August 4, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

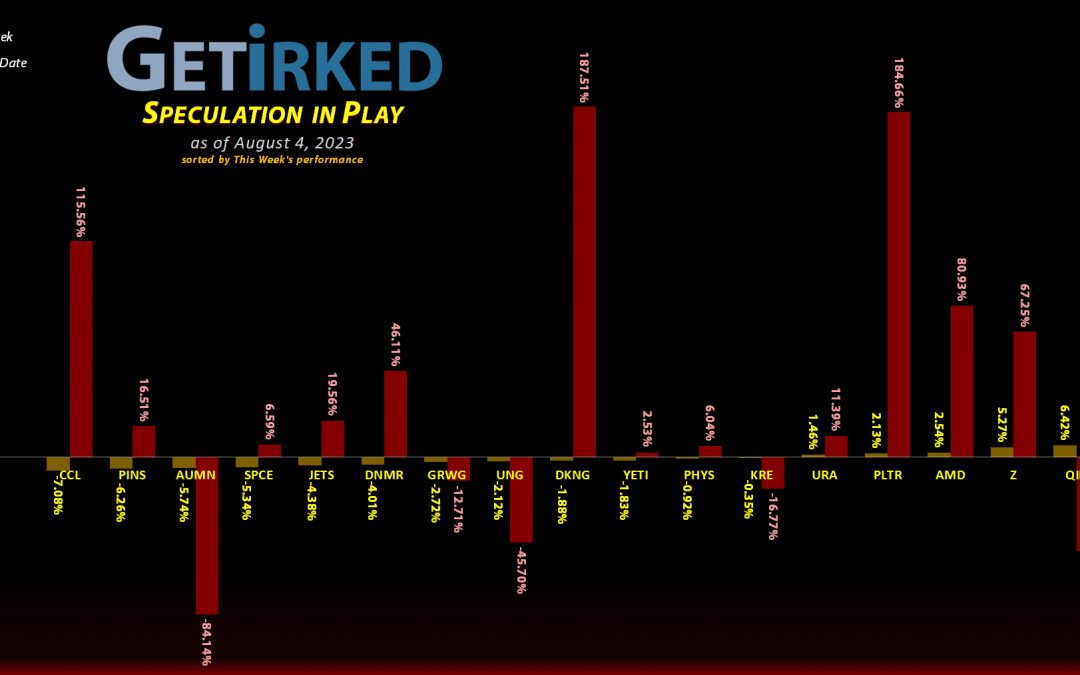

The Week’s Biggest Winner & Loser

Zillow (Z)

Even though the biggest winners this week were my short positions in QID and SPXU, the inverse ETFs that bet against the Nasdaq and S&P 500, respectively, I’m choosing to focus on Zillow (Z / ZG) which, thanks to an incredible earnings report, rocketed +7.11%, an outstanding gain in a down week. Zillow, despite having limited existing home sales thanks to high mortgage rates, still managed to pull it off, making it the Biggest Winner this week by a large margin.

Carnival Cruise Lines (CCL)

Between rising interest rates and its competitors having a tough go of it during earnings season, Carnival Cruise Lines (CCL) sold off in sympathy with its sector as investors know they can expect little different when Carnival reports in September. CCL sold off -7.08% this week and sailed in as the Week’s Biggest Loser.

