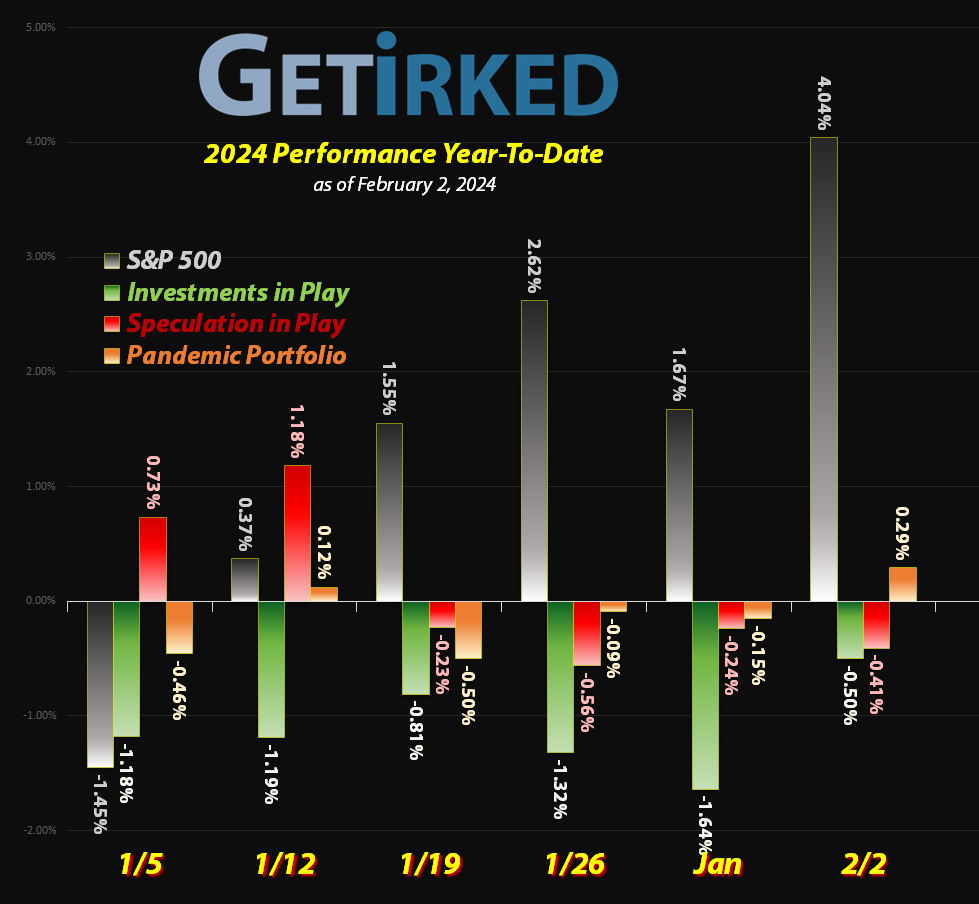

February 2, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

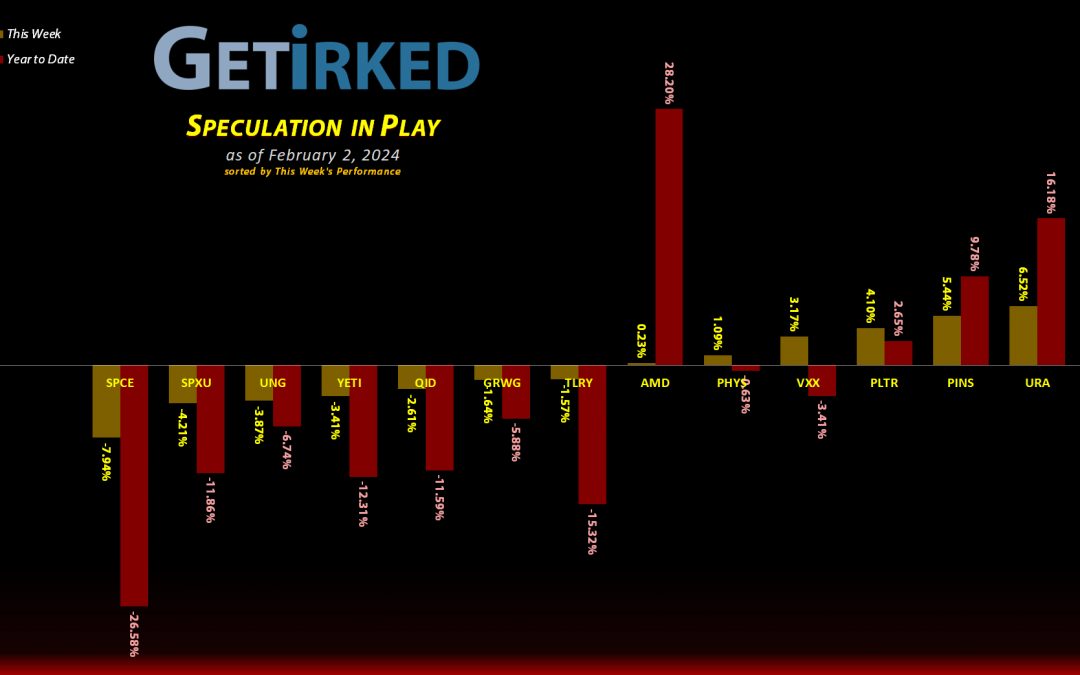

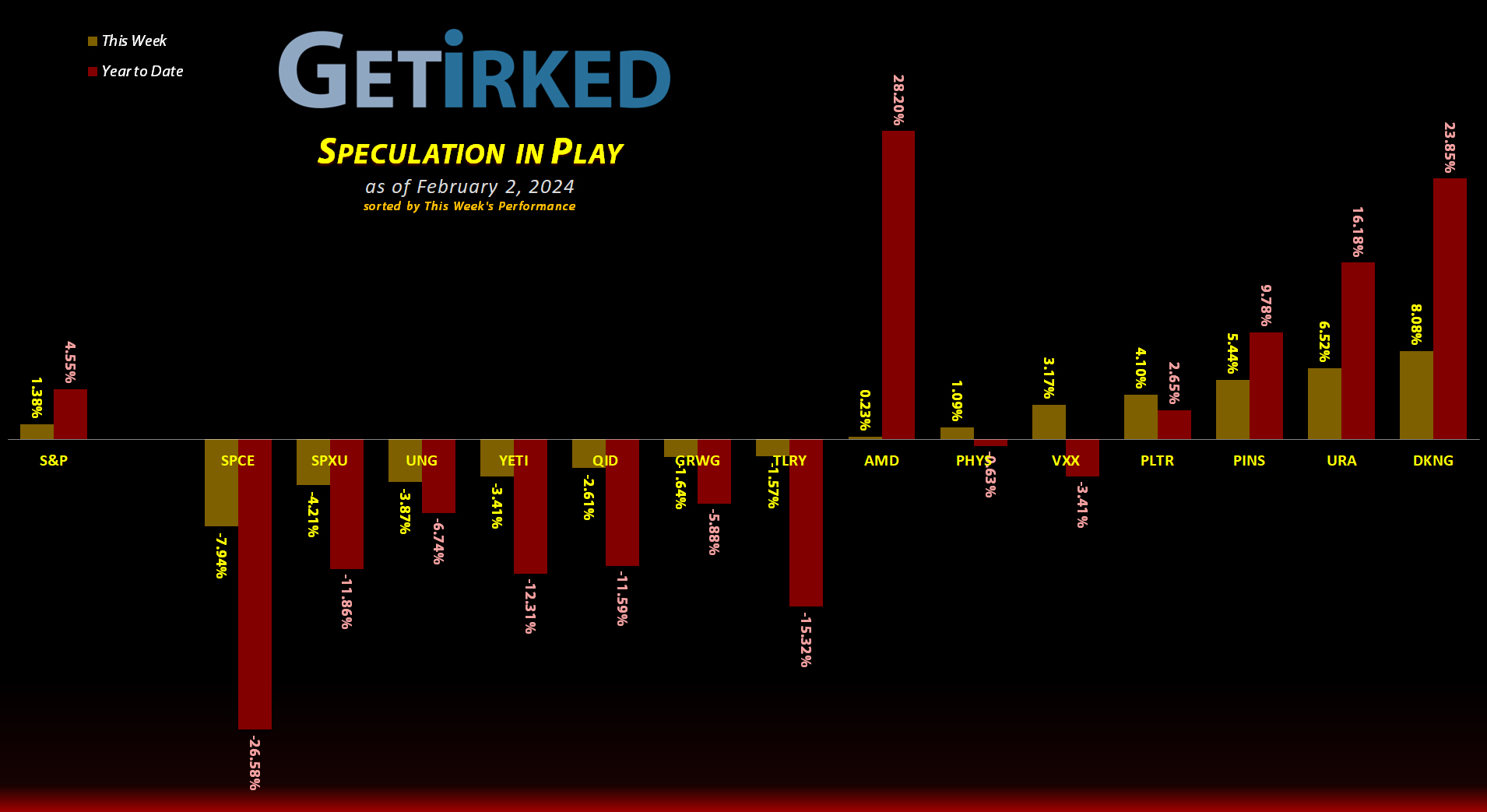

The Week’s Biggest Winner & Loser

DraftKings (DKNG)

DraftKings (DKNG) wins two-in-a-row, continuing to ride high on competitor FanDuel (FLUT) being introduced on the New York Stock Exchange, and on exciting new prospects in online gambling. DKNG popped +8.38% this week and won itself its second Week’s Biggest Winner.

Virgin Galactic (SPCE)

It’s hard to say how much longer Virgin Galactic (SPCE) has for this world. Sure, it’s had some commercial flights, but this one just can’t seem to stay in the air (pun intended). SPCE dropped -7.94% on a week when almost everything else rallied, crashing in as the Week’s Biggest Loser.

