February 9, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

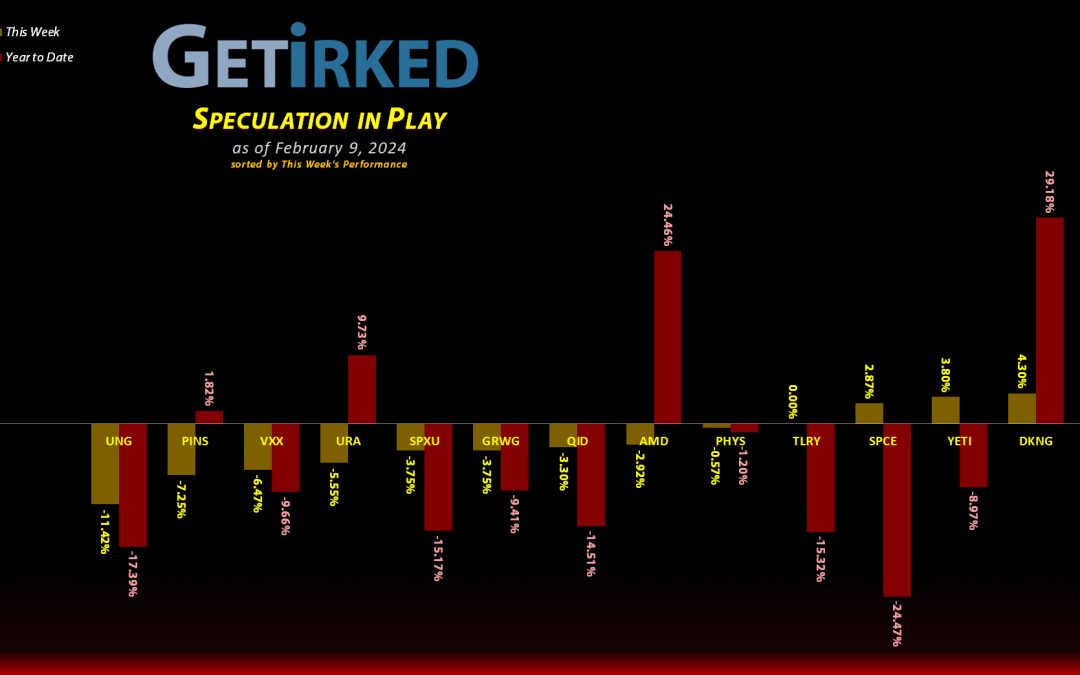

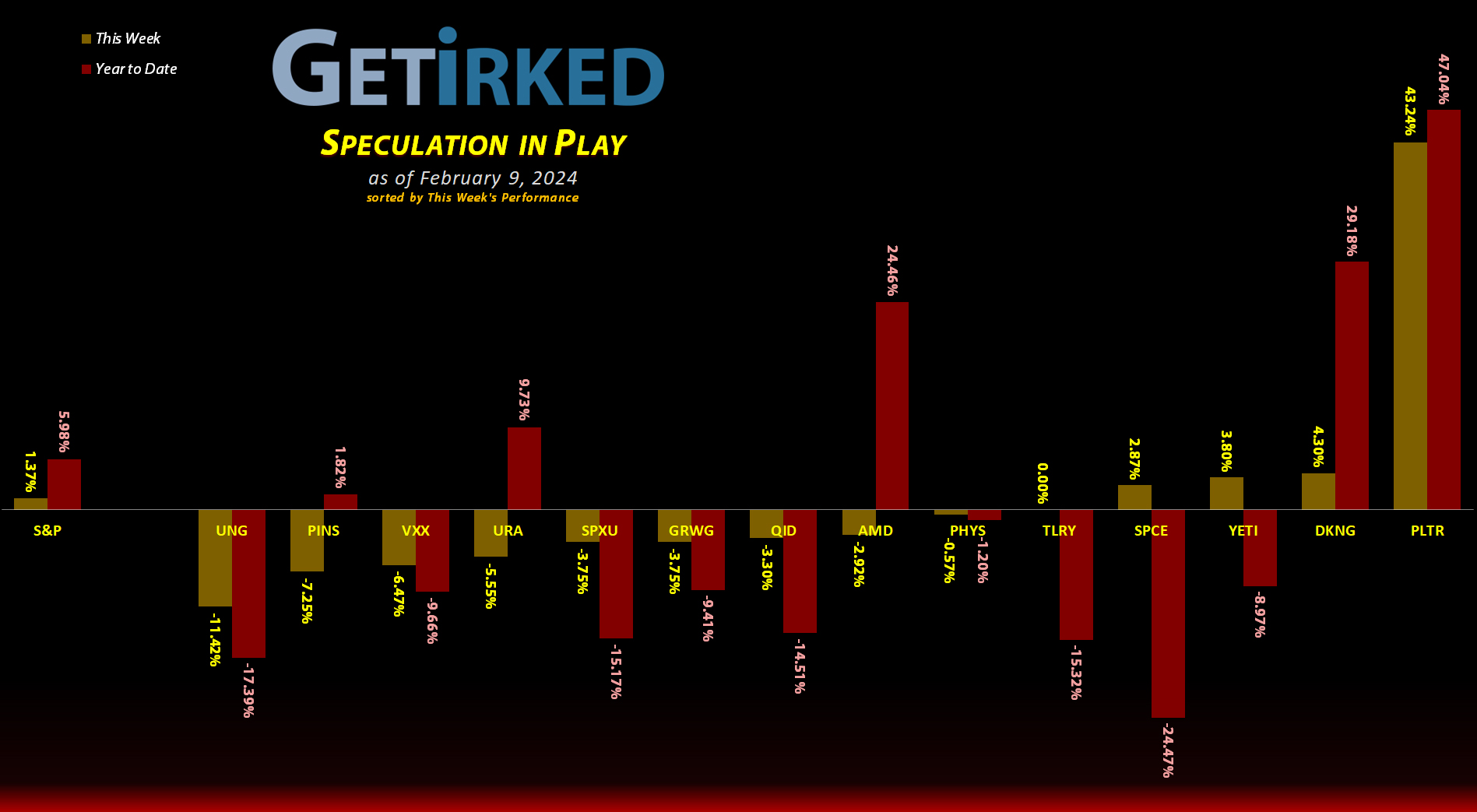

The Week’s Biggest Winner & Loser

Palantir Tech (PLTR)

There’s nothing artificial about the profits in the artificial technology sector! Everything AI continues to fly and Palantir Technologies (PLTR) is no exception. After reporting a stellar quarter during earnings, Palantir rocketed +43.24% this week, easily stealing the spot of the Week’s Biggest Winner!

Natural Gas (UNG)

The price of natural gas can’t go negative, can it? Given the performance of the odorless gas, I’m starting to wonder if it will eventually be free, at least. The U.S. Natural Gas Fund (UNG) continued to sell off dramatically this week following reports of a much warmer winter than anyone was expecting. As a result, UNG dropped -11.42%, imploding as the Week’s Biggest Loser.

