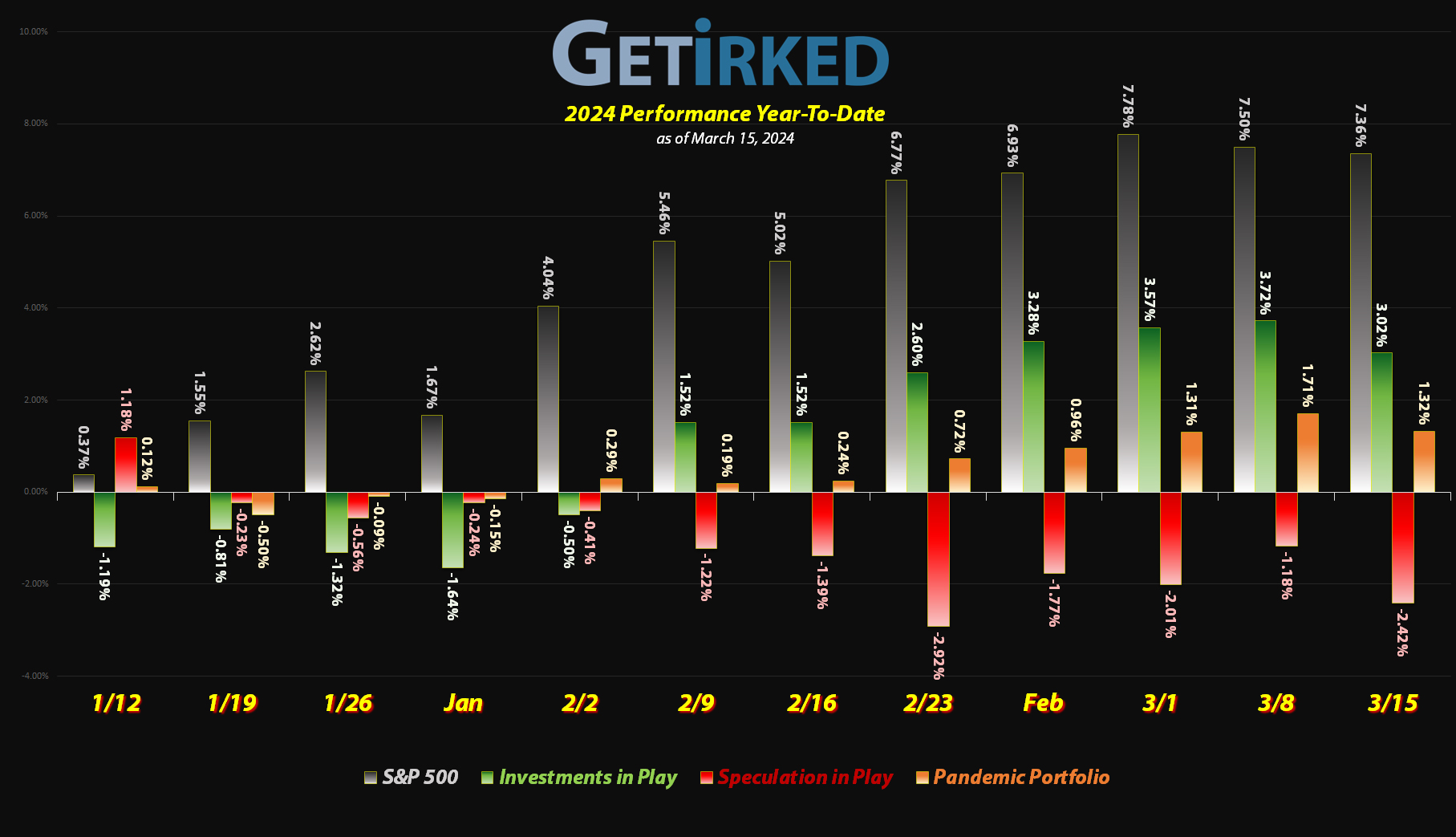

March 15, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

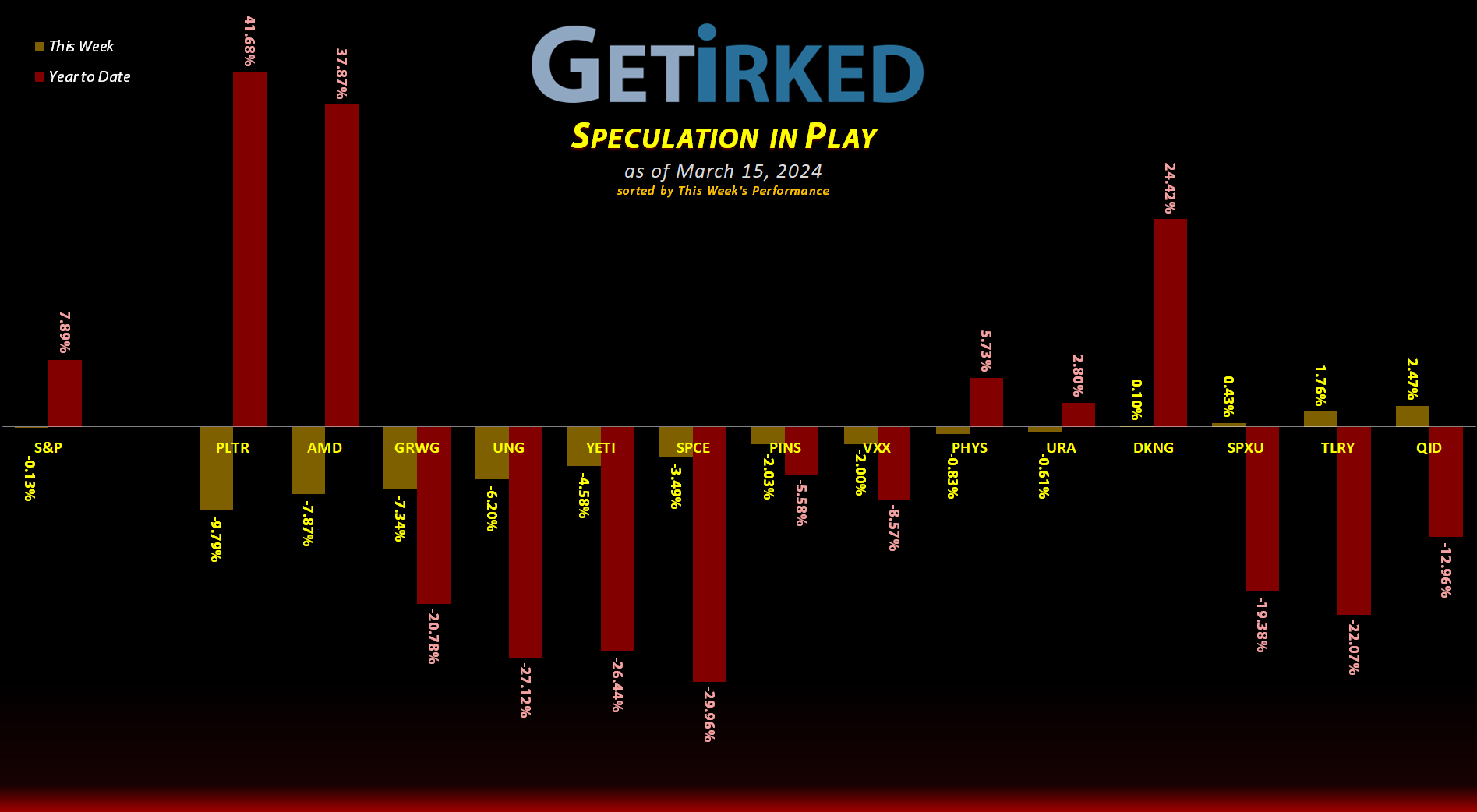

The Week’s Biggest Winner & Loser

Tilray Brands (TLRY)

The entire cannabis sector saw a pretty significant pop this week on the back of no news. Of course, there’s speculation that the DEA will be declassifying cannabis from a Schedule-I narcotic to a Schedule-III narcotic any day now, so that likely had something to do with it. Tilray Brands (TLRY) caught a bid along with its cohort, rallying +1.76% this week and becoming the Week’s Biggest Winner, which just goes to show how bad a week it was for this portfolio!

Palantir Tech (PLTR)

Palantir Technologies (PLTR) took a beating this week along with everything else in the artificial sector. The CEO blamed short-sellers for the drop in PLTR, however with only 5% of shares currently shorted, it’s likely a market rotation caused Palantir to drop -9.79% and land in the spot of the Week’s Biggest Loser, not nefarious short-sellers.

