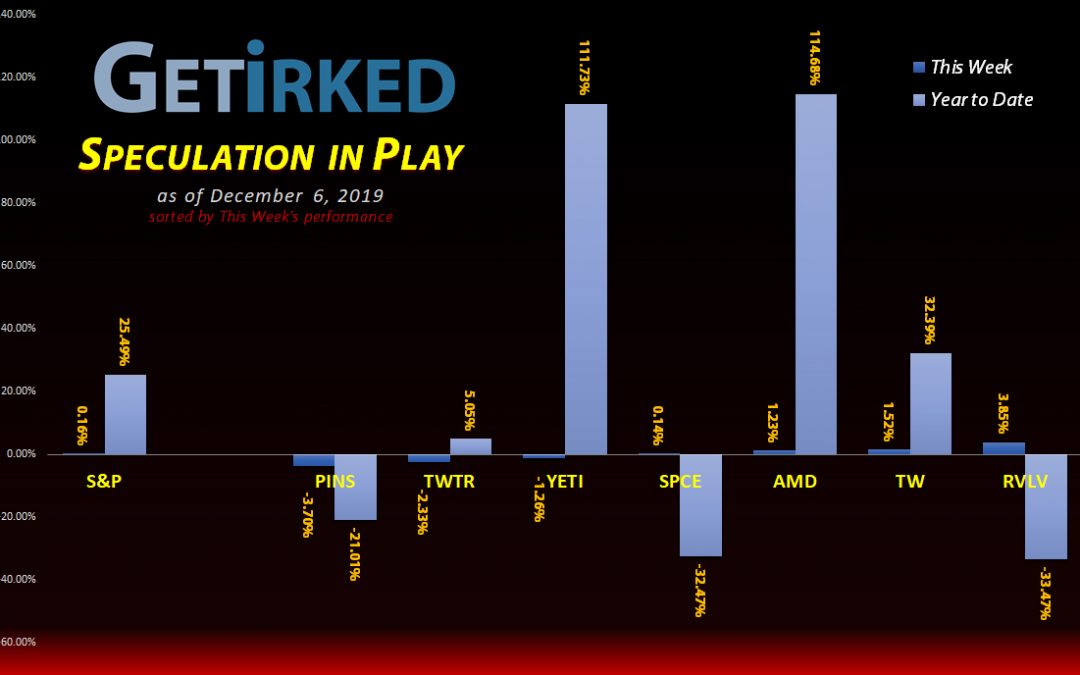

The Week’s Biggest Winner & Loser

Revolve Group (RVLV)

It’s hard to call a stock that’s down -33.47% since it IPO’ed a “winner,” but Revolve Group (RVLV) bounced 3.85% this week, earning itself the title of the week’s Biggest Winner.

Pinterest (PINS)

Pinterest (PINS) retreated a bit this week on no real news, pulling back -3.70% and earning itself the Biggest Loser title.

