August 25, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

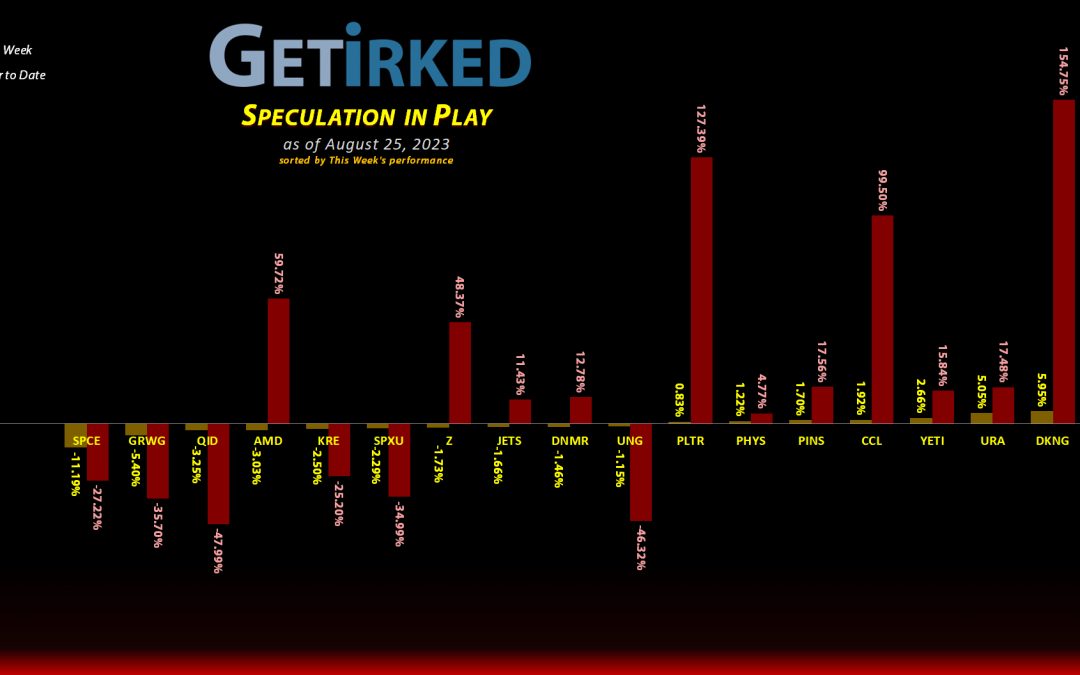

The Week’s Biggest Winner & Loser

Golden Minerals (AUMN)

While just a penny stock, Golden Minerals (AUMN) didn’t simply bounce because of potential trade manipulation, it actually had fundamental news backing up its move. Golden Minerals announced its plan to maintain its listing on the New York Stock Exchange, and the news initially caused the stock to pop nearly +30% before it retreated to finish the week up +6.79%.

There was so much damage done to this stock in the past few months that it will take ages for it to recover (if it ever does) but not getting delisted is a start and earned AUMN the spot of the Week’s Biggest Winner.

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) continued last week’s death-defying drop, losing another -11.19% in value to crash-land as the Week’s Biggest Loser for two weeks running. There doesn’t seem to be any end in sight for the selling in this stock as the super-speculative sectors sell off.

