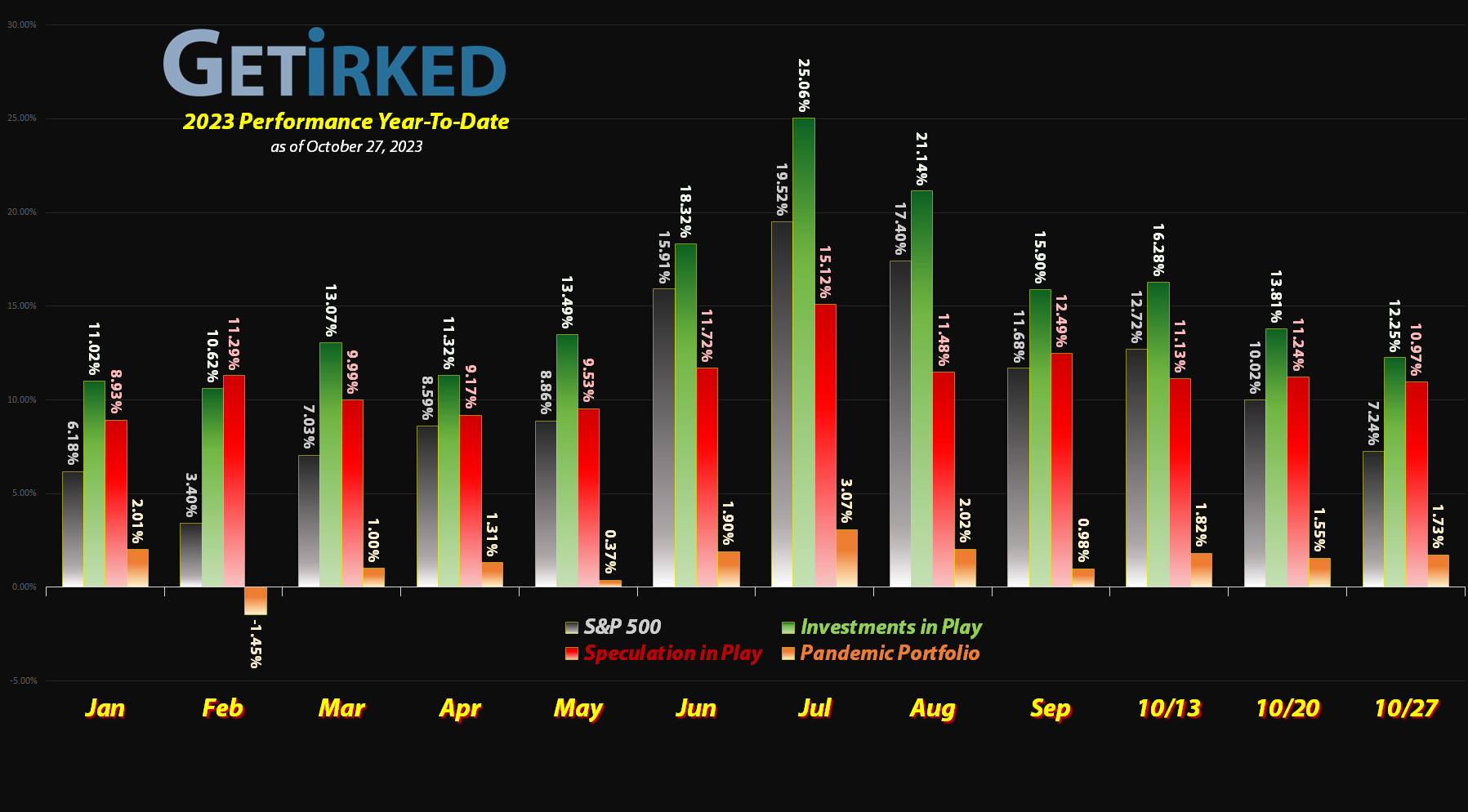

October 27, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

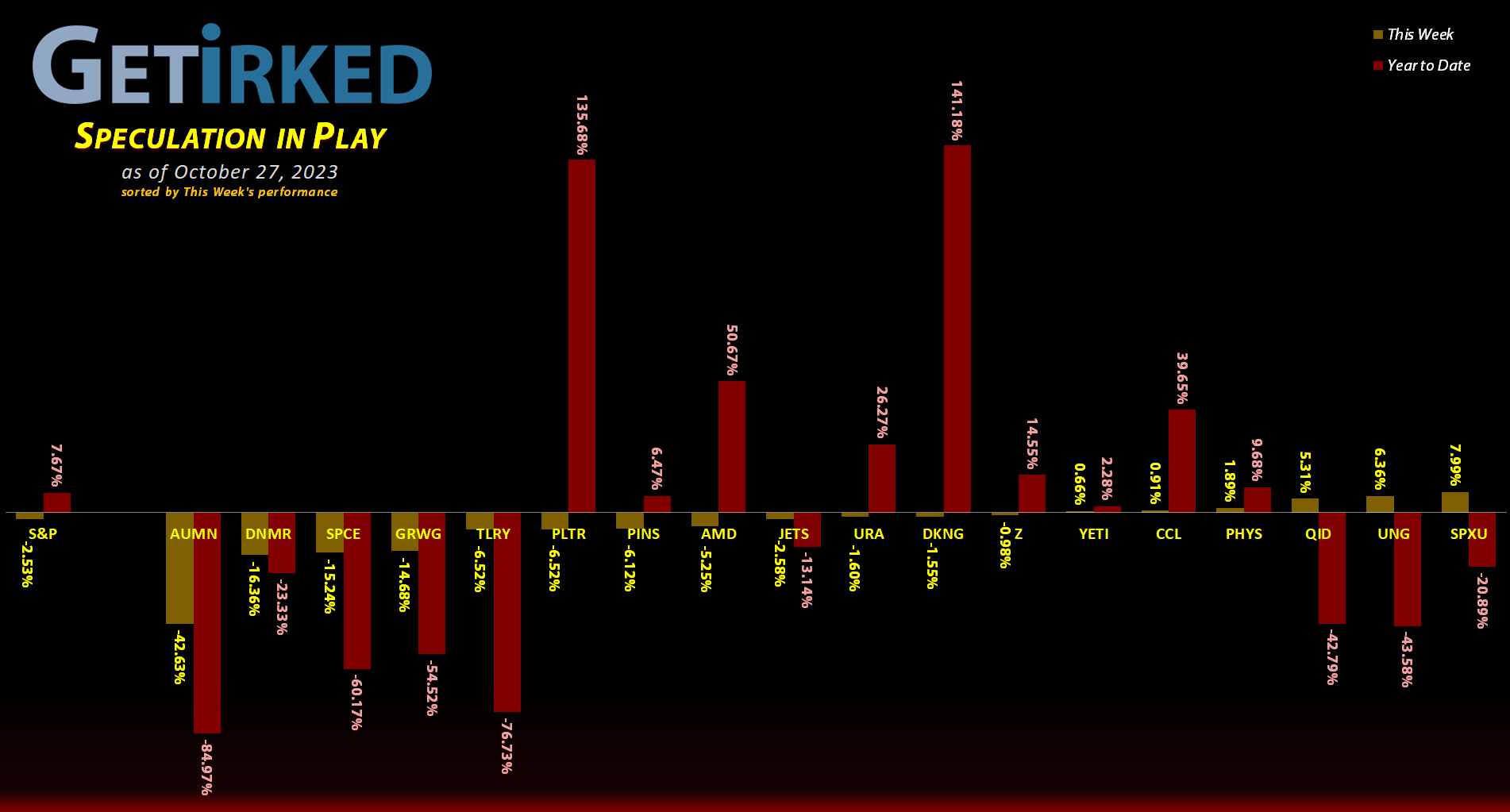

The Week’s Biggest Winner & Loser

U.S. Natural Gas (UNG)

As always, I don’t consider my short positions on the S&P 500 (SPXU) or Nasdaq 100 (QID) when it comes to choosing the week’s Biggest Winner, so, this week, it’s the U.S. Natural Gas Fund (UNG) which rallied +7.99% on the back of news that it turns out the world will be having a winter this year as forecasts released from around the globe indicated a potentially cold one ahead..

Golden Minerals (AUMN)

After several weeks of the most epic short-squeeze I’ve seen in years, Golden Minerals (AUMN) finally came back down to Earth with a resounding “thud.”

While AUMN is higher now than where it was when the squeeze started, it still lost a whopping -42.63% this week which easily puts it in the spot of the Week’s Biggest Loser.

