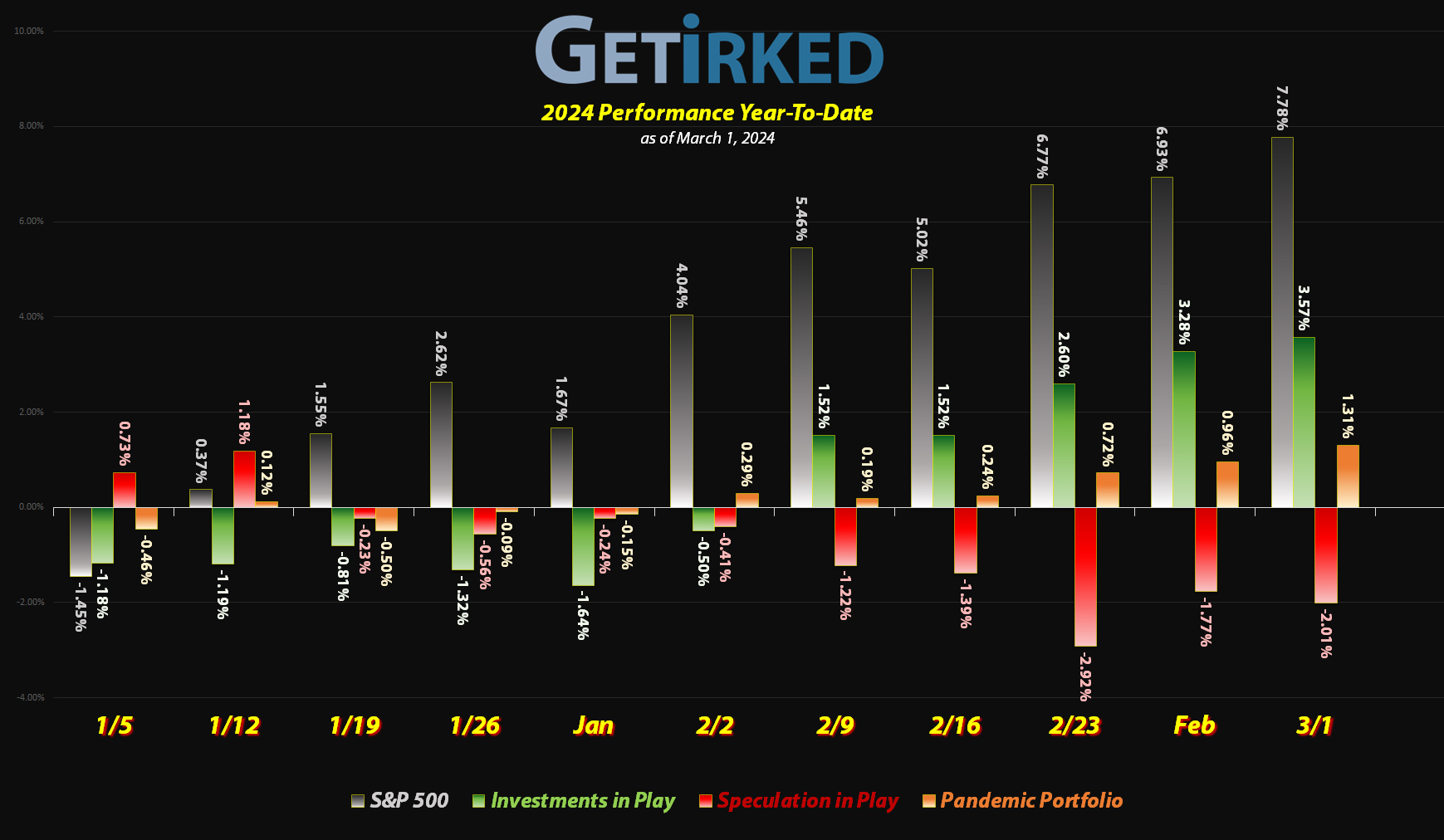

March 1, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

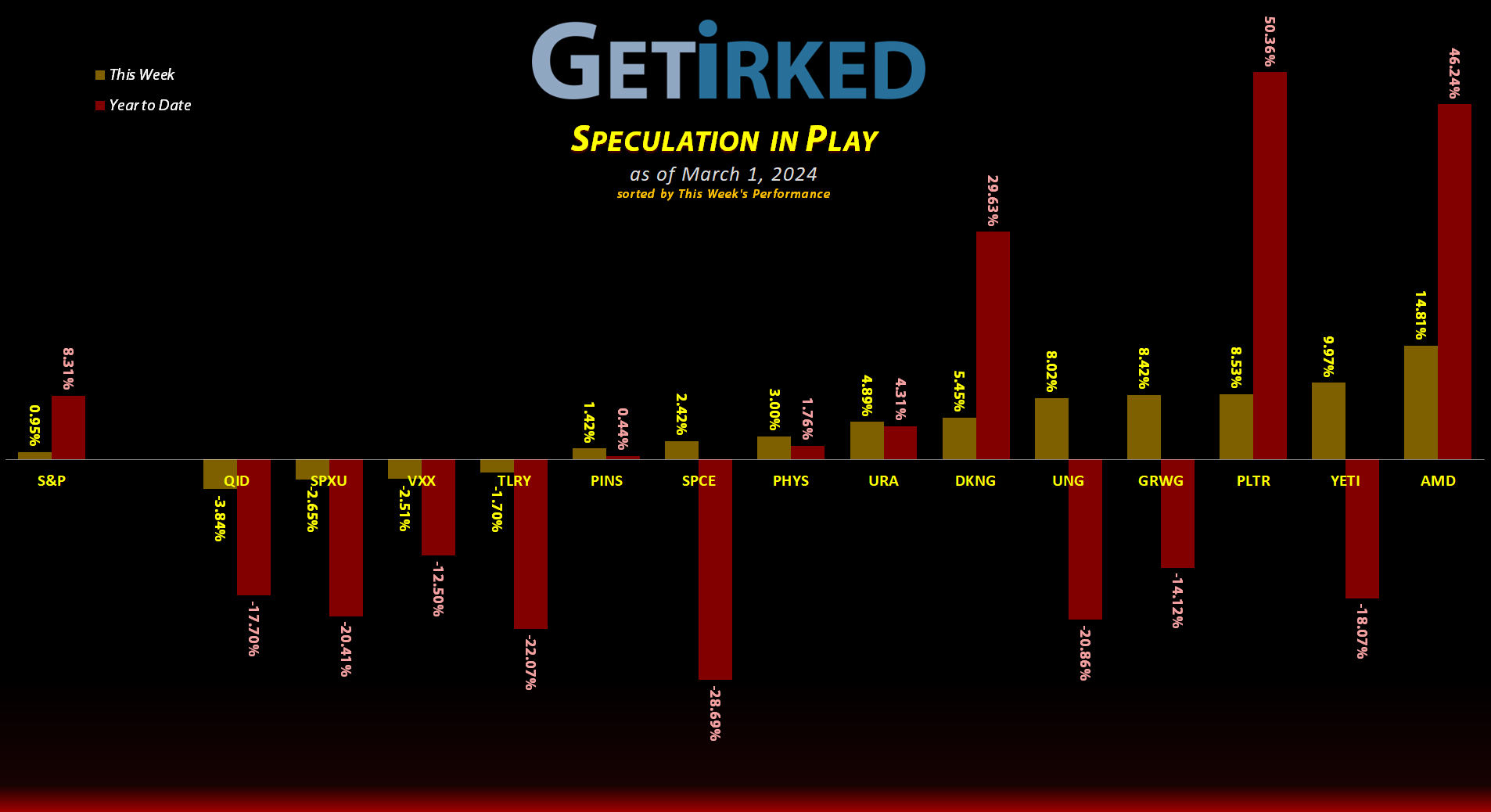

The Week’s Biggest Winner & Loser

Advanced Micro (AMD)

When computer manufacturer, Dell Technologies (DELL), reported a blowout quarter thanks to sales of its Artificial Intelligence servers powered by Advanced Micro Devices’ (AMD) chips, the stocks of both companies skyrocketed to end the week. AMD rallied +14.81%, easily coming in as the Week’s Biggest Winner.

Tilray Brands (TLRY)

As is custom, I don’t acknowledge any of my short positions as the Week’s Biggest Loser which brings this dubious honor down on Tilray Brands’ (TLRY) illustrious shoulders. It was a mixed week for cannabis stocks as some of them rallied – GrowGeneration (GRWG) right in this portfolio – while others sold off. It was the latter for TLRY, selling off -1.70% which was enough to earn it the spot of the Biggest Loser this time around.

