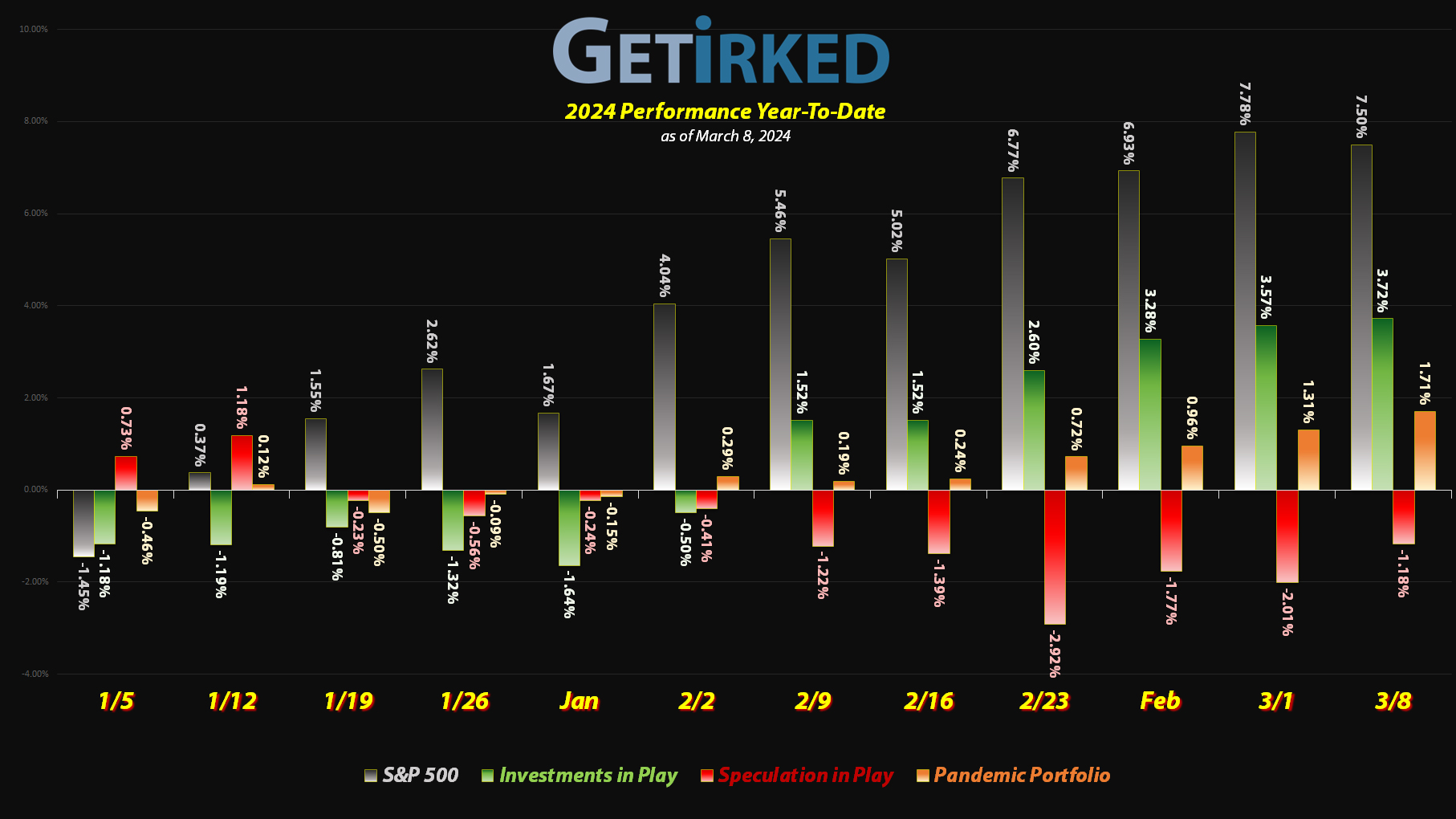

March 8, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

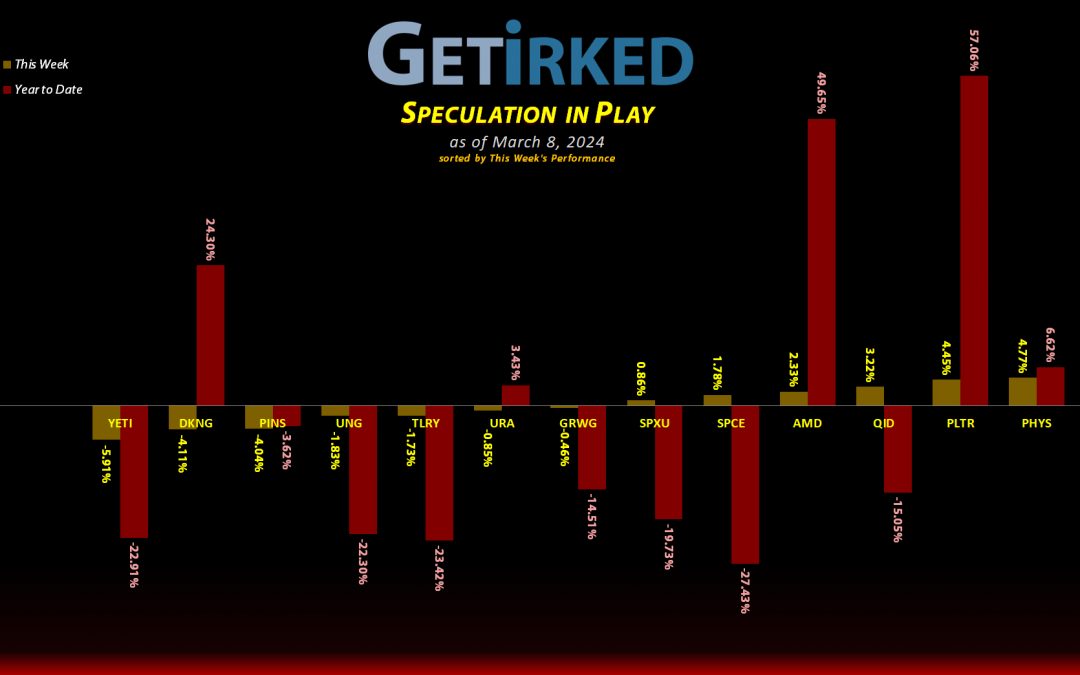

The Week’s Biggest Winner & Loser

Sprott Gold (PHYS)

While Bitcoin (BTCUSD) and Nvidia (NVDA) are sucking up all the oxygen in the room, the precious yellow metal has been rallying to new all-time highs.

Last week marked the first time since Bitcoin’s creation that both it and gold made new all-time highs.

While there are many bulls who believe there’s a lot of upside in the stock market rally, I have to look at two plays against inflation and “stores of value” hitting all-time highs as not exactly a good sign for where stocks go from here, but only time will tell.

In this portfolio, gold is represented by the Sprott Physical Gold Trust (PHYS), which rallied +4.77% and came in as the Week’s Biggest Winner. (Yes, the VIX has come alive, too, but I don’t count my shorts in the competition for Biggest Winner and Loser; though seeing the Volatility Index pick up is also not a good sign for the stock market).

Yeti (YETI)

Yeti (YETI), the outdoor equipment manufacturer such as coolers and thermoses, suffered a series of price downgrades from Wall Street over the course of the week. Many analysts believe Yeti sales will dry up as consumers seek to cut down on more expensive products.

As a result, YETI sold off -5.91% this week and slid in as the Week’s Biggest Loser.