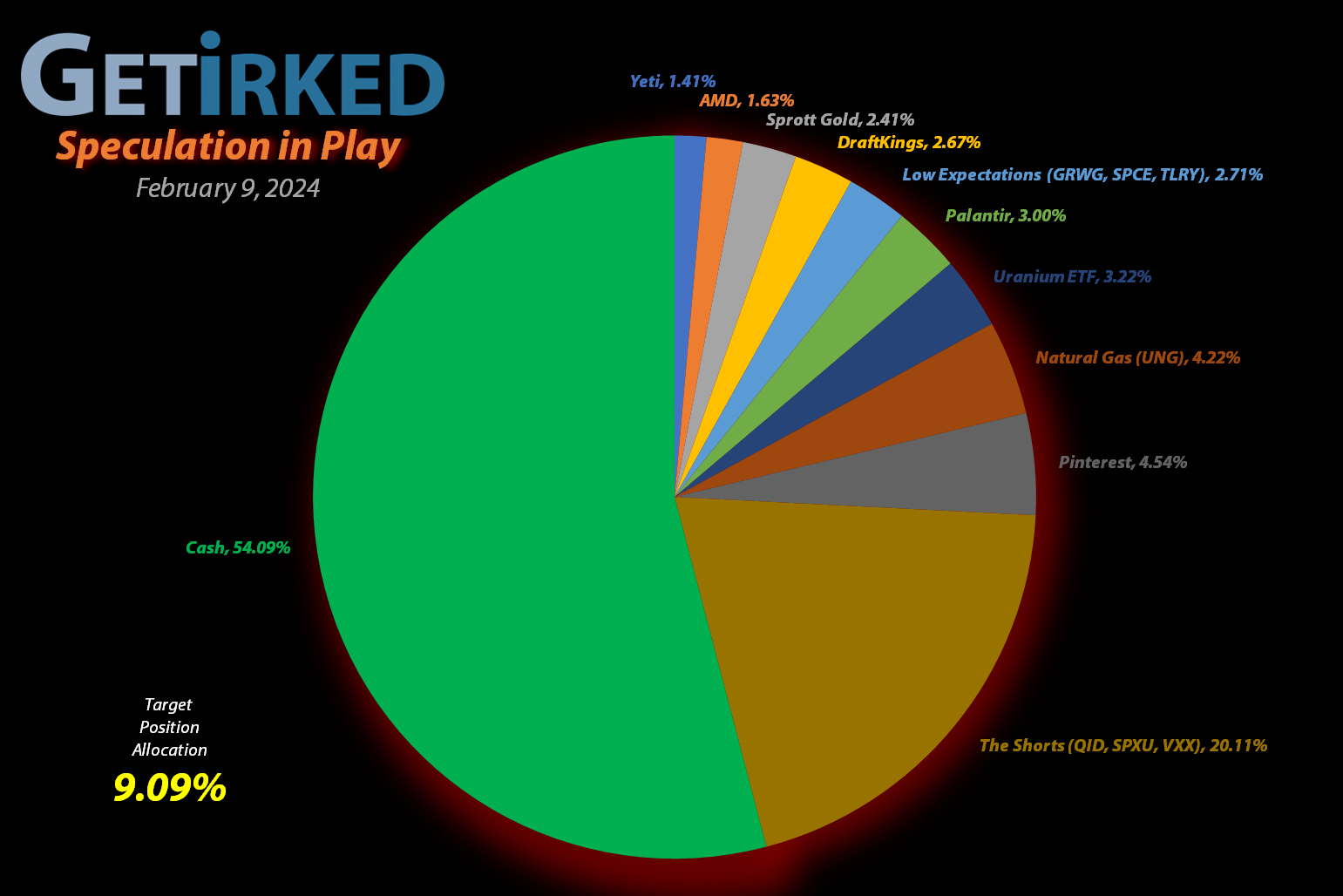

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+801.36%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+437.70%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+404.28%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+165.74%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+93.63%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Palantir (PLTR)

+72.75%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $14.12

DraftKings (DKNG)

+52.18%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Tilray Brands (TLRY)

+48.02%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

Sprott Gold Trust (PHYS)

+7.40%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-22.79%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-27.37%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.25

Short QQQ (QID)

-33.33%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.05

U.S. Natural Gas (UNG)

-40.17%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $28.66

Grow Gen (GRWG)

