February 23, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

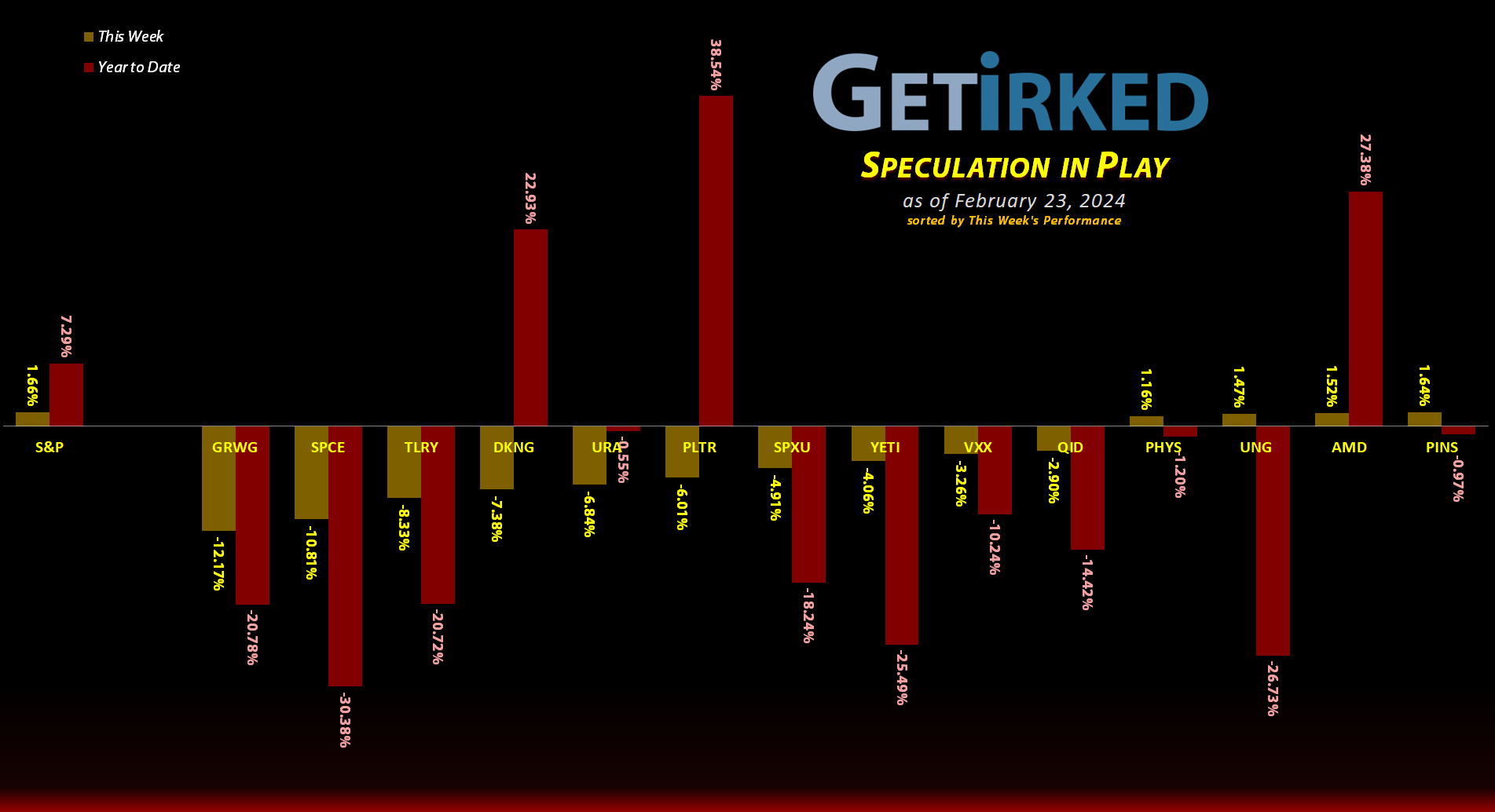

The Week’s Biggest Winner & Loser

Pinterest (PINS)

You know it’s a weird week when the Biggest Winner gained just +1.64% during a week when a few stocks gained a lot and most gained nothing at all. Pinterest (PINS) saw the pop this week, and while that wasn’t on the back of any real news, it was enough to make PINS the biggest winner, for what it’s worth.