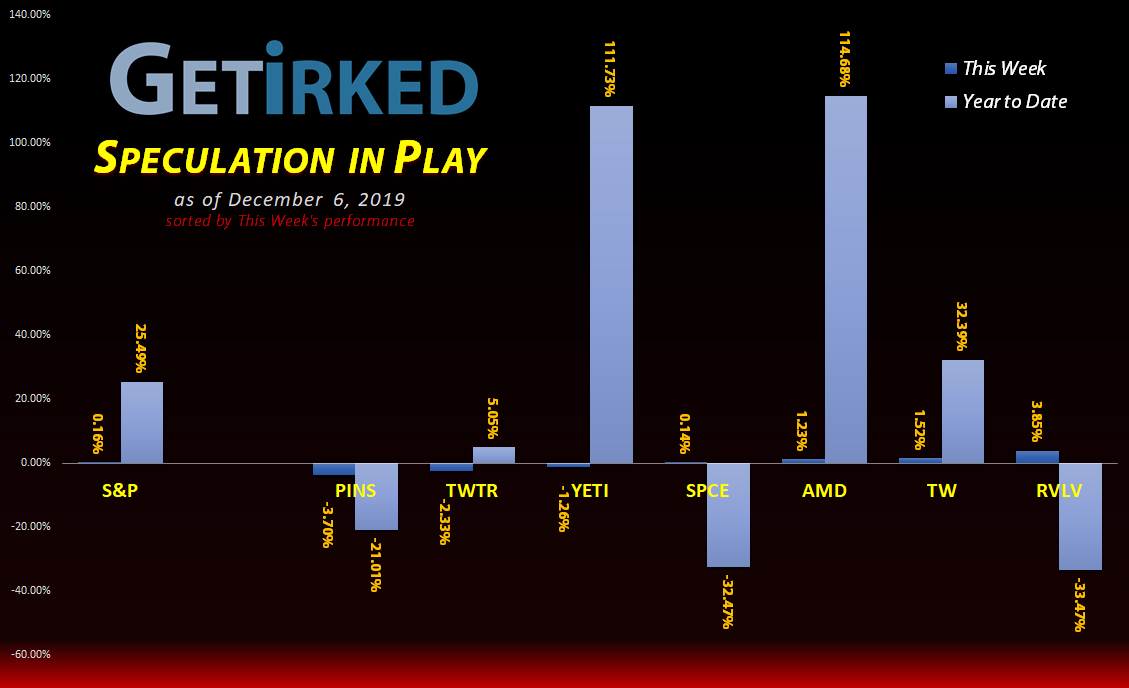

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+1611.88%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $2.32

Yeti (YETI)

+230.74%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $9.50

Put Spread (SPY Dec 31)

+54.89%*

Cost: $1.83

Current Value: $0.00*

Tradeweb Mkts (TW)

+28.11%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $35.45

Twitter (TWTR)

+1.34%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $29.79

Pinterest (PINS)

-18.71%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $23.08

Virgin Galactic (SPCE)

-21.57%

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: $9.26

Revolve Group (RVLV)

