February 16, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

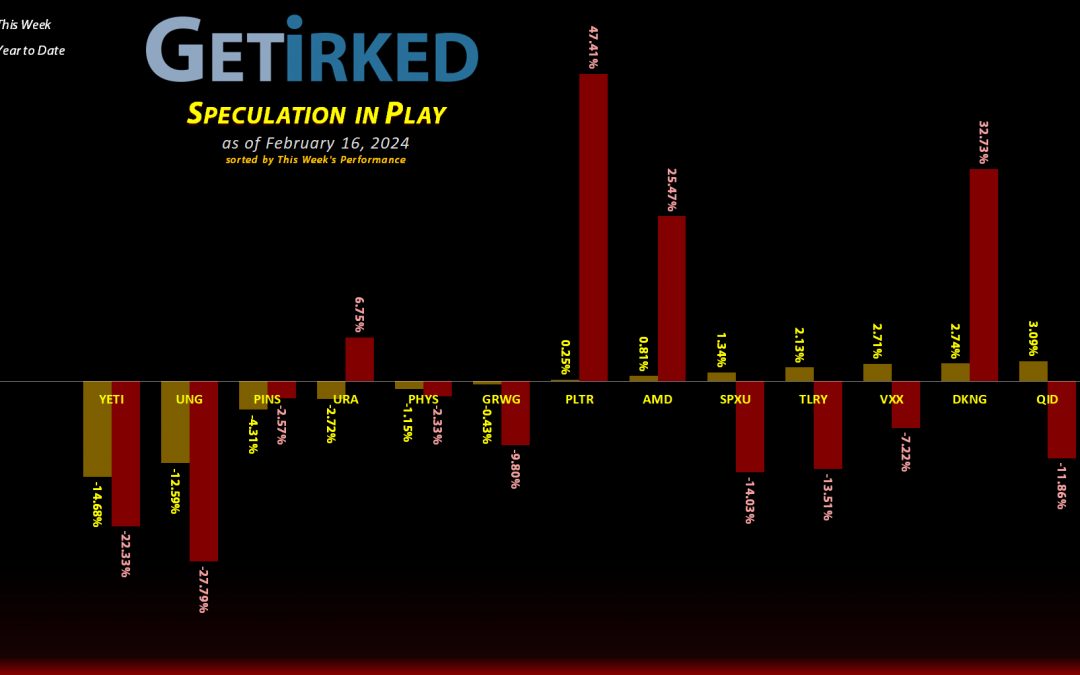

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

In a down week, Virgin Galactic (SPCE) landed as the Week’s Biggest Winner with a +3.35% gain… yes, the week was that bad for this portfolio.

However, I couldn’t find any positive catalysts for the stock despite scouring the web. In fact, the news reports about SPCE are actually bad with a law firm announcing an investigation into the company.

Go figure.

Yeti (YETI)

Yeti (YETI) the camping supply and cooler manufacturer missed on earnings, and, despite the crazy bull market we may or may not be in, if your company misses on earnings, the market takes you task for it.

Yeti lost -14.68% in value over the course of the week, and, in this portfolio, that makes YETI worse than natural gas! YIKES!