GrowGeneration (GRWG)

The cannabis sector has been a mixed bag lately seeing huge rallies only to be followed by epic selloffs. However, throughout it all, one thing has remained clear – GrowGeneration (GRWG) is an epic stinker. This company tried to align itself with the cannabis sector, but it turns out that you can buy hydroponic equipment from Home Depot (HD) and Lowes (LOW). GRWG dropped -12.17% on the back of no real news this week, but can we really be surprised? Take the Week’s Biggest Loser award, GrowGeneration, you deserve it.

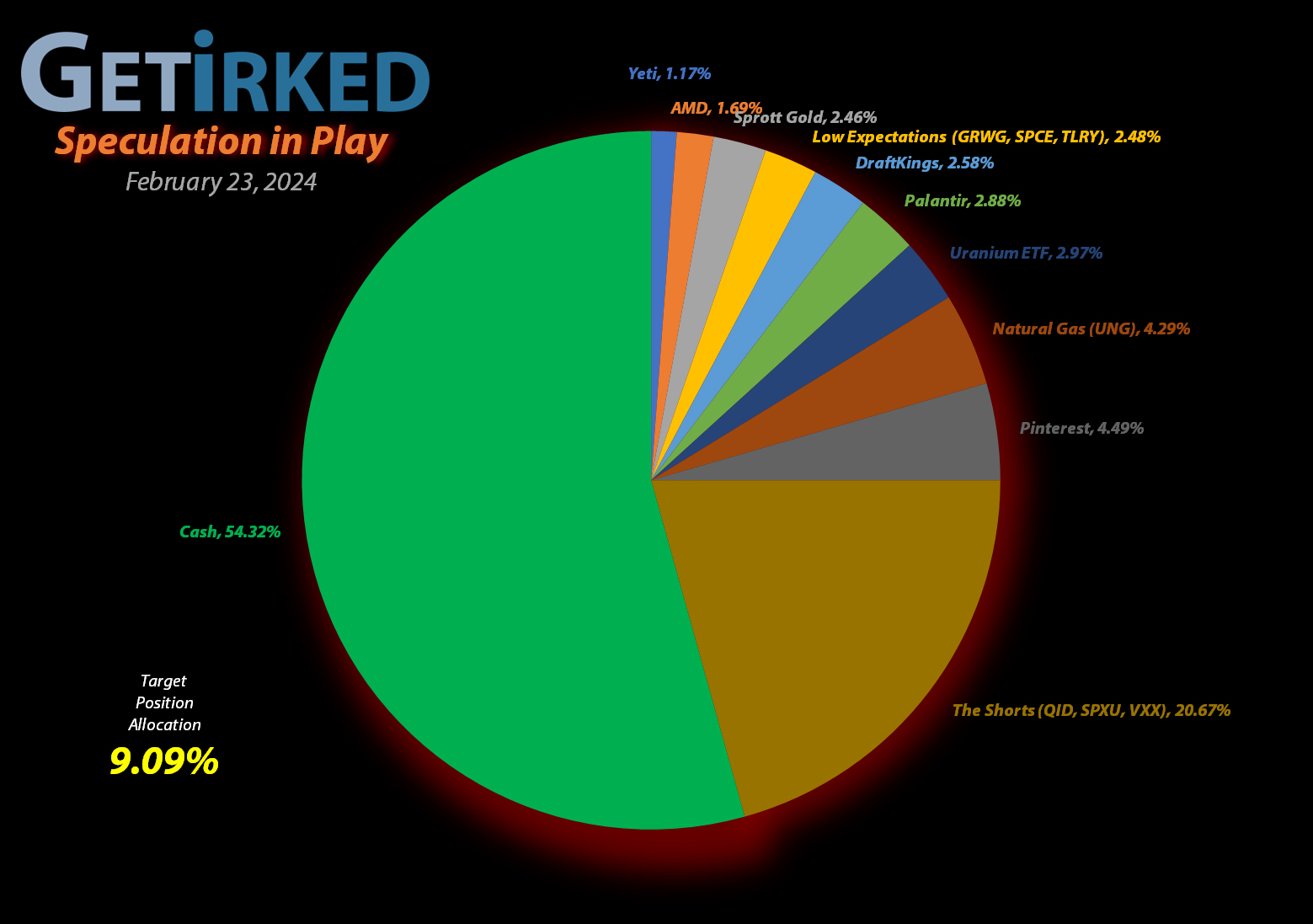

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+804.52%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+432.38%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+386.66%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+140.88%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+90.00%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+62.80%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+44.82%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+47.00%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

Sprott Gold Trust (PHYS)

+7.43%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-23.51%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-28.30%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.00

Short QQQ (QID)

-33.22%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.05

U.S. Natural Gas (UNG)

-44.08%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-85.09%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

