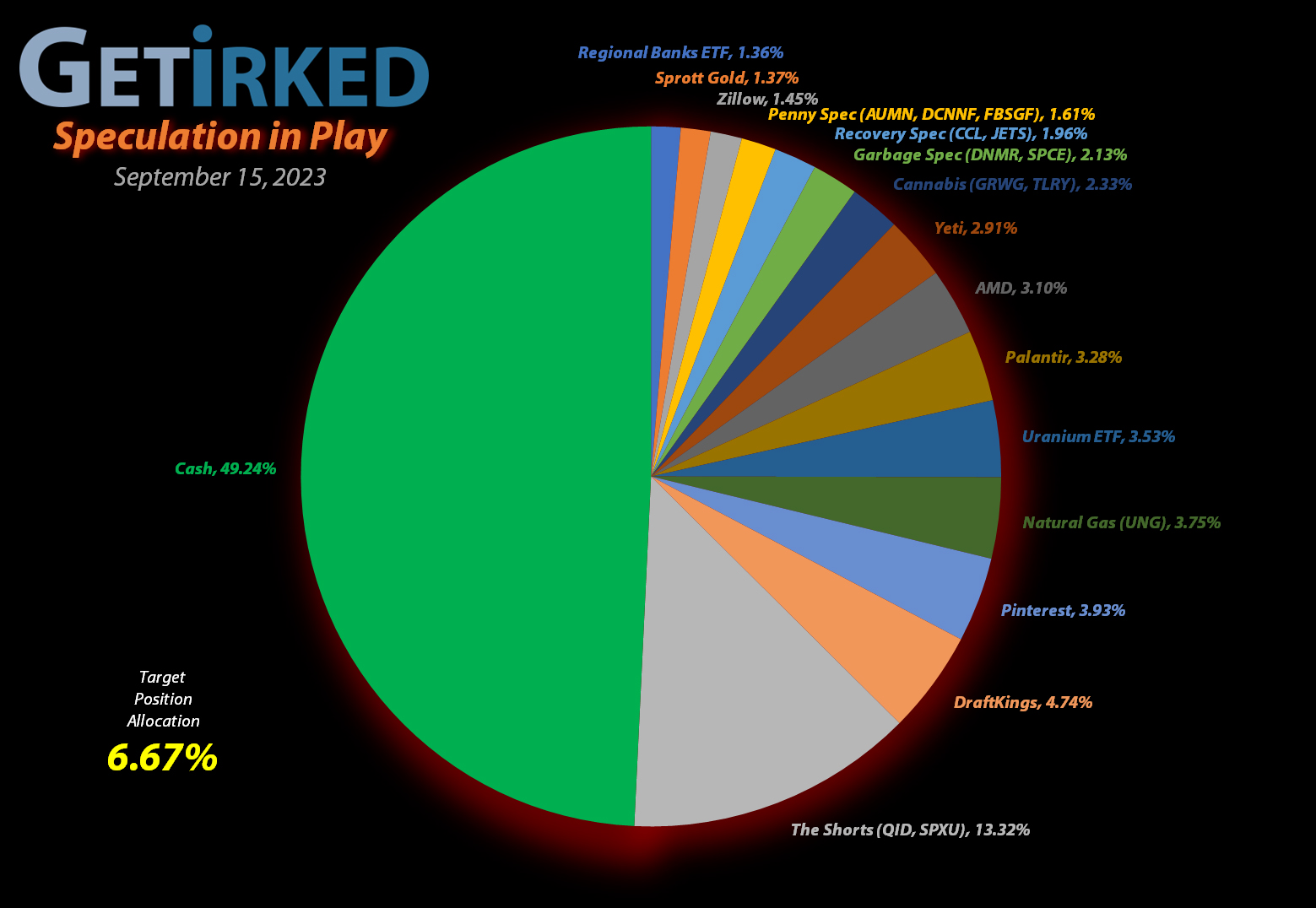

September 15, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

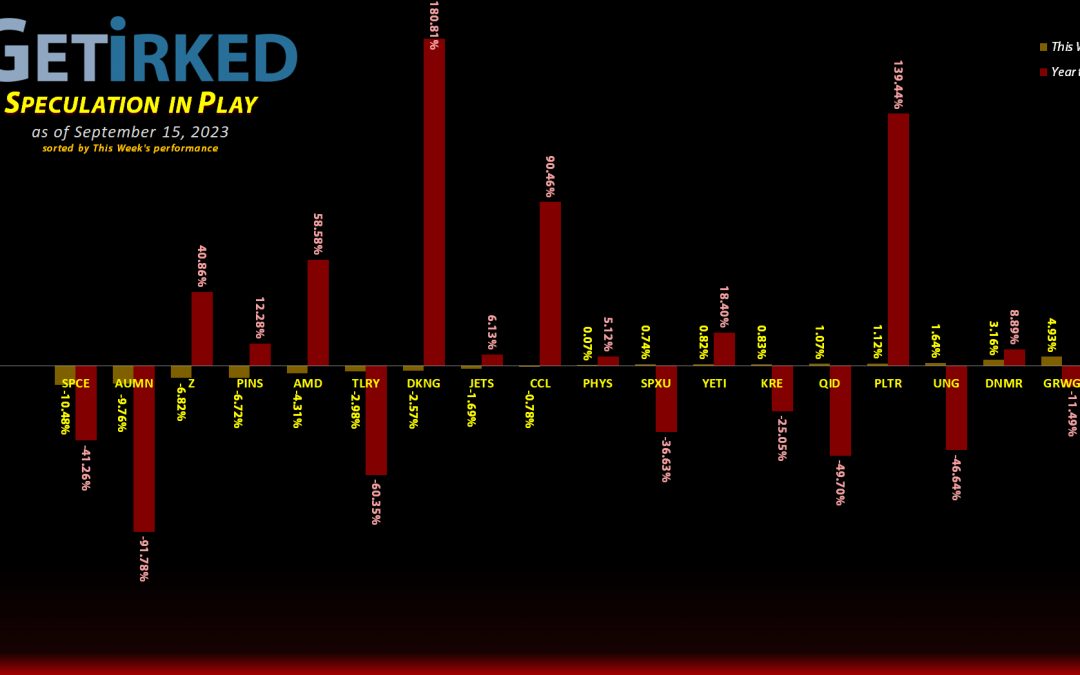

The Week’s Biggest Winner & Loser

Uranium ETF (URA)

With many of the world’s governments finally acknowledging that nuclear energy may be the only way to transition to a future of green energy, uranium rocketed to a record high price this week.

Naturally, all the companies associated with the precious “yellow cake” also saw a pop in their stocks, causing the Uranium ETF (URA) to radiate higher, gaining +9.06% and becoming the Week’s Biggest Winner.

Virgin Galactic (SPCE)

Virgin Galactic’s (SPCE) seemingly never-ending tailspin continued this week with the stock plummeting an additional -10.48%, a total collapse of -41.26% Year-to-Date.

This drop easily won SPCE the spot of the Week’s Biggest Loser, but there’s no end in sight for its crash-landing, so stay tuned to see if it’s next week’s Biggest Loser, too.

