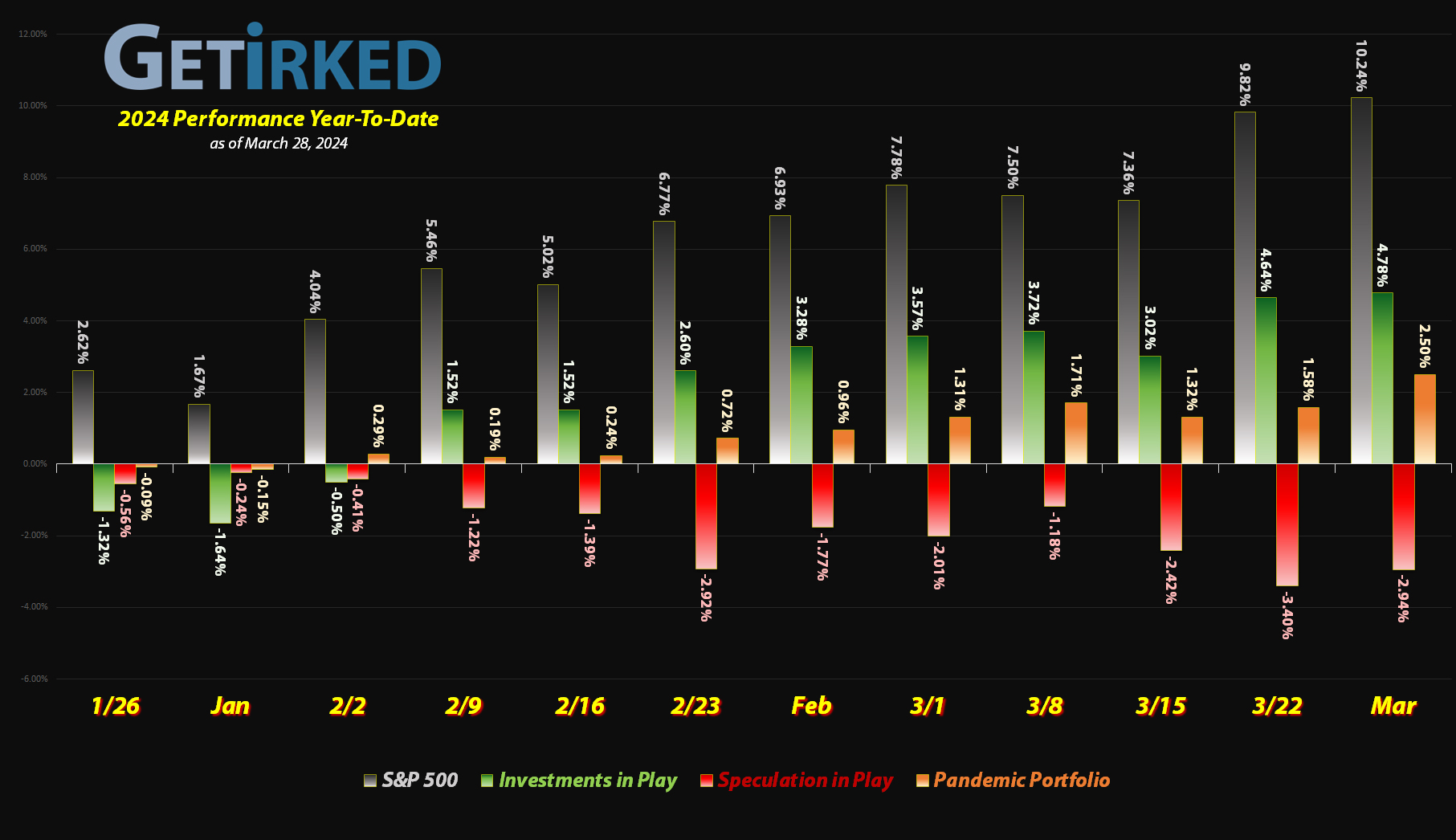

March 28, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

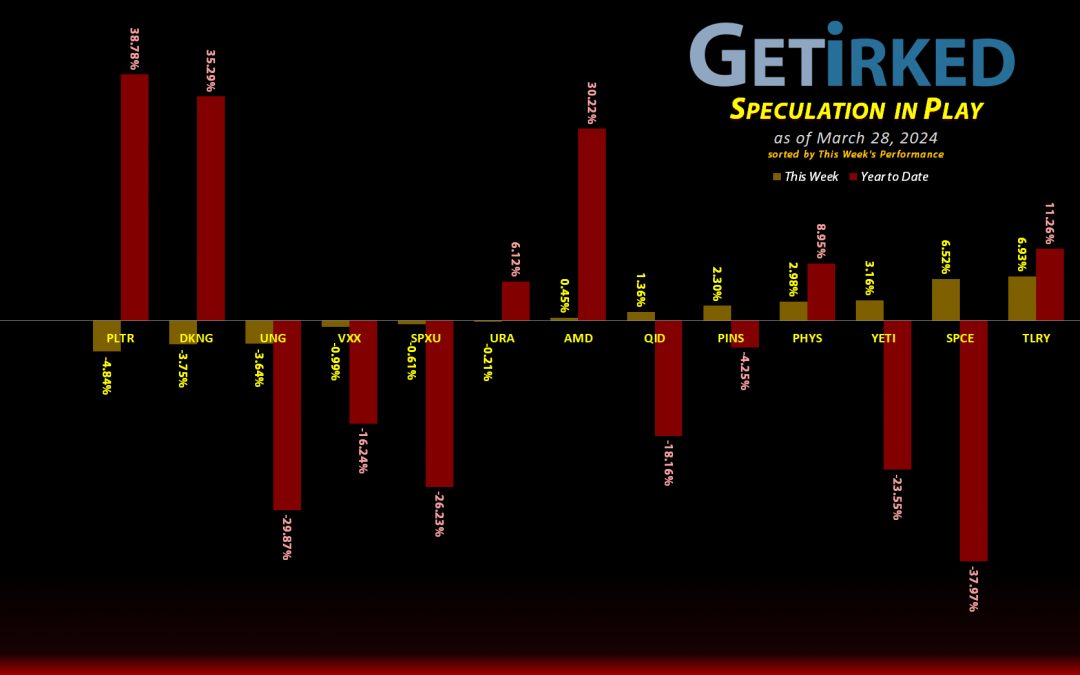

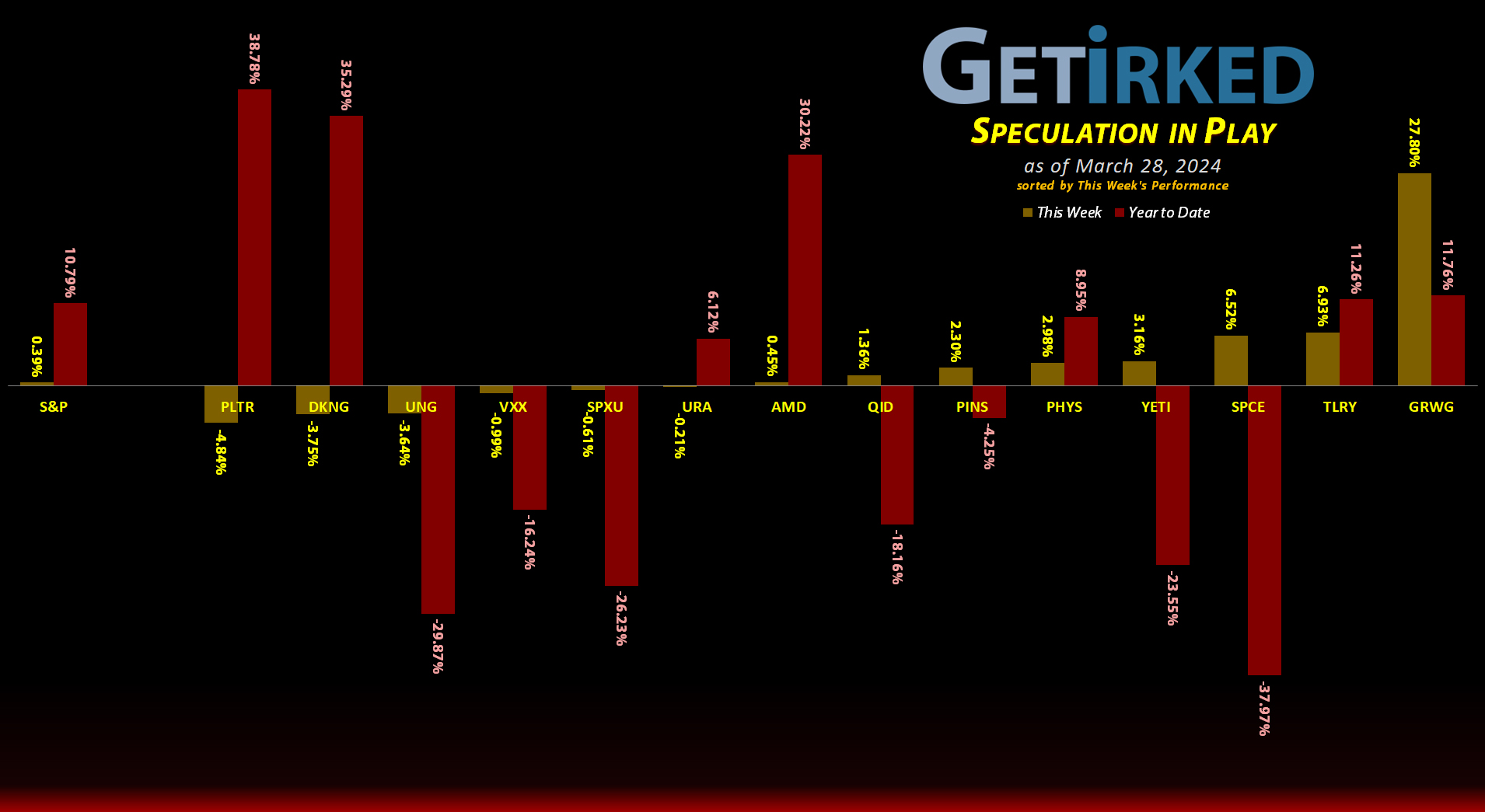

GrowGeneration (GRWG)

Cannabis remains the market’s newest darling, rallying again this week. Even the shabbiest in the space like GrowGeneration (GRWG) are feeling the love, with the hydroponic supplies store popping +27.80% this week on the back of a stock buyback plan. GRWG was easily the Week’s Biggest Winner in this portfolio!

Palantir (PLTR)

The money to buy the winners has to come from somewhere, and it looks like the artificial intelligence cohort has become the ATM for the moment. Palantir (PLTR), along with Nvidia (NVDA) and the rest of the AI plays, pulled back this week. PLTR dropped -4.84% and that was enough for it to come in as the Week’s Biggest Loser.

