March 22, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Tilray Brands (TLRY)

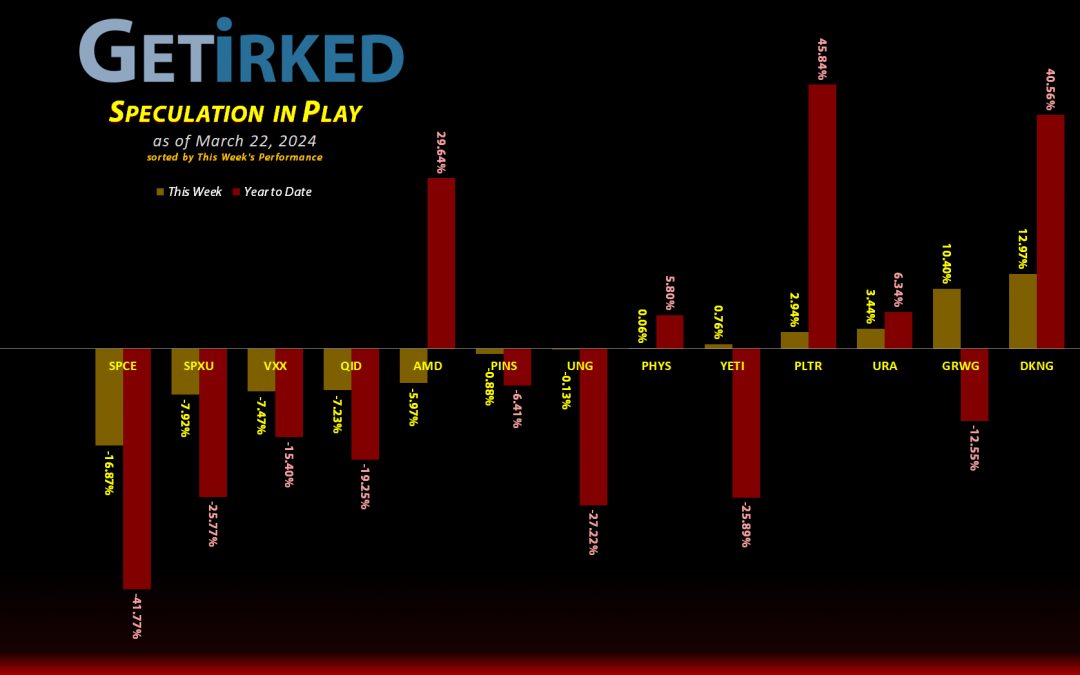

It’s a cannabis twofer! After locking in the spot of last week’s Biggest Winner, Tilray Brands (TLRY) did it again this week, rallying another +33.51% when the cannabis sector got another big rally! WILD!

Virgin Galactic (SPCE)

It’s funny how the market likes trends. A few years ago, traveling into outer space was the hottest thing. Now? You can’t give it away.

Virgin Galactic (SPCE) actually met expectations when it reported earnings, however it’s still losing a ton of money and isn’t generating as much revenue as investors would prefer.

As a result, SPCE crash-landed -16.97% this week, coming in as the Week’s Biggest Loser.

