April 12, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

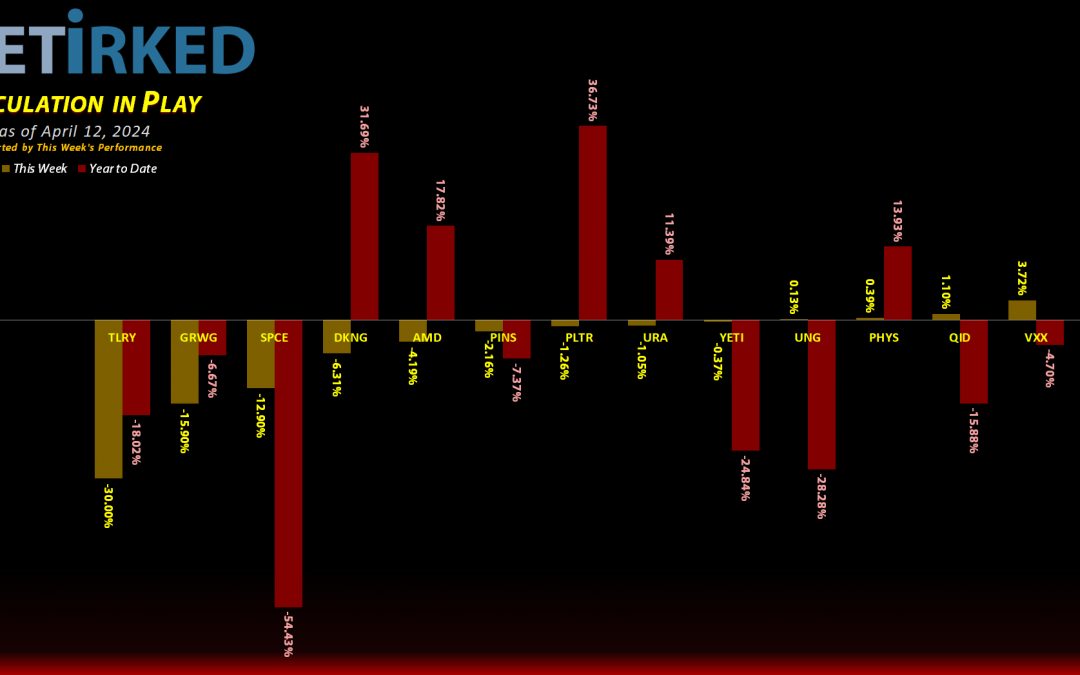

The Week’s Biggest Winner & Loser

Sprott Gold Trust (PHYS)

As always, I don’t recognize my short plays as the Biggest Winner or Loser of the week, so that left us with incredibly slim pickings this week. The Sprott Physical Gold Trust (PHYS) managed to edge out a gain of +0.39%, and, in a week as crappy as this one, that was enough to earn it the spot of the Week’s Biggest Winner.

Tilray Brands (TLRY)

“What goes up, must come down!” Tilray Brands (TLRY) had a particularly bad week. Not only did the cannabis sector – one of the highest-flying, most speculative sectors lately – get smacked during Friday’s selloff, Tilray gave a dismal earnings report. As a result TLRY got positively sliced and diced, down -30.00% on the week where it was easily the Week’s Biggest Loser, even in a week this bad.