-33.68%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $25.25

Profit % for * positions = Current Gross Profit / Original Capital Investment

This Week’s Moves

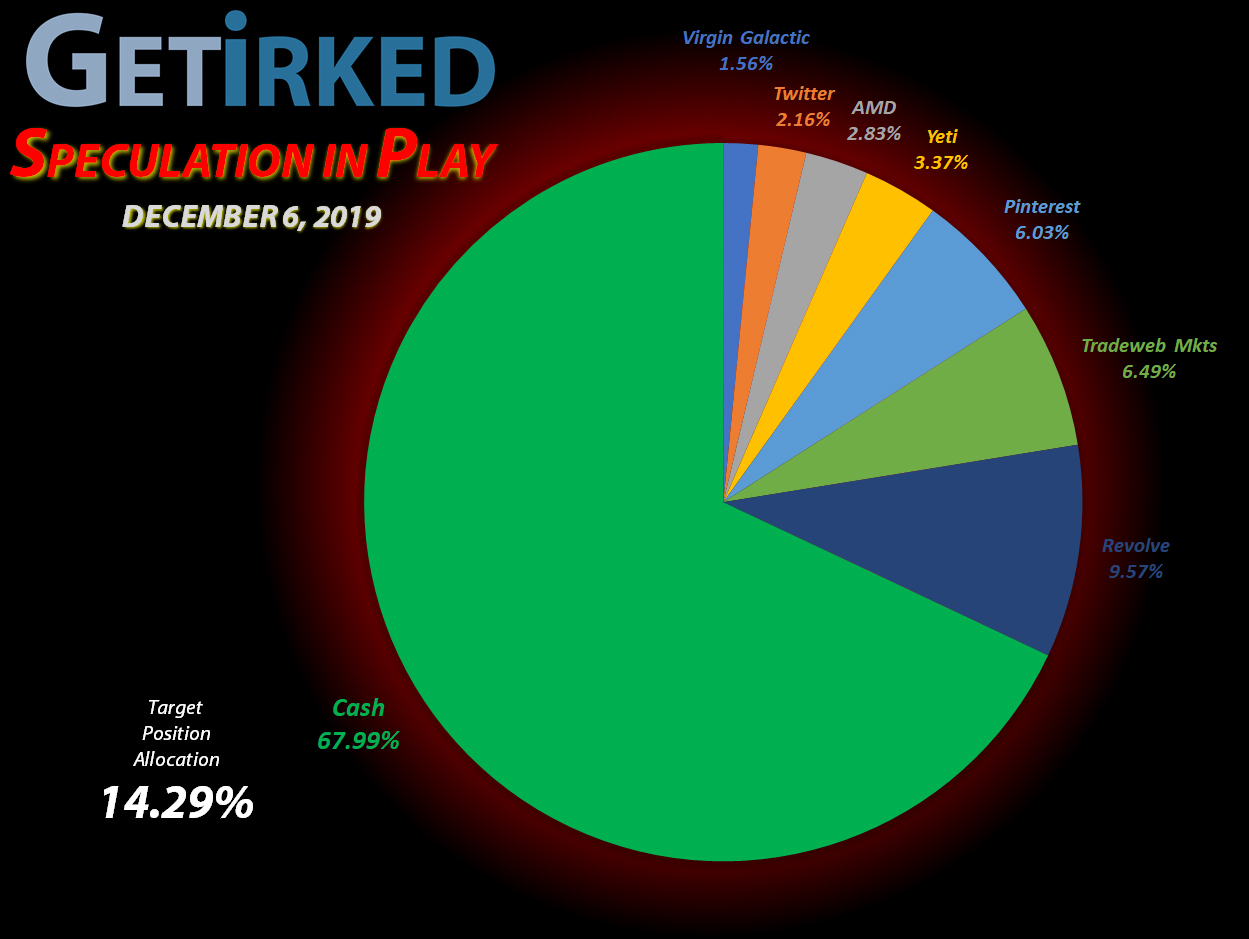

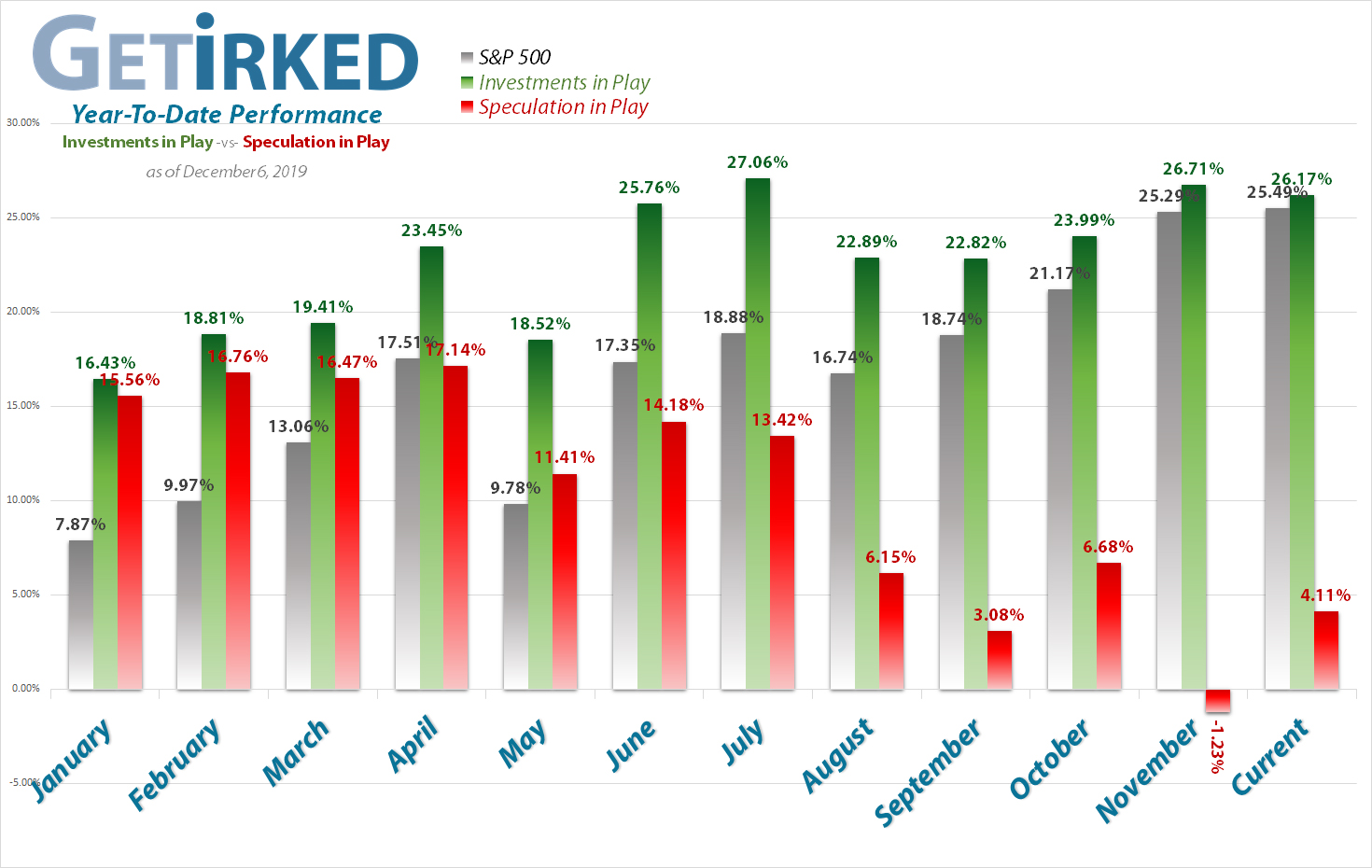

SPY Put Spread: *Closed: +54.89% Gain*

While I did expect the market to head south at some point as we approached the end of the year, I had no idea it would happen so quickly… not even a week after I opened the position!

Between a bad manufacturing PMI number on Monday and Trump announcing he’d be okay waiting until after the 2020 election to pass a trade deal with China on Tuesday, the market sold off incredibly throughout Monday and Tuesday.

During trading on Tuesday, the value of my put spread had flipped from being down -19.97% at the close last Friday to a gain in excess of 50%.

I closed the position with the SPY ETF around $308.00 on Tuesday by selling my long put, the SPY Dec 31 313, for $8.23, and buying back the SPY Dec 31 307 puts I had shorted for $5.38, leaving me $2.85 for each put option I held – a gain of $1.01 per put over my initial $1.84 cost.

Total profit for the trade? 54.89%!

While the initial potential profit target for this put spread was much higher, I’m happy to take my 54.89% gain after holding the puts for just four-and-a-half trading days.

I risked 7% of my Speculation in Play portfolio’s capital on the trade and added 3.88% after selling. That sounds like risking 1 to make 1/2, but the initial maximum profit potential for the trade was risking 1 to make 3; I just decided to grab my profits when I could.

Overall, the profit from this one trade added nearly 4% to the annual returns for my entire Speculation in Play portfolio, flipping this year’s returns from being in the red last week to being in the green this week. While the trade risk was higher than I normally take on, I had enormous confidence in the potential success of the trade – the thesis being that the market would see some sort of a pullback between last week and the end of 2019.

