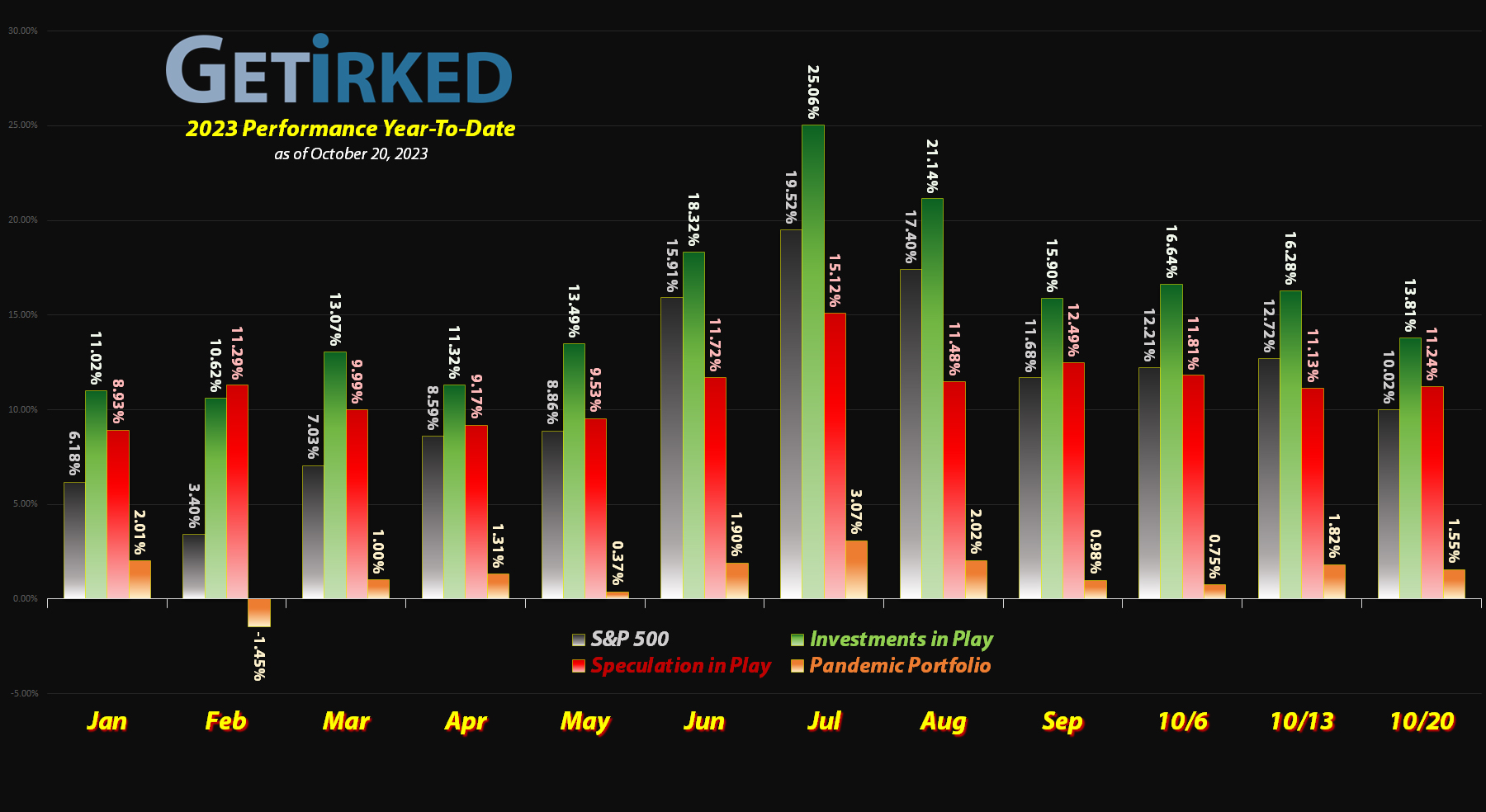

October 20, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

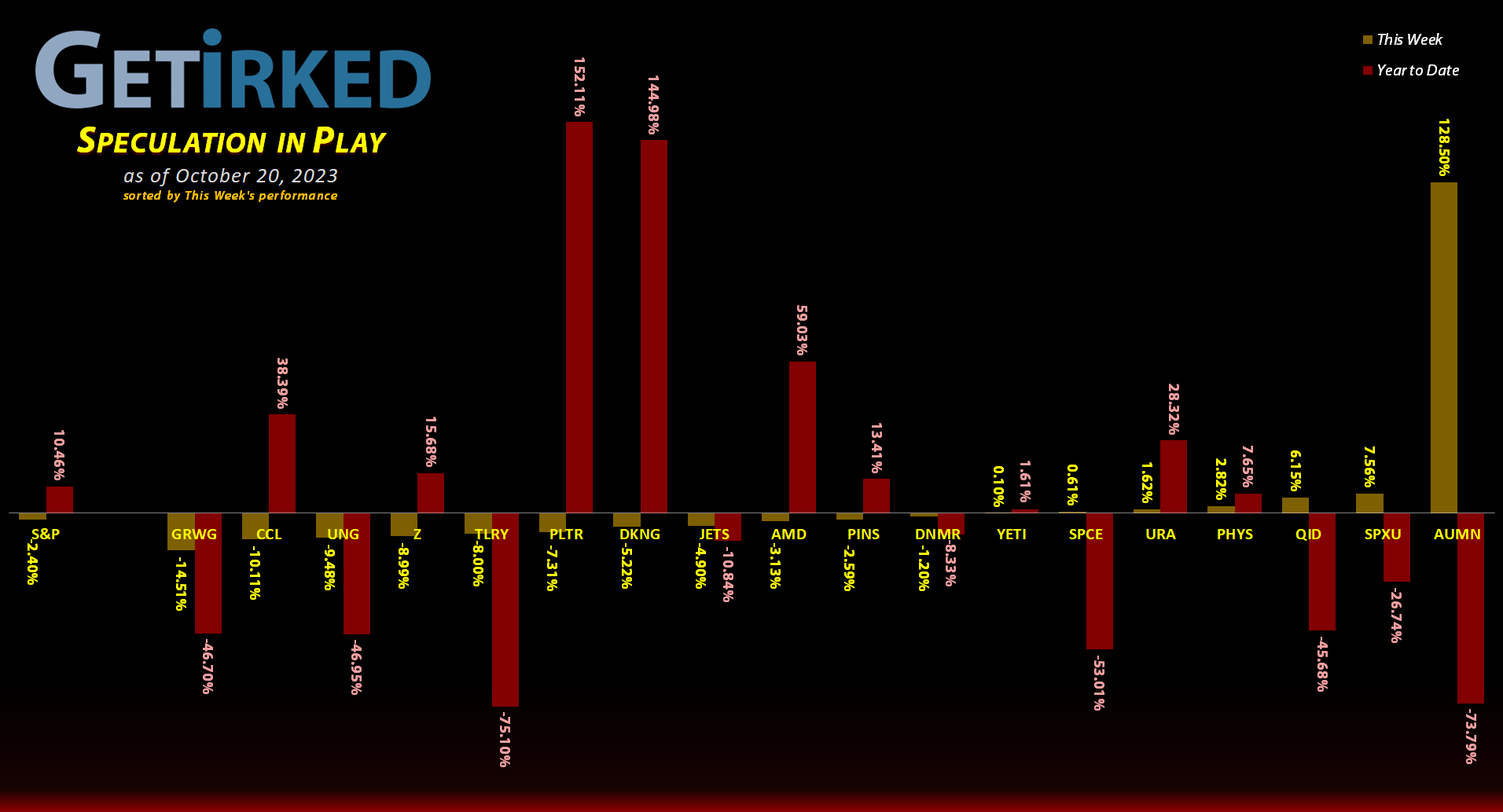

Golden Minerals (AUMN)

If you’re new to markets or, heck, even if you’re not new but just aren’t familiar with penny stock price action, you might think this week’s +128.50% move in Golden Minerals (AUMN) is downright impossible.