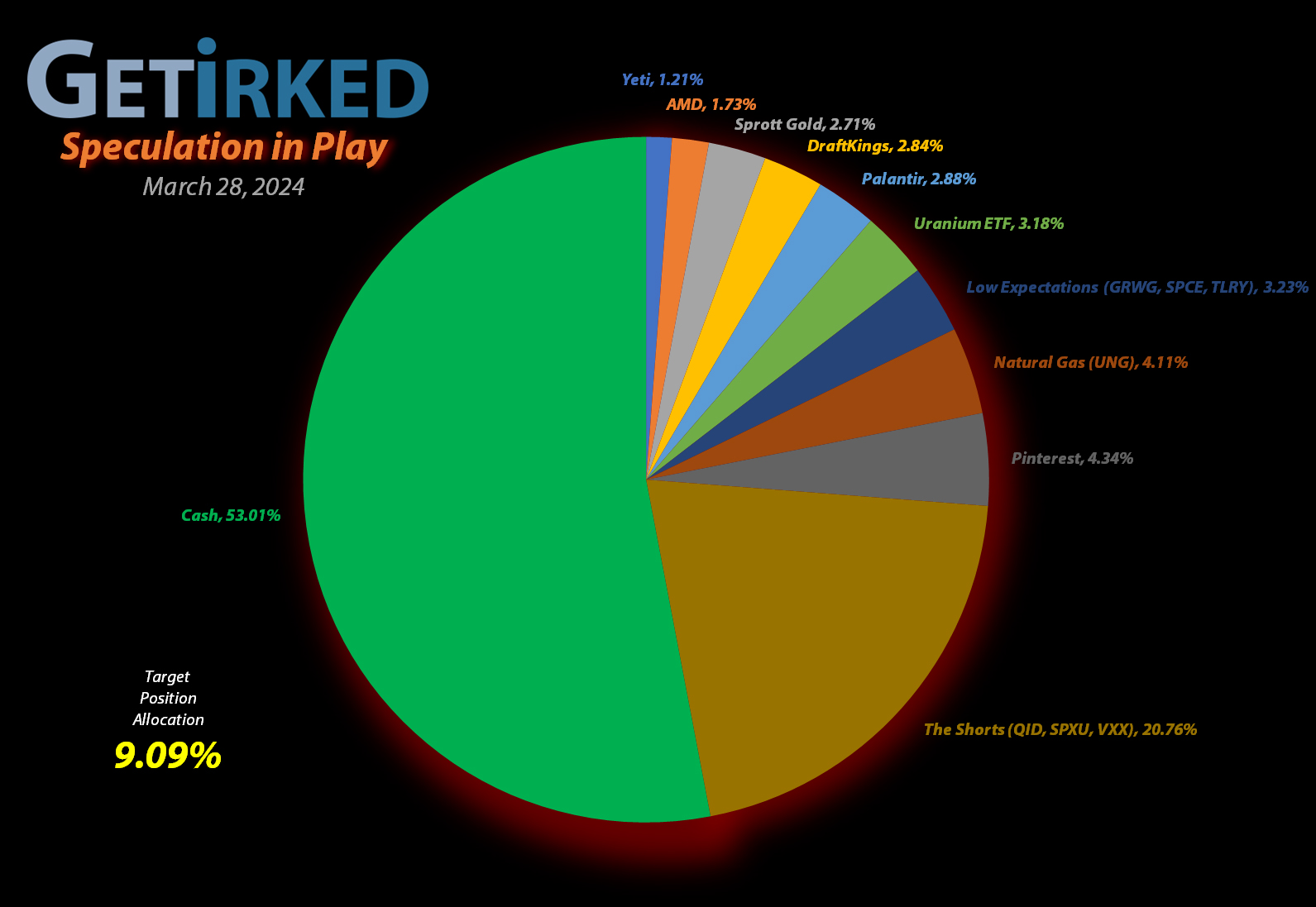

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+807.63%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+426.09%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+388.82%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+157.35%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+86.02%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+63.05%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+59.31%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+53.69%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

Sprott Gold Trust (PHYS)

+18.49%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-27.41%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short QQQ (QID)

-33.46%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $13.47

Short SPY (SPXU)

-33.75%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $9.76

U.S. Natural Gas (UNG)

-46.45%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-78.89%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Short Nasdaq-100 ETF (QID): Dividend Payout

The ProShares UltraShort QQQ ETF (QID), my short play on the Nasdaq-100, paid out its quarterly dividend on Wednesday. Since this is a short, I do not reinvest the dividend, opting to take the payout in cash in order to reduce my cost basis.

The dividend reduced my cost basis -1.10%, down from $13.62 to $13.47. I have decided I will no longer add to this position as it’s simply been a complete disaster so I have no buy targets, however I will start aggressively reducing my allocation if it ever gets back to cost basis with my next sell target at $13.47.

Short S&P 500 ETF (SPXU): Dividend Payout

The ProShares UltraPro Short S&P 500 ETF (SPXU), my short play on the S&P 500 index, paid out its quarterly dividend on Wednesday. Just like my QID short, I do not reinvest the dividend, taking the cash payout instead.

The dividend reduced my cost basis -1.12%, down from $9.88 to $9.76. Just like my QID position, I will not be adding any more funds into SPXU so I have no additional buy targets. My next sell target is $9.76… my cost basis… where I will dramatically reduce the size of my allocation.