November 3, 2023

Risk Disclaimer

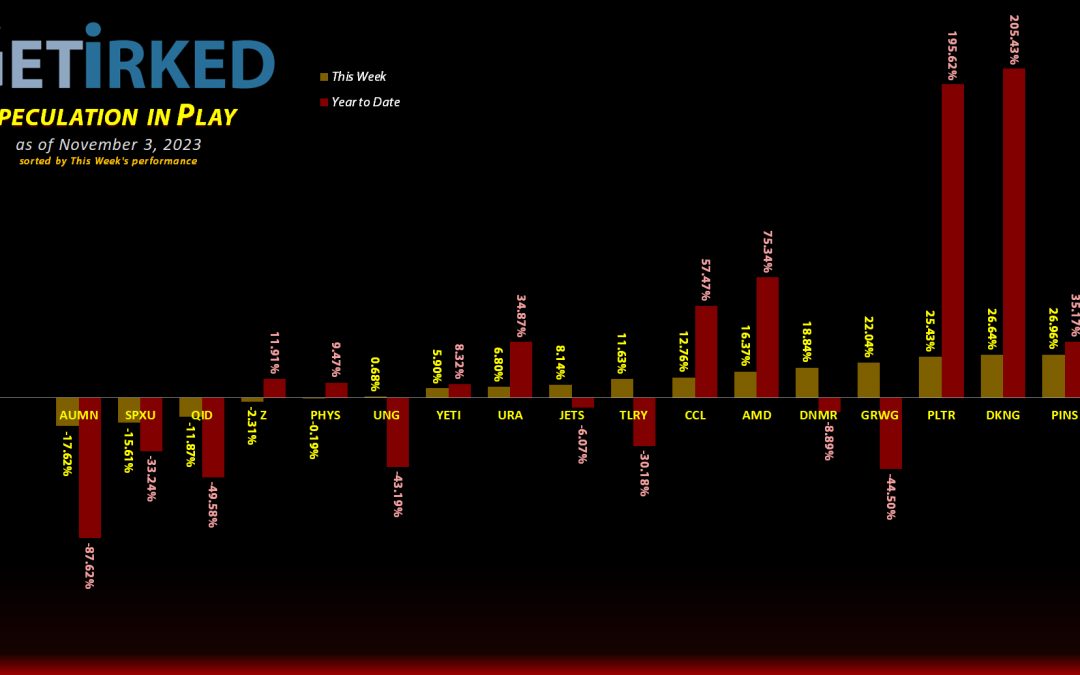

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Virgin Galactic (SPCE)

The funny thing about oversold rallies is that it’s often the crappiest investments that see the most pop as traders pile in to try and take advantage of the volatility. That was the case this week when Virgin Galactic (SPCE) rallied +33.09%, easily flying into the stratosphere as the Week’s Biggest Winner.

Golden Minerals (AUMN)

Even this week’s epic rally couldn’t save Golden Minerals (AUMN) from having even more steam taken out of its short squeeze rally. Golden Minerals sunk another -17.62%, giving it two weeks in a row as the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Airlines ETF (JETS)

+1670.51%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $0.90

AMD (AMD)

+631.89%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+399.70%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+378.82%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+94.68%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Uranium ETF (URA)

+70.78%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+55.49%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+48.36%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($3.75)*

Palantir (PLTR)

+20.40%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $15.69

Sprott Gold Trust (PHYS)

+6.85%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

DraftKings (DKNG)

+2.11%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Short SPY (SPXU)

+1.07`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $11.28

VIX Short-Term (VXX)

-2.56%

1st Buy: 11/2/2023 @ $21.75

Current Per-Share: $21.75

U.S. Natural Gas (UNG)

-10.43%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.10

Short QQQ (QID)

-14.27%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.52

Zillow (Z)

-20.97%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Danimer Sci (DNMR)

-80.12%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.25

Grow Gen. (GRWG)

-84.01%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.20

Golden Mine. (AUMN)

-86.29%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Palantir Technologies (PLTR): Profit-Taking

Combine a market-wide rally with an excellent earnings report, and you get Palantir Technologies (PLTR) taking off and triggering my next sell order which filled on Friday at $18.54, selling 14.29% of my position.

The sale locked in +44.96% in gains on shares I bought for $12.79 more than a year ago, back on January 24, 2022, and lowered my per-share cost -2.55% down from $16.10 to $15.69.

From here, my next sell target is $21.41, just below the next level of resistance, and my next buy target is $10.49, above a key level of support.

PLTR closed the week at $18.90, up +1.94% from where I took profits Friday.

Short Nasdaq-100 ETF (QID): Added to Position x 2

When the markets rallied into the end of October, I decided to add a bit more to my ProShares UltraShort QQQ ETF (QID) with a buy that filled at $14.60, adding 4.66% to my position.

When the markets rallied with the kind of irrational exuberance we haven’t seen since 2021 following the Fed’s announcement they would be pausing again, I decided to add even more to my QID position with a buy that filled on Thursday at $13.70, adding 4.18% to my position and giving me a $13.95 average buy price.

The combined buys lowered my per-share cost -0.83%, down from $15.65 to $15.52. From here, my next buy target is $12.90, above a past point of support, and my next sell target is $15.75, just below two key moving averages as well a confluence with a Fibonacci Method calculation.

QID closed the week at $13.30, down -4.66% from my $13.95 average buy price.

Short S&P 500 ETF (SPXU): Profit-Taking

When the S&P 500 rallied on Monday, I used stop-loss limit orders to lock in gains on my position in the ProShares UltraPro Short S&P 500 ETF (SPXU). My sell order filled at $13.07, selling 10.00% of my allocation and locking in +4.14% in gains on shares bought for $12.55 on June 1.

The sale lowered my per-share cost -1.57% from $11.46 to $11.28. From here, my next sell target is $13.91, slightly below a key point of resistance, and my ne4xt buy target is $10.99, right around a point of support SPXU saw in the past.

SPXU closed the week at $11.40, down -12.78% from where I took profits.

VIX Short-Term Futures (VXX): *New Position*

The Volatility Index (VIX) measures the amount of forward-looking volatility by tracking the futures market. The name implies that this instrument would increase in value during periods of extreme movements both up and down, however, it does not. The VIX only increases in value during bearish price action which is where it earned the nickname “The Fear Index.”

The VIX is a notoriously difficult instrument to play since even moderate selloffs in the stock market can result in very little movement in the VIX. To make matters even worse, the instruments traders can use to play the VIX degrade over time due to contango and other factors.

So, why the heck am I opening in a position in VXX, the iPath Short Term Futures ETN?

Simple. This is my speculative portfolio and, after the incredible rally into the weekend, the VIX pulled back so significantly that it’s only slightly off its all-time lows. Additionally, I believe that there may be a credit event or other unknown Black Swan Event looming on the horizon, so I think the VIX will increase – perhaps substantially – from now to the year end.

That being said, I am managing my risk very carefully in this position, opening a buy with less than a 25% allocation on Thursday at $21.75. I will add more should it test its all-time low with my next buy target at $19.96, slightly above that low, and I will start trimming the position relatively quickly with my next sell target at $26.74, quite a bit under the high the VIX saw just this week.

VXX closed the week at $21.19, down -2.56% from where I opened the position.