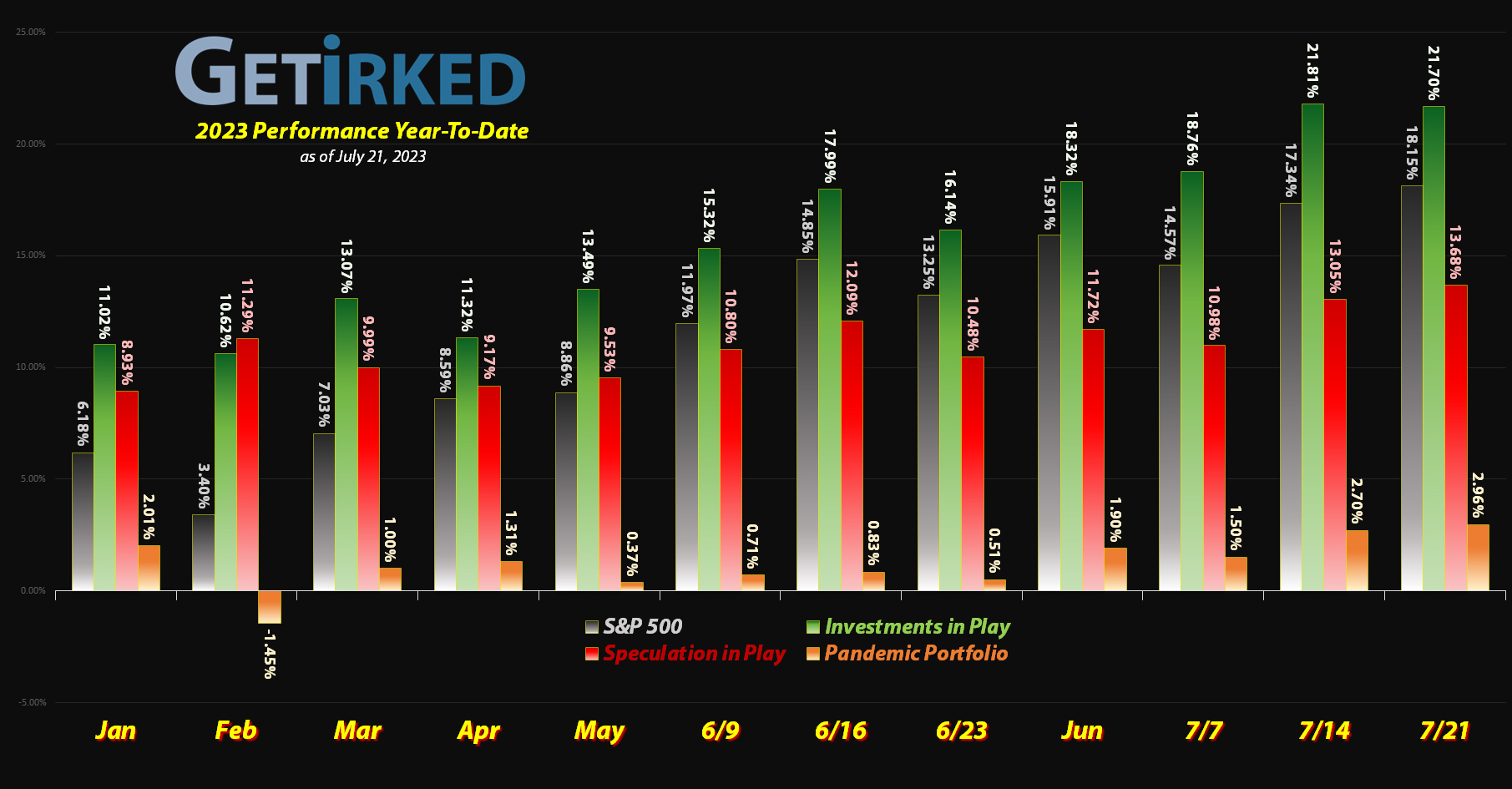

July 21, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

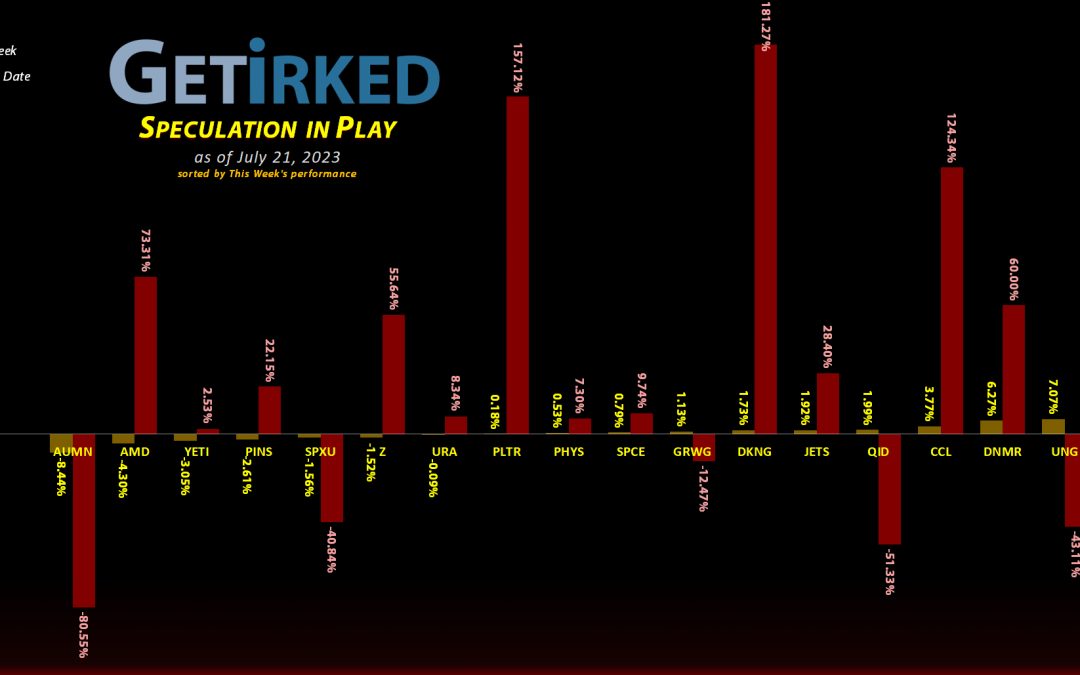

The Week’s Biggest Winner & Loser

Regional Banks ETF (KRE)

While many had left the regional banks for dead following the crisis in March, they came back in full force this week, reporting an excellent earnings for the quarter (given the circumstances, of course).

As a result, the Regional Banks ETF (KRE) popped +7.54% this week, cashing in as the portfolio’s biggest winner.

Golden Minerals (AUMN)

What can I say about Golden Minerals (AUMN) that I haven’t said many, many times before? An analyst cut their price target on AUMN from $15 to $9 (which seems incredibly optimistic given the stock closed at $1.41 on Friday) and the stock dropped -8.44%.

In fact, AUMN broke its all-time low to make a new low at $1.38. What an absolute stinker! Naturally, AUMN has slid in for what seems to be its favorite place in the portfolio… last.