-82.95%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

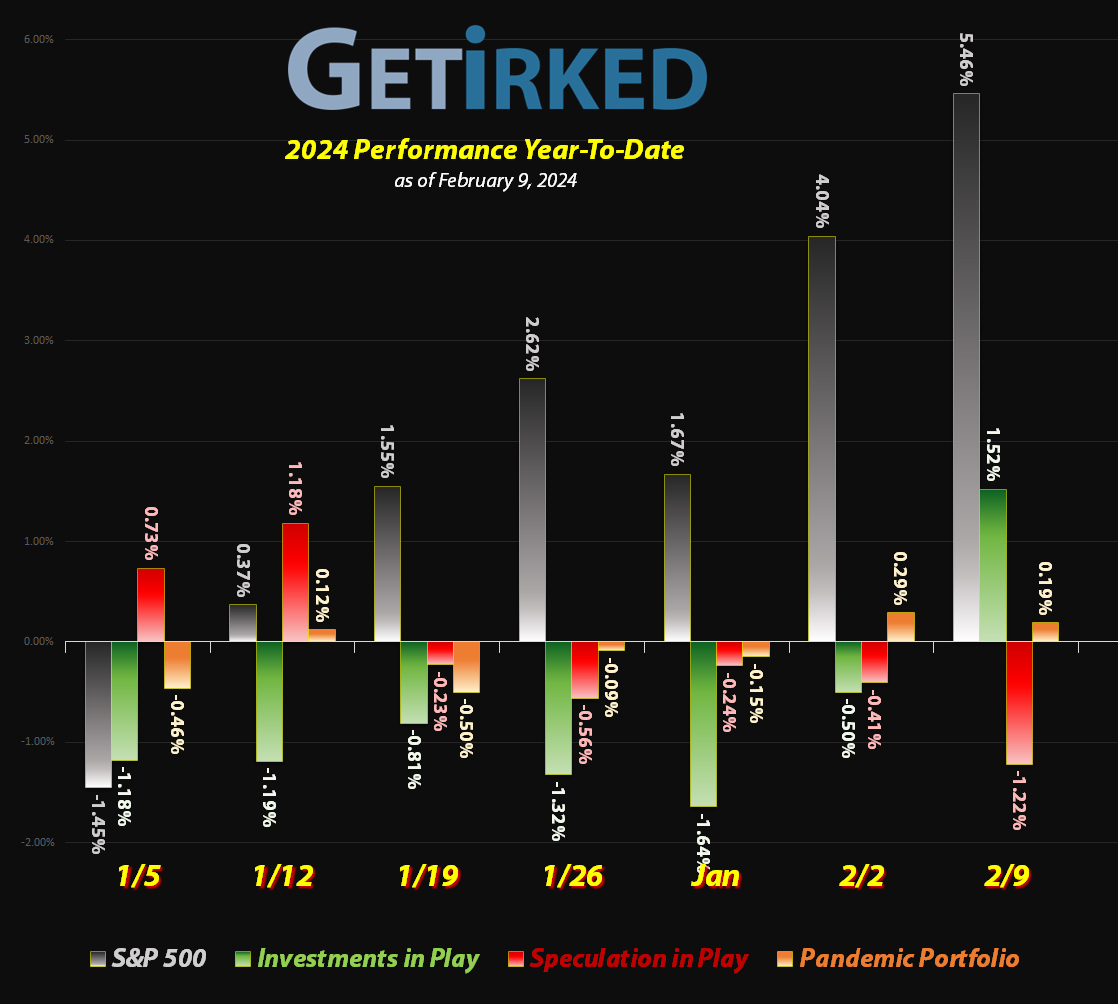

Palantir Technologies (PLTR): Profit-Taking

Palantir Technologies (PLTR) rocketed higher on Tuesday after reporting blowout earnings Monday evening, triggering my next sell target, selling 20.00% of my position at $20.40. The sale locked in +17.31% in gains on shares I bought for $17.39 a few years ago on January 5, 2022, and lowered my per-share cost -8.13% from $15.37 to $14.12.

My next buy target is $13.80, above a key point of resistance that Palantir tested repeatedly throughout 2023. If it never gets that low, that’s a high-quality problem: it means my position is incredibly profitable. However, given how volatile Palantir has proven to be, I’m going to temper my enthusiasm to add back into the position too soon. My next sell target is $29.15, below the next point of key resistance.

PLTR closed the week at $24.38, up +19.51% from where I took profits Tuesday.