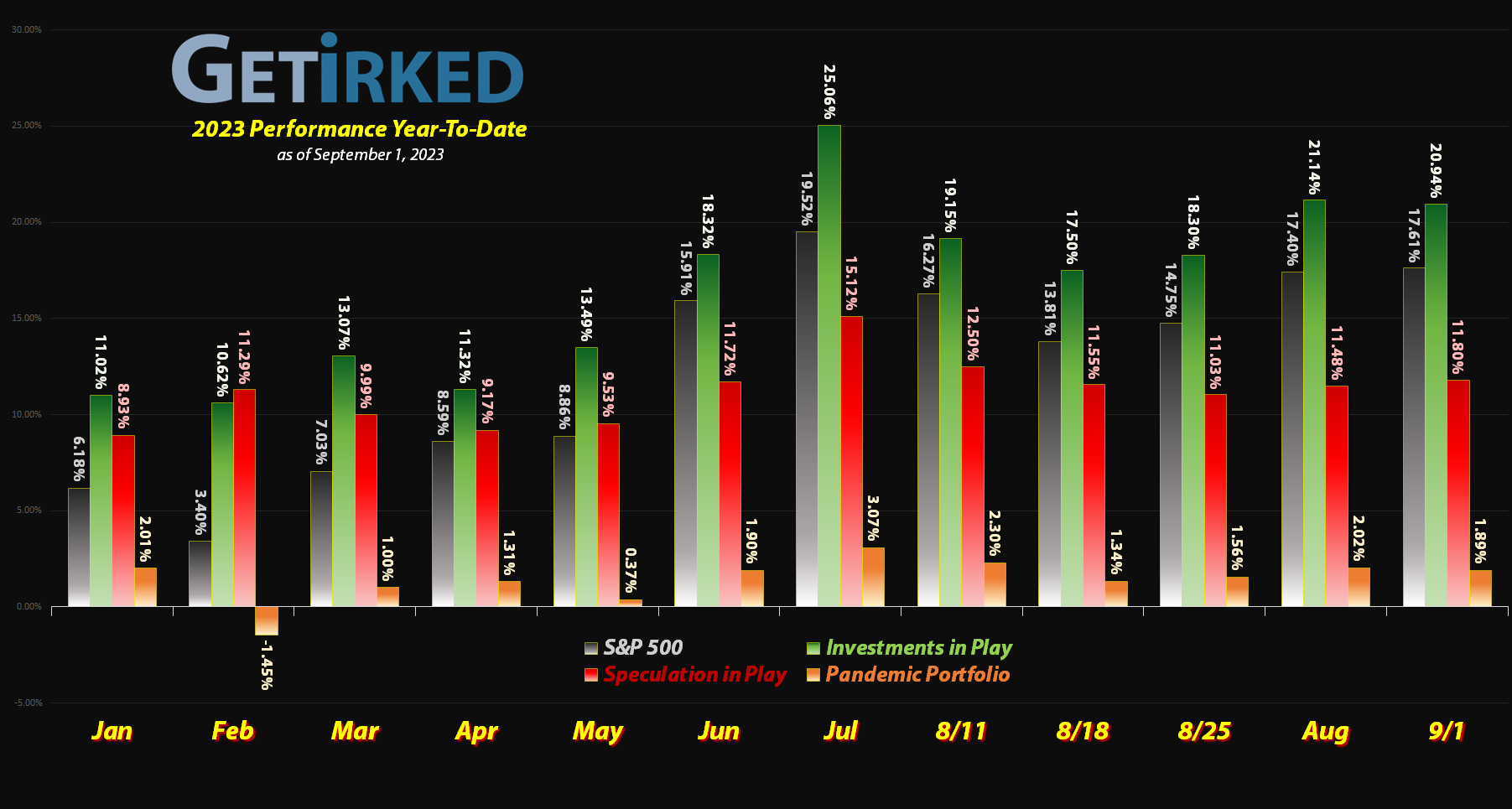

September 1, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

GrowGeneration (GRWG)

GrowGeneration (GRWG) and the rest of the cannabis sector finally caught a small modicum of relief this week when the U.S. Department of Health and Human Services (HHS) through the FDA advised the Department of Justice to reduce cannabis from a Schedule 1 narcotic (where it shares space with cocaine, heroin, and LSD) to a level 3 narcotic (where its brethren are mostly medical such as anabolic steroids).

As a result, the entire sector exploded higher with GRWG locking in a +23.95% gain on the week and getting high as the Week’s Biggest Winner.

Golden Minerals (AUMN)

The funny thing about penny stocks is they can go from being a winner one week to a loser the next, and that’s exactly what happened with Golden Minerals (AUMN).

After becoming last week’s winner on the back of its agreement with the NYSE to prevent delisting, AUMN rolled over and gave back all of its gains and then some, dropping -11.08% to become this week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+624.84%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+409.66%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+377.78%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+110.51%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+88.44%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+69.28%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+37.63%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+15.56%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+8.74%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Sprott Gold Trust (PHYS)

+1.77%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

Palantir (PLTR)

-5.75%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

DraftKings (DKNG)

-10.38%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-14.48%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Short SPY (SPXU)

-15.59`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.25

Short QQQ (QID)

-20.06%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $15.95

Canadian Pal (DCNNF)

-63.24%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-77.66%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-78.12%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-87.28%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-97.12%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Short Nasdaq & S&P (QID & SPXU): Added to Position

When the market started to recover from its brief pullback, I decided to start adding to my short positions again. My buy order on the ProShares UltraShort Nasdaq ETF went through on Tuesday at $13.26.

The small buy lowered my per-share cost -0.93% from $16.10 to $15.95. From here, my next buy target is $12.27, slightly above QID’s lows from the Nasdaq’s recent high in 2023, and my next sell target is $16.14 where I’ll start reducing the size of this short.

Later on Tuesday, my next buy went through on the ProShares UltraPro Short S&P ETF (SPXU) with a buy that filled at $10.65. Also a small buy, it lowered my per-share cost -0.81% from $12.35 to $12.25. From here, my next buy is $9.87, above a recent point of support, and my next sell target is $12.49.

QID finished the week at $12.75, down -3.85% from where I added Tuesday.

SPXU finished the week at $10.34, down -2.91% from where I added Tuesday.