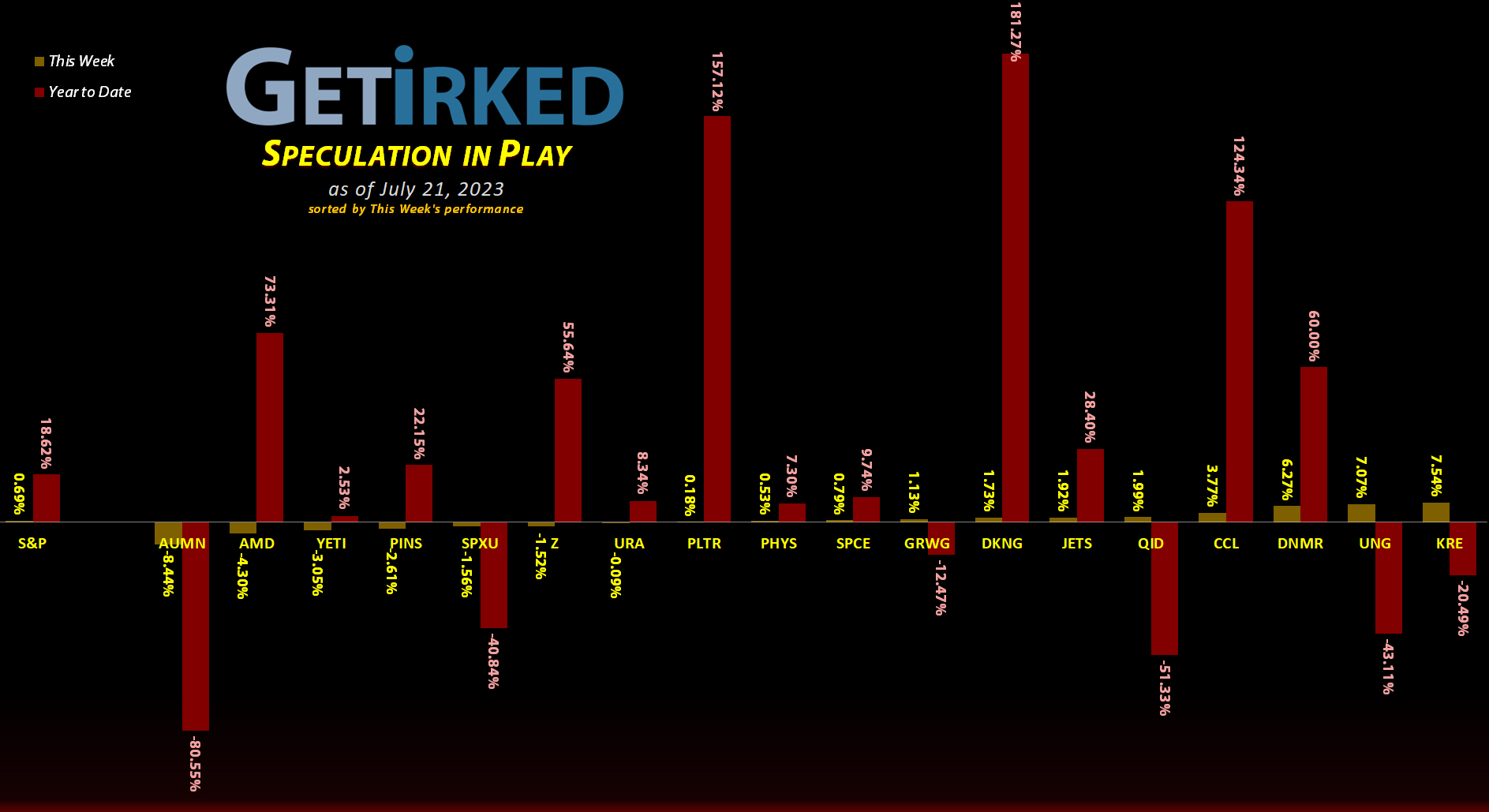

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

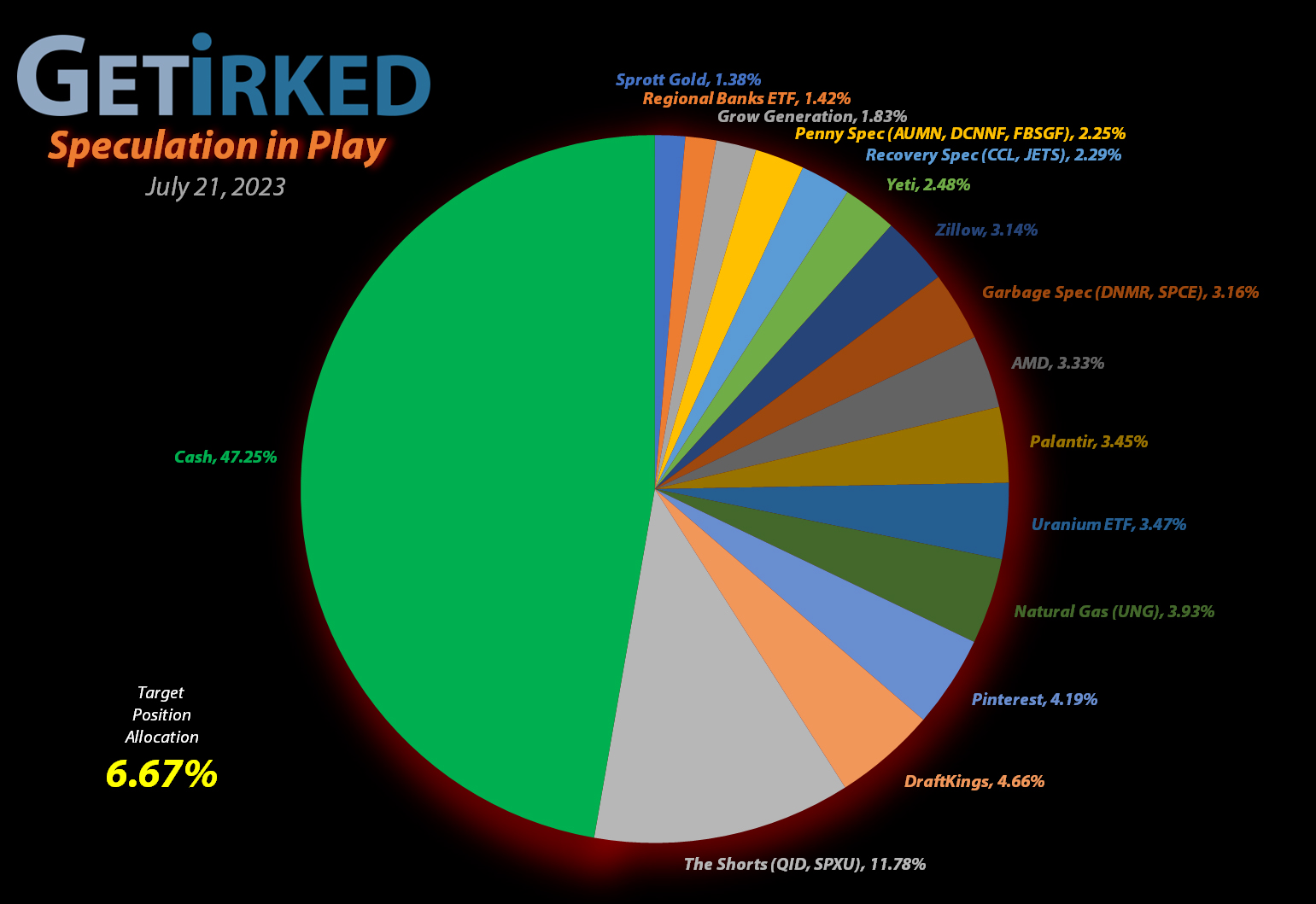

AMD (AMD)

+628.57%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+379.91%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+368.95%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+135.27%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+93.16%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$29.12)*

Carnival Cruise (CCL)

+78.63%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+22.82%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Regional Banks ETF (KRE)

+17.46%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $39.49

Zillow (Z)

+8.53%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Sprott Gold Trust (PHYS)

+2.71%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $14.89

Palantir (PLTR)

+2.05%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.10

DraftKings (DKNG)

-5.97%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-11.88%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Short SPY (SPXU)

-18.14`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.35

Short QQQ (QID)

-20.31%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $16.10

Canadian Pal (DCNNF)

-56.59%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-66.32%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-75.97%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Golden Mine. (AUMN)

-77.86%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Fabled Gold (FBSGF)

-95.35%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Airlines ETF (JETS): Profit-Taking

When the markets pulled back on Thursday, I decided to take profits in the high-flying Airlines ETF (JETS) – pun intended – by using a stop-loss limit order which filled at $21.64, locking in +91.51% in gains on shares I bought for $11.30 when I initially opened the position on May 14, 2020.

