – $317.00)

Total profit possibility: $2.97 / $3.03 (cost of the trade) = 0.9802 or 98.02%

CURRENT TRADE STATUS:

SPY Close on Friday: $321.75 ($1.78 away from break-even)

Cost of each Spread : $3.03

Current Value of each Spread at Friday’s Close: $1.93

Profit/Loss: -36.30%

Time Remaining: 28 Days (20 Trading Days)

Yeti (YETI): Profit-Taking

In a week featuring the biggest selloff the market had seen in months, it feels strange to take profits in a position, but that’s exactly what happened when outdoor product manufacturer Yeti (YETI) popped on no news Thursday morning.

Yeti made a new all-time high of $37.54, triggering a limit sell order I had in place at its previous $37.15 high. The order sold shares I just bought at the beginning of the month on January 6 for $31.90, locking in +17.68% in gains and lowering my per-share cost -48.68% from $15.10 to $7.75.

YETI closed the week at $36.36, down -3.14% from where I sold on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.