December 22, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

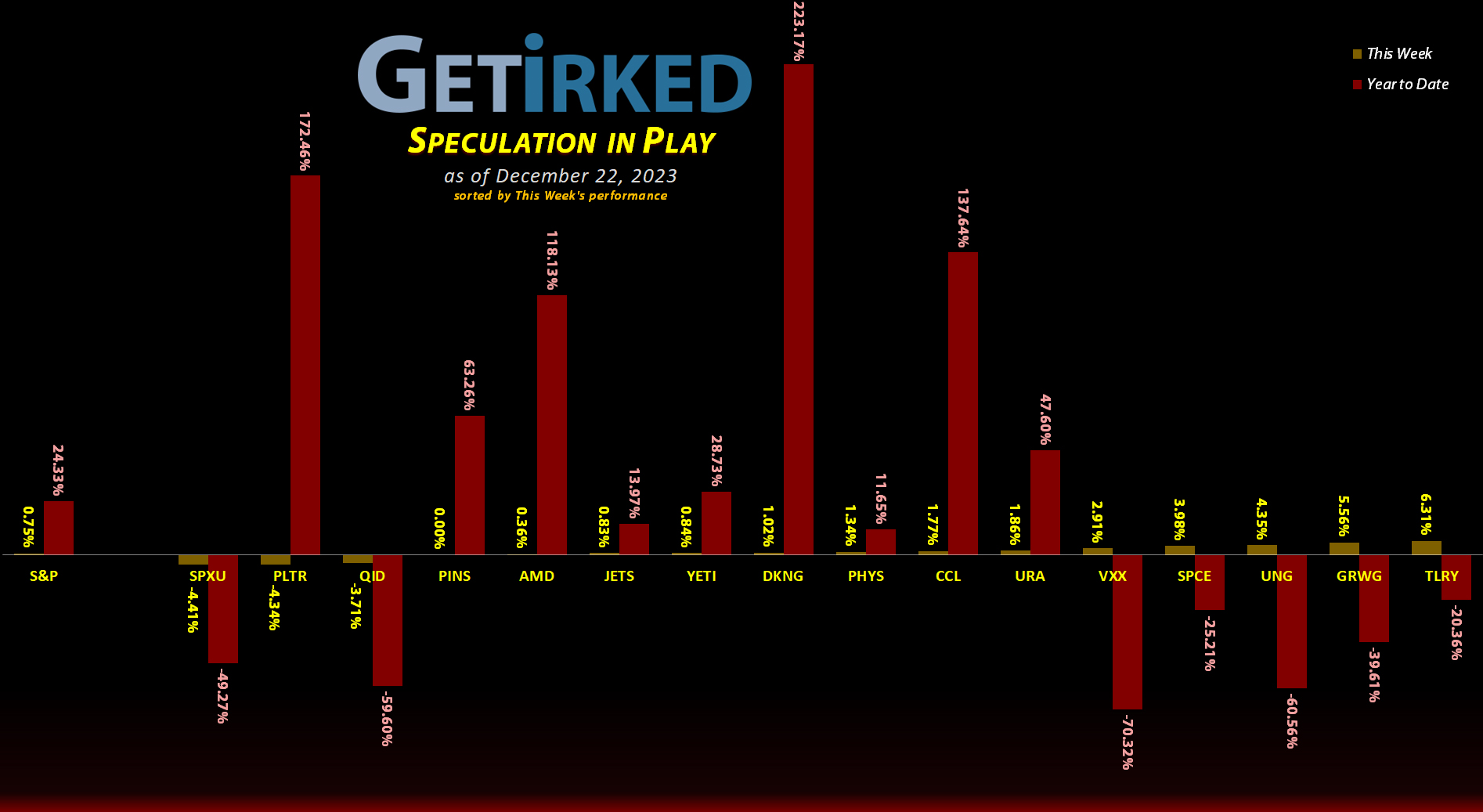

The Week’s Biggest Winner & Loser

Tilray Brands (TLRY)

Someone seems to think they know something in the cannabis sector because it’s been crazy volatile in the past couple of weeks. After selling off, the entire space rallied this week, causing Tilray Brands (TLRY) to gain +6.31% and swing in as this week’s Biggest Winner.

