November 10, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

AMD (AMD)

When the artificial intelligence stocks got bid up during this week’s rally, Advanced Micro Devices (AMD) was, of course, one of the stocks to get hit, rallying +5.66% and swinging in as the Week’s Biggest Winner.

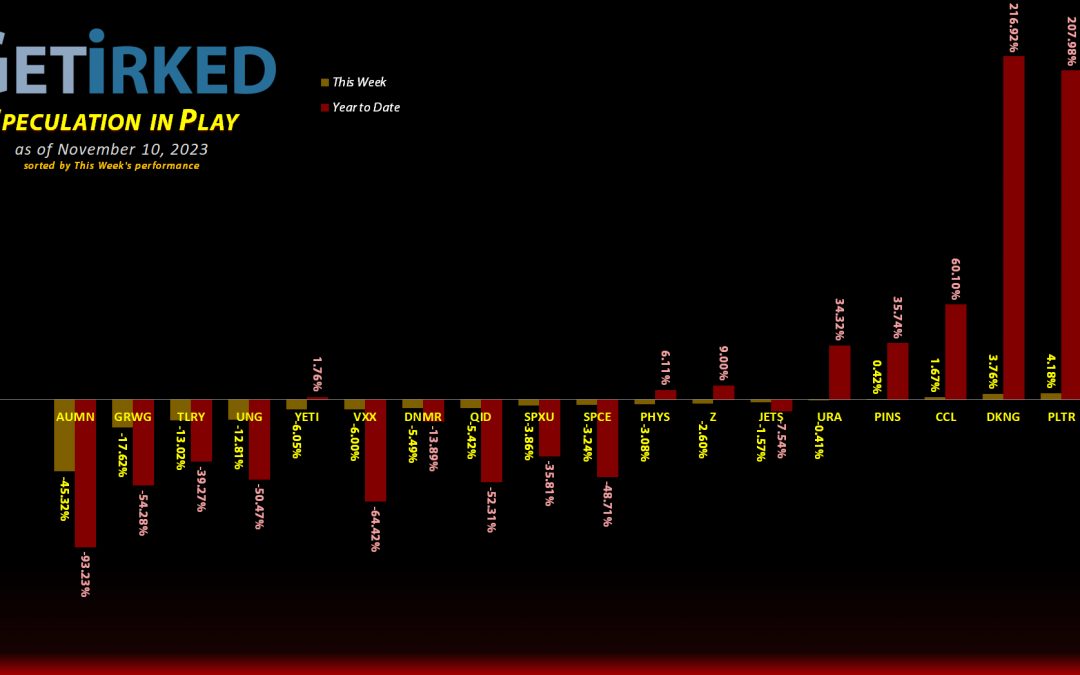

Golden Minerals (AUMN)

Should it come as any surprise that Golden Minerals (AUMN) is once again the Biggest Loser? This week makes it a hat trick – three in a row – as Golden Minerals announced that it would once again have to hit the equity markets for a cash transfusion.

While AUMN did report upside earnings late in the week which offset a tiny bit of the selloff, the never-ending streak of epically bad news sent Golden Minerals down another whopping -45.32% on the week.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Airlines ETF (JETS)

+1643.83%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $0.90

AMD (AMD)

+648.12%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+400.57%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+367.63%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+93.39%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Uranium ETF (URA)

+70.08%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+56.36%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+46.23%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($3.75)*

Palantir (PLTR)

+25.40%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.69

DraftKings (DKNG)

+6.66%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $32.84

Sprott Gold Trust (PHYS)

+3.56%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

Short SPY (SPXU)

-2.53`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $11.25

The “VIX” (VXX)

-6.74%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $21.35

Short QQQ (QID)

-18.41%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.40

U.S. Natural Gas (UNG)

-20.44%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $7.95

Zillow (Z)

-23.02%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Danimer Sci (DNMR)

-81.21%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.25

Grow Gen. (GRWG)

-86.20%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $13.55

Golden Mine. (AUMN)

-92.29%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

DraftKings (DKNG): Profit-Taking

When DraftKings (DKNG) continued its epic rally from last week on Monday, I decided it was time to trim some profits off this long-held position. My sell order went through at $33.93 on Monday, selling 20.00% of my position.

The sale locked in +64.71% in gains on shares I bought for $20.60 way back on January 20, 2022 and lowered my per-share cost -0.67% from $33.06 to $32.84. From here, my next sell target is $44.78, slightly below a past point of resistance, and my next buy target is $17.42, above a consistent point of support.

DKNG closed the week at $35.02, up +3.21% from where I took profits Monday.

GrowGeneration (GRWG): Added to Position

GrowGeneration (GRWG) reported bad earnings (which was to be expected, honestly, given the state of the cannabis industry) and sold off on Thursday, triggering my next buy order which filled at $1.85, adding just 0.72% to my position.

The small buy lowered my per-share cost -4.58% from $14.20 to $13.55 (I obviously bought my position at much, much higher levels, sadly). From here, I only have a few more buys before I’m done throwing good money after bad with my next small buy at $1.55, a price calculated by Fibonacci Method. My next sell target is above my cost basis, below a point of resistance at $13.93.

GRWG closed the week at $1.87, up +1.08% from where I added Thursday.

Natural Gas Fund (UNG): Added to Position

The price of natural gas sold off with the price of crude oil this week which meant that the U.S. Natural Gas Fund (UNG) tripped my next buy order which added 5.48% to the position at $6.45 on Wednesday.

The buy lowered my per-share cost -1.85% from $8.10 to $7.95. From here, my next buy target is $5.86, right near UNG’s all-time low, and my next sell target is $8.45, right under a previous point of resistance.

UNG closed the week at $6.33, down -1.86% from where I added Wednesday.

Short Nasdaq-100 ETF (QID): Added to Position

When the Nasdaq continued to rally on Tuesday, it filled my next buy order, adding 3.78% to the position at $12.90. The buy lowered my per-share cost -0.77%, down from $15.52 to $15.40.

From here, my next buy target is $12.27, above a past point of support, and my next sell target is $15.74, under key moving averages coming down to meet this trade.

QID closed the week at $12.57, down -2.56% from where I added Tuesday.

Short S&P 500 ETF (SPXU): Added to Position x 2

When the market seemed to stabilize on Monday after last week’s epic rally, I decided to add to my ProShares UltraPro Short S&P 500 ETF (SPXU) position despite the fact it was above my cost basis (long-time readers know how much I hate raising my cost basis).

My buy order filled at $11.35, adding 4.83% to my position and locking in a -13.16% discount on shares I sold for $13.07 on October 30.

On Friday, the market continued to rally further and triggered my next buy order which added 9.47% at $11.07, leaving me with an $11.16 average buy price, locking in a -14.11% discount on shares I sold for an average $12.89 in late October.

The combined buys left me with a cost basis of $11.25 per-share. From here, my next buy target is $10.20, slightly above a past point of support, and my next sell target is $13.46, a bit below SPXU’s recent high.

SPXU closed the week at $10.97, down -1.70% from my $11.16 buy price.

The Volatility Index (VXX): Added to Position

I added to my ill-fated position in the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX) – my play on the Volatility Index or the “Fear Index” – when it continued to calm down, triggering my next buy order which filled at $20.16 on Wednesday, adding 7.10% to my allocation.

The buy also lowered my per-share cost -1.84%, down from $21.75 to $21.35. From here, my next buy target is $17.85, a price calculated using the Fibonacci Method, and my next sell target is $26.75, a bit below the VXX’s recent high.

VXX closed the week at $19.91, down -1.24% from where I added Wednesday.