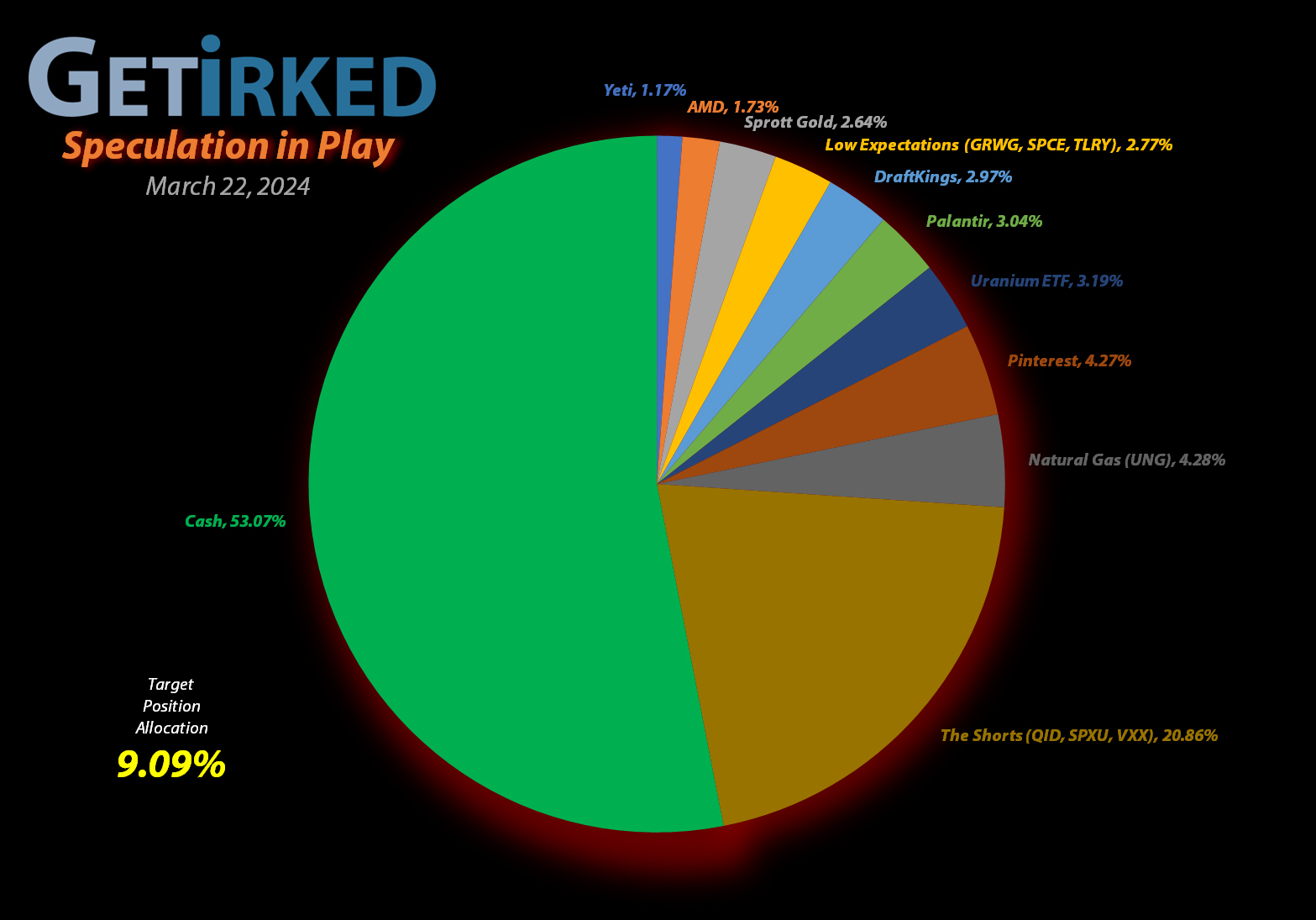

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

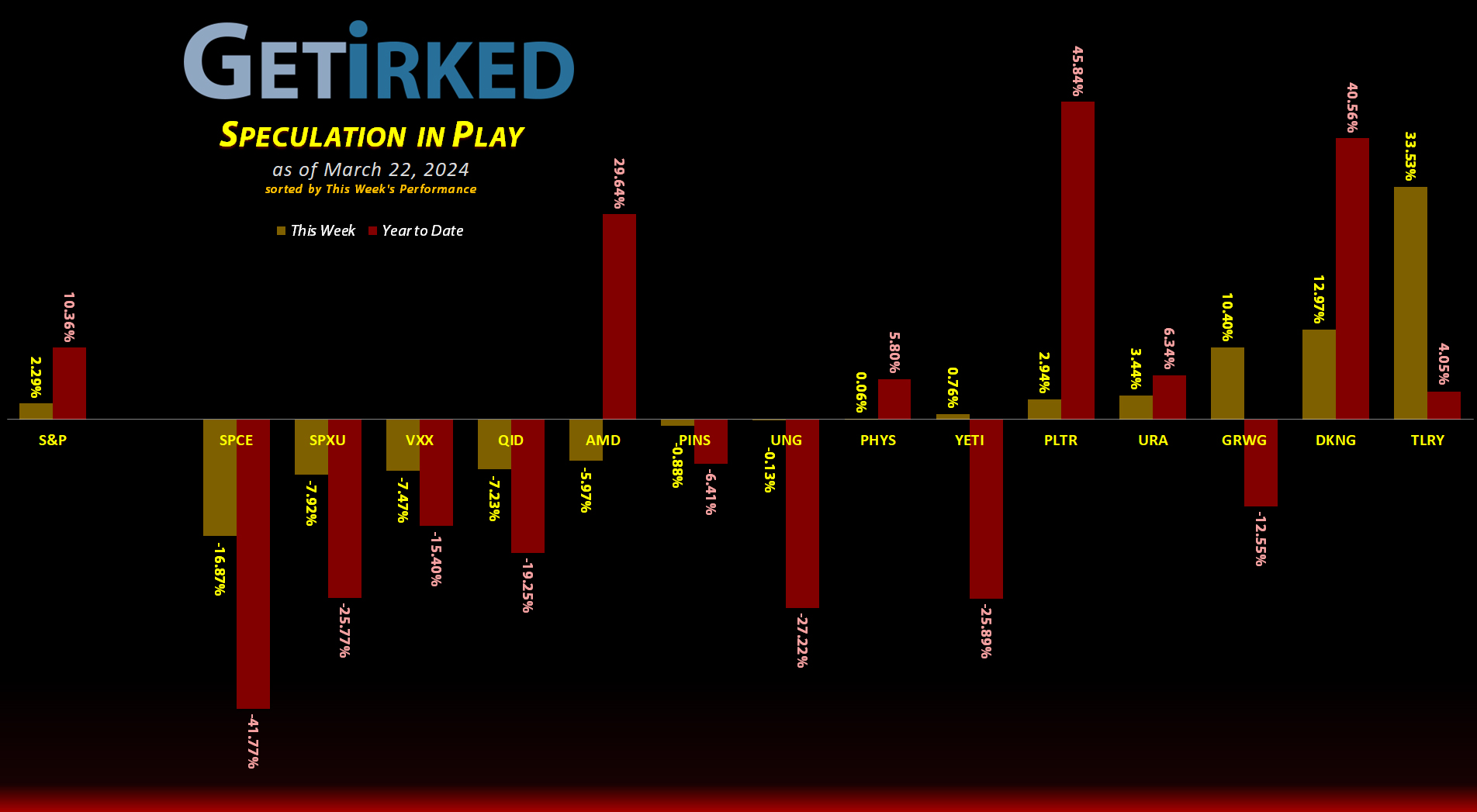

AMD (AMD)

+806.97%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+422.00%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+386.23%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+157.62%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+83.68%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+71.30%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+65.58%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+52.20%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

Sprott Gold Trust (PHYS)

+15.00%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-26.52%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-34.02%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $9.88

Short QQQ (QID)

-35.02%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $13.62

U.S. Natural Gas (UNG)

-44.43%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-83.54%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

