The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

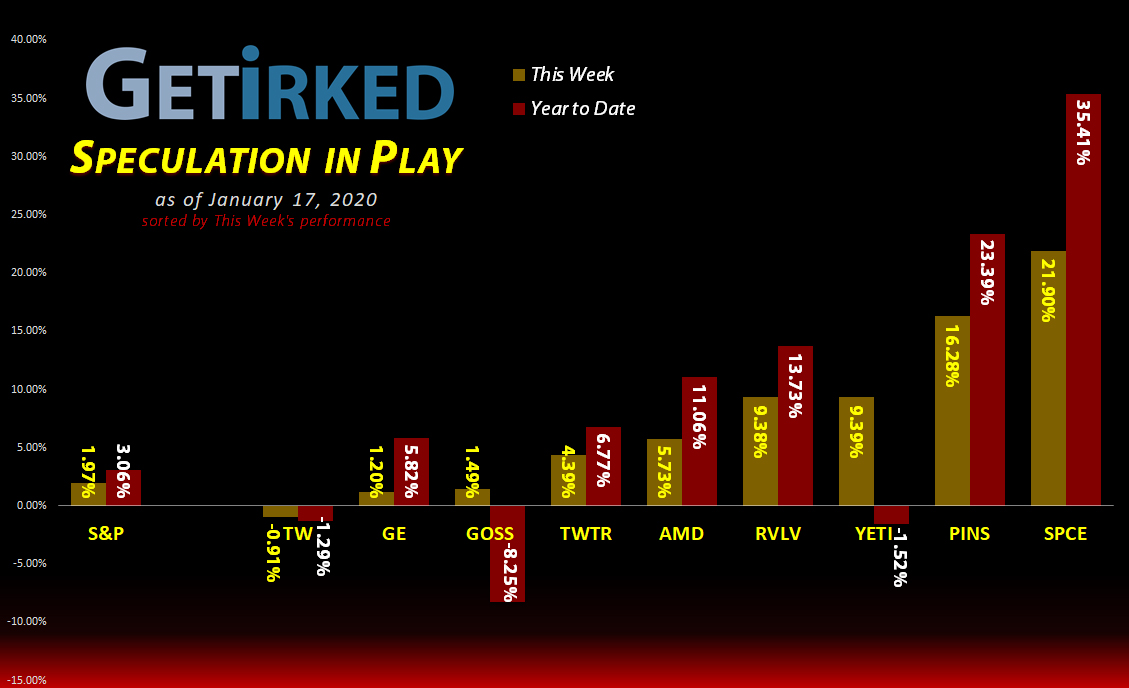

For a company with absolutely no revenues and only the promise of interested customers in the future, Virgin Galactic (SPCE) continues to surprise as it returns as this week’s Biggest Winner for its 5th win out of 6 weeks and 2nd week in a row in 2020.

Tradeweb Markets (TW)

Given Tradeweb Markets (TW) performance since it IPO’ed in 2019, it’s hard to call it the week’s Biggest Loser as it dropped less than one percent (-0.91%). However, given that it’s the only negative position in the portfolio, TW is this week’s #1 loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+215.28%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$37.04)*

Yeti (YETI)

+126.82%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $15.10

Virgin Galactic (SPCE)

+78.34%

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: $8.77

Tradeweb Mkts (TW)

+29.37%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $35.37

General Electric (GE)

+6.62%

1st Buy: 12/19/2019 @ $11.08

Current Per-Share: $11.08

Twitter (TWTR)

+14.23%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $29.96

Pinterest (PINS)

+5.74%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $21.75

Gossamer Bio (GOSS)

+0.70%

1st Buy: 12/17/2019 @ $14.51

Current Per-Share: $14.24

Revolve Group (RVLV)

-17.28%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $25.25

SPY 2/3 Put Spread

-86.31%

Cost: 1/9/2020 @ $3.54

Current Value: $0.485

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

Gossamer Bio (GOSS): Added to Position

The bottom fell out on Gossamer Bio (GOSS) again on Monday, with the stock plummeting more than -5% in trading and triggering a buy order I had placed at a Fibonacci Retracement level targeting $13.42 which filled at $13.44.

Unfortunately, GOSS continued to drop before finding support at $13.19. The buy order lowered my per-share cost by -1.86% from $14.51 to $14.24.

For the moment, I am holding steady on my position with no additional adds until we see where GOSS goes from here since biopharmas can easily lose more than 70% from their highs which gives GOSS a potential price target of around $8.15, 70% less than its $27.15 high. My first sell target for the stock is around $22.30-$22.40, a past point of significant resistance.

GOSS closed the week at $14.34, up +8.72% from where I bought Monday.

Pinterest (PINS): Profit-Taking

Pinterest (PINS) caught fire this week after several analysts and pundits pointed to it as a good long-term investment in the social media space.

Since I have a bit of a substantial position (relative to the rest of the portfolio) in the stock, I used a trailing stop to sell about 8% of my allocation when it pulled back to $22.28 on Wednesday.

The sale lowered my per-share cost by a marginal -0.23% from $21.80 to $21.75 but frees up a bit of capital to add back if PINS pulls back from its pop.

My next sell target is $24.79 and my next buy target is $19.82.

PINS closed the week at $23.00, up +3.23% from where I sold on Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.