The sale lowered my per-share cost -$24.95 from -$4.17 to -$29.12 (a negative per-share cost indicates all capital has been removed in addition to $29.12 per share added to the portfolio’s bottom line in addition to each share’s current value).

From here, my next sell target is $28.91, just under JETS’ 2021 high, and my next buy target is $17.09, slightly above the ETF’s low in February.

JETS closed the week at $21.79, up +0.69% from where I took profits Thursday.

Palantir Technologies (PLTR): Profit-Taking x 2

Palantir Technologies (PLTR) rallied to new Year-To-Date highs on Tuesday, crossing through my next sell order which filled at $17.65. The sale locked in +79.19% in gains on shares I bought for $9.85 on May 6, 2022.

When PLTR hit a high of $19.00 on Wednesday but proceeded to pull-back more than -6% before its close – decidedly bearish price action – I placed a stop limit sell order which triggered on Thursday, filling at $17.70. This sale locked in +59.32% in gains on shares I bought for $11.11 on February 18, 2022 and gave me an average selling price of $17.68.

The combined buys lowered my per-share cost -2.13% from $16.45 to $16.10, but, more importantly, mitigated risk by lowering my allocation in case PLTR and/or the rest of the market is preparing for a deeper pullback.

From here, my next sell target is $20.60, below a past point of resistance, and my next buy target is $11.70, a price calculated using both the Fibonacci Method and above a past point of support Palantir saw recently during its rise to prominence.

PLTR closed the week at $16.43, down -7.07% from my $17.68 average price.

Regional Banks ETF (KRE): Profit-Taking

When the market started to retreat slightly on Thursday, I used stop-loss limit orders to reduce riskier positions, like my position in the Regional Banks ETF (KRE), to lock in gains and reduce allocation.

My stop triggered and my limit sell order filled at $46.42, locking in +7.38% in gains on shares I bought for $43.23 on 3/16/2023 and lowering my per-share cost -8.01% from $42.93 to $39.49. From here, my next buy target is $35.78, above the KRE’s recent low in May, and my next sell target is $65.04.

KRE closed the week at $46.38, down -$0.04 from where I took profits.

Short Nasdaq QQQ (QID): Added to Position

When the Nasdaq continued to rally on Tuesday, it triggered the next buy order for my ProShares Inverse QQQ position, the QID ETF, with the order filling at $12.10. The order lowered my per-share cost -6.40% from $17.20 to $16.10.

As I’ve said before, I’m building my short positions on the S&P 500 and Nasdaq – SPXU and QID, respectively – very slowly. As the markets continue to rally to frothier and frothier highs, I keep adding small amounts in increasing quantities to both of these inverse ETFs.

From here, my next buy target for the QID is $11.60, a price calculated using the Fibonacci Method, and my next sell target is $16.35, just under a key point of past resistance.

QID closed the week at $12.83, up +6.03% from where I added Tuesday.

Short S&P 500 (SPXU): Added to Position

When the S&P 500 continued to rally on Tuesday, it triggered the next buy order for my ProShares Inverse SPY position, the SPXU ETF, with the order filling at $9.97. The order lowered my per-share cost -2.68% from $12.69 to $12.35.

From here, my next buy target for the SPXU is $9.20, a price calculated using the Fibonacci Method, and my next sell target is $12.70, just under a key point of past resistance.

SPXU closed the week at $10.11, up +1.40% from where I added Tuesday.

Sprott Physical Gold Trust (PHYS): Profit-Taking

When every sector started rolling over on Thursday, I used stop-loss limit sell orders in my Sprott Physical Gold Trust (PHYS) position to lock in small gains and reduce allocation. My order filled at $15.34, locking in +4.00% in gains on some of the shares I bought for $14.75 less than a month ago on June 22.

The sale also lowered my per-share cost -0.73% from $15.00 to $14.89. From here, my next buy target is $14.61, just a bit above PHYS’ $14.60 low from May, and my next sell target is $16.06, slightly below its 2023 high.

PHYS closed the week at $15.29, down -0.33% from where I took profits.