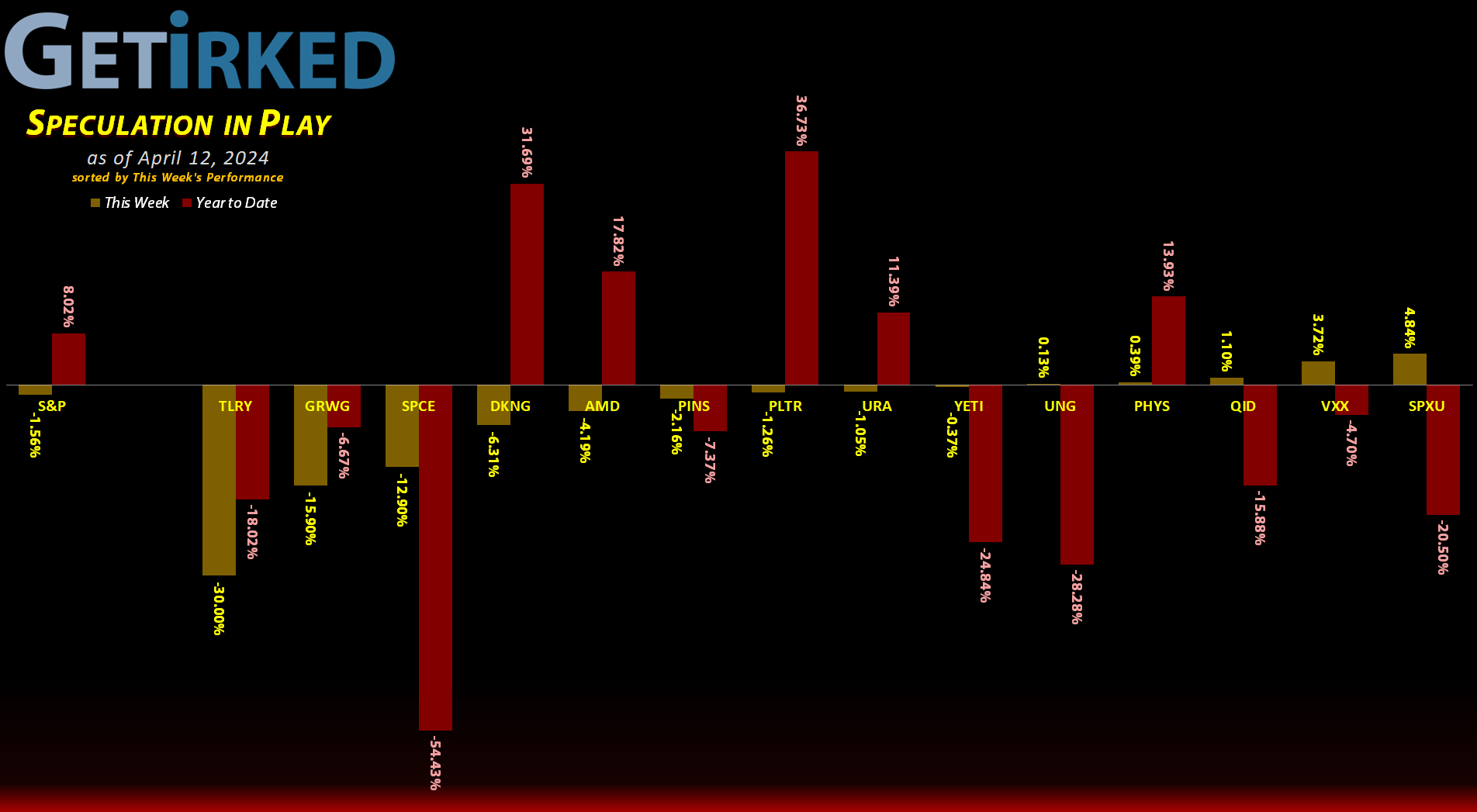

Portfolio Allocation

Positions

%

Target Position Size

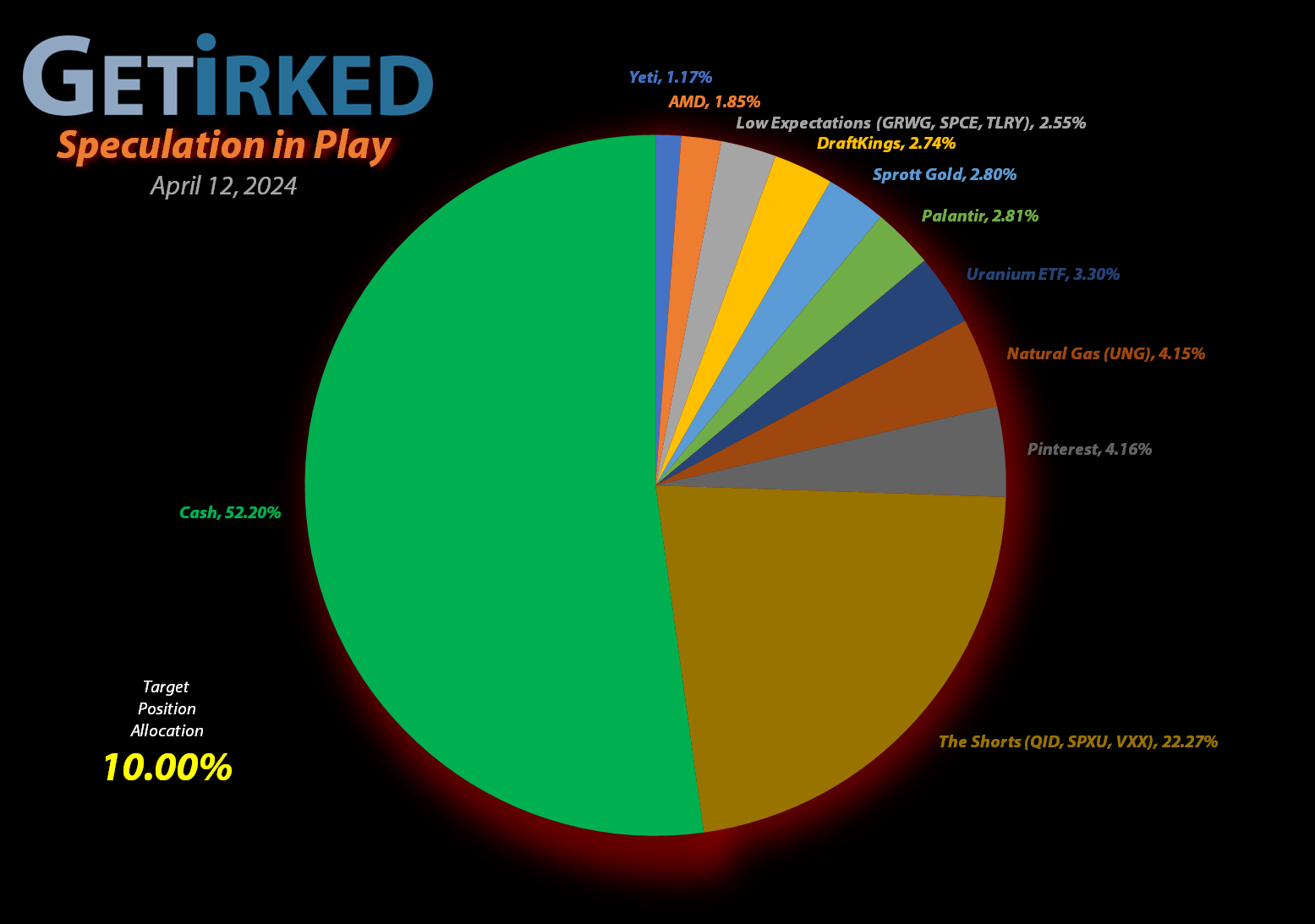

Current Position Performance

AMD (AMD)

+792.94%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$687.73)*

Pinterest (PINS)

+420.05%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+387.35%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+169.76%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.20

Virgin Galactic (SPCE)

+76.41%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$1.96)*

Palantir (PLTR)

+60.60%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+55.31%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+47.64%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

Sprott Gold Trust (PHYS)

+23.77%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-15.90%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $17.55

Short SPY (SPXU)

-27.49%

1st Buy: 3/9/2023 @ $73.75

Current Per-Share: $48.04

Short QQQ (QID)

-31.53%

1st Buy: 3/7/2023 @ $101.00

Current Per-Share: $67.33

U.S. Natural Gas (UNG)

-45.31%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-82.44%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