Palantir (PLTR)

As always, I don’t count my short positions in the competition for the biggest winner or loser, preferring to look at individual stocks. The rotation out of Artificial Intelligence and the big tech stocks that took us higher this year continued this week with AI stocks like Palantir Technologies (PLTR) taking it on the chin. Palantir dialed in a loss of -4.34% which was enough to make it the week’s Biggest Loser.

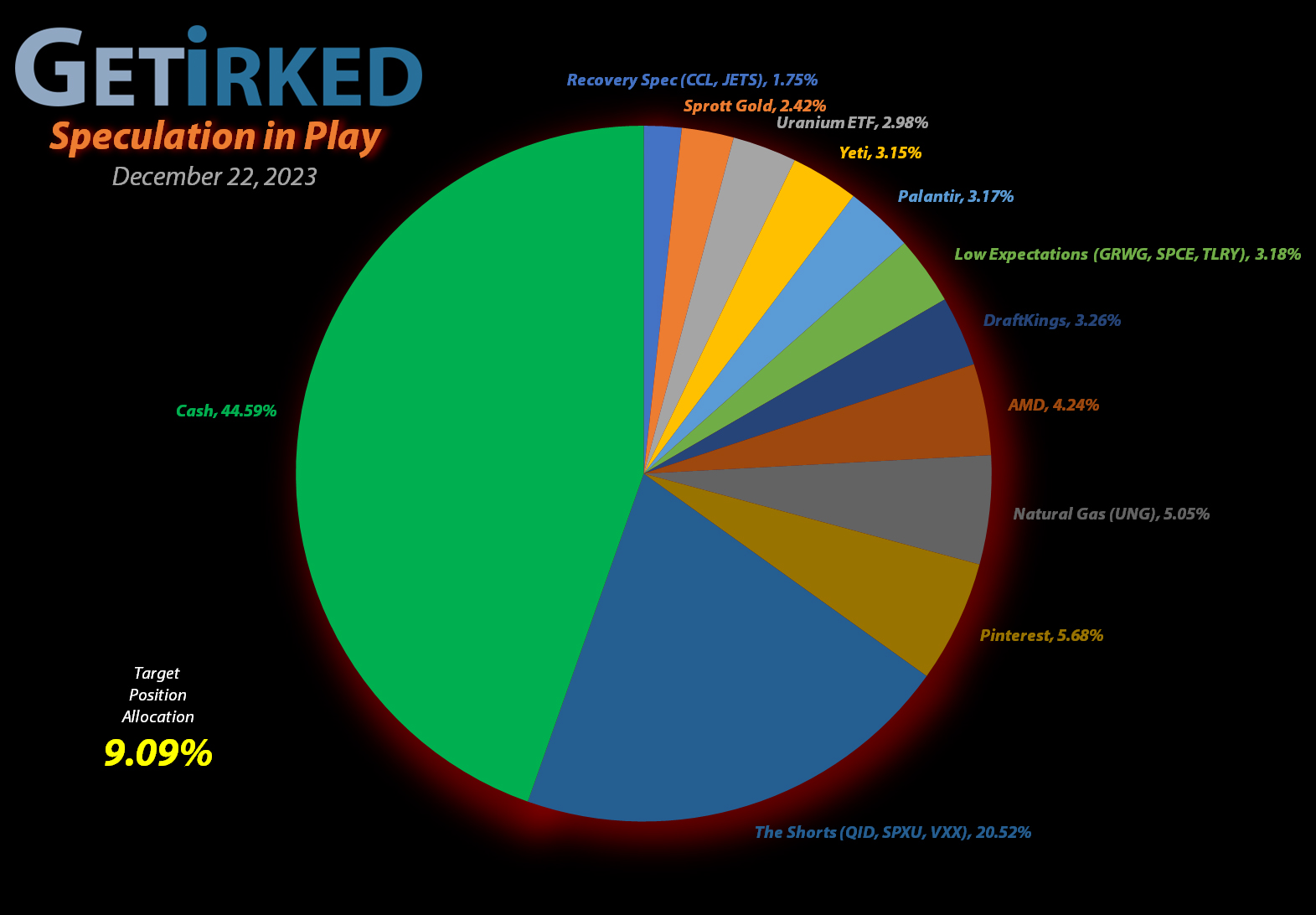

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+701.79%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+442.55%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: (-$29.14)*