How could this crappy penny-stock gold miner suddenly skyrocket so much?!

Simple. This is the mother of all short squeezes.

When a trader bets against a company, they’ll borrow the stock and sell it, assuming they can buy back the stock at a lower price.

If there’s good news, say, such as the price of gold rallying significantly for a goldminer, the trader will have to buy back the shares they sold at a much higher price. Since stocks can theoretically continue going higher infinitely, the loss could be infinite.

When enough traders are short a particular stock – Golden Minerals, in this case – that means there’s a rush to cover which can cause a stock’s price, particularly a penny stock, to skyrocket into the stratosphere.

It’s hard to know how much longer this rally in AUMN can go, but one thing is for certain – Golden Minerals was most definitely this week’s Biggest Winner (for the second week in a row)!

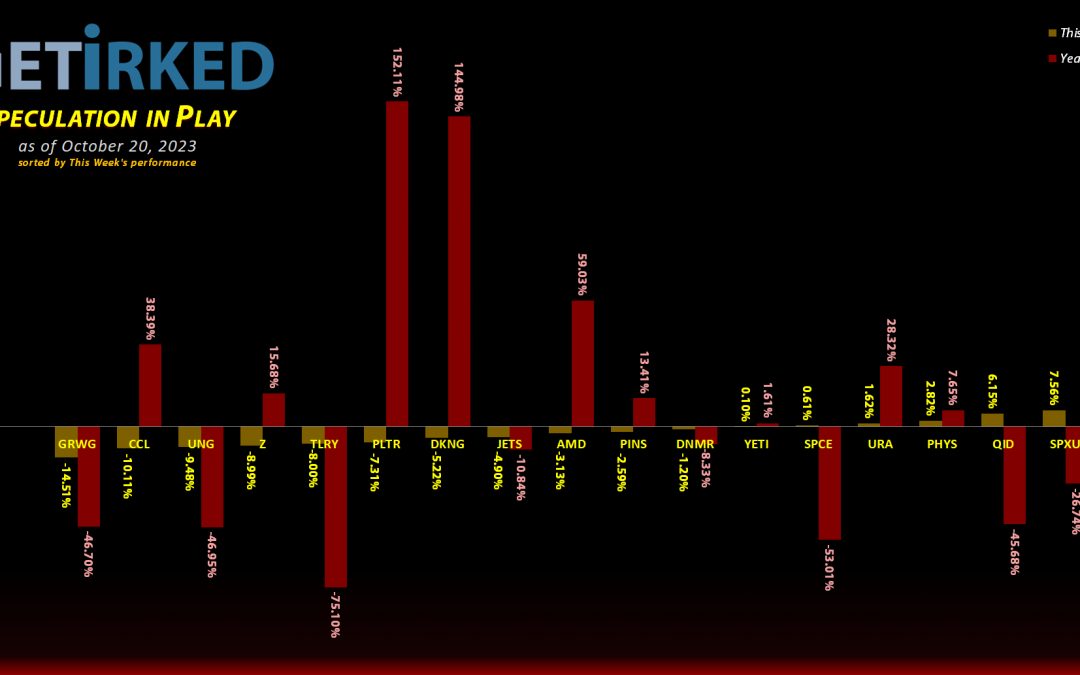

GrowGeneration (GRWG)

With likely no hope of the SAFE Banking Bill being introduced into Congress this year, the cannabis sector has gotten positively slammed as high interest rates mean many companies could have a very difficult time affording recapitalized loans.

Hydroponics supplier GrowGeneration (GRWG) wasn’t spared, careening -14.51% this week and landing in at the spot of the Biggest Loser for the second week running.