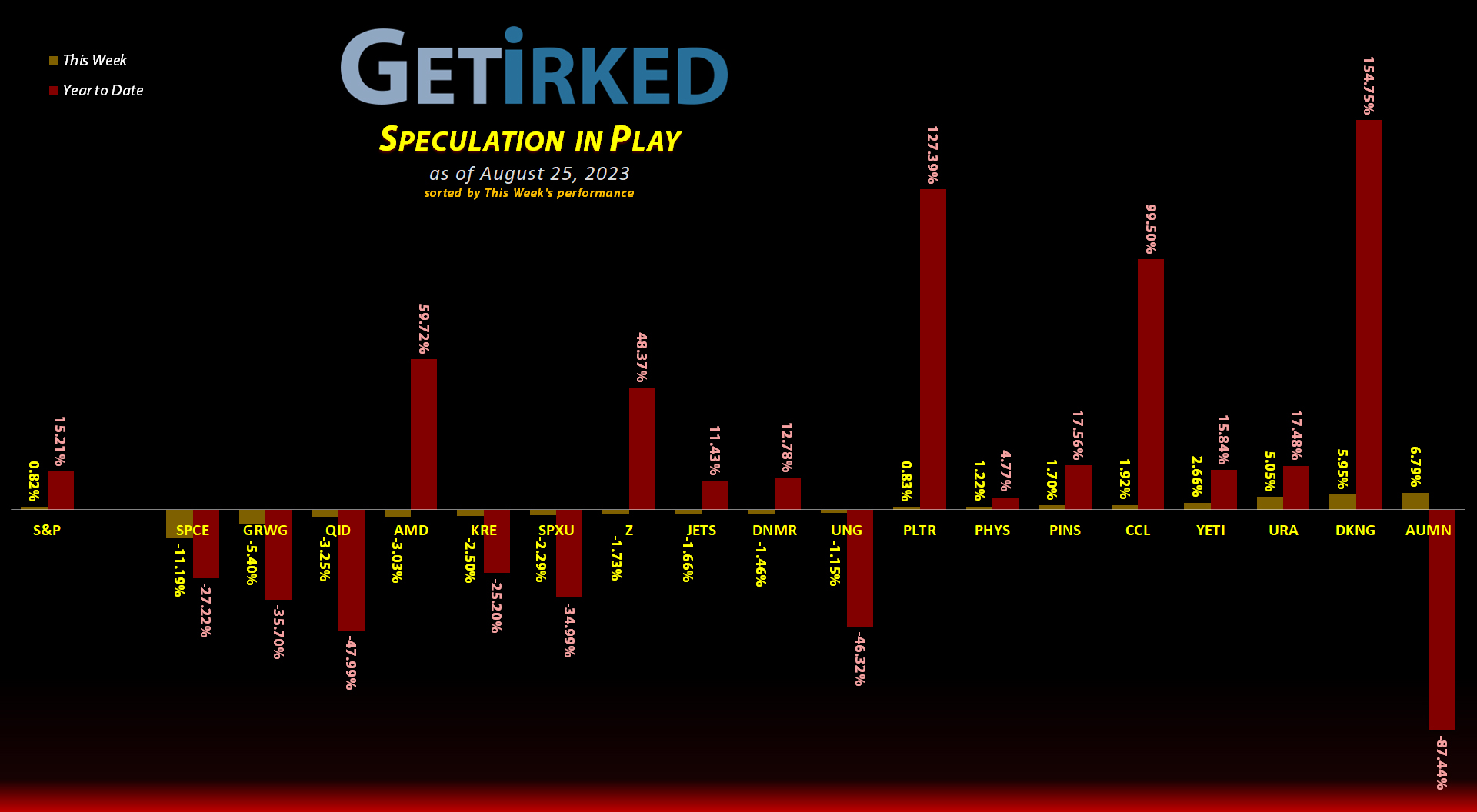

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+606.34%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Yeti (YETI)

+391.65%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+372.99%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+109.62%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+87.94%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+70.02%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+33.13%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+10.50%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+3.46%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Sprott Gold Trust (PHYS)

+0.29%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

Palantir (PLTR)

-9.81%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

Short SPY (SPXU)

-10.04`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.35

DraftKings (DKNG)

-14.83%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Short QQQ (QID)

-14.90%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $16.10

U.S. Natural Gas (UNG)

-16.97%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Canadian Pal (DCNNF)

-63.24%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-76.26%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-82.35%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-85.73%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-97.12%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