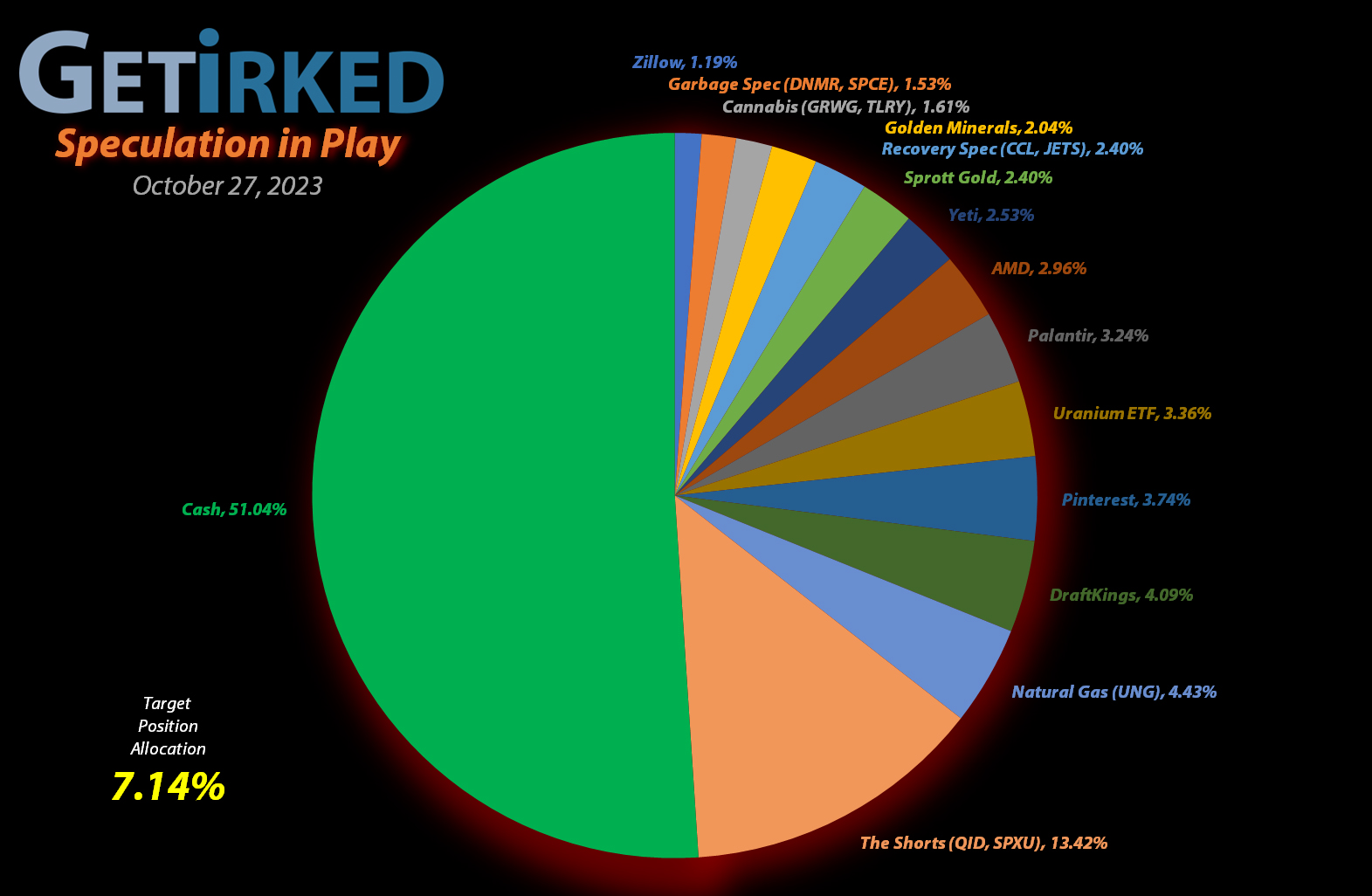

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Airlines ETF (JETS)

+1538.25%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $0.90

AMD (AMD)

+591.54%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+368.52%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+356.02%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+84.03%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Uranium ETF (URA)

+59.90%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+49.25%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+46.65%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($3.75)*

Short SPY (SPXU)

+18.00`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $11.46

Sprott Gold Trust (PHYS)

+7.05%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

Short QQQ (QID)

-3.64%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.65

Palantir (PLTR)

-6.46%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

U.S. Natural Gas (UNG)

-10.99%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.10

DraftKings (DKNG)

-19.37%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Zillow (Z)

-19.10%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Golden Mine. (AUMN)

-82.89%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Danimer Sci (DNMR)

-83.27%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.25

Grow Gen. (GRWG)

-86.90%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.20

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Short S&P 500 ETF (SPXU): Profit-Taking x 3

When the market rallied on Monday, I used stop-loss limit orders to lock in gains on my ProShares UltraPro Short S&P 500 ETF (SPXU position. My sale filled at $12.39, selling 7.69% of the position and locking in +7.55% in gains on shares I bought for $11.52 on October 9.

On Wednesday, I took more profits in SPXU as the S&P 500 continued to sell off with another buy which went through at $12.76, selling another 9.79% of the position and locking in +6.78% in gains on some of the shares I bought for $11.95 on June 2.

On Thursday, I used a trailing stop-loss order to take more profits if the S&P 500 reversed intraday which it did, filling the order to take another 9.09% out of the position at $13.02. This sale locked in +8.96% in gains on the remainder of the shares I bought for $11.95 on June 2.

The combined orders gave me a $12.72 average selling price and lowered my per-share cost -2.47% from $11.75 to $11.46. From here, my next buy target is $11.37, a bit above a recent point of support, and my next sell target is $13.78, quite a bit under the next point of resistance.

SPXU closed the week at $13.52, up +7.47% from my $12.58 average sell price.