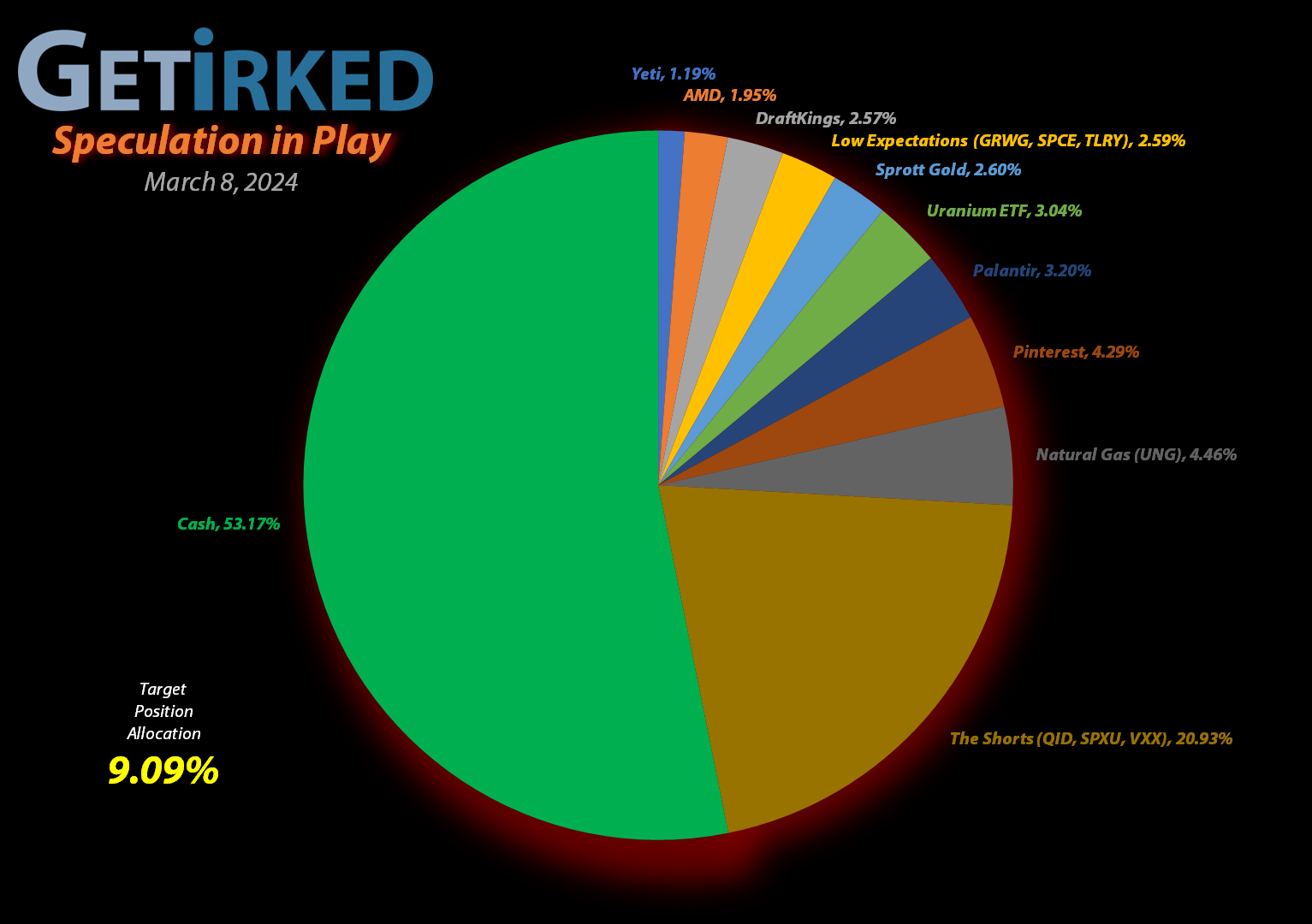

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

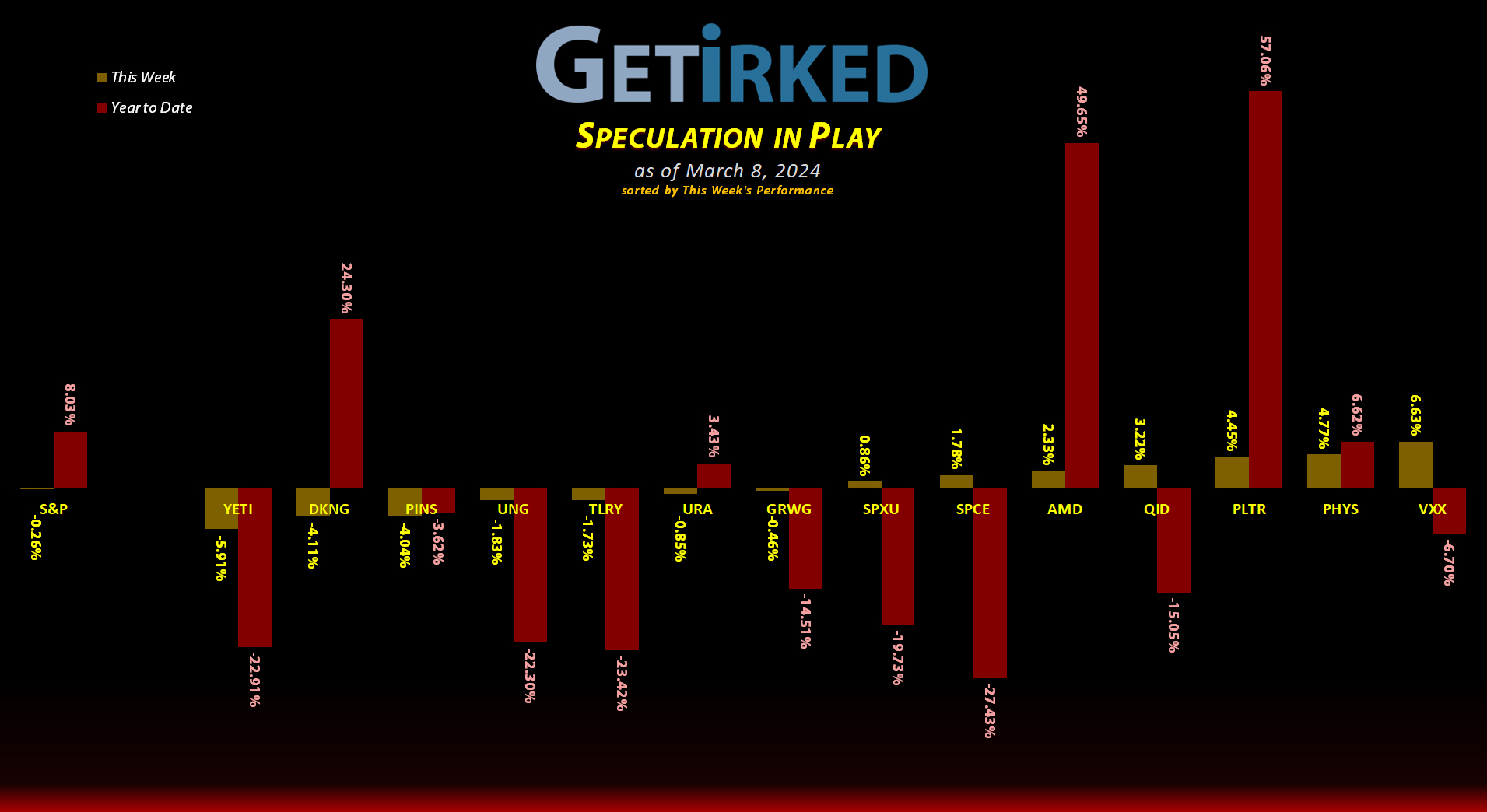

AMD (AMD)

+828.68%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+427.37%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+389.41%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+150.56%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+91.87%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+84.48%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

Tilray Brands (TLRY)

+46.52%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.30)*

DraftKings (DKNG)

+46.43%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Sprott Gold Trust (PHYS)

+15.99%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-20.43%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-29.55%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.00

Short QQQ (QID)

-32.40%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $13.75

U.S. Natural Gas (UNG)

-40.75%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-83.91%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Tilray Brands (TLRY): Added to Position

Tilray Brands (TLRY), my speculative play on the cannabis sector, sold off with the rest of the market on Tuesday and triggered my next buy order at $1.65, adding 1.24% to the position.

I had a few people on X call me out for even adding to Tilray, pointing out that there’s a high potential it may go to zero. This is certainly true – with any investment – which is why I have already mitigated my risk. Not only is this play in my speculative portfolio, I’m playing entirely with the House’s Money and will only be using profits for this position.

In other words, don’t worry about me – I’ve got this.

The buy locked in a -99.06% discount replacing some of the shares I sold for $174.83 back on October 16, 2018 and raised my per-share “cost” +$0.45 from -$3.75 to -$3.30 (a negative per-share cost indicates all capital has been removed in addition to $3.30 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $1.25, below Tilray’s all-time low, at a Fibonacci Retracement level. My next sell target is $22.55, below a point of resistance Tilray has seen several times in the past.

TLRY closed the week at $1.70, up +3.03% from where I added Tuesday.