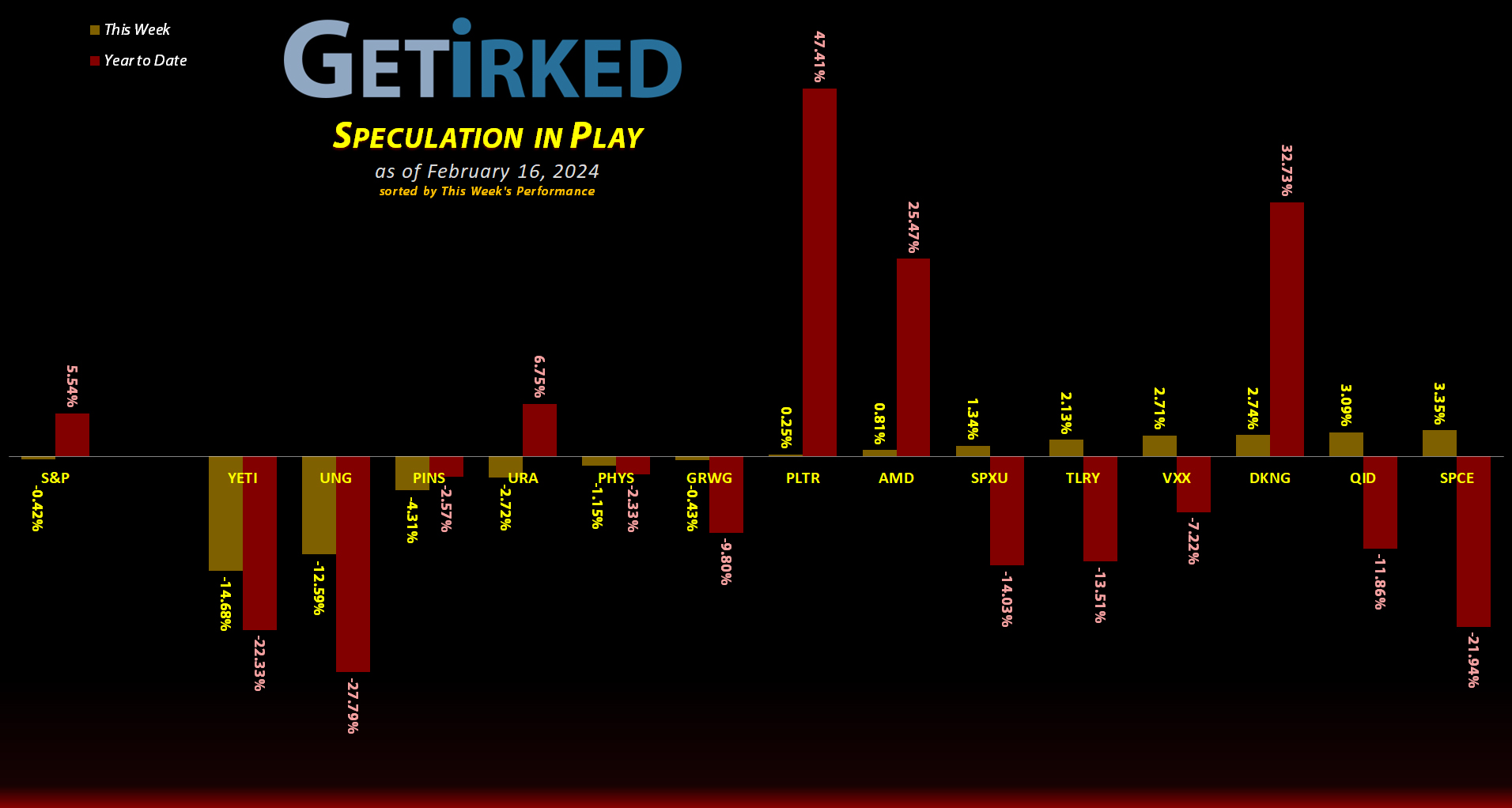

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+802.44%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+429.23%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+390.02%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+158.69%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+94.91%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+73.32%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+56.36%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+48.36%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

Sprott Gold Trust (PHYS)

+6.13%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-20.98%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-26.49%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.25

Short QQQ (QID)

-31.16%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.05

U.S. Natural Gas (UNG)

-44.87%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $27.21

Grow Gen (GRWG)