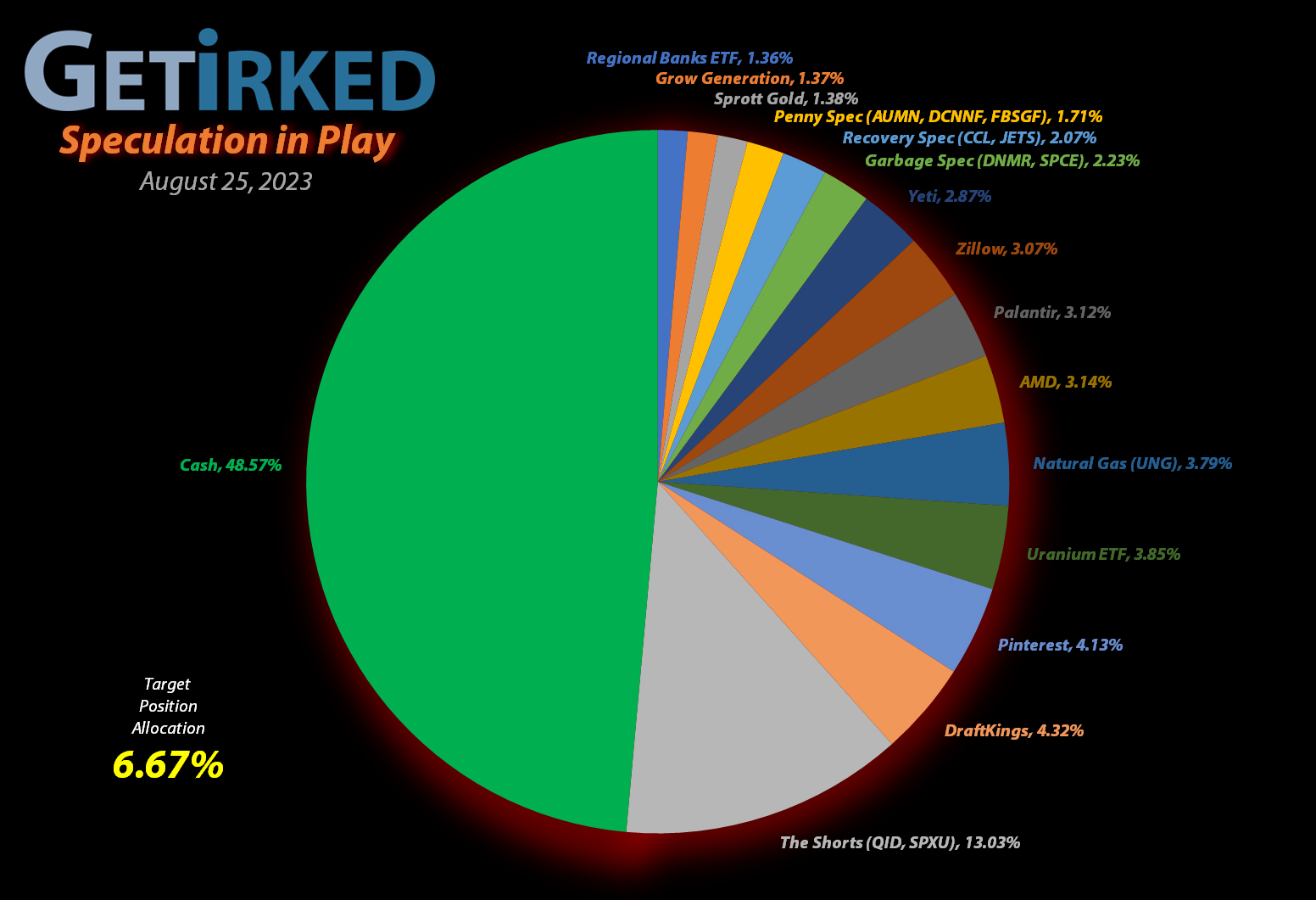

The Third Season of the Stock Market

Last week, I talked about the rotation of the stock market from Buying Season to Selling Season. Let’s talk about the market’s third season – Rotation Season (or, as I referred to it last week, “Boring Season”).

It’s been five weeks with no moves in the Speculation in Play portfolio, things feel dull, but that’s the worst time to try and make a move or change my discipline. Investing should be boring, and if I didn’t have 40+ positions, it probably would be for me, too.

Rotation Season is important. A lot of new investors and traders (and even seasoned ones) will think that the instant the market turns from bullish to bearish or bearish to bullish, you should make a move.

Absolutely not.

The key to long term investing is time in the markets. When the markets are headed higher, I peel off profits at key price targets. When the markets sell off, I add at key targets. The rest of the time, I wait.

So, right now is an extensive waiting game. That’s fine. There are a number of huge market-moving catalysts coming up in September including a potential United Auto Workers strike, a government shutdown over budget negotiations, the Federal Reserve meeting where they’ll likely hike rates again, and student loan payments come back soon which will weaken the consumer.

It’s not time to force a move. It’s time to wait.

(… even if it is incredibly boooooorrrrinnnngg)