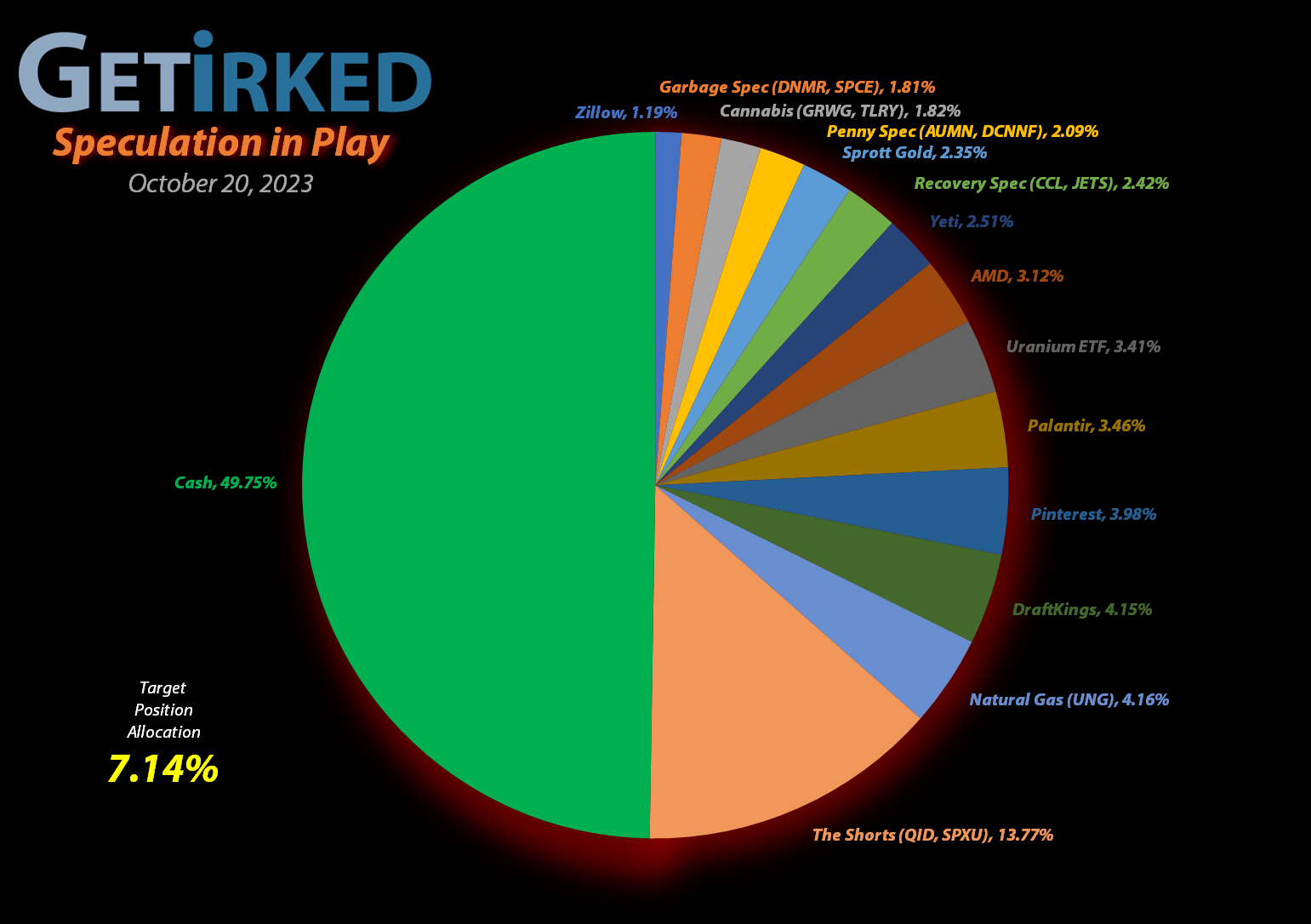

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Airlines ETF (JETS)

+1581.59%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $0.90

AMD (AMD)

+605.21%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+367.38%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+366.60%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+89.65%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Uranium ETF (URA)

+62.49%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+48.84%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+47.68%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($3.75)*

Short SPY (SPXU)