Yeti (YETI)

+413.73%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Uranium ETF (URA)

+149.12%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $11.85

Virgin Galactic (SPCE)

+112.35%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Airlines ETF (JETS)

+97.42%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$8.19)*

Carnival Cruise (CCL)

+81.08%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$37.00)*

Tilray Brands (TLRY)

+50.66%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: (-$3.75)*

DraftKings (DKNG)

+16.16%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $30.75

Palantir (PLTR)

+10.94%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.69

Sprott Gold Trust (PHYS)

+8.90%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

The “VIX” (VXX)

-11.88%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $18.85

Short SPY (SPXU)

-17.57%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $10.70

Short QQQ (QID)

-26.58%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $14.50

U.S. Natural Gas (UNG)

-29.00%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $7.15

Grow Gen (GRWG)

-81.85%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Carnival Cruise Lines (CCL): Profit-Taking

When Carnival Cruise Lines (CCL) reported good earnings before the market open on Thursday, the subsequent pop triggered my next sale order which filled at $19.00, selling 50.00% of my remaining position and locking in just +10.14% in gains on shares when I initially opened the position at $17.25 on March 12, 2020.

The sale lowered my per-share cost -$28.00 from -$9.00 to -$37.00 (a negative per-share cost indicates all capital has been removed in addition to $37.00 per share added to the portfolio’s bottom line in addition to each share’s current value).

Given that Carnival has rallied more than 78% since its lows in October less than two months ago, I’ve decided to aggressively take profits in my position. In fact, if CCL reaches $23.00, a past point of resistance, I will close the position entirely.

However, if Carnival rolls over before reaching $23.00 and tests its lows from October, I will rebuild the position once more with my next buy target at $11.10.

CCL closed the week at $18.93, down -0.37% from where I took profits Thursday.

Danimer Scientific (DNMR): Not Actively Covered

This week, it’s time to clean house, and Danimer Scientific (DNMR) is one of the positions I will no longer actively cover. Since I have no intention of adding additional funds into this position, it remains dead-weight in the portfolio.

The story of this investment is a testament to my discipline – never take stock tips from anyone else.

The origin of this tip came from a supposed “expert” from Stansberry Research who called Danimer Scientific his “best pick for the next five years.”

If this was his best pick – down more than -85% from the day he recommended it – imagine how bad his worst pick performed!!

At any rate, since the position is down so much and worth so little, I will not be selling it, rather holding on to it as a lottery ticket should it ever recover. However, I don’t want new readers of Get Irked to get the idea that I somehow like this piece of garbage stock since it’s still in the portfolio.

Accordingly, going forward, the value of Danimer Scientific will be reflected in my cash position and I will only mention it if it recovers over my cost basis and I take action.

Since Danimer shared an allocation – the Garbage Spec Basket – with Virgin Galactic (SPCE), I’ve now rolled Virgin Galactic in with GrowGeneration (GRWG) and Tilray (TLRY), to create the Low Expectation Basket.

Golden Minerals (AUMN): Not Actively Covered

Due to its subpar performance and its tiny portion of the portfolio, I made the decision to stop covering Golden Minerals (AUMN) each week. I will not be adding to the position nor will I be selling it unless it crosses over my cost basis, but without any significant movements (and the fact that it’s an absolutely terrible investment that I don’t want anyone unknowingly following me into), I will no longer be referencing it regularly after this week.

Should something happen – either Golden Minerals goes bankrupt or, miraculously, crosses my cost basis, I will bring it back, but, in the meantime, the position’s paltry value will be rolled into the “Cash” portion of the allocation chart.