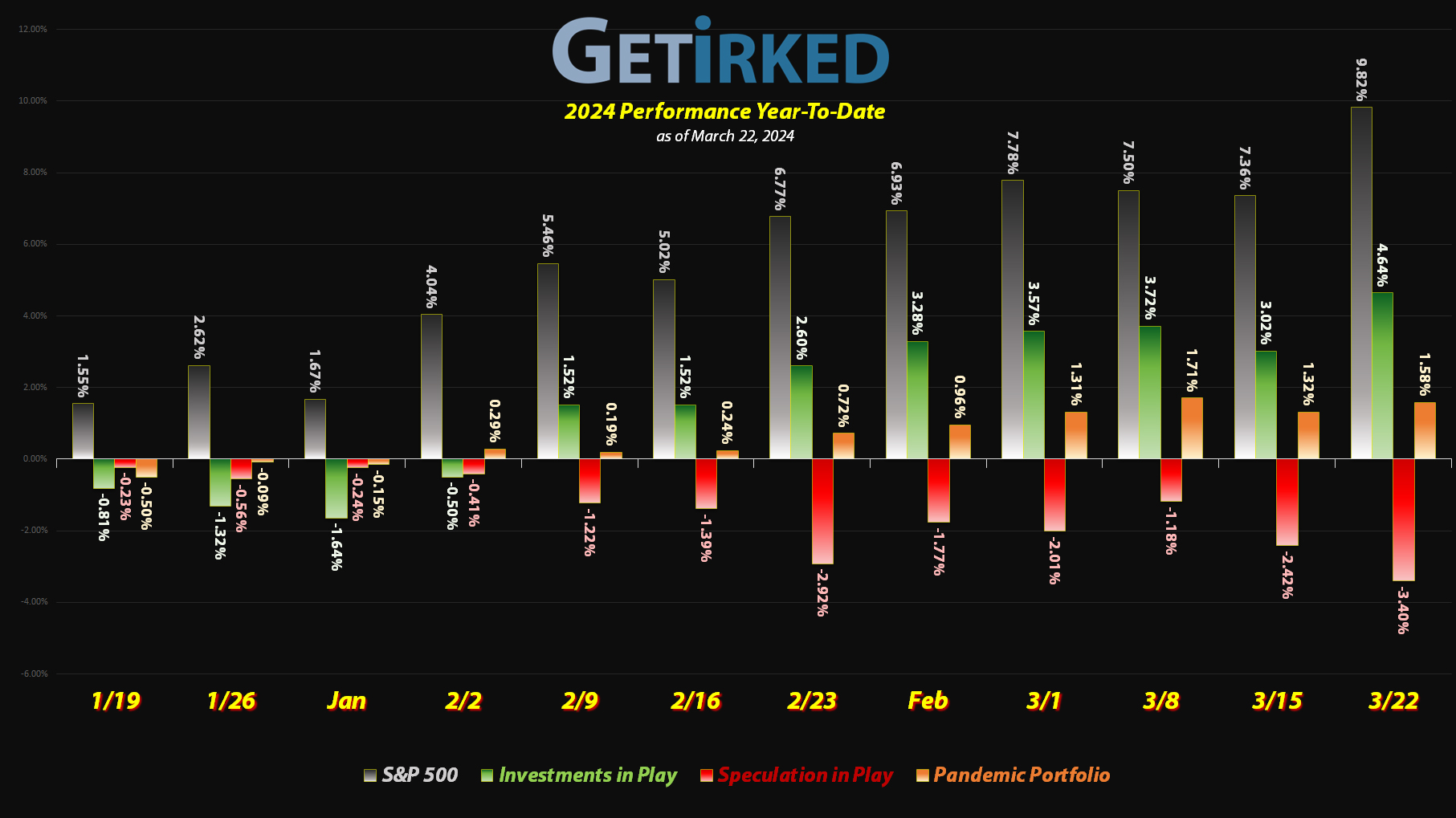

Short S&P 500 (SPXU): Added to Position

After the markets rallied on Tuesday and then started to pop prior to the Fed meeting on Wednesday, I decided to go ahead throw another 2.11% on the fire in my ProShares UltraPro Short S&P 500 ETF (SPXU) with a buy that filled at $6.72 on Wednesday morning.

I just can’t shake the feeling that the markets are due for something. We recently broke the record for the longest number of trading day without a -2% drawdown in the S&P 500. We’ve been breaking a lot of records like that, lately.

Maybe it’s nothing, maybe it’s something.

SPOILER ALERT: It was nothing.

Powell whispered sweet nothings into the stock market’s ear, and the rally ripped the face off my short positions. You’d think I’d learn, right?

The buy lowered my per-share cost -1.2% from $10.00 to $9.88. From here, my next buy target is $5.19, above a level calculated using Fibonacci Retracement, and my next sell target will be right above my cost basis of $9.89 where I will substantially reduce the position.

SPXU closed the week at $6.52, down -2.98% from where I added Wednesday.

Short QQQ Nasdaq-100 (QID): Added to Position

After adding to SPXU, I couldn’t leave my ProShares UltraShort QQQ Nasdaq-100 ETF (QID) feeling ignored, so I added 1.96% to it at $9.15. The buy lowered my per-share cost -0.95% from $13.75 to $13.62.

At this point, I have no additional buy targets. The position is quite large and my risk tolerance won’t allow me to put any more into it at this time. From here, my next sell target is $13.64, below a past point of resistance, where I will significantly reduce the size of the position.

SPXU closed the week at $8.85, down -3.28% from where I added Wednesday.

Volatility “Fear” Index (VXX): Added to Position

On Tuesday, I noticed that the VIX, the volatility index which measures fear in the markets, continued to get lower despite the upcoming Federal Reserve meeting on Wednesday. I couldn’t wrap my head around the idea that there wouldn’t be a jump in volatility after the next day’s meeting.

I was virtually certain that the Fed would come out hawkish and that the dot-plot, where the voting members show where they think there should be rate cuts in the coming year, would show significantly fewer cuts than the market has priced in.

SPOILER ALERT: I was wrong.

While normally, I don’t make spur-of-the-moment decisions, I decided to add 4.25% to my iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) at $13.59, which lowered my per-share cost -1.81% from $18.20 to $17.87.

From here, I will add more if the VIX keeps heading lower with my next buy target at $12.34, a price calculated using Fibonacci Retracement. If we do see a spike in the VIX and VXX meets my cost basis, I will substantially reduce my position with my sell target at $17.92.

VXX closed the week at $13.13, down -3.38% from where I added Tuesday.