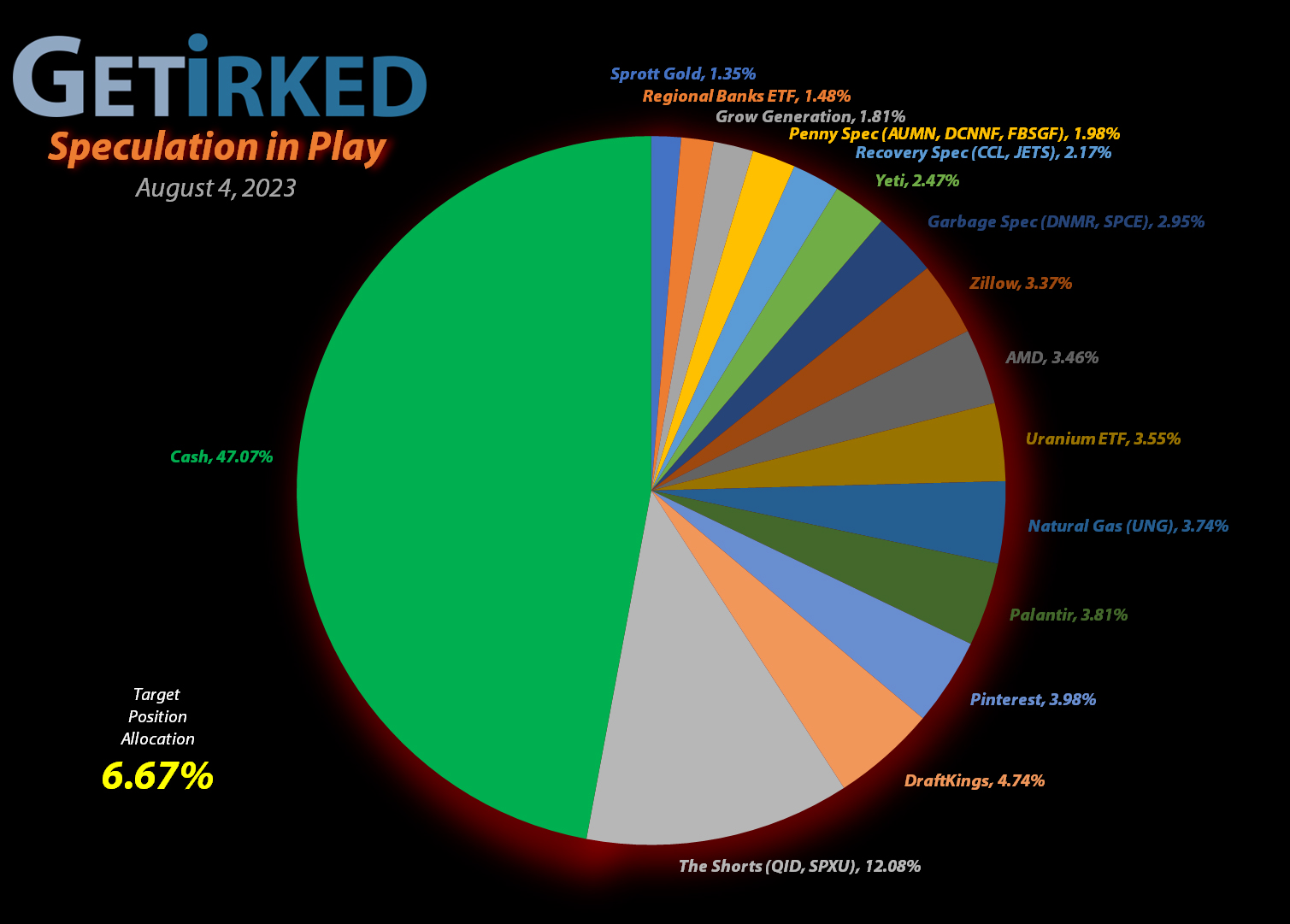

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+641.02%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+371.26%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+368.95%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+133.09%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+90.42%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+75.50%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+26.28%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+22.29%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+16.63%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Palantir (PLTR)

+13.04%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

Sprott Gold Trust (PHYS)

+1.47%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

DraftKings (DKNG)

-3.97%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Short SPY (SPXU)

-14.74`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.35

U.S. Natural Gas (UNG)

-15.76%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Short QQQ (QID)

-18.63%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $16.10

Canadian Pal (DCNNF)

-57.75%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-69.30%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-76.04%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-81.95%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-97.17%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

