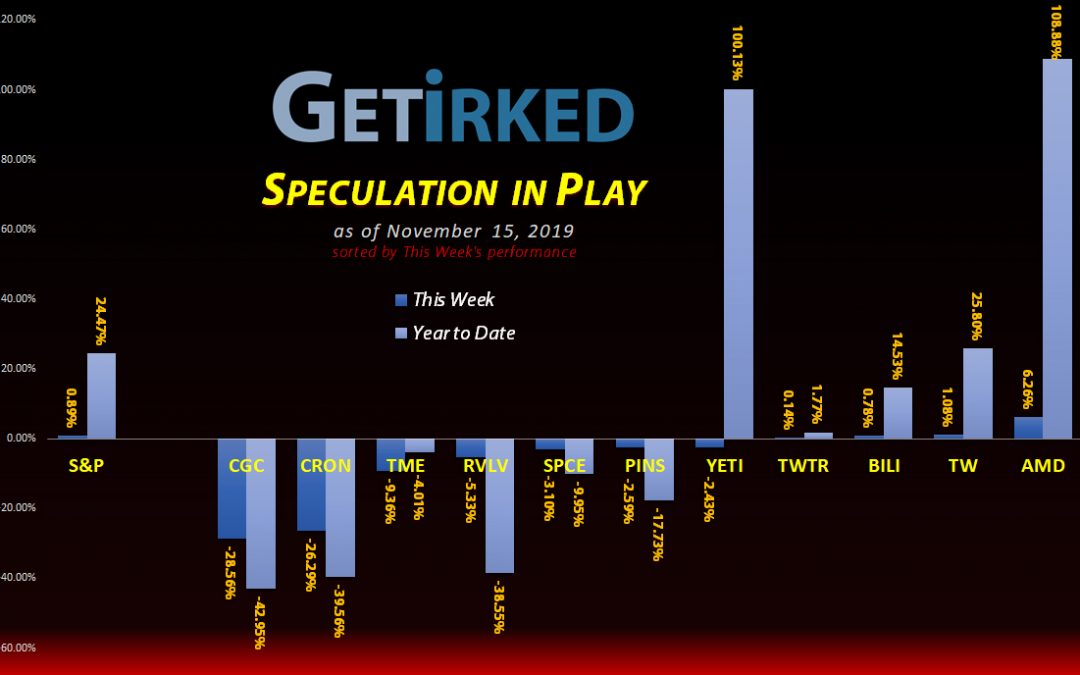

The Week’s Biggest Winner & Loser

AMD (AMD)

AMD (AMD) and the rest of the semiconductors continue to fly with AMD earning +6.26% and locking in its spot as the Biggest Winner.

Canopy Growth (CGC)

Canopy Growth Corp (CGC) and the rest of the consumer cannabis space completely collapsed this week, losing -28.56% as the week’s Biggest Loser (for the last time?).

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+1565.66%

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: $2.32

BiliBili (BILI)

+179.90%

1st Buy: 3/7/2019 @ $17.68

Current Per-Share: $5.97

Yeti (YETI)

+90.05%

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: $15.63

Tencent Music (TME)

+47.55%

1st Buy: 12/14/2018 @ $12.96

Current Per-Share: $0.00

Tradeweb Mkts (TW)

+16.19%

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: $37.14

Virgin Galactic (SPCE)

+1.20%

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: $9.57

Twitter (TWTR)

-1.81%

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: $29.79

Pinterest (PINS)

-22.19%

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: $25.12

Canopy Growth (CGC)

-23.46%

1st Buy: 8/21/2018 @ $38.28

Current Per-Share: $20.03

Revolve Group (RVLV)

-38.75%

1st Buy: 6/13/2019 @ $39.06

Current Per-Share: $25.25

Cronos Group (CRON)

-41.18%

1st Buy: 12/3/2018 @ $10.27

Current Per-Share: $0.00

This Week’s Moves

Canopy Growth Corp (CGC): *Closure Imminent*

Canopy Growth Corporation (CGC) disappointed the street as the amount of shares its using as compensation exceeded its profits, causing the stock to sell off dramatically on Thursday. I added far too early at $16.53 and the stock price continued to fall further.

The small buy lowered my per-share cost -1.71% from $20.38 to $20.03.

After additional information came out throughout the week, the powerful weakness in the cannabis sector due to an overestimation of the size of the market led me to plan to exit both Canopy Growth Corporation (CGC) and Cronos Group (CRON). As you’ll see below, Cronos’ lost its support and I took an epic -41.18% loss as I believe this sector has further to fall.

The recreational marijuana sector is now a very long-term play as federal legalization in countries other than Canada will be the only catalysts to bring back CGC and its colleagues. This revelation means the pot plays have no place in my speculative portfolio (although I will continue building a CGC position in for my long-term investment portfolio).

CGC closed the week at $15.33, down -7.26% from where I added on Thursday.

Cronos Group (CRON): *Closed, -41.18% Loss*

With the cannabis sector becoming a mess that will only be fixed in the long-term (if ever), I decided to take the hit and bail on both Canopy Growth (CGC) and Cronos Group (CRON).

Cronos Group (CRON) came first when the stock lost its $6.30 footing and headed to new lows on Friday, where I used a trailing stop to close out my position at $6.23, an epic -41.18% overall loss for the position since I first opened it last December.

Professional traders and advisers (which I am not one of either) recommend never risking more than 5% of your overall worth in speculation and CRON is an example of why this is true (my entire Speculation in Play portfolio – holdings and cash – accounts for about 1.7% of my assets).

The cannabis sector is no-touch for the moment unless I was interested in exploring shorting (although the biggest move’s been missed there, too).

CRON closed the week at $6.28, up +0.80% from where I closed on Friday.

Revolve Group (RVLV): Added to Position

I added to Revolve Group (RVLV) on Monday when it continued to make lower lows, buying more shares at $15.41 after its drop appeared to stabilize at a new all-time low of $15.29.

The order lowered my per-share cost by -5.25% from $26.65 to $25.25, however, I’m playing this dramatically oversold condition for a potential bounce opportunity. In other words, I won’t be holding for my per-share cost of $25.25, rather selling some shares at a potential point of resistance around $20.00.

The result will raise my per-share cost but lower my allocation, capitalizing on profits from these shares purchased last week and this week.

Important: I’m only playing Revolve Group this way because it’s in my speculative portfolio and an incredibly small position relative to my actual investment portfolios. I would not permit taking such an overweight position in a long-term investment portfolio without seeing significant signs of a turnaround.

RVLV closed the week at $15.46, up +0.32% from where I added on Monday.

Tencent Music (TME): *Closed w/47.55% Gain*

Tencent Music (TME) popped going into earnings on Monday, leading me to place a trailing stop to take profits on shares I purchased back in September.

My order filled at $14.24, capturing 12.66% of gains on shares I purchased on 9/27/2019 for $12.64. The sale also lowered my per-share cost by -5.39% from $10.76 to $10.18.

Tencent Music’s earnings were in-line with analyst expectations, however, when you run a growth company, analysts want you to beat expectations so TME sold off on Wednesday.

As we approach the year-end, I’ve decided to clean up the Speculations in Play portfolio to make room for new strategies in 2020, so TME was on the chopping-block if its earnings didn’t create a new pop in the stock. I used a trailing stop order to close the position at $13.21 on Tuesday.

From an initial buy on December 14, 2018, Tuesday’s position closure represents a lifetime gain of +47.55% on my investment in 11 months.

TME closed the week at $12.69, down -3.94% from where I closed it on Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.