Bears make money, Bulls make money, and Hogs get slaughtered.

After closing my position on Tuesday, the SPY roared back over $311 (my break-even price for the trade) on Wednesday which would have turned a profitable trade into a loser. Option prices move incredibly fast so following my discipline of taking profits when I have them will continue to be a rule I strictly adhere to.

The SPY ETF closed the week up at $314.87 which made my spread worth $1.43, or an overall loss of -22.28%! This means I grabbed almost the maximum profit available to me for this trade (for this week, at least – the trade could be more profitable again if we see a more dramatic pullback later in December).

Pinterest (PINS): Added to Position

Pinterest (PINS) sold off with the rest of the market on Monday, triggering a buy order I had in place to add a small amount to my position at $18.76.

The buy lowered my per-share cost -2.29% from $23.62 to $23.08. My next buy is at $18.14, near a key support level estimated using Fibonacci Retracement analysis.

PINS closed the week at $18.76, exactly where I added on Monday.

Yeti (YETI): Profit-Taking

Yeti (YETI) gapped up into Thursday’s market open following an analyst upgrade and news about a lucrative corporate partnership, triggering a targeted sell order I had in place at $34.01, a past point of support/resistance.

The sale locked in a substantial 25.96% gain on shares I purchased back in August for $26.11, and also lowered my per-share cost -39.22% from $15.63 to $9.50.

My next sell target for YETI is $38.52, slightly above its all-time highs, which will pull the remaining capital I have in the position (as well as some decent profits), leaving me to play with the house’s money. I also have a buy target at $29.25 if YETI drops on a market pullback.

YETI closed the week at $31.42, down -7.62% from where I sold on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.