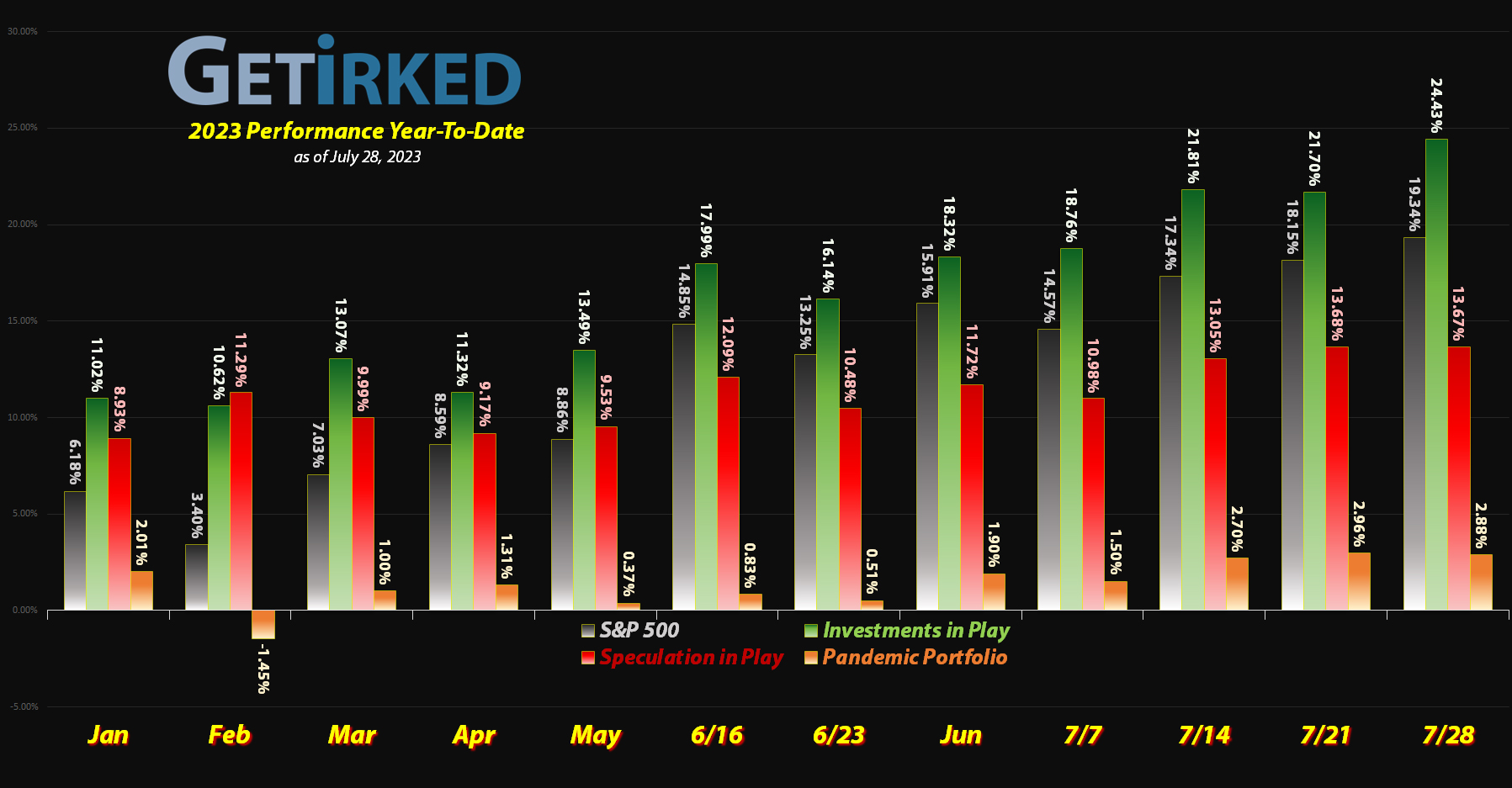

July 28, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

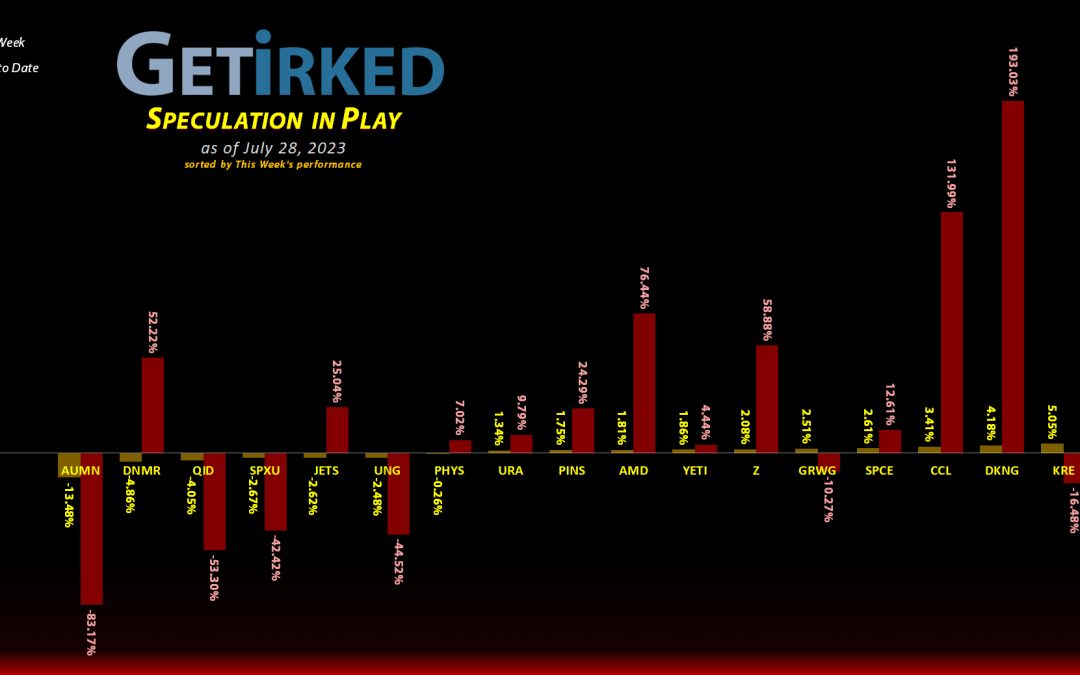

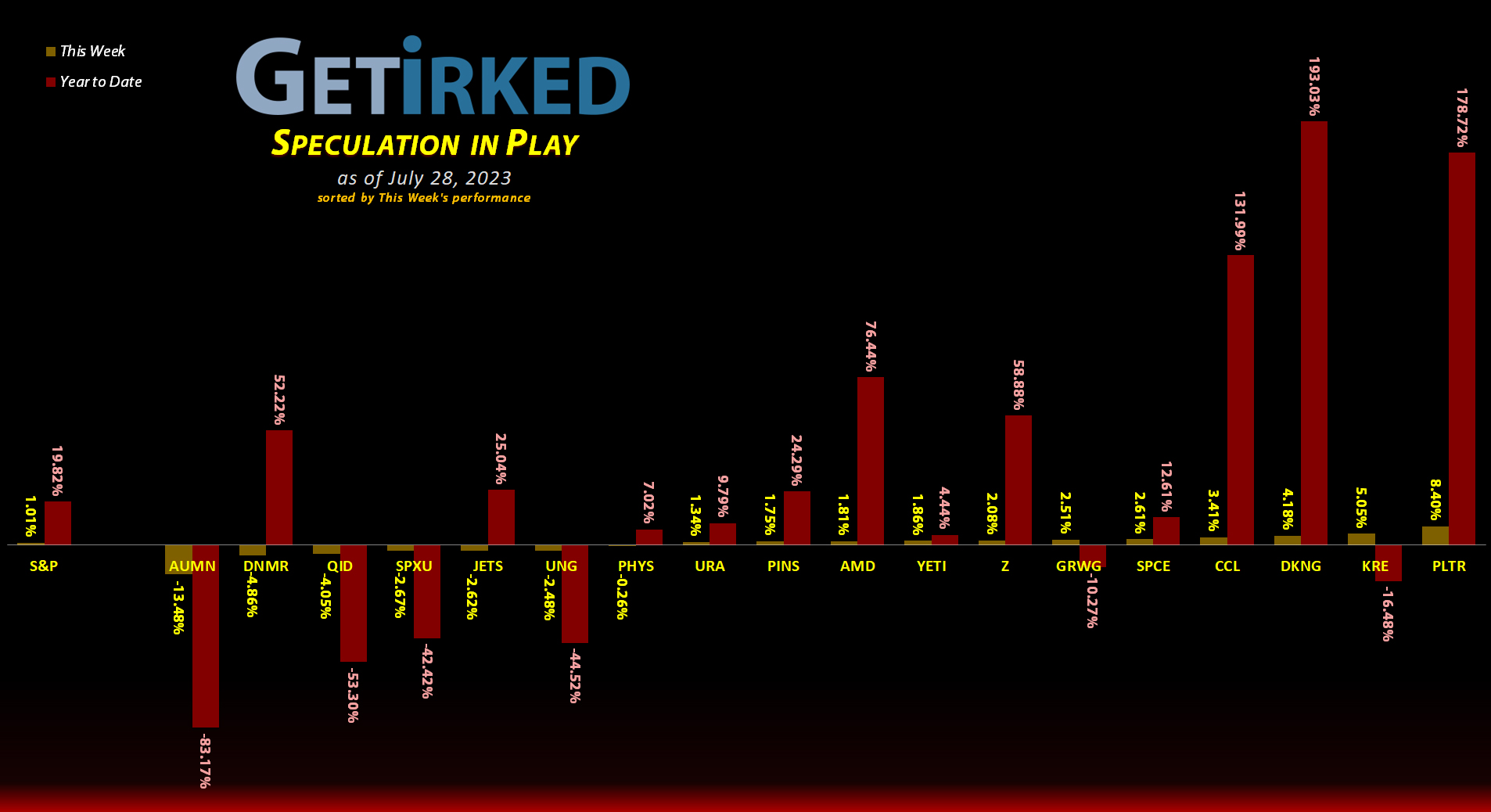

The Week’s Biggest Winner & Loser

Palantir Tech (PLTR)

Palantir Technologies (PLTR) rocketed higher when investors poured back into the artificial intelligence space this week. Despite not reporting earnings, yet, PLTR popped +8.40% this week and earned itself the spot of the Biggest Winner!

Golden Minerals (AUMN)

Let’s just think about this for a second – out of the past 6 weeks, Golden Minerals (AUMN) has been the Biggest Loser 5 of the 6 times.

Exactly how bad must a company be to perform the absolute worst in a portfolio with 15 positions 5 of the past 6 weeks??

I’m not sure what’s left to say about AUMN. It made new lows. It’ll probably continue to make new lows. Maybe someone will put this stinker that lost another -13.48% this week out of its misery?