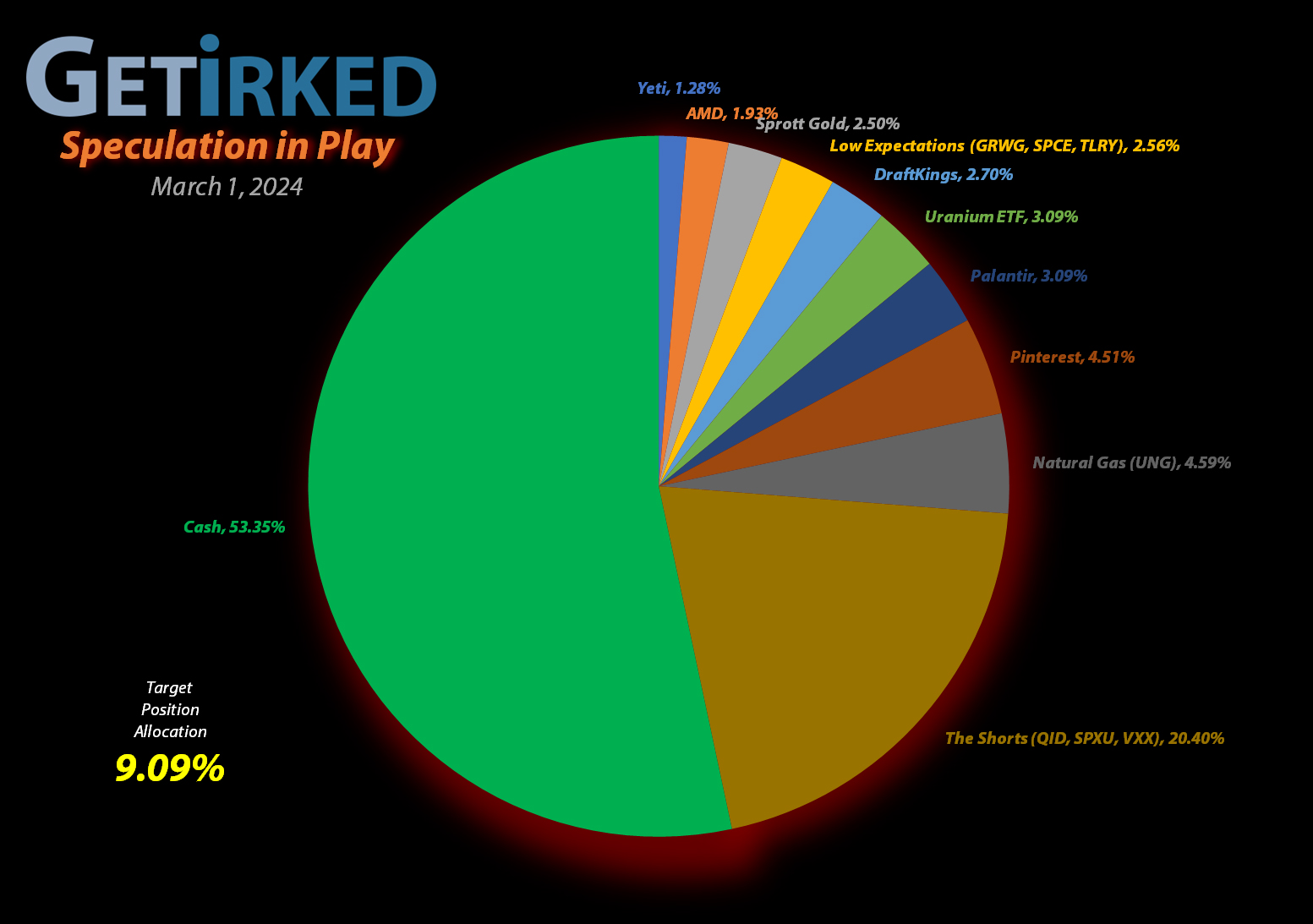

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+824.98%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+435.14%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+394.58%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+152.62%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+91.05%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+76.62%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+52.71%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+46.74%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

Sprott Gold Trust (PHYS)

+10.62%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-25.38%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-30.20%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.00

Short QQQ (QID)

-34.40%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $13.75

U.S. Natural Gas (UNG)

-39.61%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-83.84%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Short Nasdaq ETF (QID): Added to Position

Somebody stop me! I can’t stop throwing good money after bad with my leveraged plays against the market! 🤣

When the Nasdaq hit new highs on Friday, it triggered my next buy order in the ProShares UltraShort QQQ ETF (QID) which added 4.00% to my position at $9.00.

The buy lowered my per-share cost -2.14% from $14.05 to $13.75. From here, I will add more (why not? It’s a speculative portfolio, after all… 🤣) at $7.45, right around a Fibonacci Retracement level.

I will start dramatically reducing the position if we see a potential March selloff drive QID to my cost basis at $13.75.

Hey, I’m basically guaranteeing this bull rally will never end, people! 😅👍

QID closed the week at $9.02, up -0.22% from where I added on Friday.