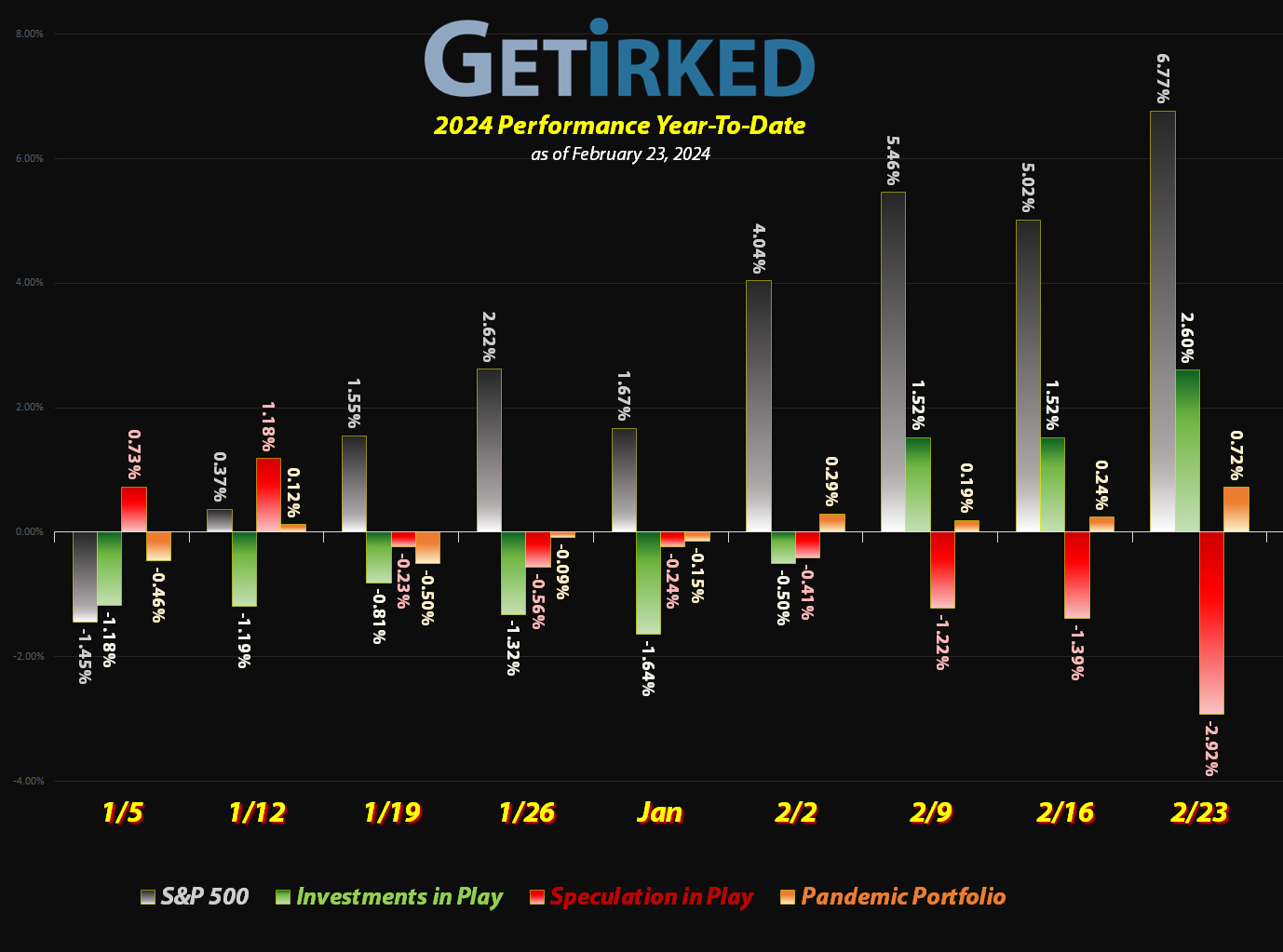

Short S&P 500 ETF (SPXU): Added to Position

The week’s incredible rally in the S&P 500 continued on Friday, triggering the next buy order in my position in the ProShares UltraPro Short S&P 500 leveraged ETF (SPXU), adding 4.43% at $7.12.

The buy lowered my per-share cost -2.44% from $10.25 to $10.00. Since I am verifiably insane (and this is my speculative portfolio), I do have another buy target, of course, down at $5.95, a price calculated using Fibonacci Retracement.

I will also start to substantially and dramatically reduce the size of this position should it hit my cost basis with sell orders already in place at $10.00.

SPXU closed the week at $7.17, up +0.70% from where I added Friday.