-82.95%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

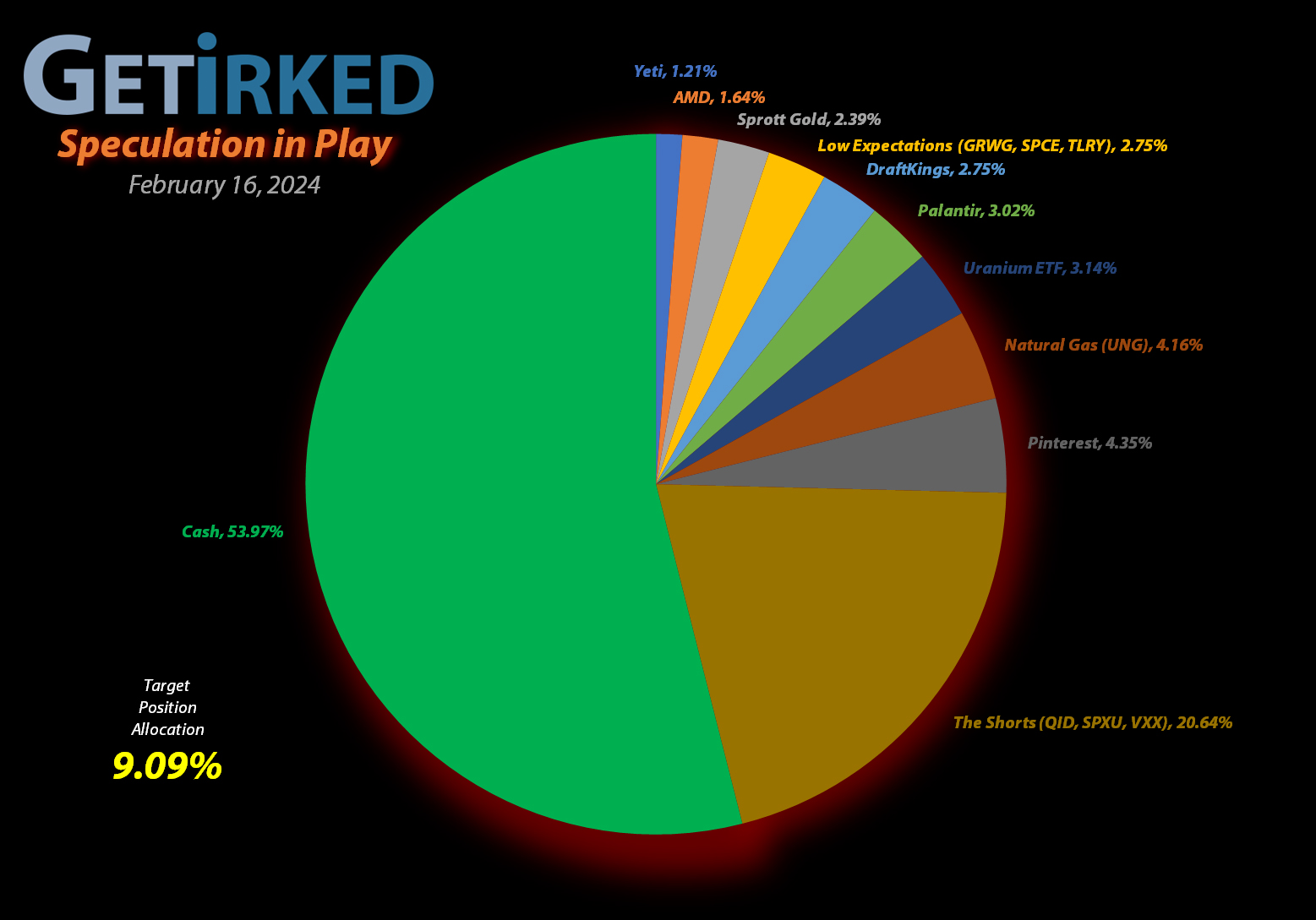

Natural Gas Fund (UNG): Added to Position

Playing the natural gas commodity through the U.S. Natural Gas Fund (UNG) is stupid. I know this. It’s been stupid since I first opened this position more than a year ago.

So, why did I add 4.81% at $15.62 on Tuesday?

Call me a glutton for punishment, call me an idiot, just don’t call me Maurice. For some reason, I have this feeling that UNG is due for a bounce. Could I be wrong? If you’ve followed me for any amount of time, you know that I’m always wrong, so the chances this play won’t end well for me are great.

HOWEVER… that’s precisely why I created the Speculation in Play portfolio and precisely why I limit my risk by only putting money on the line that I’m willing to lose entirely.

So, when natural gas continued to plummet on Tuesday, I added 4.81% at $15.62, lowering my per-share cost -5.06% from $28.66 to $27.21. From here, I will continue throwing good money after bad with my next buy order at $13.64, a price calculated using the Fibonacci Method.

I will also start drastically selling the position if it reaches $27.34, slightly above my cost basis and below the point of resistance UNG saw earlier in 2024.

UNG closed the week at $15.00, down -3.97% from where I added Tuesday.