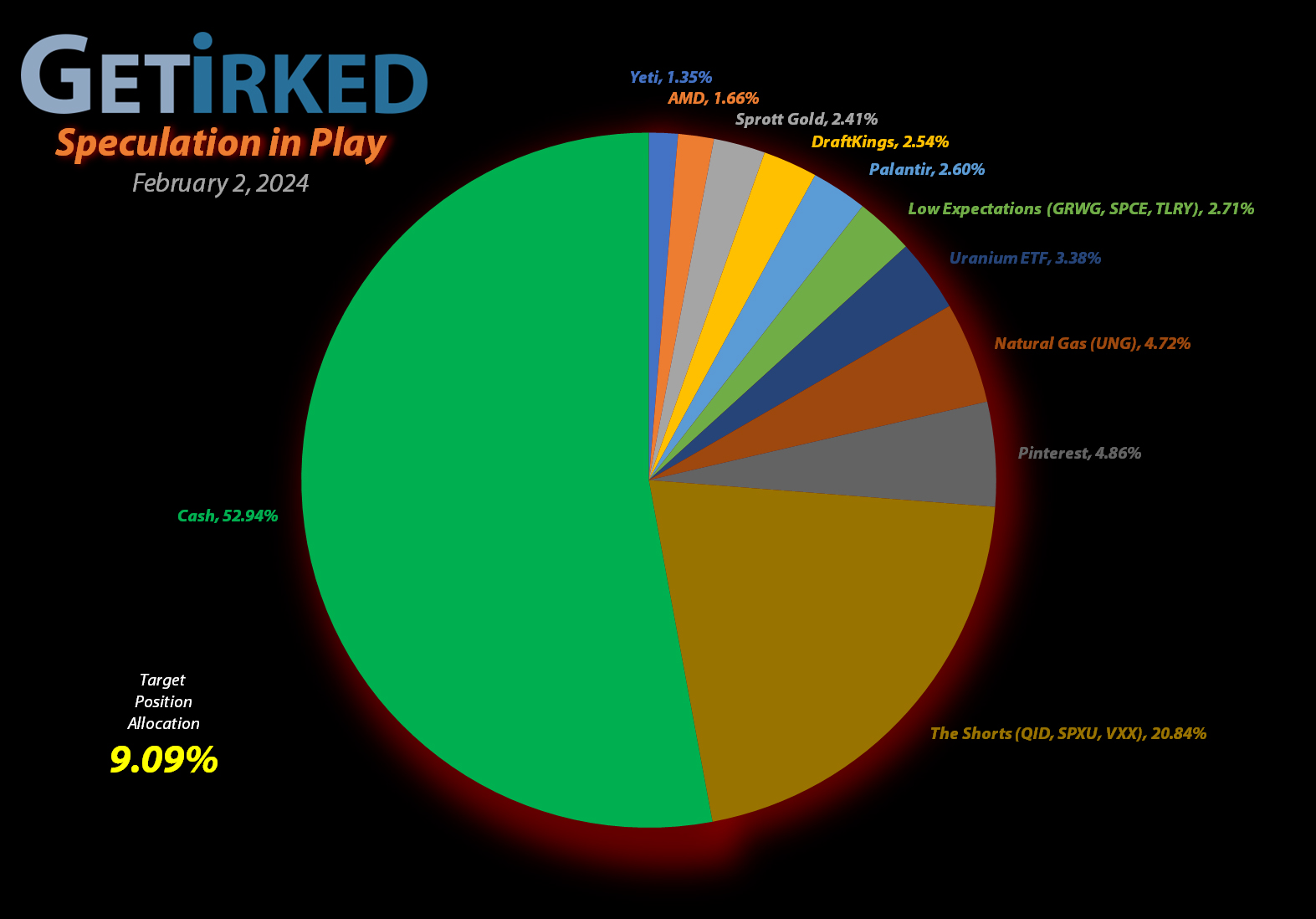

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+805.41%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$851.26)*

Pinterest (PINS)

+453.29%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+400.72%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+181.36%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+92.22%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Tilray Brands (TLRY)

+48.02%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

DraftKings (DKNG)

+45.90%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Palantir (PLTR)

+10.74%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.37

Sprott Gold Trust (PHYS)

+8.01%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-17.74%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.20

Short SPY (SPXU)

-24.59%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.25

Short QQQ (QID)

-30.95%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.05

U.S. Natural Gas (UNG)

-32.47%

1st Buy: 1/30/2023 @ $37.20

Current Per-Share: $28.66

Grow Gen (GRWG)

-82.29%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Advanced Micro Devices (AMD): Added to Position

As I theorized it might, Advanced Micro Devices (AMD) wasn’t able to live up to the impossibly high expectations set for earnings and disappointed. So, on Wednesday, it was time to start replacing some of the shares I had sold in advance of earnings.

My first buy added 1.52% back to my position at $168.17, locking in a -6.94% on a fraction of the shares I sold at $180.72 last week, and raised my per-share “cost” up +11.39% from -$960.72 to -$851.26 (a negative per-share cost indicates all capital has been removed in addition to $851.26 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $145.89, above a past level of support, and I still have no plans to take additional profits as this position is so profitable, I’d rather keep what I have for the long term.

AMD closed the week at $177.66, up +5.64% from where I added Wednesday.