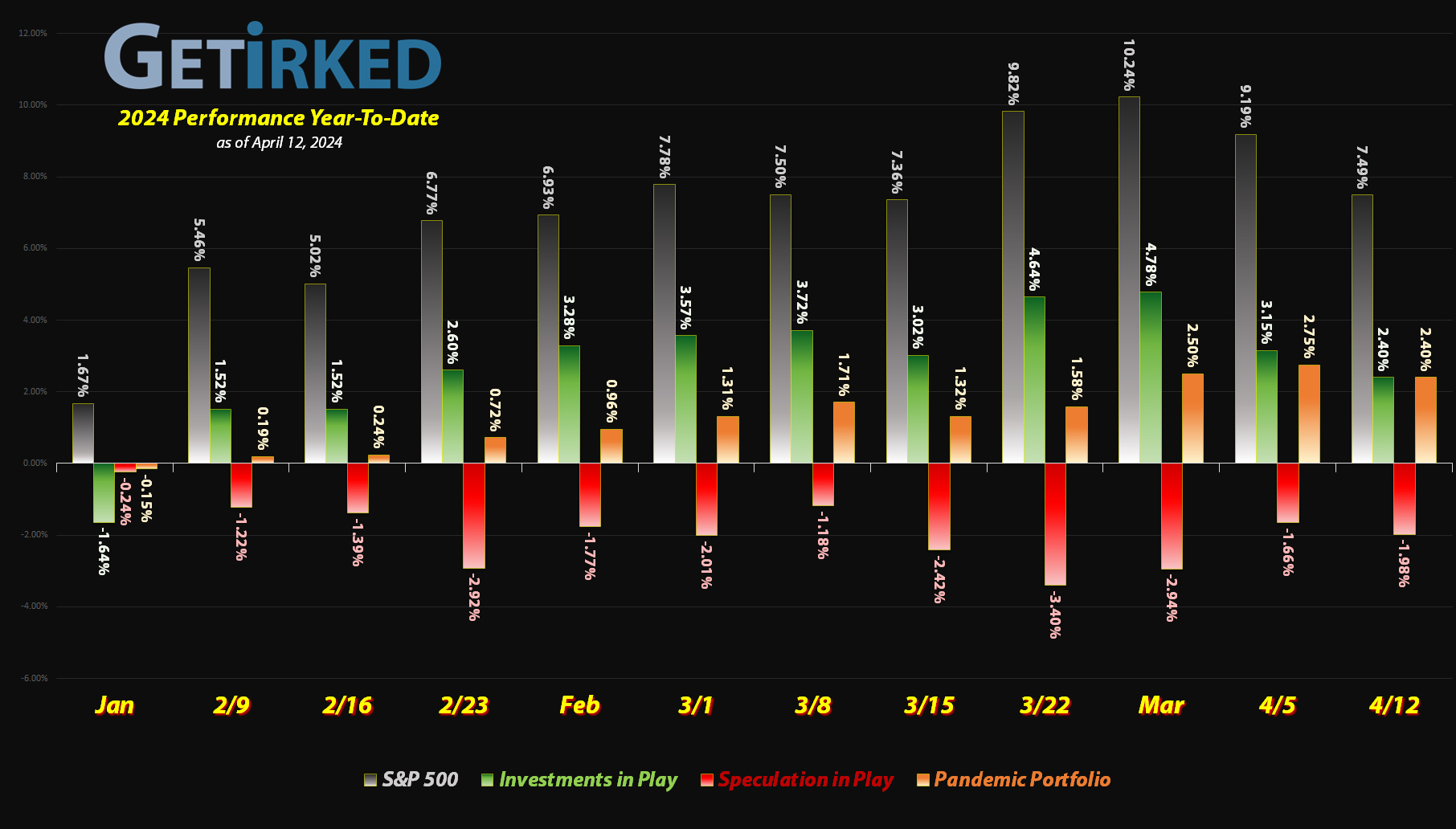

This Week’s Moves

Inverse ETFs QID & SPXU: 1:5 Reverse Split

On Wednesday, both the UltraShort ProShares QQQ Inverse ETF (QID) and the UltraPro Short SPY Inverse ETF (SPXU) held 1-for-5 reverse splits. Due to the nature of an inverse ETF, it will lose value over time, especially if it tracks any of the major indexes like the Nasdaq or S&P 500 which gain over time. Additionally, since there is a substantial expense ratio to these ETFs, that causes the ETFs to lose value over time, too.

Naturally, these aren’t investment instruments, they’re trading vehicles, so ProShares must regularly execute these reverse splits to keep the ETFs viable. Just as with regular stock splits, no value is added or subtracted. In this case, shareholders receive one share for every five they held at the time of the split, and the price of the stocks are multiplied by five.

For me, this makes $67.33 my new cost basis in QID, down -33.34% from my initial buy at $101.00. Over in SPXU, my new cost basis is $48.04, down -34.86% from my initial buy at $73.75.

My new sell targets are $67.46 for QID and $48.06 for SPXU, and, as I mentioned in a previous update, I will not be adding any additional funds to either of these positions in order to lock in my maximum possible losses.