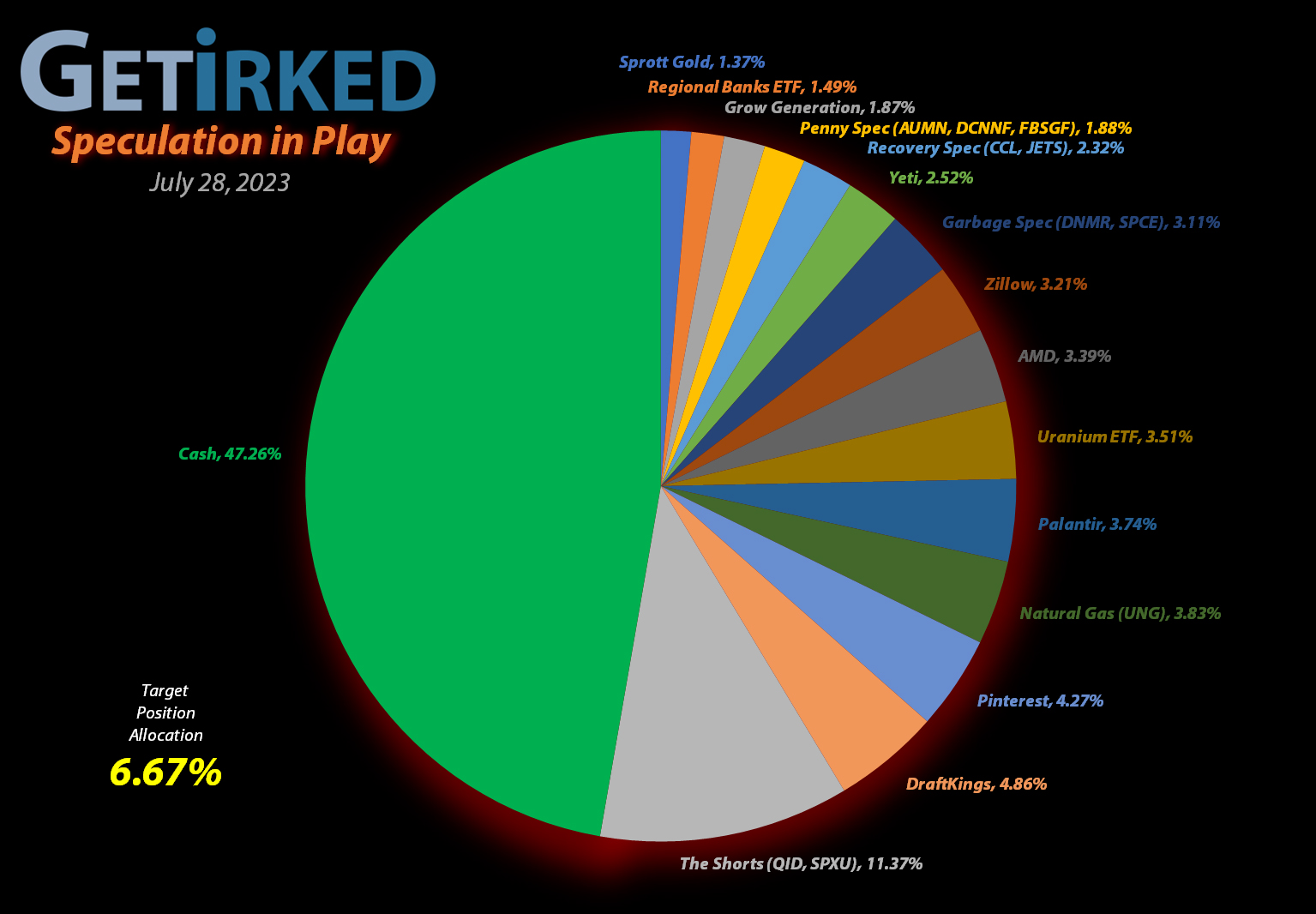

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+633.71%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+383.17%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+372.21%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+137.25%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+92.12%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+81.28%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+24.47%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+23.39%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+10.79%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Palantir (PLTR)

+10.62%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

Sprott Gold Trust (PHYS)

+2.44%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

DraftKings (DKNG)

-2.03%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-14.06%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Short SPY (SPXU)

-20.36`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.35

Short QQQ (QID)

-23.54%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $16.10

Canadian Pal (DCNNF)

-63.82%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-67.95%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-75.37%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-80.85%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-97.18%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Investing is supposed to be boring…

There were no moves in the Speculation in Play portfolio this week, and that’s okay. In fact, it’s preferable. Many new investors (and even seasoned ones, for that matter) will make the mistake of thinking that long-term investing should be thrilling with moves to be made in a portfolio on a daily basis. This isn’t the case.

In fact, a recently-published study showed that passive investors who buy an S&P 500 mutual fund over an S&P 500 Exchange Traded Fund (ETF) will make greater returns over the long term than their ETF counterparts.

Why is that? They both own the same asset just in a different vehicle type!

Here’s the issue – since mutual funds settle their trades at the end of the day, investors who choose a mutual fund are less likely to overtrade. Since ETFs trade throughout during market hours, ETF investors are more likely to be tempted to make a move thinking they can take profits before an impending selloff or add more to their position before a perceived rally.

Success in investing all comes down to the same thought: investing should be boring.

If you’re a typical investor (and not a crazy person like me who spends 60-80 hours each week doing this), you might have 5-10 positions in your portfolio. In fact, most experts don’t recommend you have more than 10 as it will take too much time to stay informed for most investors.

With that few positions, you likely won’t make a move in your portfolio each week. In fact, you may not make a move in your portfolio for months.

Even though it looks like I’m making moves all the time, that’s simply because I own a total of more than 60 positions between the Speculation in Play, Investments in Play, and Pandemic Portfolios. As a result, I’m often making moves, but, in reality, most of my positions have no movements in months.

For example, check out some of the “stagnant” positions even in the Speculation in Play portfolio:

- DraftKings (DKNG): No move in 2 months

- Grow Generation (GRWG), U.S. Natural Gas Fund (UNG), Virgin Galactic (SPCE) & Yeti (YETI): No moves in 3 months.

- AMD (AMD) & Pinterest (PINS): No moves in 6 months.

- Danimer Scientific (DNMR): No moves in 7 months.

- Uranium ETF (URA): No moves in 11 months.

There’s absolutely nothing wrong with being an active investor, but it’s always worth remembering the adage:

It’s not timing the markets, but time in the markets that matters.