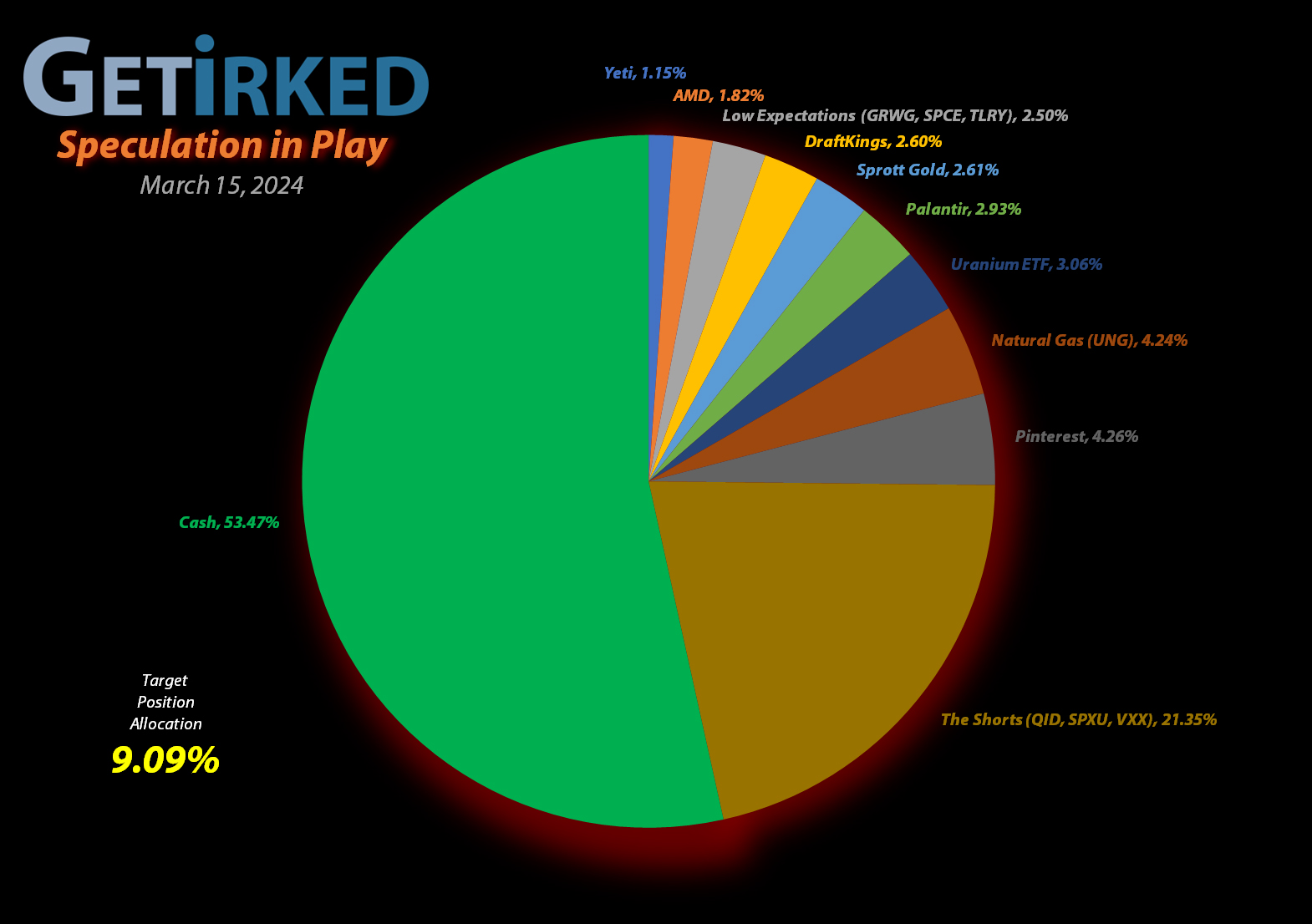

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+815.90%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+423.54%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+385.64%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+148.96%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+90.35%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+66.45%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

Tilray Brands (TLRY)

+46.80%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

DraftKings (DKNG)

+46.57%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Sprott Gold Trust (PHYS)

+14.86%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-22.02%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-29.30%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.00

Short QQQ (QID)

-30.62%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $13.75

U.S. Natural Gas (UNG)

-44.39%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-85.24%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Ya Gotta Know When to Hold ‘Em…

Whenever we enter into a period of market volatility, many investors can be tempted into thinking they might need to make a move in their portfolios. With stocks selling off dramatically and then rallying powerfully, the excitement of seeing so much price action in such a little amount of time may feel like a call to action.

It isn’t. Never succumb to “exciting” price action.

One of my key disciplines is to always make my plan in advance. I review every single one of my positions and create my buying price targets to add more to positions and my selling price targets to take profits. By making my plan in advance when I am unemotional and capable of being totally objective, I’m able to ignore systemic selloffs or FOMO rallies.

Instead, I simply wait for my positions to hit my next price target. If my investments don’t hit buy or sell targets, I hold. I do nothing because nothing is the action that is called for.

Never forget one of the most important investing tenets: if you don’t know what to do, do nothing at all.

… or, said another way from poker greats, “ya gotta know when to hold ’em.”