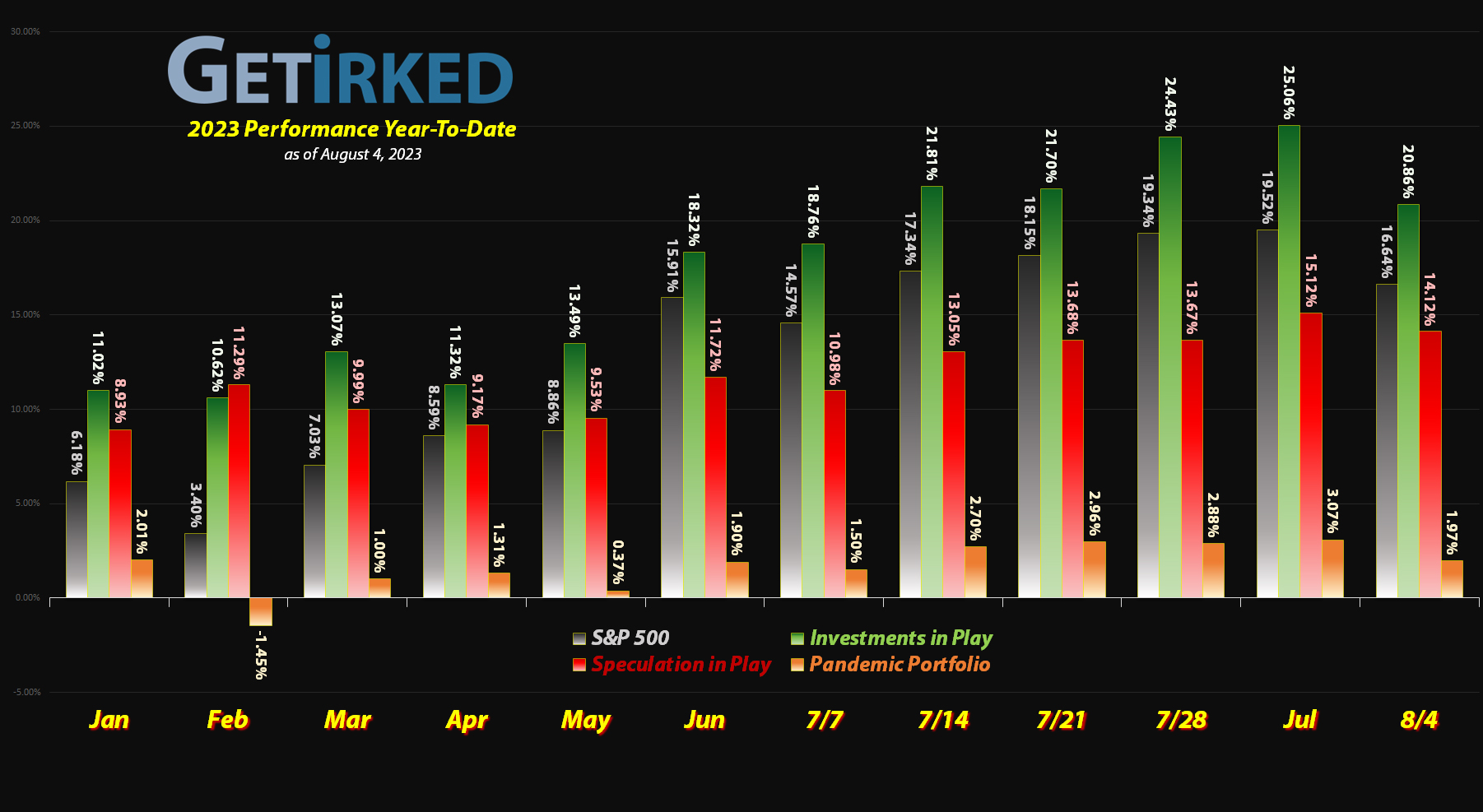

The Unknown Unknowns…

Donald Rumsfeld, Secretary of Defense under both Gerald Ford and George W. Bush, famously spoke of the “unknown unknowns,” referring to unexpected events suddenly occurring.

In the stock market, the “known unknowns” are things like quarterly earnings or jobs reports – we don’t know the outcome in advance but we know they’re coming. The “unknown unknowns” come from unexpected events such as the Fitch Ratings downgrade of U.S. debt from AAA to AA+ this week.

Although not significant enough to be considered a Black Swan Event (think: the pandemic or the Great Financial Crisis of 2008), the Fitch debt downgrade was enough to start a cascade of selling as investors locked in profits in light of what had been an incredible rally from March through July.

Now, August is seasonally volatile, so it’s certainly living up to its reputation already, but will the selling continue? No one knows for sure. Maybe we’ll bounce on Monday.

However, as investors or traders, it’s important to be aware that unknown unknowns can happen at any time. Accordingly, it’s vital to plan in advance for big moves in your positions in either direction so you can be prepared as best you can for those unexpected events that come out of nowhere.