January 12, 2024

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

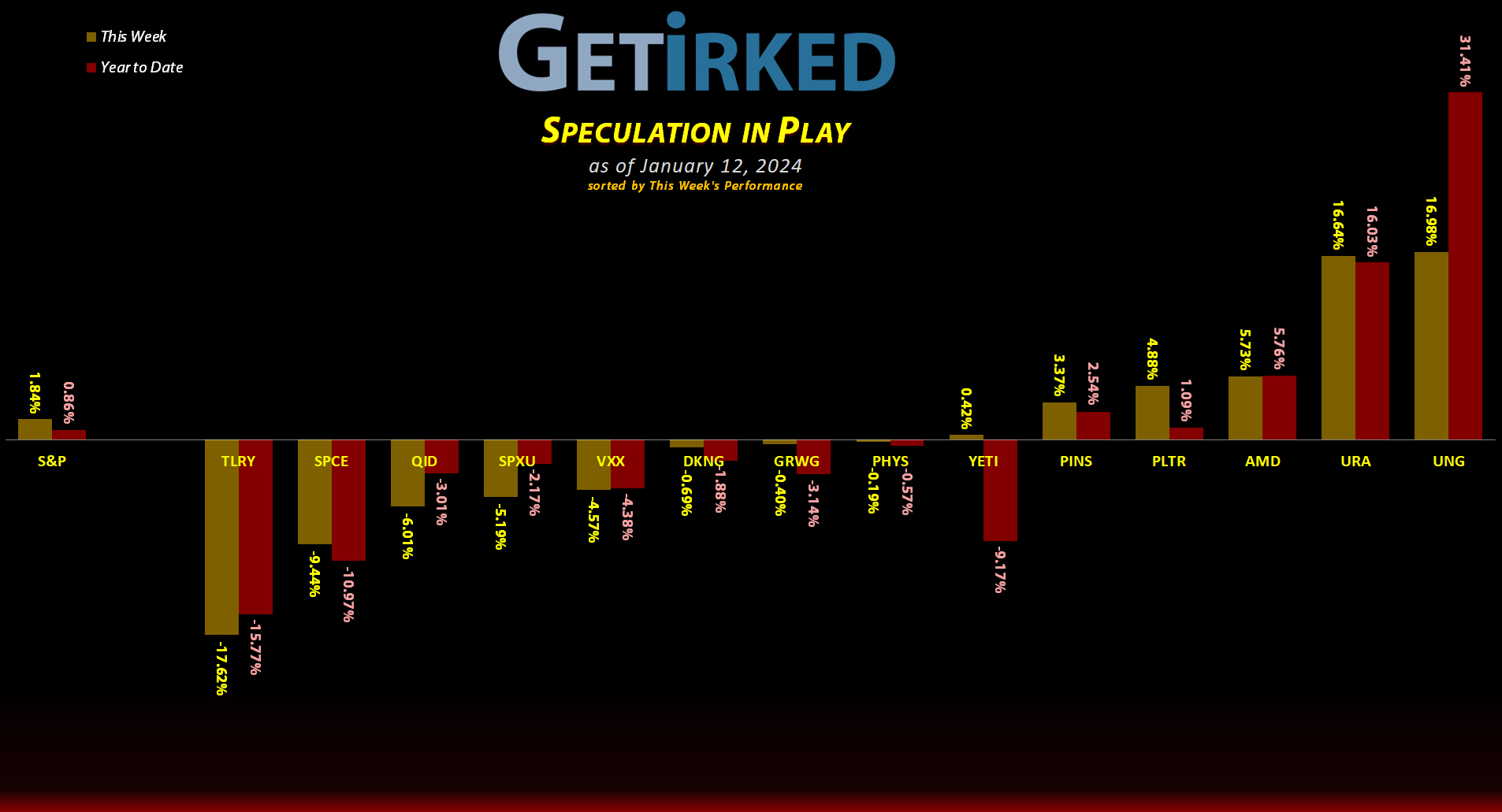

The Week’s Biggest Winner & Loser

Natural Gas (UNG)

Surprisingly cold temperatures and winter storms finally made the markets realize that natural gas shouldn’t be free! As a result, the U.S. Natural Gas Fund (UNG), rallied a pretty incredible +16.98% this week, swinging in just ahead of the Uranium ETF (URA) at +16.64% to earn the spot of the Week’s Biggest Winner.

Tilray Brands (TLRY)

Cannabis stocks rally on the back of any rumor that the DEA’s declassification is right around the corner only to collapse even quicker when those hopes are dashed. Such was the case this week with Tilray Brands (TLRY) dropping an eye-watering -17.62% and sliding in as the Week’s Biggest Loser.

