The Week’s Biggest Winner & Loser

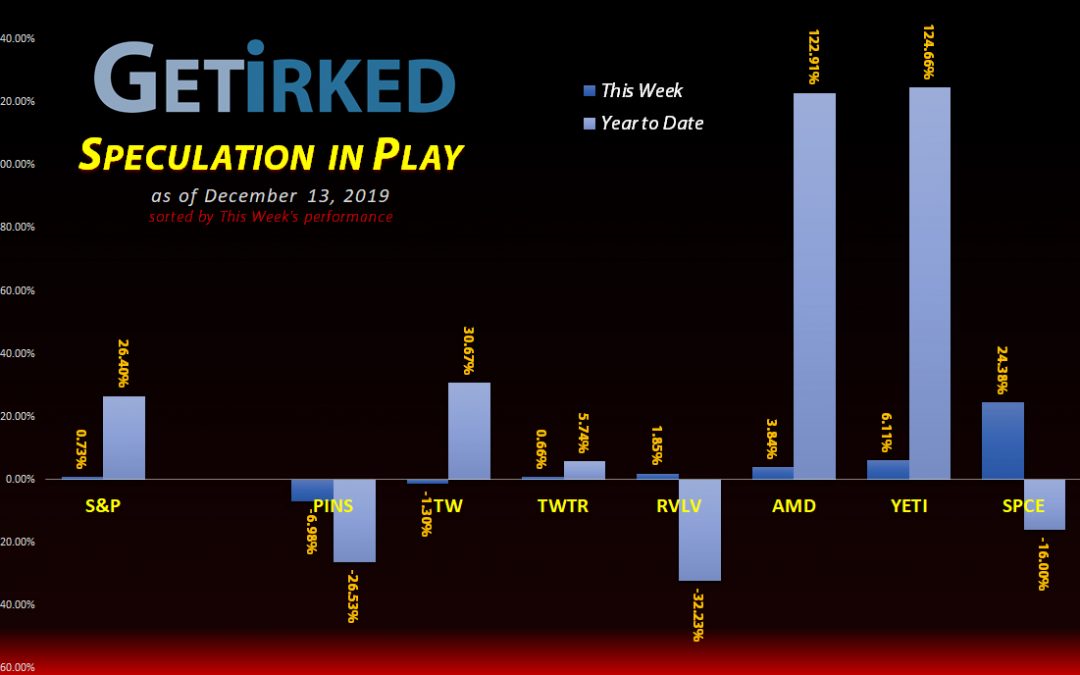

Virgin Galactic (SPCE)

When do you ever see an analyst reach into a raging dumpster fire to put it out? Sir Richard Branson is one lucky sunuva as an analyst decided to claim they see Virgin Galactic tripling which caused SPCE to take off out of the poop chute and gain +24.38% as our Weekly Winner (although it’s still worth noting it’s down -16% from where it listed in the U.S.)

Pinterest (PINS)

Pinterest (PINS) is on pins and needles for its second week in a row as the Weekly Loser, dropping another -6.98% on news that social media influencers are full of it since they’re all paid for their opinions. PINS is down a whopping -26.53% from its IPO earlier this year, and definitely earned its spot as the Weekly Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Yeti (YETI)

+250.95%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $9.50

AMD (AMD)

+202.46%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$37.04)*

Tradeweb Mkts (TW)

+26.45%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $35.45

Twitter (TWTR)

+1.45%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $29.96

Virgin Galactic (SPCE)

-2.45%

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: $9.26

Pinterest (PINS)

-19.94%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $21.80

Revolve Group (RVLV)

-32.45%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $25.25

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

AMD (AMD): *Cost Basis Removed*

AMD (AMD) roared with the rest of the market following Trump’s announcement of a Phase One Trade Deal on Thursday, triggering a sell order I had in place at $41.67.

The sale pulls my initial cost basis as well as some significant profits of the position. AMD has been very good to me given that I made my first purchase back on January 10 of this year, so I have every intent of adding back in should we see a pullback, beginning with a $35.64 target.

AMD closed the week at $41.15, down -1.25% from where I sold on Thursday.

Pinterest (PINS): Added to Position

Pinterest (PINS) continued losing ground this week, dropping below the $18.00 level on Tuesday, triggering trailing-stop buy orders I had in place which filled with an average buying price of $17.95.

The buys lowered my per-share cost by -5.55% from $23.08 to $21.80. My next buy target is 17.15 if PINS continues making new all-time lows.

PINS closed the week at $17.45, down -2.79% from my average buy price.

Twitter (TWTR): Added to Position

Twitter (TWTR) surprised me by not showing more weakness after I initially opened my position in October at $29.79 which left me with a smaller allocation than I would like.

So, when Twitter (TWTR) pulled back during Thursday’s trading, I added to my position with a trailing-stop buy order filling at $30.29.

The order raised my per-share cost 0.57% to $29.96 from $29.79 but also adds more exposure should TWTR try to regain its highs in the $40s. In the meantime, I still have plenty of dry powder to add more to the position, starting if TWTR drops below $29 again.

TWTR closed the week at $30.39, up +0.33% from where I added on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.