+6.64`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $11.75

Sprott Gold Trust (PHYS)

+5.07%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.60

Palantir (PLTR)

+0.12%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

Short QQQ (QID)

-8.53%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.65

U.S. Natural Gas (UNG)

-16.17%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.10

DraftKings (DKNG)

-18.10%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Zillow (Z)

-18.31%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Golden Mine. (AUMN)

-69.86%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Canadian Pal (DCNNF)

-78.15%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-80.00%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.25

Grow Gen. (GRWG)

-84.65%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.20

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Airlines ETF (JETS): Added to Position

The airlines stocks have been a never-ending downturn since they rallied to a high in late June following high gas prices and high interest rates dragging down the sector.

On Thursday, the Airlines ETF (JETS) finally fell through my next buy target which added 13.29% to my allocation at $15.45. The buy locked in a -24.45% discount replacing shares I sold for $20.45 back on June 15.

Since I use the ETF as a trading vehicle – not a typical long-term investment – this buy broke one of my rules by adding capital back into the position. The buy raised my per-share cost from -$6.26 to $0.90.

From here, my next buy target is $12.80, above a past point of support, and my next sell target is $22.37, just under JETS’ high this summer.

JETS closed the week at $15.13, down -2.07% from where I added Thursday.

GrowGeneration (GRWG): Added to Position

GrowGeneration (GRWG) came under pressure with the rest of the cannabis sector this week, breaking its 2022 low at $2.54 and triggering my next buy order which added 0.91% to my allocation at $2.30. The buy lowered my per-share cost -4.70% from $14.90 to $14.20.

I continue to make incredibly small buys in this position as, although I believe cannabis will legalized eventually, there’s no telling whether the small players in the space will survive e.g. the risk is very high for these stocks.

From here, my next buy is at $1.85, near a point of support from GRWG’s distant past, and my next sell target is $14.60, slightly above my cost basis and beneath a key point of past resistance.

GRWG closed the week at $2.18, down -5.22% from where I added Thursday.

Short S&P 500 ETF (SPXU): Added & Profit-Taking

When the market rallied intraday on Tuesday, the subsequent selloff in the ProShares UltraPro Short S&P 500 ETF (SPXU) triggered my next buy order which added 4.76% to my position at $11.15.

The buy locked in a -9.49% discount replacing some of the shares I sold for $12.43 on October 3 and lowered my per-share cost -0.42% from $11.90 to $11.85.

On Friday, the market selloff caused SPXU to rally through my sell target which filled at $12.50, locking in +12.11% in gains on the shares I bought earlier in the week and reducing my per-share cost -0.84% from $11.85 to $11.75.

From here, my next buy target is $11.05, above a past point of support, and my next sell target is $13.55, below a past point of resistance.

SPXU closed the week at $12.52, up +0.16% from where I took profits.

Tilray Brands (TLRY): Added to Position

Tilray Brands (TLRY) sold off with cannabis and the rest of the market, triggering my next buy order which filled on Friday at $1.88, adding 4.11% to my position.

The buy locked in a -98.92% discount replacing some of the shares I sold for $174.83 on October 16, 2018 and raised my per-share cost +$1.25 from -$5.00 to -$3.75 (a negative per-share cost indicates all capital has been removed in addition to $3.75 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $1.50, Tilray’s low from earlier in 2023, and my next sell target is $54.75, under a key point of resistance TLRY saw in 2021.

TLRY closed the week at $1.84, down -2.13% from where I added Friday.

U.S. Natural Gas Fund (UNG): Added to Position

On Friday, natural gas pulled back with the rest of the market, triggering my next buy order in the U.S. Natural Gas Fund (UNG) which filled at $6.75, adding 5.81% to my allocation.

The buy lowered my per-share cost -1.82% from $8.25 to $8.10. From here, my next buy target is $5.90, slightly above UNG’s all-time low, and my next sell target is $9.05, slightly below a key level of support.

UNG closed the week at $6.79, up +0.59% from where I added Friday.