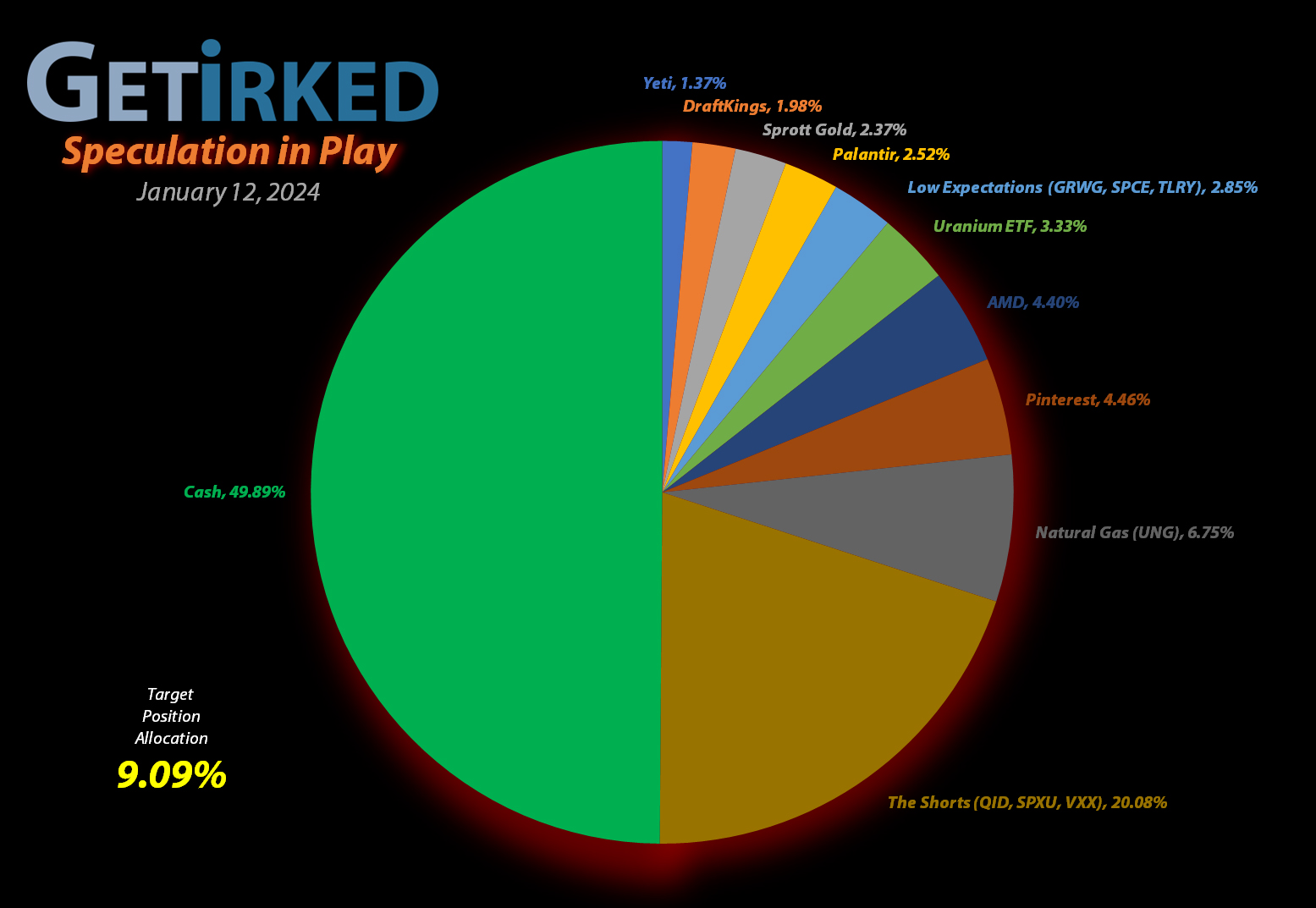

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+719.58%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+439.14%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$45.39)*

Yeti (YETI)

+404.07%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$145.01)*

Uranium ETF (URA)

+180.91%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.21

Virgin Galactic (SPCE)

+100.77%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Tilray Brands (TLRY)

+47.93%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

DraftKings (DKNG)

+15.59%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $28.51

Palantir (PLTR)

+9.11%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.37

Sprott Gold Trust (PHYS)

+8.08%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

U.S. Natural Gas (UNG)

-4.06%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $7.15

Short SPY (SPXU)

-18.38%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.52

The “VIX” (VXX)

-20.05%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.55

Short QQQ (QID)

-25.63%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.30

Grow Gen (GRWG)

-81.77%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Uranium ETF (URA): Dividend Reinvestment

The Uranium ETF (URA) is a bit of an odd beast. In combination with a few of its holdings paying dividends, the ETF regularly has distributions (these occur when there are more inflows toward the end of a year and the ETF managers can’t purchase enough shares of the underlying holdings and, therefore, must distribute the remaining cash as a “dividend”).

These dividend-distributions occur semiannually, and, sometimes, they are quite large, as was this case with the year-end distribution paid out on Wednesday. After reinvestment, the dividend lowered my per-share cost an incredible -5.40%, down from $11.85 to $11.21.

From here, my next buying price target is $19.09, above a point of support URA saw last year, and my next sell target is $41.93, a high that the ETF hasn’t seen in nearly a decade, but one that I believe we may see soon given the rising popularity of nuclear energy’s recent renaissance.

The Volatility “Fear” Index (VXX): Added to Position

Despite the selling the markets saw last week, the profit-taking has been remarkably orderly. As a result, the Volatility Index (VIX), also known as the “Fear Index,” has continued to weaken since the start of the new year. On Monday, the next buy target in my position on the VIX using Barclays’ Short-Term Futures ETN (VXX), was triggered, adding another 4.60% to my doomed experiment trading the VIX at $15.25.

The buy lowered my per-share cost -1.59% from $18.85 down to $18.55.From here, my next buy target is $14.00, right at “round-number” psychological support, and my next sell target is $19.10, under a the first potential level of resistance above my cost basis.

VXX closed the week at $14.83, down -2.75% from where I added Monday.