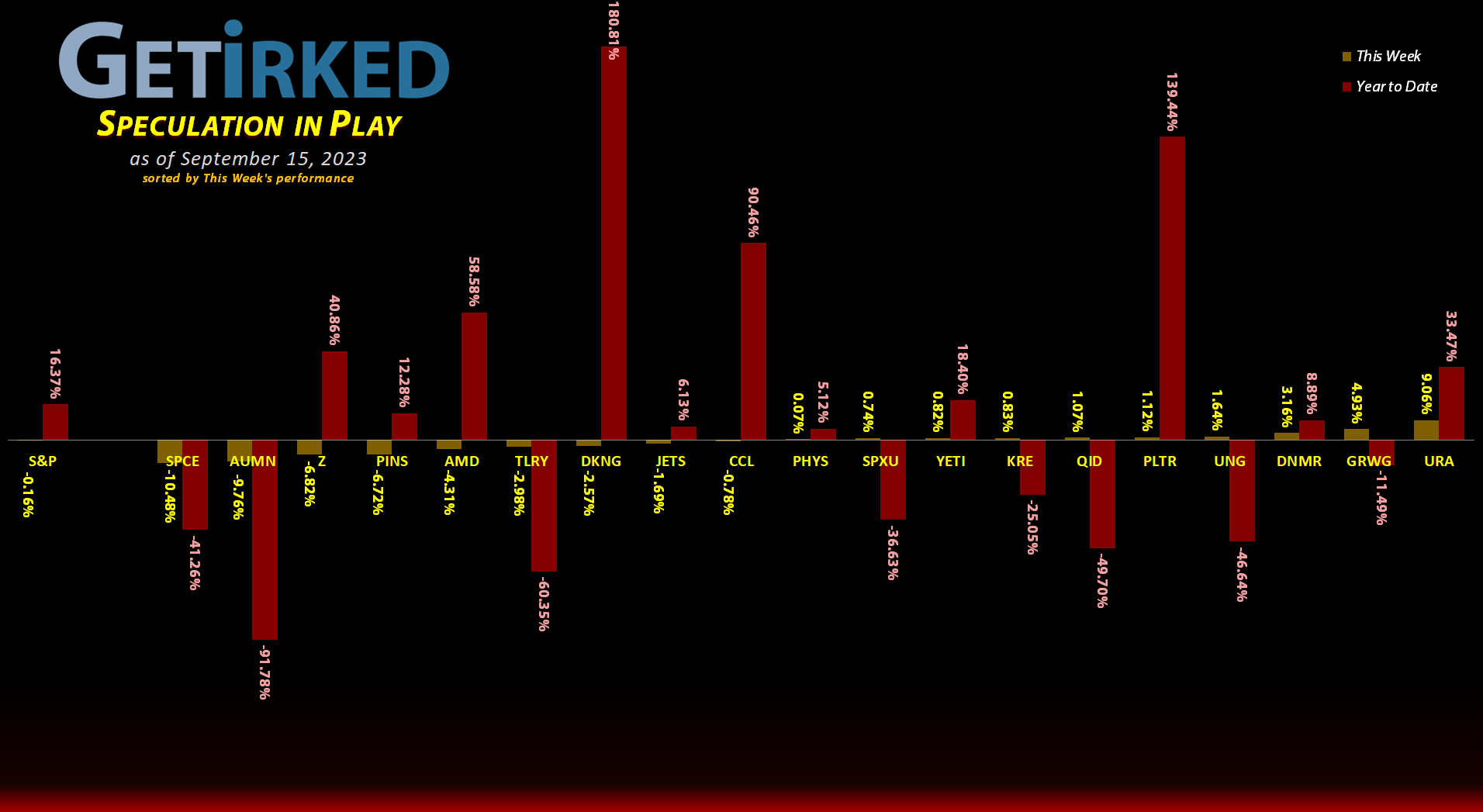

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+604.40%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+396.02%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+364.94%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+99.48%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$2.20)*

Airlines ETF (JETS)

+86.23%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Uranium ETF (URA)

+68.88%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $15.81

Carnival Cruise (CCL)

+66.93%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Tilray Brands (TLRY)

+53.07%*

1st Buy: 9/21/2018 @ $128.97

Current Per-Share: -($10.76)*

Regional Banks ETF (KRE)

+10.71%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Sprott Gold Trust (PHYS)

+0.63%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

Zillow (Z)

-0.55%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.69

Palantir (PLTR)

-4.78%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

DraftKings (DKNG)

-6.09%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Short SPY (SPXU)

-11.67`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.25

Short QQQ (QID)

-16.87%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.95

U.S. Natural Gas (UNG)

-17.45%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Canadian Pal (DCNNF)

-57.75%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Grow Gen. (GRWG)

-75.70%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Danimer Sci (DNMR)

-77.08%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Golden Mine. (AUMN)

-90.65%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-96.69%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Uranium ETF (URA): Profit-Taking

The Uranium ETF (URA) has been on a positive tear for several weeks now, and, while I do still believe in the long-term prospects of the sector, I believe this run will absolutely correct soon so I decided it was time to trim some of my position with a sell order that went through on Wednesday at $25.66, locking in +12.94% in gains on shares I bought for $22.72 back on December 14, 2021.

I sold 18.78% of my position and lowered my per-share cost -10.48% from $17.66 down to $15.81. From here, my next buy target is $19.21, slightly above the low URA saw in May 2023, and my next sell target is $31.48, slightly below the high URA saw in 2021.

URA closed the week at $26.70, up +4.05% from where I took profits Wednesday.

Virgin Galactic (SPCE): Added to Position

Virgin Galactic (SPCE) crashed down significantly over the past week and eventually triggered my next buy order on Tuesday which filled at $2.00. The adds 8.33% to my position and locked in a -95.04% discount on shares I sold for $40.36 on January 26, 2021.

The buy also raised my per-share “cost” +$0.35 from -$2.55 to -$2.20 (a negative per-share cost indicates all capital has been removed in addition to $2.20 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next buy target is $1.30, a price calculated using the Fibonacci Method, and my next sell target is $41.00, slightly below SPCE’s first all-time high in February 2020.

SPCE closed the week at $2.05, up +2.50% from where I added on Tuesday.

Zillow (Z): Profit-Taking

Between the overvalued and potentially weakening residential real estate sector and the fact Zillow (Z) was losing support this week, I decided to take profits and reduce my exposure with a sell order which went through on Thursday at $48.91.

While the order only locked in +2.56% in gains and lowered my per-share cost just -1.26% from $48.30 to $47.69, it served the more important purpose of mitigating risk. Given that Zillow hit a low of $26.14 less than a year ago, it felt prudent to reduce my allocation just in case we head into that kind of weakness again.

From here, my next buy target is $31.21, a point of support has seen many times in the past, and I will hold the remainder of my position until we see where the economy takes us from here.

Z closed the week at $47.43, down -3.03% from where I took profits Thursday.